In 15 days, the price of an ounce of gold in euros has risen from €1555 (first fixing on February 24 in London) to €1443 at the time of writing. With a low of €1437 per ounce, this represents a drop of 7.59%. And, since March 6, the price seems to have started to fall again. Should we be worried about this?

Gold price in euros since January 1

As the title of this post suggests: not at all!!

But you may prefer a reasoned response. Let's start by placing the last movement of gold in its global context.

CORONAVIRUS AND FALLING OIL PRICES: WHEN TWO BLACK SWANS MEET

After a calming 2019 in which the next day's scenario was more or less the same as the previous day's scenario on the equity markets, 2020 is proving to be the best year since 2008 in terms of entertainment.

Why do we love markets?

— Sven Henrich (@NorthmanTrader) March 10, 2020

Simple. Because it's the biggest show on earth.

In particular, Monday, March 9 set a series of all-time records, which contrasted somewhat with the near-weekly historical records of the previous year, at least in the US equity markets. Just look at that.

Crude Oil ETF was down over 25% today, its largest 1-day decline ever by 2x. Also the highest volume day in its history w/ over 150 million shares traded (inception: 2006). $USO pic.twitter.com/N3mWhstqAf

— Charlie Bilello (@charliebilello) March 9, 2020

This is the only day in the history of S&P 500 futures that they gapped down more than -5% and didn't close above the open.

— SentimenTrader (@sentimentrader) March 9, 2020

Fun times.

In case you missed it: Fear Index #VIX spiked to highest since 2008 in manic Monday trading, surpassed even the #Volmageddon level from 2018. pic.twitter.com/ruXfH8iJqO

— Holger Zschaepitz (@Schuldensuehner) March 9, 2020

It must be said that the previous week, which began with the Fed's catastrophic 50-basis-point cut in key rates (on March 3), had already been quite busy.

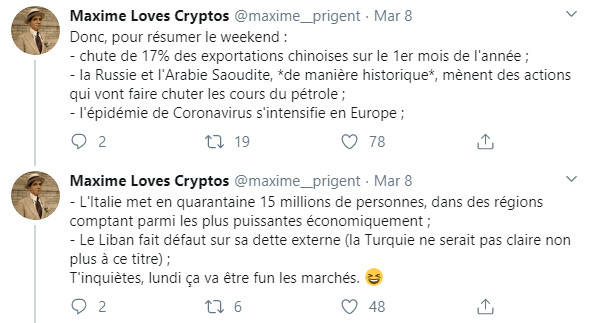

"*So, to sum up the weekend:

- Chinese exports dropped 17% in the first month of the year;

- Russia and Saudi Arabia, *historically*, are taking actions that will drive oil prices down;

- the Coronavirus epidemic intensifies in Europe;

*- Italy is quarantining 15 million people in some of the most economically powerful regions;

- Lebanon defaults on its external debt (Turkey would also be unclear on this point);

Don't worry, Monday's gonna be fun in the markets."

In other words, this exceptional decision by the great American financier did not particularly convince the markets.

Market to Fed: Please no more 50 bp rate cuts.

— Sven Henrich (@NorthmanTrader) March 8, 2020

We're not sure we can survive another one.

"Wall Street's opening at -7%. Futures markets are still under the influence of circuit breakers. You are experiencing a stock market crash live."

Wall Street ouvre à -7%. Les marchés Futures sont toujours sous le coup des coupe-circuits. Vous vivez un krach boursier en direct live.pic.twitter.com/iA9XPvoKGQ

— Maxime Loves Cryptos (@maxime__prigent) March 9, 2020

At the end of the day, the media were even dusting off their whole panoply of financial disaster hashtags.

#Bourse : Le #CAC40 clôture en très forte baisse de 8.39% à 4 707.91 Pts #krach #LundiNoir #GrandeDepression https://t.co/K3SgEoanzL pic.twitter.com/S6Twm7vKLj

— Boursorama (@Boursorama) March 9, 2020

The trend has yet to be confirmed but, in just a few days, the S&P 500 has broken through the symbolic 20% drop that characterizes a bear market, showing market participants that when markets forget the stairs and take the elevator up to the heavens, they can descend at the speed of a meteorite.

This was a 20% drop off of the all time highs for the S&P 500 btw.

— Sven Henrich (@NorthmanTrader) March 9, 2020

Going back to the June lows.

8 months of buying taken out in 13 trading days. pic.twitter.com/lgwi8qh7uk

Monday's shock was such that some commentators have hinted that a remake of 2008 could be unfolding before our very eyes...

#Oil crash sends new shock through world crippled by virus. Brent crash of >30%, if sustained, would savage national budgets from Venezuela to Iran, threaten America’s shale revolution & upend politics around the world. Looks like a global crisis 08’ style https://t.co/tMfvjAqljF pic.twitter.com/kXLHdNlMji

— Holger Zschaepitz (@Schuldensuehner) March 9, 2020

... forcing Jérôme Kerviel to specify that he had not set foot in a trading room all day.

"I was home all day eh... sometimes..."

J’étais chez moi toute la journée hein... des fois que ... pic.twitter.com/iiNC8FGzaP

— Kerviel Jérôme (@kerviel_j) March 9, 2020

GOLD IN EUROS: WHAT TO EXPECT IN THE EVENT OF AN EQUITY MARKET MELTDOWN?

Let's start by recalling that despite the bearish attacks of February 28 and March 9, the yellow metal is still up by more than 8% since the beginning of the year, while the S&P 500 is down 15% and the CAC40 is down 23%.

In addition, the ounce always sails above its bracket in the €1,387-1,414 area.

However, in the equity markets, we are still a long way from the losses recorded during the 2008 crisis. Between its high in October 2007 and its low in February 2009, the S&P 500 fell by more than 53%, and the CAC40 collapsed by 58% between July 2007 and March 2019. We are still a long way from such underperformance.

As for the yellow metal, it had gone through this period in a jagged fashion, losing in particular about 20% of its value between March and September 2008.

Gold prices between July 2007 and March 2009

You know the rest of the story: the price of an ounce would then hardly stop rising to reach € 1380 in October 2012.

But what had happened at the time for gold to lose 20% in just over 6 months? Roughly the same thing that is happening today.

GOLD IS A VERY LIQUID ASSET: IT HAS ADVANTAGES AND DISADVANTAGES

As I mentioned in the introduction, between its high of €1555 and its low of €1437, the ounce fell by 7.59%.

This raises the following question:

Answer: it's simply the mechanics of 2008 that are being repeated. During the severe falls in the equity markets, caught short, market participants dipped into their liquid assets to replenish their portfolios.

Gold sees its biggest one-day drop since 2013 as investors sold the metal to cover margin calls https://t.co/6ZrH6MCwb2 via @markets

— Ronnie Stoeferle (@RonStoeferle) March 1, 2020

Holger Zschaepitz doesn't write otherwise:

#Gold drops despite collapse in mkt sentiment: As stocks collapse, gold positions are said to be liquidated to meet margin calls. This was exactly how #gold initially behaved during the 2008-09 crisis as well. pic.twitter.com/60xi7CN5Pe

— Holger Zschaepitz (@Schuldensuehner) March 9, 2020

On Zero Hedge, Michael Maharrey relates in more detail the fall in the price of gold on February 28th: "Traders and investors were scrambling to liquidate assets to raise capital for margin calls. In other words, they were selling gold to keep afloat. As one analyst told MarketWatch, “Investors are selling anything with a bid and running for cover, and that includes typical hedges like gold.”

We’ve seen this same thing happen before – in the early stages of the 2008 crash. As the MarketWatch article pointed out, there was a rash of gold-selling as the stock market began to tank in ’08.

Once investors understood and appreciated the scope of central bank stimulus coming down the pike, they began buying gold.”

An additional explanation is that the fall in equity markets led market participants to rush into US government bonds, which led to a sharp drop in the dollar against the euro. This relative strength of the euro did not, of course, contribute to the influence of the yellow metal expressed in the single currency.

Euro jumps >$1.13 as US 10y yields collapsed and US/German 10y yield spread dropped below 150bps, lowest since 2016 pic.twitter.com/SG9NTkEsSp

— Holger Zschaepitz (@Schuldensuehner) March 6, 2020

So gold has by no means failed as a safe haven asset. But it is true that the situation is ironic: while there is widespread panic and equities are becoming illiquid, the ultimate safe haven asset is temporarily sold off because of its liquidity.

So don't panic if gold should fall again; even more so. As Bruno Bertez reminds us, it is only when the mother of all bubbles - the government bond bubble - is pierced that gold will shine in all its glory. Until then, there will be ups and downs.

L'or ne sera vainqueur que dans le combat final , il perdra les batailles intermédaires, c'est l'experience qui le dit.

— bruno bertez (@BrunoBertez) March 9, 2020

Gold will only be victorious in the final combat, it will lose the intermediate battles, it is experience that says it https://t.co/8hFfYfGrDU

Patience is the mother of all virtues.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.