Hindsight is the most exact of all sciences. Most people who live their life backwards have a miserable life. Having been around for a while, I tend not to look back, especially not at negative events. Much better to embrace uncertainty since everything going forward from here is uncertain. We can’t do anything about the past but we certainly have more control over our future. And looking at the next few years, it does seem that these are going to be extremely turbulent both economically, socially and politically.

In spite of not normally looking back, I have had a look at a Newsletter that I wrote in July 2009 when gold was just over $900 and the Dow 9,100. It was called “The Dark Years are here” and received quite a lot of attention at the time. This was at the end of the sub-prime crisis when the Dow had just declined by 60% and gold had risen from $250 in 1999 to $925.

I am clearly putting my head on the block here because like with most forecasts, the timing of my predictions contained many errors. But we must remember that protecting risk is more important than being right on timing.

At the end of the article I am drawing some important conclusions.

The Dark Years are here (written July 2009)

In this newsletter we will outline what is likely to be the devastating effect of the credit bubbles, government money printing and of the disastrous actions that governments are taking. Starting in the next 6 months and culminating in 2011-12, the world will experience a series of tumultuous events which will be life changing for most people in the world. But 2011-12 will not be the beginning of an upturn in the world economy but instead the start of a long period of economic, political and social upheaval that could last for a couple of decades.

We will discuss the three areas that we for some time have argued will determine the fate of the world for the foreseeable future, namely the coming unemployment explosion, the next and much more serious phase in the credit markets and finally the likely hyperinflationary or just inflationary effect this will have on the world economy and investments.

EMPIRES ARE BUILT ON THEFT PILLAGE, SLAVE LABOUR AND FINALLY MONEY PRINTING

Let us first go back in history and analyse what creates an empire and the prosperity that comes with it.

The British Empire started in the 17th century and reached its peak in the 19th century during Queen Victoria’s reign. By the end of the 19th century The British Empire included nearly 20% of the land surface of the world and 25% of the world’s population. So Britain which is less than 0.5% of the world’s land surface area controlled an empire which was more than 50 times greater. So by using slave labour and by stealing the resources of 20% of the world, it is no wonder that Britain was the wealthiest nation for several centuries. But like all empires, Britain carried the seeds of its own destruction. All empires – e.g. Mongolian, Roman, Ottoman or British etc. – eventually overstretch their resources both militarily and financially. This combined with decadence and illusions of grandeur eventually leads to the collapse of an empire.

The US empire was slightly different from the point of view that it never conquered the world although the US was itself a colony conquered from its original inhabitants. But the US has intervened in many areas (e.g. Korea, Vietnam, Afghanistan, Iraq etc.). Also, there are US military bases in 120 countries. Initially the US was an economic superpower based on an entrepreneurial spirit and a very strong production machine backed by fierce military power. But after the Vietnam war the US had overstretched its resources and by 1971 Richard Nixon abolished the gold standard in order to be able to start money printing in earnest. The money printing phase is normally the last stage of an empire before it collapses and this is where the US is now. The US dollar became the reserve currency of the world when the US was strong economically. But as the US economy started to weaken in the 1960-70’s the US government found a much better method for maintaining a strong economy. It started to print paper that it sold to other nations or exchanged for goods and services. For almost 50 years this has been the most clever way ever devised of maintaining the living standards of an economically deteriorating nation without even having to spend any resources on building an empire. It is a Ponzi scheme which has worked for several decades but slowly the world is now waking up to the fact that they are holding worthless paper printed by the US Government. (We realise this is a much simplified version of empire building and destruction but it is nevertheless an accurate analysis).

THE US GOVERNMENT IS IN DENIAL

The US is haemorrhaging financially and economically. It has lent or committed almost $13 trillion in the last 18 months to prop up the financial system. The estimated government deficit in the current year is almost $2 trillion or 50% of the budget. All the money committed so far has only achieved two things: Firstly it has created some short term hope which together with totally illusionary sightings of green shoots have generated a small stock market correction (which we forecast in our January Newsletter) and some belief that the crisis is ending. Secondly, all the funds printed so far to save the system have gone to Wall Street but has done nothing whatsoever for the real economy. Every single sector of the real economy is deteriorating whether it is production, unemployment, corporate profits, real estate, credit defaults, construction, federal deficits, local government and state deficits etc.

And what is the government doing about it. They are doing the only thing they know which is to print more money. This is total lunacy! How can any intelligent person believe that printed pieces of paper can solve an economic catastrophe?

If that were the case we could all go home and write out pieces of paper or use Monopoly money to spend in the shops or repay our debts.

How can the US government, the UK government and most other governments not understand that the only way to run an economy is to cut your coat according to your cloth. This is why the emperor had no clothes because the country had run out of gold thread to make the cloth. Until now the US as well as other countries have been able to buy the cloth because the world has been foolish enough to accept worthless pieces of paper as payment. But this is coming to an end very soon and many countries will be without both coats and cloth.

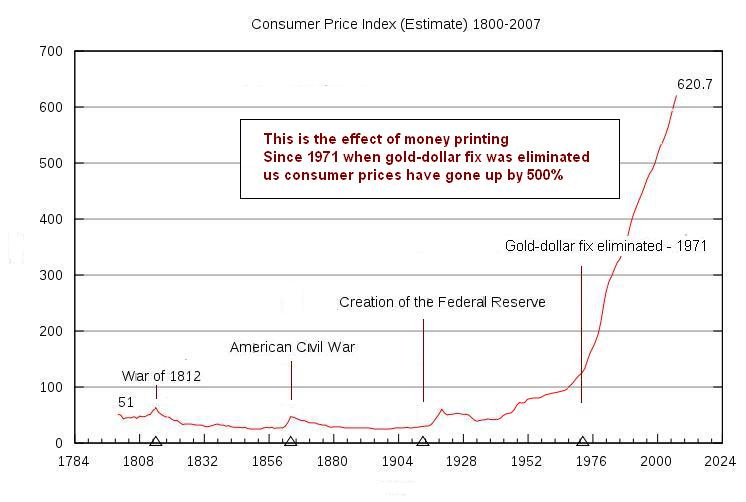

What governments are doing with people’s money is to totally destroy its value. Purchasing power in the US and many other countries has declined more than 95% in the last 100 years. While it might buy votes short term it will only generate massive misery long term. And this is what many countries are starting to experience now. But sadly it will get a lot worse. We are still only in the first phase of this tragic saga. The second phase is likely to start in the next 6 months.

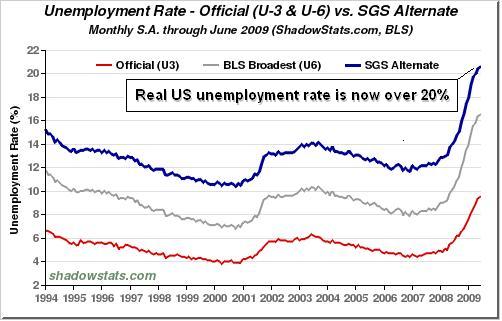

THE US HAS 100 MILLION AFFECTED BY UNEMPLOYMENT

The real unemployment in the US is 20% or 30 million. These are the real unadjusted figures calculated on the same basis as the official figures before the method of the calculation was changed in the 1990’s. Reported government figures, especially in the US, are continually manipulated in order to suit the political aims of the government. Therefore, one should not give any credence to the published figures. Most governments mislead the people most of the time.

With 20% unemployment in the US we are already approaching the levels in the 1930’s when peak total unemployment reached 25%. The 20% current level is the non-farm unemployed and is still a lot lower than the non-farm peak figure in the 1930’s which was 35% unemployed.

Since we are still in the early stages of this crisis, it is our firm opinion that non-farm unemployment levels will reach 35% at least in the US in the next few years.

But even the current figure of 30 million unemployed is a catastrophe. Adding dependants to every unemployed person there are currently 100 million people affected by unemployment in the US. In the next three months 3 million unemployed will fall out of the social security safety-net. These are the people who were laid off in the second half of 2008. Including their families this means that around 10 million people will become destitute between now and September with no social security and no savings. If we then add the 4 million that were made redundant in the first half of 2009 that will result in an additional 13 million people including families will become destitute around Christmas.This is a disaster of unimaginable consequences that will affect the whole fabric of American society.

The consequences will be social, political, financial and the effects on the US economy will be of a magnitude which is substantially greater than during the Depression of the 1930’s. We must remember that none of the problems in the financial system have been resolved but only put on a very temporary hold. The rise in unemployment combined with the reduction in consumption will lead to the next and much more severe banking crisis.

Unemployment in Europe is also rising fast and shows no signs of abatement. Many countries are reaching 10% with for example Spain at 19% and Latvia at 16%. But as we have said for quite some time, of the larger European nations, the country with the biggest problems is the UK. Unemployment in the UK is currently “only” 2.5 million or 7% but it is estimated to reach over 3 million by the end of 2009. The combination of government deficits, a banking system which is extremely fragile and too big for the country, very high personal credit that will not be repaid and a housing bubble which still has a long way to fall makes the UK very vulnerable to a major financial shock.

During the next 6-9 months unemployment will severely affect most parts of the world including China, Asia and Africa. Never before has there been a global unemployment crisis affecting the world simultaneously. This will not only mean a massive decline in consumption and world trade leading to a recession or depression worldwide but also poverty, famine and social unrest.

THE BANKERS ARE STILL RUNNING THE SHOW

The masters of the financial circus are the bankers. Not only did they reap the benefits from manufacturing toxic financial products to the extent of receiving bonuses and stocks in the $trillions during the last 15-20 years. But they are also the only beneficiaries of the trillions of dollars that have been printed by governments to rescue the financial system. Why are the bankers benefiting from the rescue of their own banks? Because they are the ones controlling the government, advising the government and making major contributions to the politicians.

Bonuses are back

Yes, many banks are paying higher bonuses in 2009 than 2008. Goldman Sachs is on course to pay bonuses of $20 billion or $700,00 per employee and Morgan Stanley a 30% increase from average per employee of $262,000 last year to $340,000 this year. JP Morgan’s bonus pool for the first quarter of 2009 is up 175% to $3.3 billion and the new chief executive of RBS, the nationalised UK bank is getting an incentive package worth £10 million! Similar bonuses are being paid by many other banks. Barclays Capital for example is on a massive spending spree recruiting executives with golden hellos and guaranteed bonuses of millions per employee. Morgan Stanley was virtually bankrupt in 2009 and had to be rescued but in spite of that 2009 bonuses were higher than the previous year.

Central banks and governments worldwide have spent trillions of dollars temporarily propping up a totally bankrupt financial system and now a few months later the bankers are back earning absurd money within a banking system which hasn’t been mended and is still bankrupt. This is scandalous.

Toxic Structures are back

But not only that, they are also back to creating new securitisation programmes in order to reduce capital requirements and increase leverage. Goldman Sachs, and Barclays Capital are doing this already and many other banks will follow. It is exactly these types of programmes that created the financial crisis in the first place and now the bankers are back at it again. This is totally disgraceful and irresponsible behaviour by bankers who have learnt nothing from their disastrous freewheeling actions except how to milk the system to the maximum again.

As we have pointed out before, none of the problems in the banking system have been resolved. The system still has a leverage of 25-50 times, it is still full of toxic debt and derivatives, loan books are deteriorating daily, it still has worthless paper assets valued at fantasy prices and most banks are run by the same bankers who created the problems in the first place. For a typical bank, a 4% drop in asset value wipes out the equity. This is what we call a recipe for disaster.

In the meantime governments are making feeble attempts at preventing a future crisis by planning new regulations. But these regulations will only deal with known and historic problems. The bankers will again run rings around the authorities in creating new structures to circumvent the new rules.

ACCELERATION OF THE DOWNTURN IS ABOUT TO START

The next phase of this tragic saga will soon start.

Compared to the of the 1930’s we are already in a worse position today than at the same stage of the Great Depression. Industrial production is worse in many countries. World trade is worse and the stock market fall is greater than at the same stage in the corresponding period of the Depression and both government and private debt is a lot worse.

SO WHAT IS LIKELY TO HAPPEN NEXT?

- Unemployment will increase government deficits

First unemployment will rise substantially as outlined above and the effects of the unemployed masses will have major repercussions on the economy. This will lead to government deficits growing substantially. Tax revenue is already falling at alarming rates in the US and UK and most other countries but it will get a lot worse. Government expenditure will rise rapidly due to the mass unemployment. Taxes will rise but this will be like getting water out of a stone – there won’t be much revenue to tax. And if Vat or sales taxes are increased this will kill consumption even more. In addition governments will have to implement more programmes to help the poor, hungry and homeless. This will lead to more money printing.

- Next phase of bank problems

Secondly the next phase of problems in the financial system will start by the autumn of 2009 at the latest. Since this will come as a total shock to everyone the effect will be much worse than in 2008. So far US banks have taken losses of $1.1 trillion. Conservative estimates put total losses at $2.2 trillion but realistic estimates are around $4 trillion and this excludes any problems in the $600 trillion to $1 quadrillion derivatives market a big part of which is worthless. In the next round of capital raising for banks there will only be one investor – the government. Thus there will be more money printing.

- Government paper will collapse – first in the US and UK

With the escalation of money printing markets will be flooded with government paper which nobody wants, leaving governments to buy its own junk. The two countries with the worst problems are the UK and the US and their precarious situation will emerge first. Within the next few months rating agencies are likely to downgrade both countries’ debt. This will lead to the value of the treasury bonds and gilts collapsing and interest rates quickly moving up into the teens. The higher rates will make the financing costs of the debt to up exponentially leading to more money printing and higher interest rates. This is the “perfect” vicious circle that will end in a hyperinflationary depression.

- Hyperinflation is a currency driven event

For many years we have been saying that this crisis will be hyperinflationary. The issuing of unlimited government paper will lead to the rest of the world selling their holdings of US/UK treasuries as well as selling the dollar and the pound. Most so called financial experts have been predicting a deflationary recession/depression since they don’t see the demand pull that they think is the cause of hyperinflation. We have been one of the very few (together with the very wise Jim Sinclair) to understand that hyperinflation is a currency driven event. The issuing of unlimited government paper outlined above will lead to the US dollar as well as the pound collapsing. It is the collapse of the currency which leads to hyperinflation. Without fail in history every hyperinflationary event has been caused by a collapsing currency not by demand pull.

Many other nations will also experience hyperinflation such as the Baltic States, certain Eastern European and Asian Countries. Many more countries will have high inflation.

THE DARK YEARS

In the next few months we will see the start of the Dark Years. For the first time in the history of the world there will be a synchronised downturn affecting all nations (although some a lot worse than others).This is the culmination of the world and especially the Western world, living above its means for decades in a mania of credit bubbles, asset bubbles, real estate bubbles as well as excesses leading to decadence and a society with very weak moral and ethical values. (Of course no society recognises this as it is happening but only afterwards). Governments have fuelled this process by printing unlimited amounts of paper thus destroying the money and purchasing power of most nations.

The Dark Years will be extremely severe for most countries both financially and socially. In many countries in the Western world there will be a severe depression and it will be the end of the welfare state. Most private and state pension schemes are also likely to collapse. It will be a worldwide depression but some countries may only have a deep recession. There will be famine, homelessness and misery resulting in social as well as political unrest. Different type of government leaders and regimes are likely to result from this.

How long will the Dark Years last? There is a book called ”The Fourth Turning” written by Neil Howe. He has identified a pattern that repeats itself every 80 years. The pattern has been extremely accurate in the Anglophile world. We have recently entered the Fourth Turning which is the final 20 years of the cycle. According to Howe we are in the early stages of a 20 year period of economic and institutional upheaval. This is a period of Crisis when the fabric of society will change dramatically. Previous Fourth Turnings have been the American Revolution, Great Depression and World War II. According to Howe the Crisis will be substantially worse before it is over and it will last for another circa 20 years.

All of this is not good news and we hope that we and Howe are wrong regarding the severity and length of this crisis. But we fear that we are both right. We must stress again that never previously has the whole world entered a downturn simultaneously in such a fragile state both financially and economically which is why the Dark Years are likely to be so devastating and long lasting.

FINANCIAL MARKETS

Stock markets

The correction up in stock markets has probably finished but there is a possibility that it will continue for another couple of months. What is important is that it is a correction (we predicted it already back in January) and it will soon lead to a strong resumption of the downtrend. In the Dow Jones, a break of the trend line at 6400 would lead to a projected decline of at least 90% from the top. Almost all major world markets point to similar declines. This sounds incredible but bearing in mind that the Dow Jones fell 90% in the 1930’s and bearing in mind our discussion in the Dark Years paragraph above, this kind of target is not impossible. Some commodity stocks as well as gold and silver mining shares will be major beneficiaries from the Crisis.

Bonds

We forecast at the beginning of the year that US long rates would go up and they have almost doubled since. But this is only the beginning since we expect US and UK long rates to reach at least the mid-teens in the next 2-3 years. Interest rates in all countries will go up substantially in the next few years.

Currencies

The dollar and the pound will have very substantial falls in the autumn of 2009. At some later stage the Euro will also weaken as a result of certain countries breaking away from the Euro area.

Gold

The currency which will be the major beneficiary from the Crisis is Gold. We have invested in gold since 2002 when we saw the Crisis coming. Gold has trebled since then. But this is just the beginning. The next major move will take place in the coming 4-5 months and it will be major. Gold for wealth preservation purposes should be held directly by the investor and stored outside the banking system in his name. Holding gold in ETF form, futures or owning part of gold bars that you don’t have personal access to is not wealth preservation.

July 2009

Egon von Greyerz

September 6th 2018

Rereading the 9 year old article, there are very few words I would change. Around 98% of the article is extremely valid today. What of course is very wrong are the dates. By just changing a couple of dates, the article could have been written today.

The gold forecast was acceptable as gold more than doubled from $900 in 2009 to $1,920 in 2011. But the stock market forecast was seriously wrong. This shows that we are gold experts and not stock experts! It also shows that stocks are in a massive bubble.

So what have I/we learnt 9 years later?

Firstly, most obvious lesson is of course that forecasting is a mug’s game.

Secondly, as this is likely to be the end of a major super-cycle, whether it is a few hundred or a couple of thousand year cycle, we must realise that things often last longer than the brief horizon of a human being.

Thirdly I, like many people who analyse risk, underestimated the ability of governments and central banks to kick the can down the road by doubling global debt since 2006 and taking total liabilities to quadrillions of dollars, including derivatives and unfunded liabilities.

Fake money, fake news and manipulated data have greatly contributed to misleading the world that “All is well on the Western front”.

But things are certainly not well in the West, nor in the East.

Risk was very high in 2009 but the Powers That Be managed to postpone the inevitable for nine years. 2007-9 was just a rehearsal. Today in 2018, the risk is exponentially higher. Rather than worrying about when the financial system will collapse, we must worry about the massive risk and the consequences of a systemic failure.

It is already happening in the periphery and it will spread to the centre. Look at Venezuela, look at Argentina, or Turkey, Brazil, Indonesia. These countries are badly affected already. It will reach Italy and Japan and the US and, and….. It is not a question of IF but WHEN. In most of these countries the Dark Years have already started.

Also in the West, ordinary people are suffering with real income stagnant and prices going up for decades and with debts that they can never afford to repay nor even service the interest. The $125 trillion increase in global debt since 2006 has landed most ordinary people with a burden that will break them. The wealthy however have used this massive increase in credit to leverage their assets and amass unimaginable fortunes. Most of these fortunes will implode in coming years.

Risk protection must be acquired before the event. There is still time to buy “insurance” at a very low price. Once you have the insurance, in the form of precious metals, put it at the bottom of your wealth pyramid and leave it there.

So buy physical gold and some silver now. Store it safely outside your country of residence. Don’t wait since there will be exchange controls as all currencies will be debased. At that point it is too late.

Then enjoy your life. Because at some point in the next few years, times will be a lot more difficult for many of us.

"There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." - Ludwig von Mises

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.