Every year for the past 13 years, Ronald Stoeferle, now accompanied by his partner at Incrementum AG Mark Valek, has published a new edition of his world-famous “In Gold We Trust” report. This publication, which is usually published in late May/early June, is then updated in the fall, giving the reader the patience to wait until the following spring. The Chartbook of the last report was published on October 24, and serves as a support for the lecture tour that Ronald Stoeferle began on November 11 at the Precious Metals Summit à Zurich.

Gold and time

In a keynote entitled, « Gold, the 7th Sense of the Financial Markets », Ronald Stoeferle starts with the dual observation that:

- "Nobody is talking about the sustainability of our monetary system";

- However, no one is questioning the solidity of gold over historical periods.

These findings seem to me to be valid. One thing, however, is clear: when we talk about gold, I think we must distinguish two things.

On a historical scale, it is indisputable that gold has always played a role in the vast majority of the monetary systems that have taken shape around the world. And for good reason, as I wrote in my book on the gold market in 2013: "Because it is universally recognized for its value, very rare, expensive to produce (gigantic costs of prospecting, extraction and refining of ore) and particularly prized, gold is a precious metal. This characteristic cannot be altered by central banks because, unlike banknotes, gold is not printed. The state of science does not allow (yet?) to artificially reproduce this metal for profit. As its intrinsic value cannot be depreciated, gold has a floor value below which its price cannot fall".

On the other hand, it cannot be repeated enough that on the scale of a human life, gold must not be acquired with a view to being passed on to one's descendants. The accumulation of gold should not be an end in itself. The objective of the saver who buys yellow metal must be to protect his assets while waiting for a claim. Coins and bars are therefore intended to be sold when the time comes, and not passed on over generations. Other types of investments, particularly equities, perform much better than gold over the long term, on a human lifetime scale.

Is gold able to warn us of financial tsunamis?

Is there still time to take a stand on the equity markets? Ronald Stoeferle disagrees, wondering about the possibility of a financial tsunami, making a detour to... the animal world.

In his last conference, the Austrian recalled the scientific hypothesis that certain types of animals would be able to predict earthquakes because of their ability to detect changes in magnetic fields - a 7th sense that humans lack. When a tsunami is imminent, these animals would thus be the first to leave the sea to take refuge further up.

Since 2002, the Icarus project, an international initiative led by the Director of the Max Planck Institute of Ornithology in Starnberg (Germany), has aimed to monitor migration patterns of small flying animals using satellite images with the help of GPS micro transmitters implanted on such animals (the tracking device was installed at the International Space Station in August 2018, and put into operation in July 2019). While not its first application, this initiative also aims to highlight a possible link between unusual animal movements and impending earthquakes. It goes without saying that the stakes are high for the insurance and reinsurance sector.

And that's where Ronald Stoeferle comes up with his thesis: like some animals, gold would be able to send us signals about the health of the economy and finance.

1st signal: after this summer's breakout, gold confirmed that it is in a global bull market

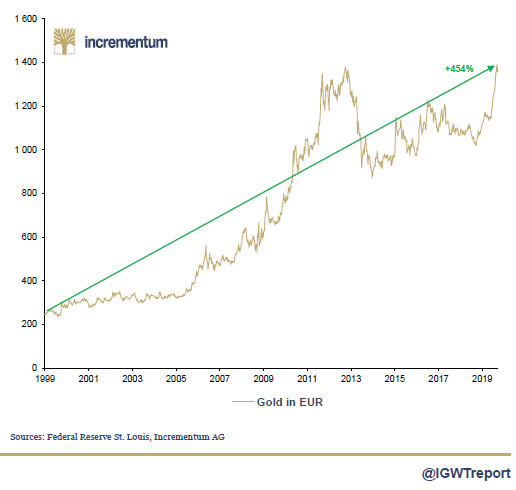

First of all, in euros, the gold price on August 25 and 26, 2019 surpassed its historic high of October 4, 2012, exceeding the 1,380.92 € mark. As I write these lines, the price per ounce is now 1324 €.

Gold prices in euros from 1999 to September 2019

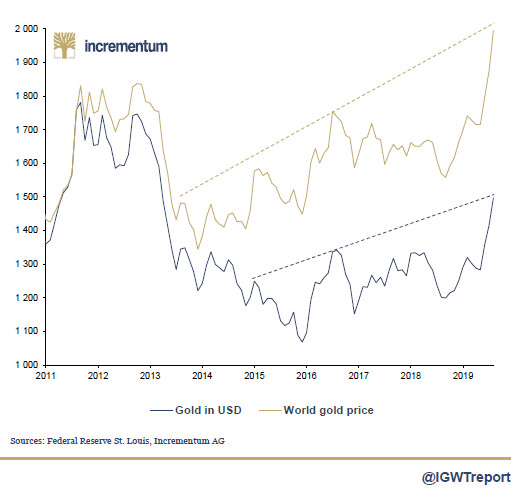

In dollar terms, Ronald Stoeferle believes that gold this summer gave an additional signal because it is "at the very beginning of a new bull market", which would have started at the end of 2015.

Gold prices in dollars (blue) and "world gold prices" (yellow), 1999 to September 2019

For this hypothesis to be confirmed, the ounce would have to continue to climb, marking ever-higher lows, until it surpasses its historic high of September 2011, a few dollars short of the $1900 mark. It is $1456 as I write these lines.

Note that, as usual, the world is keeping its eyes fixed on the price of gold in dollars. However, the ounce has already surpassed its historical high in many currencies. The "world gold price", i.e. the price per ounce expressed in a basket of currencies, has even reached a new historical high, as you can see on the graph above!

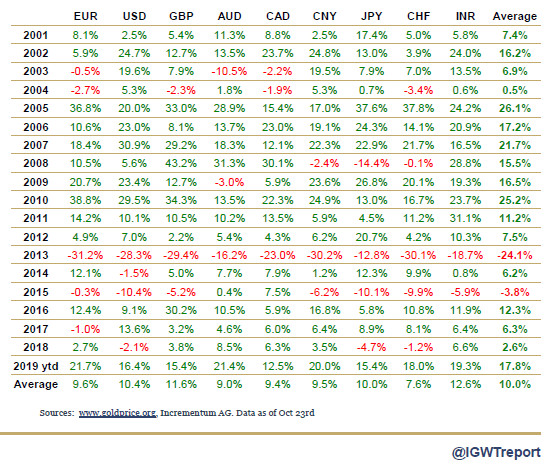

Here are the performances achieved by the ounce on October 23rd:

As you can see, since January 1, 2019, gold has recorded a 21.7% return in euros, 16.4% in dollars and an average of 17.8% in the various currencies considered. Since 2001, this represents an average annual performance of 9.6% in euros, 10.4% in dollars and 10% on average.

Is the "barbaric relic" sending us a signal? Soon, I will have a good opportunity to tell you more about it...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.