On May 28th, the 13th edition of the In Gold We Trust report written by Ronald-Peter Stöferle and Mark J. Valek (S&V) of the Liechtenstein management company Incrementum was published.

One year after the 2018 report that I had the opportunity to mention in these columns, our two Austrians are back in the game to comment on the past twelve months and share with us the scenarios they are envisaging.

Reading only the title of the report, we know that this is a very special edition since S&V have chosen this year as their central theme: “Gold in the Age of Eroding Trust”.

In other words, for our two Austrians, we are getting closer to the moment of truth when holders of physical precious metals should be able to smile again.

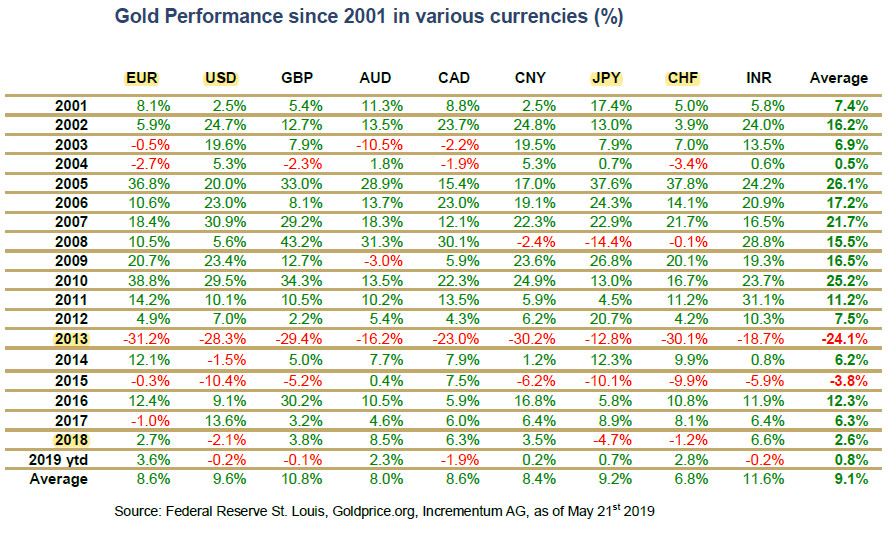

2001-2019: the main currencies devalued by an average of 9% per year compared to the yellow metal

If only the yellow metal holders had never lost their smile because, as S&V reminds us, gold has recorded a remarkable performance over the past eighteen and a half years, regardless of the currency considered.

Including the so-called "safe haven" currencies, namely the US dollar, the yen, and the Swiss franc, gold appreciated on average by 9.6%, 9.2% and 6.8% per year between 2001 and May 28, 2018.

The importance of following the price of gold in your local currency

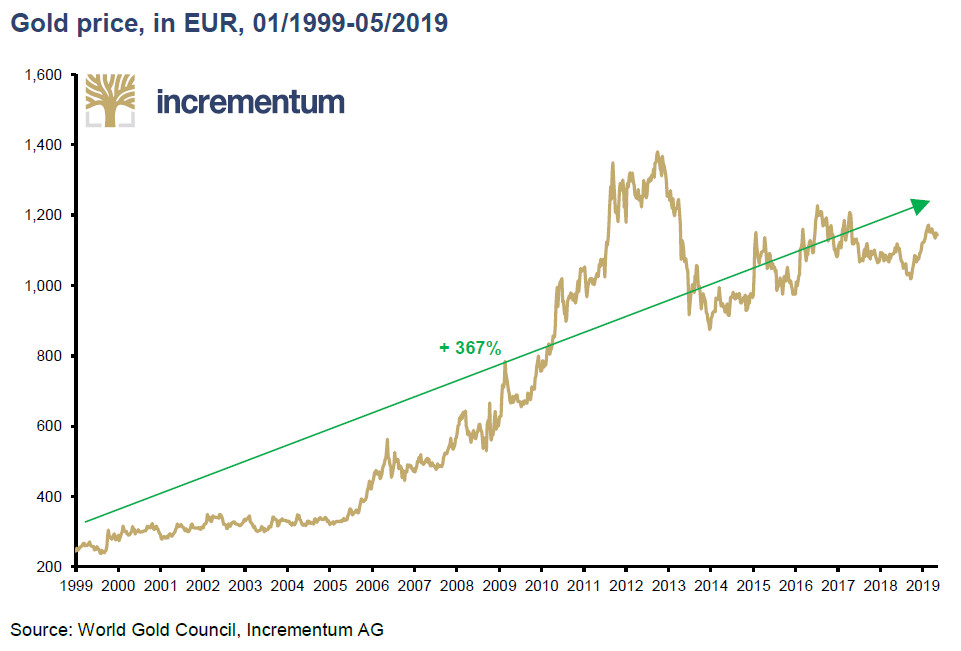

As for the euro, I would like to give you an extract from S&V's comments, which confirms the very particular importance I attach to the currency in which the price of the yellow metal is expressed*.

“The whole world seems to be looking exclusively at the gold price in US dollars. The whole world? No, we have looked at the large number of currencies in which the gold price is already close to its all-time high. It is incomprehensible to us that even in the eurozone the price of gold in US dollars enjoys more media attention than the price of gold in euros, and that therefore the considerable gains of gold in euros fall by the wayside, making gold appear much less attractive than it actually is for the euro investor”.

And for good reason, over the past five years and the current year-with the notable exception of 2017-gold has performed much better against the euro than it has against the US dollar. However, as savers residing in the euro zone, it is of course these statistics that interest us.

Looking back to the introduction of the euro as a unit of account in January 1999, gold appreciated by a total of no less than 367%.

This is even more impressive when looking at the single currency. It has lost 77.5% of its value to gold since January 1999.

(*Unusually, however, I will only express myself in US dollars in the rest of this article, since this is the currency most used in the IGWT report.)

“Gold is at the beginning of a multiyear bull market”,which started at the end of 2015

According to our two Austrians, gold should continue on its own merry way to new heights. They reiterate their conviction expressed last year that "gold is at the beginning of a multiyear bull market" which began (in US dollars, this time) at the end of 2015.

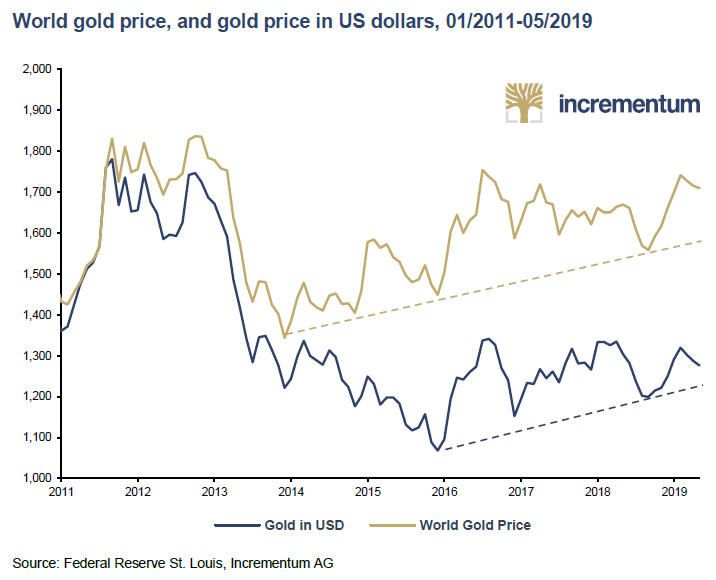

On the technical level, S&V emphasizes, in particular, that both the gold price expressed in US dollars and the "world gold price" evolve on a medium that has been tested without being called into question.

Moreover, the fact that the yellow metal rose above its moving average some fifty days after the publication of this report is in line with S&V's comments - the moving average at 200 days has never been called into question since the lowest level at the end of 2015.

For S&V, crossing the technical Rubicon of 1360-1380 USD would put “a gold price of USD 1,800 within reach.”

Let us now look at the fundamental S&V arguments behind their technical prognoses. As the IGWT report this year is 339 pages long in its "extensive version", I would ask you in advance to excuse me for only providing you with the substantial details. However, you can read more about the S&V analysis on this page, which is available this year not only in English and German but also in Mandarin.

The upcoming U.S. recession will precipitate the loss of confidence still enjoyed by central banks, and will therefore drive up the price of gold

S&V believe that it is from the United States that the signal of the rise in the price of gold will be given. “We stand by our assessment that the social climate, the economic dynamics, and the course of the public debate suggest that the Federal Reserve will initiate a turnaround in monetary policy before the next presidential election in November 2020. This turnaround, and probably just its announcement, has a good chance of being the trigger that lifts the gold price above the psychologically important resistance zone”, mentioned above, they write.

“Recession risks are significantly higher than discounted by the market. In the event of a downturn, negative interest rates, a new round of QE, and the implementation of even more extreme monetary policy ideas (e.g. MMT) are to be expected”, they add. The application of such policies will ultimately lead markets to gradually have "trust withdrawn from conventional currencies”.

In terms of timing, S&V cannot be blamed for not taking a risk. You see then: “How solid the US economic foundation – and thus the US dollar – really is will only become apparent in the next crisis. We are convinced that the boundless trust in the US economic engine and the US dollar might begin to crumble in the coming months”, they write.

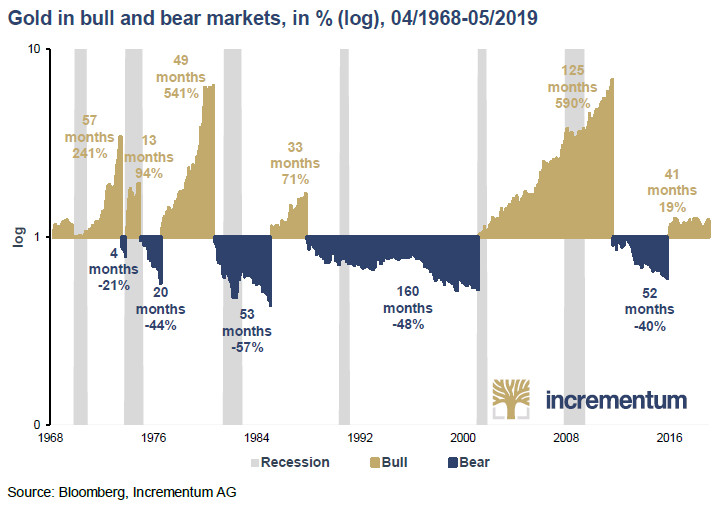

This leads me to suggest that you update an Incrementum chart that I had already included in these columns, namely that of the bull and bear markets for gold expressed in US dollars.

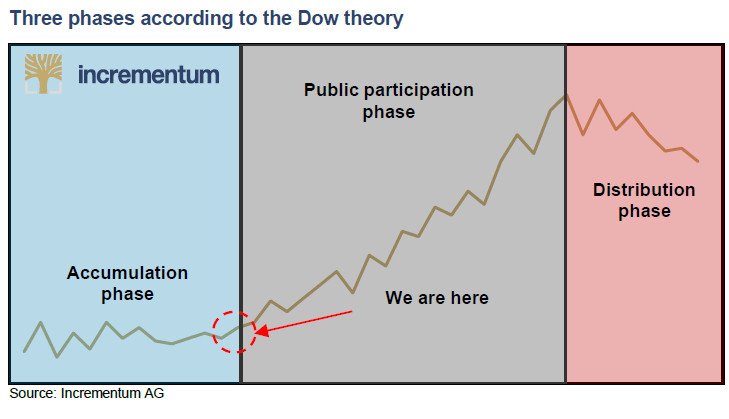

In other words, if our two Austrians are right, we are at the end of the accumulation phase, during which, “the most informed, astute, and contrarian investors buy”.

This initial phase of the bull market will then be followed by the so-called "participation" phase (according to Charles Dow's theory), which in principle proceeds as follows: “Prices are starting to rise slowly. Trend followers are showing interest; news is improving; and commentators, the media, etc. are writing increasingly optimistic articles. Speculative interest and volumes are rising, new products are being launched, and analysts’ price targets are being raised”, as explained by their guest colleague Florian Grummes from Midas Touch Consulting.

This is followed by the so-called "distribution" phase, this “final mania phase” during which “the group of informed investors who have accumulated from near the low point begins to reduce their positions. Media and analysts outperform each other in raising their price targets, and the environment is characterized by “this time is different” sentiment (see Bitcoin at the end of 2017, oil in 2008 and FAANG stocks or unicorns at the moment)”, Florian Grummes explains.

If you share S&V's vision, it is up to you to decide during which phase of the bull market you want to take a position on the metal.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.