Previously we’ve seen that even though the bancassurers’ “physical gold” offers may constitute an easy solution for wealth management advisors, they are far from offering the kind of services proposed by the precious metals specialists.

On top of the fact that their turnkey offers bring a very high level of security for their clients, certain precious metals brokers have put in place a commission program dedicated to WMA business providers.

The purpose of this post is to analyse GoldBroker.com’s commercial offer through the lens of what we’ve already established and to introduce the modalities of the commission program for WMAs put in place by GoldBroker.

1. Broker’s duration and reputation

GoldBroker Ltd, founded in 2011 by Fabrice Drouin Ristori, from France, is located in Malta and it offers its services on its GoldBroker website, www.goldbroker.com. GoldBroker is positioned as a leader in the European market with high-end solutions. You can meet the team in person in its London and Barcelona offices, and also in Paris (upon appointment).

Any time a book dedicated to the precious metals market is published in French, GoldBroker’s offers are systematically invoked[1].

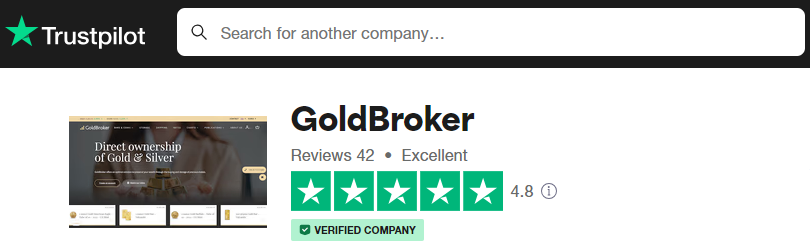

The Trustpilot website, which allows commentaries from verified clients, shows an immaculate reputation with commentaries that are, on average, “excellent”.

2. Purchasing products from a broker who gets supplied closest to the source of production (national mints)

All products sold by GoldBroker have only circulated within the professional circuit. Its inventory is exclusively comprised of coins and bars from LBMA-accredited refineries (the highest accreditation possible), which guarantees the origin and quality of the products.

The company, notably, is recognized as an official purveyor of the Royal Canadian Mint, the Perth Mint and the Austrian Mint. Its clients are thus completely protected against the risks of counterfeiting, which may not be the case for investors choosing “second-hand” products.

3. A vast array of coins and bars – no more offers limited to Napoléons and bars

GoldBroker offers a vast array of gold and silver coins and bars (also palladium and platinum), which includes the whole of must-have investment products. You may peruse the list of available products by clicking here.

4. Storage solution included in the offer, with several imperatives

We previously mentioned the following necessities: 1. External storage outside of the banking system; 2. In a “segregated” account with “allocated” assets (reduction to a minimum of counterparty risks and clear identification of coins’ and bars’ ownership); 3. In a country that has historically guaranteed the respect of private property; 4. Storage with a leader in the custodian sector; 5. With regularly published audits of the vault’s contents by a reputable independent party, or issuing of storage certificates with a recognized custodian company with the possibility of inspecting one’s precious metals in person.

Contrary to other brokers who offer shares in a stock of bars with multiple owners, products offered by GoldBroker.com are legally and exclusively owned by a single client.

Ownership – direct – is realized via a storage account in the client’s name with Malca-Amit, which issues a storage certificate that constitutes an ownership title. Said document guarantees the existence of your precious metals, while laying out a very precise description of them: shape (bars or coins), weight, refiner’s name, serial numbers, value and quantity of items purchased by the client and put under seals.

Investors who would desire to inspect their metals in person have the possibility (by appointment) to visit Malca-Amit’s vaults. This secured storage specialist, founded in 1963 and renowned all over the world, has absolutely no financial ties with GoldBroker Ltd. It is also possible to request photographs of the purchased products clearly showing their serial numbers.

A storage contract is signed between GoldBroker’s clients and Malca-Amit, which manages the storage of the metals in its secured vaults in Zurich, New York, Toronto and Singapore. Since the clients’ assets never figure at any moment on either GoldBroker’s or Malca-Amit’s balance sheets, they are protected in the case of bankruptcy of any of those two companies.

The metals are also insured against all risks, excluding losses resulting from civil war, nuclear explosion and/or terrorism. The insurance policy is directly subscribed by Malca-Amit with Lloyd’s. An advantage of this insurance contract is that the amount of guarantee tracks the actual value of the clients’ assets (based on LBMA’s gold spot price). Thus, if gold were to rise substantially, your clients would still be insured for the integrity of their investment, which wouldn’t be the case with a policy covering only the value of assets at the moment they are stored.

5. Taking delivery of your metals

For any withdrawal – partial or total – investors wishing to take possession of their metals may go directly to Malca-Amit’s vaults.

GoldBroker can also arrange for the delivery of your clients’ assets at their home or in other secured locations throughout the world. A quote is made for each order on the basis of the country of destination.

6. Ease of buying and selling

After opening a client account on GoldBroker’s website, a member of our team will contact the client in French, English or Italian to make an investment roadmap.

The minimum order amount is $5,000 (EUR, USD, CHF, CAD, GBP). Once funds are received, GoldBroker puts in the client’s order, based on his investment roadmap, and manages the delivery of his metals in the vault of his choice. A storage account is opened in the client’s name with Malca-Amit, with which he signs a storage contract. After delivery of the client’s metals in the vault of his choice, he receives a copy of his storage certificate.

As a WMA, you have two possibilities to collaborate with GoldBroker:

- You could either buy coins and bars on behalf of your clients, in which case all you have to do is open a “company” account on GoldBroker’s website;

- Or your clients could buy directly coins and bars using the tracking link that will be communicated to you by GoldBroker, as a business provider. This way, you will be automatically identified and paid commission to, as a “godfather”.

GoldBroker insures the buying back of precious metals stored with Malca-Amit within 2 days, thus guaranteeing the liquidity of the investment. The metals will then be resold to our other clients.

7. Last BUT NOT least: the costs of buying, selling and storage, because security comes with a price

Purchasing costs: sales prices shown on our products include GoldBroker’s commission. Commissions vary from one product to another and are degressive with larger quantities ordered.

* Assets value = (number of troy ounces) x (spot price)

Which type of clients is targeted by GoldBroker’s offer?

This offer is well suited for high-net-worth individuals looking for maximum guarantees and having the possibility of taking delivery of their metals.

How are WMA business providers remunerated?

GoldBroker guarantees a commission on the storage service corresponding to 26.67% of the storage fee, for the entire lifetime of the customer.

Example:

If your customer has a stock of $200,000, his storage costs will amount to $2,300 per year.

In this case, you will receive a commission of $613.41 (= 26.67% x 2300) attached to his invoice (quarterly or annually).

What now?

Here we are, at the end of this series of notes on gold for wealth management advisors. I hope these notes have helped you to see more clearly about this asset class, which is hard to fully understand at first.

Do not hesitate to contact the management at GoldBroker for more information on the details of its offer or, more generally, on the yellow metal itself.

[1] Yannick Colleu, "Investir dans les métaux précieux: Le guide pratique complet", Eyrolles, 2014 ; Philippe Herlin, "L'or, un placement d'avenir", Eyrolles, 2017 ; Nicolas Perrin, "Investir sur le marché de l'or : Comprendre pour agir", SEFI Arnaud Franel, 2013.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.