Is the $32 billion collapse of the crypto exchange FTX the catalyst for the fall of the financial system?

We will soon know, but at least the GOLD vs CRYPTO debate was settled last week for the ones who believed cryptos represent wealth preservation. I have always argued that cryptos are a binary investment.

My view on Bitcoin has for years been that it can go to either $1 million or to Zero. So not a good risk and certainly not an investment for the fainthearted or for widows and orphans.

Not that I ever thought Bitcoin is worth $1 million or anything at all for that matter. But manias always go to excesses before they collapse.

Again we have learnt that cryptos are a lottery ticket. It can be worth a lot or nothing. What was worth $24 billion a week ago is today worth ZERO, ZILCH, NADA!

Not long ago FTX, the ex second largest crypto exchange was worth $32 billion but declined to $24b and now zero.

Ouch, that must hurt for all the investors who piled in to this Ponzi scheme. And it is not just any investor, names like Blackrock, Lightspeed Venture, Brevan Howard, Tiger Global, SoftBank and many more major investors. Most of the bigger investors are Venture Capital or Hedge Funds so they understand the risk.

It is amazing how greed and FOMO (Fear Of Missing Out) can attract almost everybody from Presidents to sport stars. See Blair and Clinton below. But sadly greed and FOMO also attract normal investors as well as greedy Pension funds managers. For example the Ontario Teachers’ Pension Plan are investors.

It is clearly totally unacceptable that pension funds should risk pensioners’ nest egg by investing in a Ponzi scheme with no assets, no real financials and just some unverifiable and unaudited electronic entries on a number of computers.

Apparently there was a backdoor to the FTX accounting software allowing the management to take billions out without triggering any alerts or audits.

Because so many recognised bigger investors jumped on the cryptowagon, pension funds clearly thought that this was a mainstream investment and therefore acceptable. For the average pension fund manager, it is always safe to do whatever other major investors do regardless if a particular investment goes to zero.

Our company has an associate in the US who knows many of the major pension funds investment managers. Interestingly no pension fund is interested in physical gold.

And that in spite of gold not only being the perfect wealth preservation investment but also an excellent hedge to balance a portfolio. More importantly in current times of high inflation and falling asset markets, gold acts as an excellent inflation hedge.

But knowing pension funds, they will wait until gold goes up and is on the front pages. At that point many pension funds will jump on the goldwagon at much higher prices.

There was also an A-list of celebrities and major sport stars involved with FTX. The founder of FTX, Sam Bankman Fried (SBF) was a superstar in the Crypto business and even managed to get Tony Blair (ex UK Prime Minister) and Bill Clinton to attend his Crypto conference in the Bahamas in 2022. I don’t know if these two world leaders received any shares in FTX but they were most certainly very well paid for attending the event.

Coming back to cryptos, exactly 12 months ago the total crypto market was worth $3 trillion.

Today, one year later the market is worth $885 billion, a fall of 70%. I obviously don’t mean that it is worth this amount but gullible investors clearly do. In my estimation it has no intrinsic value at all even though the market currently values cryptos at $0.9 trillion.

Next Bitcoin Target $3-5K On The Way To Zero?

Bitcoin dominates the crypto market and represents 39% of the total.

Obviously anyone who bought Bitcoin anywhere between $10 and say $1,000 has made a fortune. But as we know, the biggest number of investors jump on the bandwagon very late. Therefore, most investors are today most probably losing on their BTC investment.

The problem is that investors have already lost 75% of the maximum gain when the price of BTC was $70,000 and now like most greedy investors, they are waiting and praying for the next move up.

With such volatility, it is difficult to fathom how anyone could believe that BTC would ever be a good alternative to gold or even fiat money.

As the BTC graph above shows, the next target could be $3-5,000 on the way to ZERO?

The well known Bitcoin investor and ardent believer Michael Saylor bought, through his Microstrategy company, 130,000 BTC at an average of $30,600. With a current price of $16,600 he is sitting on a neat loss of $1.8 billion. He might very well have bought these on margin in which case his position could be liquidated at any time.

Since Bitcoin is almost a religion for many investors, very few have got out but are instead hoping for the next rally to $100,000, $250,000 and much higher.

They might be lucky or they might lose it all as the total CRYPTO market crashes after major margin calls.

Although FTX was only 3% of the total crypto market, the total loss of $24 billion in a couple of days will change the crypto market for ever. It might not ever be the same again except for the crypto fanatics.

Since FTX had a very high profile, the repercussions will be major. Not long ago FTX was seen as a buyer of Goldman Sachs.

Will we now see a continued rapid liquidation of all crypto assets as nervous investors realise that the whole crypto market could be a Ponzi scheme.

When the second biggest crypto exchange goes under overnight, there is nothing to guarantee that this will not happen to others.

Remember that there is no saviour and no central bank that will step in.

What is likely is that institutional investors will get out and stay out in the future. What is also probable is that cryptocurrencies will now be regulated in most major economies which defeats the object of this whole sector.

Pension Funds Buy Cryptos But Not Gold

My and our company’s position regarding cryptos has always been clear. We don’t consider that cryptos have an intrinsic value.

At a time when most assets are in bubble territory, cryptos do not for us represent real value. They have become yet another bubble asset although the aficionados obviously swear by their virtues.

Still since we see a major risk of the financial and monetary system collapsing, we are totally convinced that wealth preservation is critical.

Cryptos have by many been seen as a wealth preservation asset. We have always seen it as a highly speculative investment. I doubt that after the overnight collapse of a major crypto business, that many investors still see it as wealth protection.

What we have just experienced with FTX confirms that digital entries on a number of computers with no physical asset backing can hardly be considered as genuine protection of assets.

Also, if you lose the key, your cryptos can never be recovered. This has happened to many.

Cryptos – Just Another Popular Delusion Or Like Trading Turds Like Charlie Munger Said

Are we seeing the end of another Tulip Bulb speculative frenzy as described in “Popular delusions and the Madness of Crowds” by Charles Mackay?

The overnight $24 billion collapse of the crypto exchange FTX is in my view just the first domino of a massive series of failures in a financial system built on delusions and madness.

So is the crypto market just the first weak link in a global Ponzi scheme.

Let’s give the final word on cryptos to Warren Buffett and Charlie Munger in the presentation below:

Buffet: Cryptos are “nothing of value and will come to a bad end”

Munger: “It is like someone else is trading turds and you think you can’t be left out”!

Warren Buffett & Charlie Munger gave their take on crypto… “It draws in a lot of CHARLATANS…who are trying to create various sorts of EXCHANGES, where people who are of less-than-stellar character…

— Wall Street Silver (@WallStreetSilv) November 12, 2022

People who are trying to get rich because their neighbor’s getting rich.”

? pic.twitter.com/MkAGkWvulK

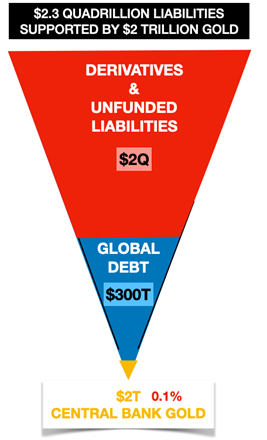

The whole financial system of $2.5 quadrillion is built on the illusion that digital entries on computers is real wealth as I write about in this article.

I elaborated further on the massive risk the financial system represents in this interview with Greg Hunter of USA Watchdog.

Most asset classes are major bubbles inflated by free money printed by central banks and created by commercial banks. When paper money started, it would normally be backed on a 1 for 1 basis by gold.

Now we have a $2.5 quadrillion debt/liability bubble backed partly by massively overvalued assets but mostly by hope and air. Not really a solid foundation for the global monetary system.

Stocks, Bonds & Property – The Next Dominos To Fall

The next big dominos to fall rapidly will be stocks, bonds and property. This fall has obviously already started but is likely to accelerate now.

For example, it looks technically like stocks will have a big fall until the end of the year. Medium/long term I would be surprised if stocks around the world don’t fall 75-90% from the top.

Another bubble to implode will be bonds. Everyone seems to have so much faith in the Fed Pivot. Yes, at some point in the rate rising cycle, the Fed might panic due to the economy imploding.

But firstly the Fed is determined to quash inflation at any cost. Remember that all the Fed’s actions have always damaged the economy since their timing is always wrong and that without exception.

But even if there is a temporary pivot by the Fed, the coming defaults in credit markets will cause massive sell offs in bond markets. At that point, the Fed and other central banks will lose control of interest rates. Then the vicious cycle of higher rates will cause more defaults which will lead to further liquidation of bonds etc until the bond market collapses.

I have always argued that central banks serve no purpose. Their actions have destroyed the efficient functioning of markets by constant manipulation. The natural laws of supply and demand are the best regulators and would have stopped the massive money creation combined with zero interest rates.

It is really very simple, when demand for money is high, rates go up to stop credit bubbles. The reverse is of course also true.

The property market is another super bubble fuelled by virtually unlimited free money. High interest rates are guaranteed to create an implosion of property values the major defaults following.

A Disorderly Reset

And so it goes on as I also discussed in a recent interview with As Good As Gold Australia about global markets failing .

But as I have said for years, the reset will not be the orderly one that Claus Schwab of WEF fame and other proponents suggest. Any reset involving central bank digital currencies will at best just work temporarily.

The real reset will be disorderly and violent. It will entail a collapse of global debt and the assets backed by this debt.

The world can never grow soundly if the debt remains. It can’t be written off in an orderly way without the other side of the balance sheet declining at the same time. But since no government or central bank would dare to take that decision, the disorderly reset is the only likely outcome.

Remember that when financial system implodes, the trigger is often what seems like a small event like the crypto market today.

No Currency Has Ever Survived In History

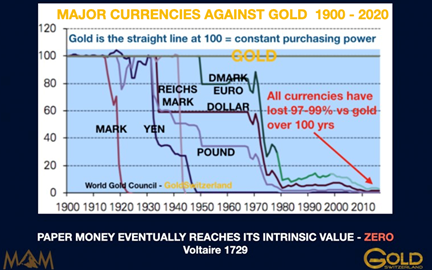

Students of history will not be surprised to see yet another collapse of the monetary system. Remember that no currency has ever survived in its original form.

Currencies always go to ZERO without fail. See Voltaire quote in the graph below.

So all currencies always lose all of their value. As the graph below shows, in relation to real money which is GOLD, all currencies have in this monetary era, since 1913, lost 97-99%. The remaining 1-3% fall is likely to take place in the next 2-5 years.

But what is important to understand is that the final 1-3% fall since 1913 means a 100% fall from today. So paper money or fake digital money is soon starting its journey to ZERO with ensuing hyperinflation.

For anyone who needs to be reminded of what that means, just look at Venezuela today or Zimbabwe, the Weimar Republic in the 1920s, John Law and the South Sea Bubble in the early 1700s and the collapse of Roman money, the silver Denarius in the 2nd and 3rd century etc. The list is of course endless.

If we look at the pyramid below with $2.3 quadrillion of debt, derivatives (which can easily turn into debt) and unfunded liabilities, it rests on only $2 trillion (0.1%) of real money or gold. So a free market revaluation of gold is very likely.

I am not in favour of gold backed currencies since that would lead to continued manipulation by governments. Much better if we have Free Gold with no paper market. When the unbacked paper gold market collapses, the true value of gold will emerge when not suppressed by 100x or more of fake paper gold.

Anyone who doesn’t hold physical gold and some silver will regret it in the next few years.

Also, as the graph below shows, gold is today, relative to US money supply, as cheap as in 1970 at $35 and in 2000 at $300. Remember that only physical gold outside the financial system is real wealth preservation.

Markets

Finally since we could see major moves in markets even in the near term, just a few comments on what I see.

Medium/Long Term Stocks, Bonds and Property are at the beginning of a secular bear market and will fall substantially in coming months and years as I have outlined above. Many bonds will go to ZERO as debtors (including sovereigns) default.

Short term a number of technical indicators including cycles point to major moves in the next 1-3 months. The likelihood that stocks will crash and gold/silver surge in the next few months is very high.

As I often point out, forecasting is a mug’s game. Thus we are talking about probabilities and not certainties.

Still when risk like today looks extreme investors should take heed to protect themselves from major losses like the ones we are seeing in cryptos.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.