At the beginning of 2019, as after every annus horribilis, forecasters were cautious-even pessimistic. There was plenty on the menu, since the menu was made up of increased volatility on the financial markets (down as much as 20% on the S&P 500 in the last quarter of 2018), increased trade tensions -particularly between the United States and China-, uncertainty over Brexit, and above all, a slowdown in the world economy.

The next US recession will start in...

— Charlie Bilello (@charliebilello) January 3, 2019

However, 2019 showed that whatever the ingredients of the anxiety-provoking cocktail, for the time being, stakeholders have maintained their confidence in central banks since they abandoned their desire for "normalization".

With this major theme of 2018 thus relegated to the drawers of the major monetary planners, 2019 may be remembered as a year where everyone wins.

2019: all lights green

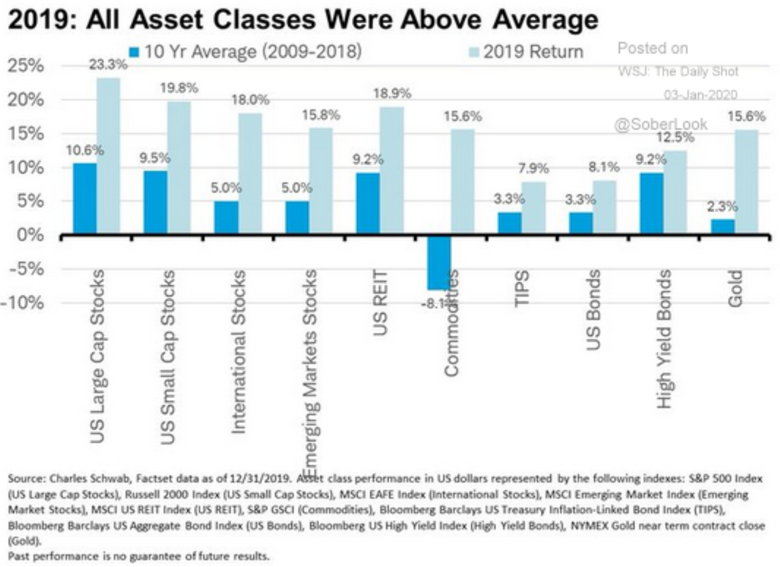

Virtually all major asset classes saw their valuations increase.

2019 Total Returns...

— Charlie Bilello (@charliebilello) December 31, 2019

Bitcoin: +90%

Nasdaq 100 $QQQ: +39%

Oil $USO: +33%

S&P 500 $SPY: +31%

REITs $VNQ: +29%

Small Caps $IWM: +25%

EAFE $EFA: +22%

EM $EEM: +18%

Gold $GLD: +18%

Investment Grade $LQD: +17%

High Yield $HYG: +14%

US Bonds $AGG: +8%

US Dollar $UUP: +4%

Cash $BIL: +2%

Stocks, bonds, real estate, gold and mining: absolutely all the lights are green on the 100 largest US ETFs, which is about the opposite of what happened in 2018.

Stocks, Bonds, Real Estate, Gold/Miners. The 100 Largest ETFs were all positive in 2019 w/ US Tech leading the way... pic.twitter.com/XyFZEGWKC6

— Charlie Bilello (@charliebilello) January 2, 2020

With a few exceptions, regardless of the country in which you purchased shares on January 1, 2019, by December 31, you have won.

Greece (+50%) and Russia (+49%) led all country equity ETFs in 2019... pic.twitter.com/YmdDEZ64qS

— Charlie Bilello (@charliebilello) January 2, 2020

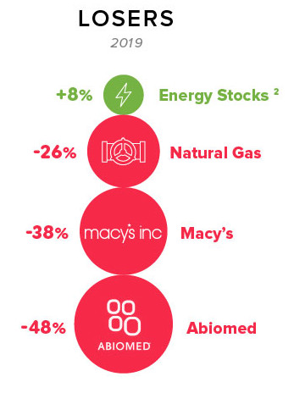

In fact, unless you took a position on natural gas, you couldn't lose.

Historically outstanding performance

Special mention to the S&P 500, which recorded its 2nd best performance in more than 20 years...

S&P 500 ends the year up 31.5%. In last 20 years, only 2013 (+32.4%) had a higher total return. $SPX pic.twitter.com/8XzyZMPcJ0

— Charlie Bilello (@charliebilello) December 31, 2019

...by stringing together a series of 35 historical highs, for a total of 242 over the 2010-2019 decade.

The S&P 500 closed at an all-time high 35 times this year and 242 times this decade (2nd most after 1990s).

— Charlie Bilello (@charliebilello) December 31, 2019

S&P 500 All-Time Highs by Decade...

1930-39: 0

1940-49: 0

1950-59: 141

1960-69: 224

1970-79: 35

1980-89: 190

1990-99: 310

2000-09: 13

2010-19: 242 pic.twitter.com/J1sobLeLPB

In the U.S. equity markets, only the 1990s saw more unbridled growth, with the S&P 500 stringing together like pearls historic highs to reach a total of 310, before the stock market crash of 2001-2002 set the record straight.

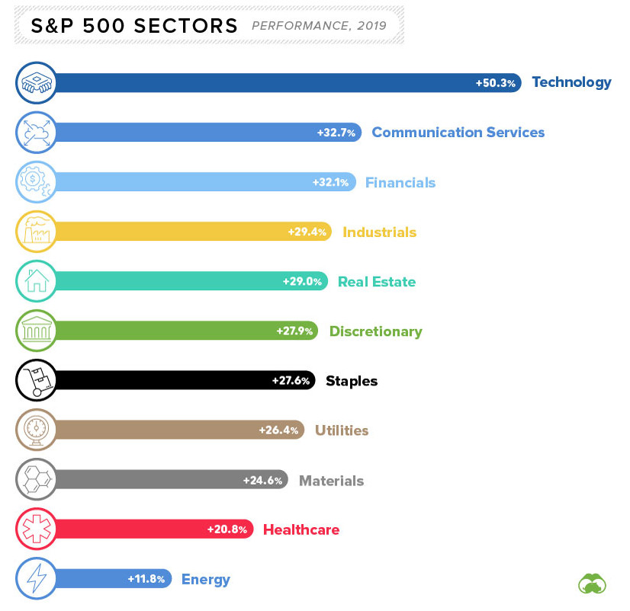

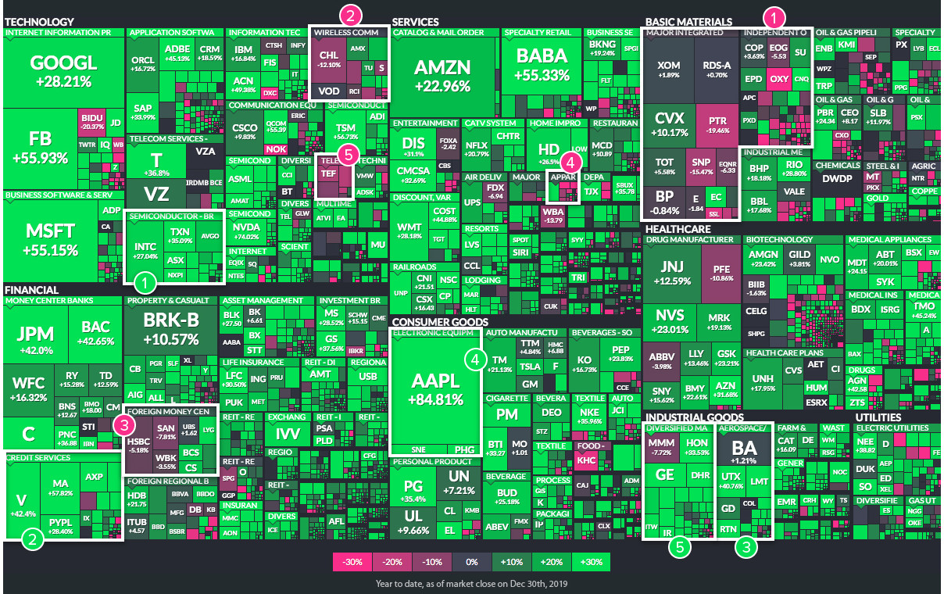

As in the 1990s, the spectacular performance of the U.S. equity markets in 2019 was driven by tech:

Note that all sectors of the S&P 500 posted double-digit returns. Over the past 20 years, this has already happened in 2003, 2009 and 2013, but by 2019, "all major asset classes have produced above-average returns [over the past 10 years], which has never happened before," as Jeffrey Kleintop of Charles Schwab & Co. notes.

On the NASDAQ, we haven't seen such a year (+39%) since 2009, and we are now at 11 years of uninterrupted positive performance.

Nasdaq 100 (total return) up 39% in 2019, its 11th consecutive positive year, a new record...

— Charlie Bilello (@charliebilello) December 31, 2019

2009: +55%

2010: +20%

2011: +4%

2012: +18%

2013: +37%

2014: +19%

2015: +10%

2016: +7%

2017: +33%

2018: +0.04%

2019: +39%$NDX

The growth of this sector, whose valuation is concentrated in the hands of GAFAM, will have been driven in particular by Apple, whose valuation increased by 84% (sic) in 2019!

2019 will thus have been the best year since 1997 for an offensive 60/40 portfolio (60% US equities and 40% US bonds):

A 60/40 portfolio of US Stocks and Bonds was up over 22% in 2019, its best year since 1997. pic.twitter.com/8nVcI69XPL

— Charlie Bilello (@charliebilello) January 2, 2020

In short, the theme last year was "Party like it's 1999":

Party like it’s 1999: The percentage of listed US comps in the red is close to 40%, highest level since late 1990s outside of postrecession periods. Tesla has doubled in 3mths, GE up 44%. The pair are 2 most valuable loss-making comps. https://t.co/BAlFHOw5Gr via @OlafGersemann pic.twitter.com/X2ChArTTZA

— Holger Zschaepitz (@Schuldensuehner) January 10, 2020

Raw materials were also at the party, with palladium exploding 56% in US dollars, oil rising 34% and an ounce of gold gaining 19% over the year.

2019 Commodity Returns (Spot)...

— Charlie Bilello (@charliebilello) January 2, 2020

Palladium: +59%

WTI Crude: +34%

Gasoline: +30%

Coffee: +27%

Lumber: +26%

Brent Crude +23%

Platinum: +22%

Heating Oil: +20%

Gold: +19%

Silver: +15%

Sugar: +12%

Wheat: +11%

Soybeans: +7%

Copper: +6%

Cocoa: +5%

Corn: +3%

Cotton: -4%

Natural Gas: -26%

In the end, it's only on the cryptos side that performance is split between tops and flops, Bitcoin having nearly doubled over the period.

2019 Crypto Returns

— Charlie Bilello (@charliebilello) January 2, 2020

Chainlink: +506%

Tezos: +192%

Binance: +124%

Bitcoin: +92%

Litecoin: +37%

Bitcoin Cash: +37%

Bitcoin SV: +12%

NEO: +9%

Tether: -0%

EOS: -1%

Monero: -4%

Ethereum: -3%

Ethereum Classic: -16%

Cardano: -20%

TRON: -27%

XRP: -46%

Dash: -49%

IOTA: -55%

Stellar: -59%

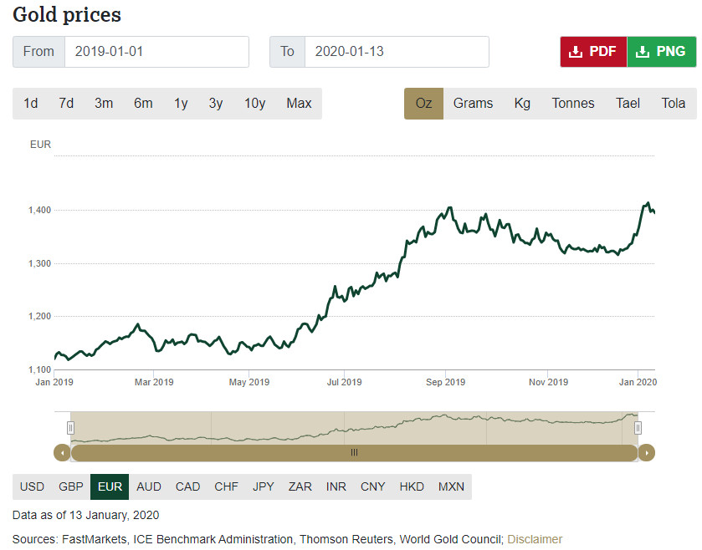

At +20% in euros, gold is not to be outdone!

As you know, I am presenting these statistics in US dollars because that is the currency in which they are most readily available. However, we are primarily interested in performance expressed in euros.

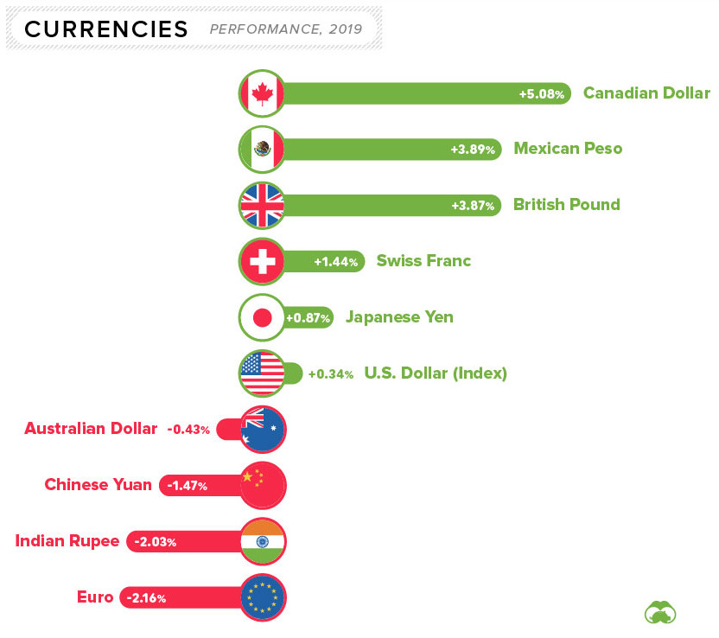

Let us first of all note that the common currency lost 2.16% against the dollar in 2019, while the British pound gained almost 4% - which will not fail to reassure those who are worried about the British economy in the run-up to Brexit.

Fortunately, if you keep some of your savings in the form of physical gold, you were able to offset this loss, as the yellow metal appreciated again by more than 20% against the euro in 2019, starting the year at 1125 € and ending it at 1358 €. On January 6, the ounce briefly surpassed its September high.

What to expect for 2020?

Scorched by the surprise of 2019, forecasters have all converted to optimism for 2020, when their forecasts are not simply euphoric.

The latest bear markets are reduced to irony in equity markets that nothing seems to stop.

Now that the economy is recession proof let's update our price forecast for the next decade.$XLK pic.twitter.com/HoY5c4ZJxv

— Sven Henrich (@NorthmanTrader) December 31, 2019

Knowing that the fundamentals have remained pretty much the same since Jerome Powell pitifully flip flopped on the subject of normalization in December 2018…

We're witnessing the biggest market pump scheme in history.

— Sven Henrich (@NorthmanTrader) January 9, 2020

1. Fed liquidity

2. Trump

3. Buybacks

4. Passive allocations, ETFs

Ever more money chasing less supply of shares, ever more concentrated market cap in fewer stocks, ever more disconnected from the economic basis. https://t.co/hM0tWMXdEh

...the central question for 2020 is whether the markets will continue to have confidence in the stabilizing powers of Robert Kaplan (Dallas Fed Chairman) and his fellow players, or whether they will feel that the party has definitely gone on long enough.

The admission:

— Sven Henrich (@NorthmanTrader) January 10, 2020

“I do think the growth in the balance sheet is having some impact on the financial markets and on the valuation of risk assets...I want to be cognizant of not adding more fuel that could help create further excesses and imbalances.”https://t.co/7kEogQ6aYW

This is a delicate way of conceding that central bank action has already contributed to creating some slight "excesses and imbalances" in the markets, isn't it?

In any case, for Ronald Stoeferle, the performance of an ounce of gold in 2019 confirmed the start of a new bull market and, on the yellow metal side,"the party has only just begun".

Whether you're in the "party" or not, I'll be sure to keep you informed!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.