As any asset class, gold has several financial properties. The yellow metal can be used for two different purposes: either as a hedging tool against certain macro-economic scenarios or for portfolio diversification. Its virtues, though, are not the ones frequently mentioned in the media...

Gold as a hedging tool against inflation: Myth or reality?

An urban legend states that “gold protects against inflation”. In reality, this varies a lot depending on the era and the times.

As for France, Thi Hong Van Hoang has focused on the 1949-2009 period in her doctorate thesis, published in 2010[1].

As I wrote in my book[2], “gold has only been profitable on the French market in periods of instability and crises (1973-1982 and since 2005). These findings brought Hoang to conclude that “there is no significant relationship, short or long term, between the price of physical gold and the consumer price index in France for the 1950-2009 period. Contrary to gold quoted in London or New York (...) gold quoted in Paris doesn’t allow French investors to protect themselves against inflation. On the one hand, the purchasing power of gold investments is negative (...) most of the time (...). On the other hand, there is no systematic relationship, short or long term, between gold quoted in Paris and the French price consumer index.

In France, the yellow metal is an efficient hedge only in periods of crises or instability. In other periods, gold does not serve as protection against inflation, as defined by rising consumer prices. These results brought Hoang to conclude that “gold is more akin to a safe haven investment than other investments such as stocks and bonds”.

(...) physical gold, thus, is not a “generational” investment. Its purpose is to be sold at the right time – not transmitted”.

This is not the usual stuff one reads in most media, right?

Of course, this analysis is valid only with inflation. It goes without saying that if France were one day to face a period of hyperinflation, things would be quite different and the price of gold would explode in euro... or in francs!

What about gold in case of deflation?

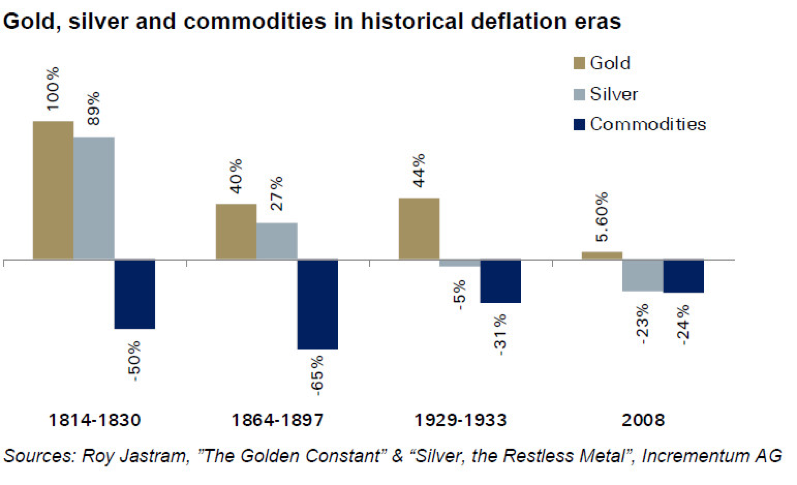

Prospective analysts are divided as to how gold acts in such a context. However, if we turn to the past, we find that deflationary periods represent a favourable environment for gold.

In any case, this is what The Golden Constant[3] - one of the most comprehensive studies on the price of gold by the statistician Roy. W. Jastram – reveals. This study focuses on the evolution of the price of gold and its real purchasing power in Great Britain and the United States between 1560 and 1976, a period covering 400 years (there is no such study dedicated to France). Jastram, in particular, concludes that “gold plays a major role in deflationary periods by appreciating in terms of operational wealth (real purchasing power)”.

As Ronald Peter Stoeferle and Mark J. Malek point out in the 2015 edition of their famous report In Gold We Trust, "this chart demonstrates clearly why gold in particular is a monetary asset, and not just another another commodity”.

Gold as a portfolio diversification tool

Thi Hong Van Hoang also focused on the virtues of gold within a financial portfolio exposed to the French stock and bond markets. According to her, for the 1949-2009 period, gold’s efficiency for the French investors was “lukewarm”.

As I summarize in my book: “The weak correlation between gold (either physical or paper) with stocks and bonds, as identified by Artigas in the United States, can be verified on the French markets. Physical gold is more efficient than paper gold to reduce the total risk in stocks and bonds.

Physical gold really improves portfolio performance only in periods where its price is in an uptrend, like recently (from 2004 to 2009). In the 2004-2009 period, adding gold to an investment portfolio allows not only to reduce risk, but also to increase profitability, whereas in the 1983-2003 period, the reduction of risk was effected to the detriment of profitability”.

Thi Hong Van Hoang took in consideration three types of gold investments. Here is her conclusion: “Physical gold is always more favourable than paper gold. Due to their very low profitability, the gold mining stocks quoted at the Bourse de Paris do not improve the profitability of said portfolios”.

So... what’s the use for gold, then?

Over the long term (1949-2009), gold has been a bad financial investment for the French saver (low returns, high level of risk, low purchasing power, negative risk premium and no regular income).

On the other hand, gold constitutes an excellent means of protection against cyclical and, a fortiori, structural risks of instability, since it becomes quite attractive in periods of financial, economic, political or social crises.

So gold is not the universal panacea, but it is at least a “safe haven” investment, to paraphrase the media at large. As far as I’m concerned, I consider gold not as an investment, but as the best wealth insurance there is. And, as is the case with all insurance policies, one should subscribe before an accident happens.

Any wealth management advisor able to offer several gold-related products will have a definite edge in his/her clients’ eyes. In a future post, we’ll look at why one should not make the mistake of equating physical gold with gold mining stocks.

[1] T. H. V., Hoang, Le marché parisien de l’or de 1949 à 2009 : Histoire et finance, Thèse de doctorat sous la direction du Professeur Georges Galais-Hamonno, Université d’Orléans, Décembre 2010.

[2] Nicolas Perrin, Investir sur le marché de l’or : Comprendre pour agir, SEFI Arnaud Franel, 2013.

[3] Roy W., Jastram, The Golden Constant, Edward Elgar, Cheltenham, UK, 1977.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.