“When China will have a right to speak in the international gold market, pricing will get revealed.” Shanghai Gold Exchange Chairman Xu Luode (1)

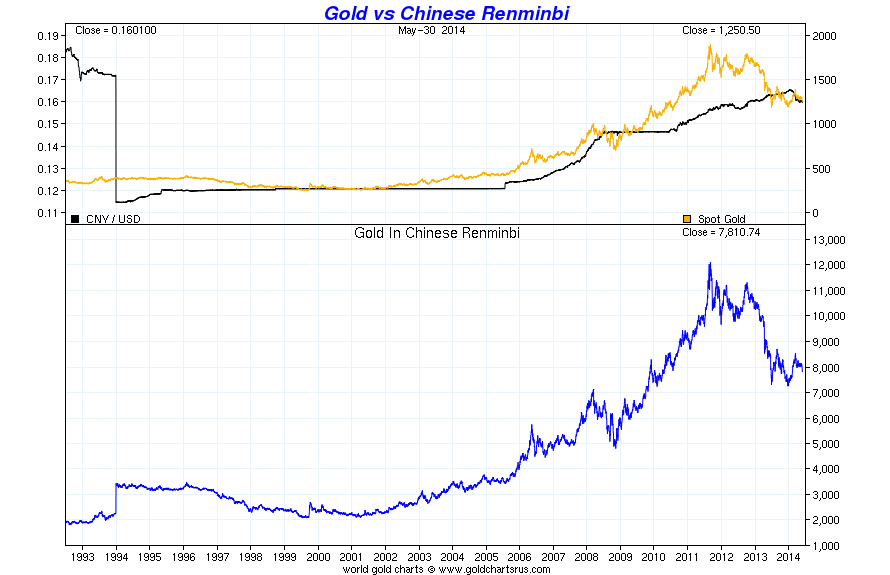

Chart #1: Gold vs China’s Yuan

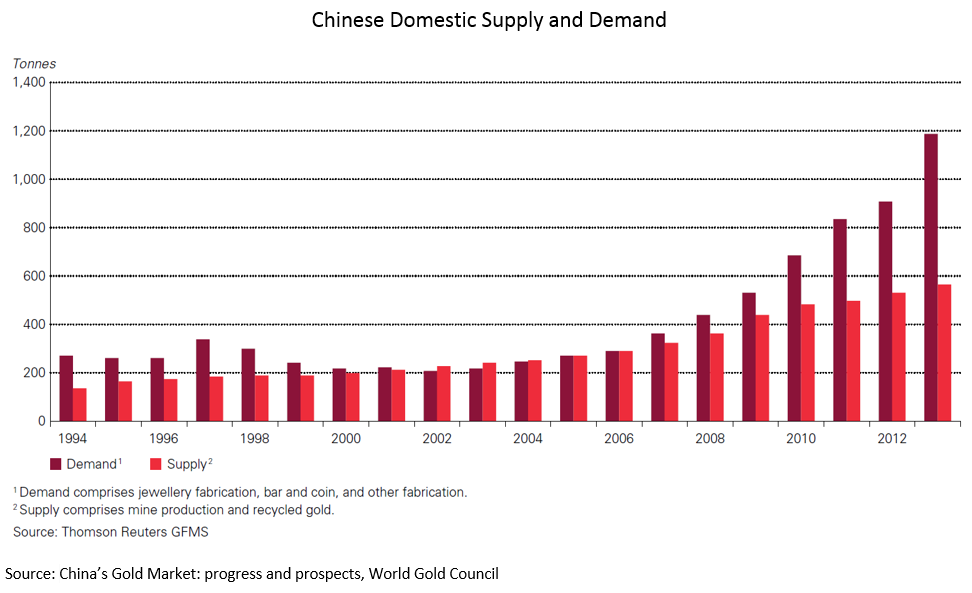

We cannot understand today’s gold market without understanding the role China and, in a different way, India play in it. The gold market in general is very opaque and the Chinese one, in particular, is even more. In this article, I will look at China’s role in the gold market. In 1950, communist China prohibited private ownership of bullion and put the gold industry under state control. Fifty years later the People’s Bank of China abandoned its monopoly on the purchase, allocation and pricing of gold. In 2004, for the first time since 1950, private persons were permitted to own and trade gold. China has become the most important physical gold market in the world. It is now both the number one producer and consumer of gold. The World Gold Council, in a recent report on China and gold, expects the Chinese private sector gold demand to be at least 1,350 tonnes by 2017. Today China is the world’s largest market for gold bars, in part because of successful development initiatives by the major chinese banks.

In an excellent recent article in the Gold Forecaster entitled “China has control of the Gold Price”, Julian D. W. Phillips says,“China is not only the main force in the global gold market, but they control the gold market. They play their control very cleverly, so that it is not apparent. China has found a way to buy gold without pushing up the gold price. China, through their selected bullion banks, are buyers of gold both on the retail and on the ‘official’ markets in both London and New York ‘on the dips’. The People’s Bank of China does not buy gold directly. It uses agents who, when the P.B.O.C. decides it is in the national interests to revise their gold reserves, deliver the gold, bought on their behalf, through S.A.F.E., the agency buying for them.To ensure prices stay low, the gold China buys comes mainly from ‘off-market’ sources. Do not be misled: China is doing all it can to support lower gold prices so it can acquire gold sold off by other gold investors. In this way, it is controlling gold prices! China wants to control this rate and manage the internationalization process without being vulnerable to ‘attack’, which could disrupt its control. It is with this in mind that China is accumulating gold in ‘official’ hands and in Chinese citizens’ hands. We are convinced that if it suits the nation’s interests, the Chinese government will require its citizens to hand over their gold to them. We do not believe that China has set a ‘ceiling’ on the amount of gold it will acquire!” (1)

The World Gold Council also says, “The major increase in gold supply to the Chinese market in 2012 and especially 2013 could be partly related to large-scale official purchases.” (2) China has been also a major buyer of gold mines across the world. What this pattern of buying does is to draw in a huge volume of gold, taking stock out of the market and away from traditional buyers, and for a long time.

Gold demand in China could not have flourished as it has without the blessing of the authorities. I was intrigued at first by this active encouragement from a government, and even more so by a communist and totalitarian one. Not only gold is an alternative to official currency, but it is also out of the reach of the government, if needed. I concluded that the Chinese government is encouraging its people to save in gold, among other reasons, also to constrain hoarding of foreign exchange paper that would have put pressure on the Chinese Yuan. With very few investment opportunities, hoarding would have been done in foreign exchange and mostly in US dollars. I observed this phenomenon in the late ’90s in Europe, before the introduction of the Euro. The “black market” run to convert its local currencies (French franc, Italian lira, German mark, etc.) to US dollars so it will avoid having to declare them to the authorities, even if it had to pay extra fees. This had the effect of pushing the US dollar up.

Another valid hypothesis is that, as the World Gold Council’s recent report, China Gold Market: Progress and Prospects, says, “China’s leaders regard the public’s gold holdings as part of the nation’s reserves that could be called upon in an emergency” and that “South Korea’s mobilisation of the public’s gold stocks during the Asian financial crisis impressed the Chinese.” (2) This is also what Julian D. W. Phillips said in his recent Gold Forecaster report that I cited above.

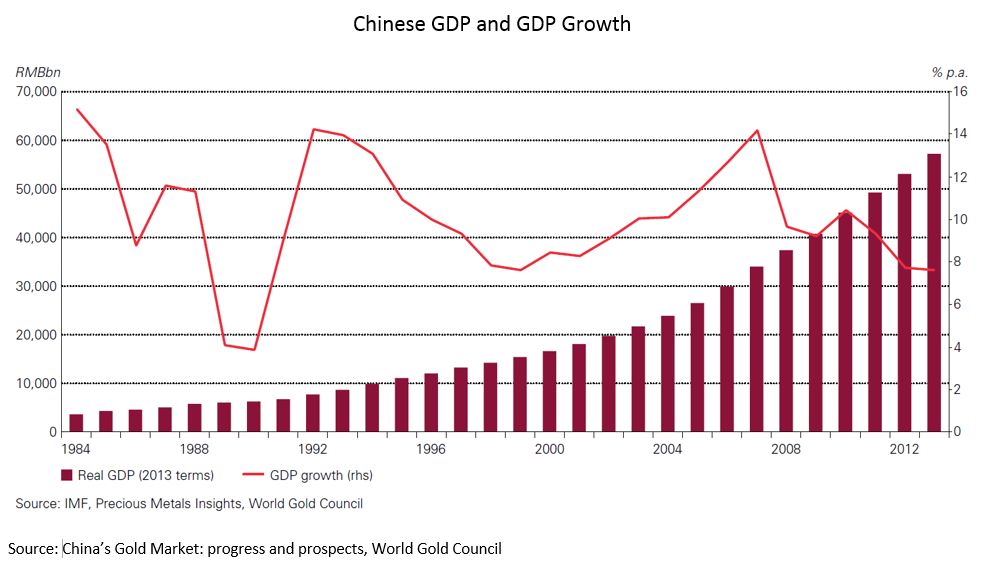

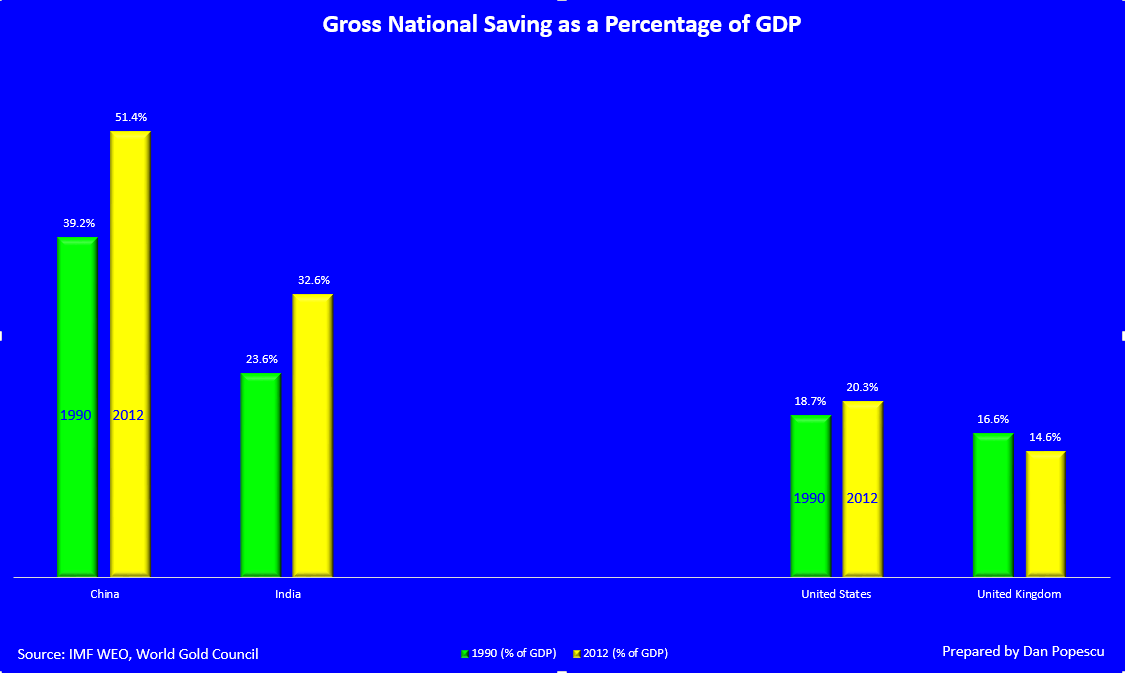

China’s growth since 1980 has been phenomenally high (graph #2). China’s economy has taken off since Deng Xiaoping’s economic reforms in 1978. Continued high national savings (graph #3) fully financed Chinese investment and sustained it at a very high level.

Chart #2: Chinese GDP and GDP Growth

In 1978, China’s per capita income stood at just over US$200 in current dollars. In 2013, this figure had increased to US$6,850. We can observe, in graph #3, that the gross national savings rate of China versus that of the US. China’s saving rate increased from already a high level of 39.2% in 1990 to 51.4% in 2012, versus an already very low level of 18.7% for the US in 1990 to just 20.3% in 2012.

Chart #3: Gross National Savings as a Percentage of GDP

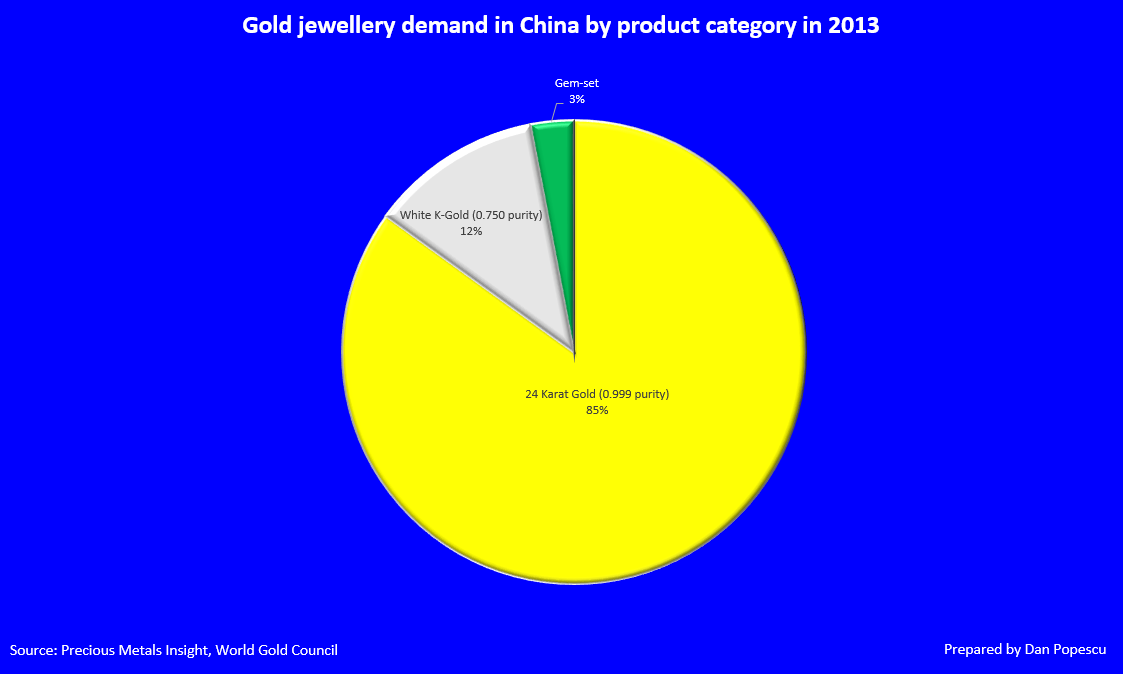

The World Gold Council also says, “The major increase in gold supply to the Chinese market in 2012 and especially 2013 could be partly related to large-scale official purchases.” (2) Investment in gold has undoubtedly benefited also from the limited selection of alternative forms of savings in China. Most investors in China that look to own gold want it in physical form and in their own direct possession, because of a lack of trust in third-party custodians. The World Gold Council says, “In China there is, to some extent, a German-style popular memory of past hyperinflation that continues to influence attitudes and behaviour today.” (2) Therefore,Chinese consumers buy 24-carat gold as a counter to currency devaluation.

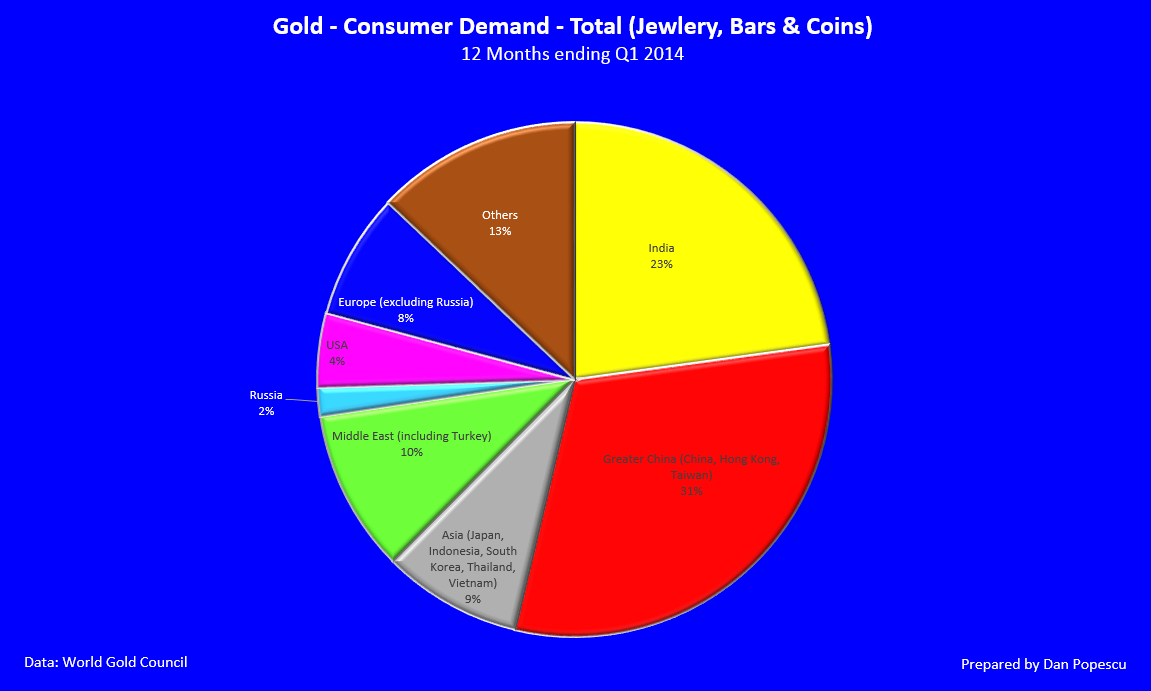

In chart #4, we see that China and India represent together 54% of global gold demand, with China 31% and India 23%. The United States and Europe only represent 12% of global gold demand, with Europe 8% and the US only half of Europe’s demand of 4%. China and India between themselves are consuming more gold than the world is actually mining.

Chart #4: Gold – Consumer Demand – Total (Jewelry, Bars & Coins)

What is interesting in the gold consumption per capita chart (chart #5) is the absence of the United States from the top 20 countries and the consumption of Hong Kong and China. However, keep in mind that mainland Chinese consumers do a lot of their gold buying in Hong Kong, which could distort the ratio of China vs Hong Kong.

Chart #5: Gold Consumption per Capita

Pure gold jewelry is a unique product that fulfils the requirements of both adornment and investment. The competition for 24-carat jewellery from platinum and silver is very limited and looks set to remain that way. In graph #6, we can see that 85% of gold jewelry demand is for pure 24-carat gold, which indicates that it is mostly for investment purposes.

Chart #6: Gold Jewelry Demand in China by Product Category in 2013

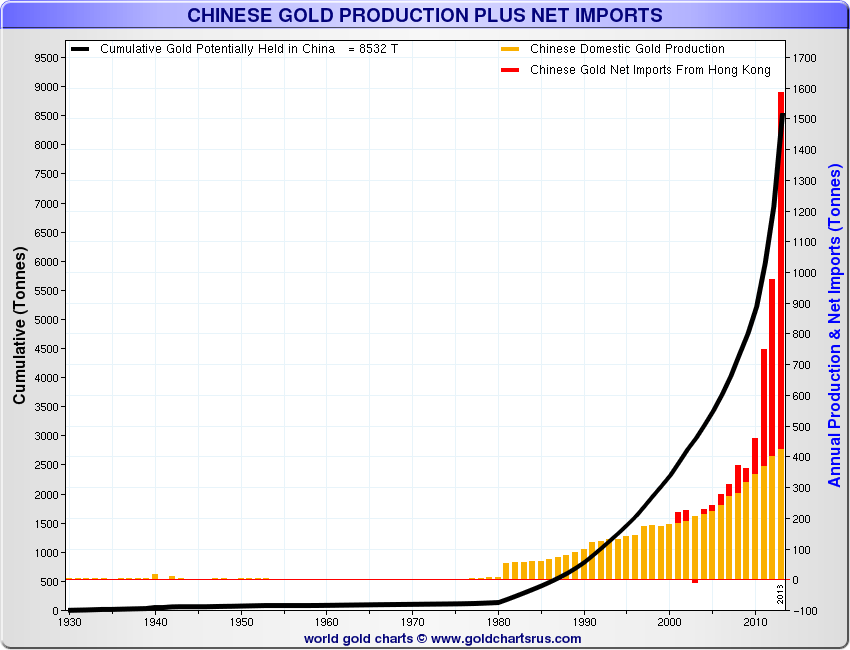

You cannot look at chart #7 and not be impressed at the parabolic shape of the cumulative gold potentially held in China and the amount accumulated since 2011. The accumulation accelerated soon after the 2008 financial crisis was over.

Chart #7: Chinese Gold Production plus Net Imports

Still the most important chart is China’s official gold reserves. However, it is also the most distorted. The last time China updated its gold reserves was in April 2009, when it announced that it had almost doubled its reserves. Speculation has it that, as of 2014, China has more than tripled its reserves since 2009 and are around 4,000 tonnes, but there is no official confirmation yet, nor has any information leaked. There is a school of thought in China that US policy is a deliberate attempt to place the burden of economic adjustment onto other countries and to maintain its strategic hegemony. There is also much speculation that the pro-gold policy of the authorities goes beyond encouraging the development of the domestic market and includes the acquisition of gold by the State itself.

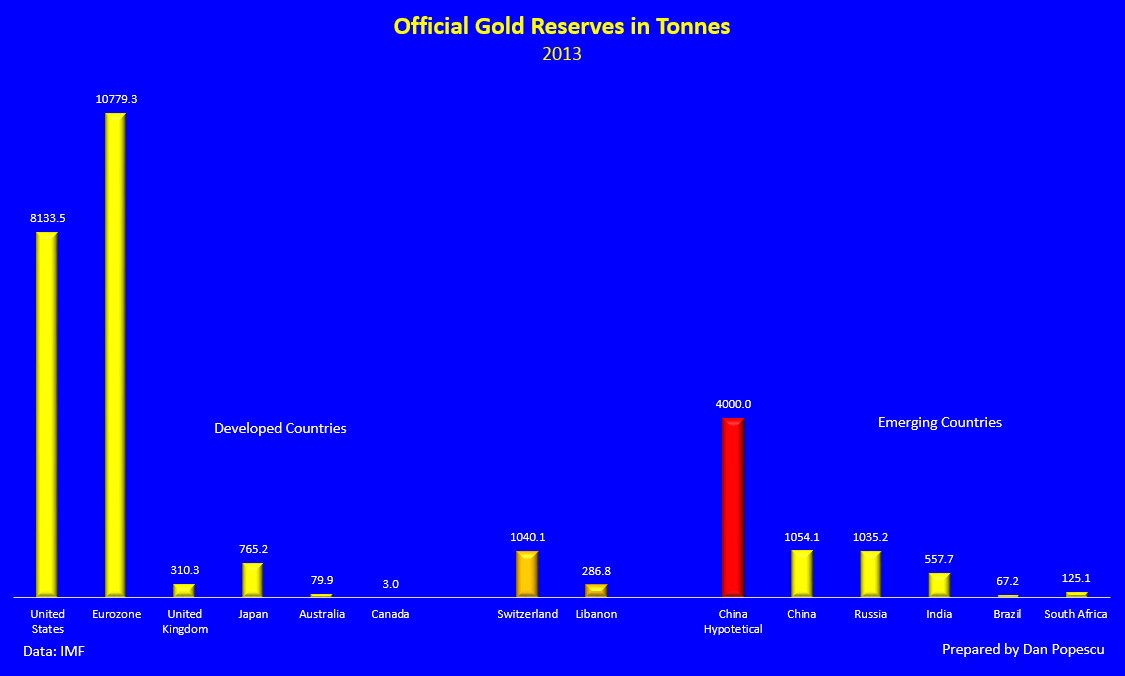

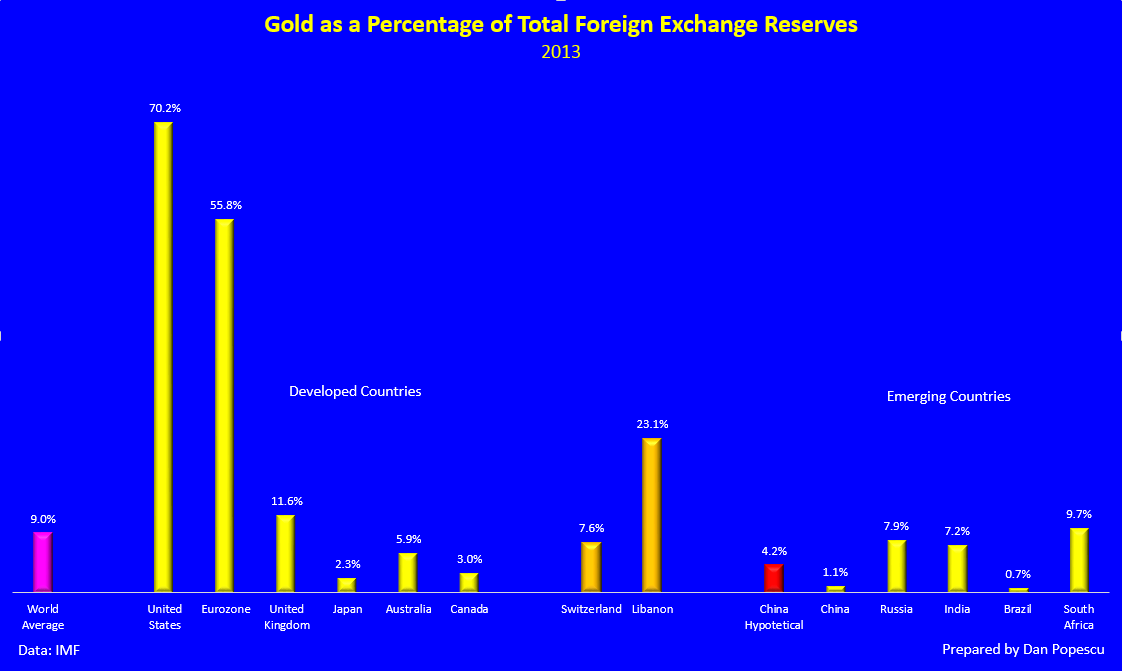

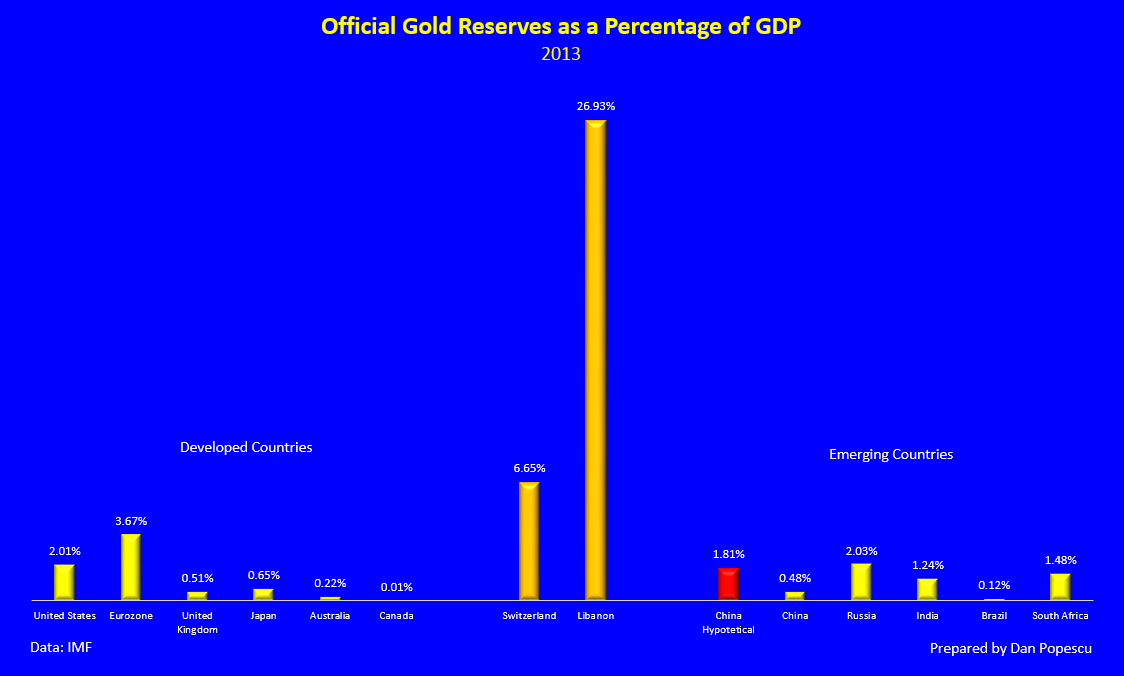

In the next three charts, I have selected six of the largest developed countries and five of the largest emerging markets to compare with China’s gold reserves. I also selected Switzerland as a developed economy and Lebanon as an emerging economy because of their large gold reserves. I also added a hypothetical “what-if? scenario” in red for China. China has not made public its gold reserves since they announced a doubling of their reserves in 2009. My hypothetical case assumes 4,000 tonnes of gold reserves, which is not unreasonable, based on the total accumulation of gold in China of possibly 8,532 tonnes (chart #7).

As of 2009, based on tonnage (chart #8), China has only 1,054.1 tonnes compared with the US with 8,133.5 tonnes, and the Eurozone with 10,799.3 tonnes. If we assume 4,000 tonnes of gold, then that would be ½ of the US declared gold reserves and close to ⅓ of the Eurozone’s. As a percentage of foreign reserves (chart #9), an increase to 4,000 tonnes will still be far less than both Eurozone and US, and only ½ of Russia’s gold reserves. However, as a percentage of GDP (chart #10) at 1.81%, it would be close to Russia’s 2.3% and US’s 2.1%. As of 2009 data, it is at 0.48%. Jim Rickards in his book, The Death of Money, says, “The gold-to-GDP ratio reveals the true money available to support the economy and presages the relative power of a nation if a gold standard resumes.” (10)

Chart #8: Official Gold Reserves in Tonnes

Chart #9: Gold as a Percentage of Total Foreign Exchange Reserves

Chart #10: Official Gold Reserves as a Percentage of GDP

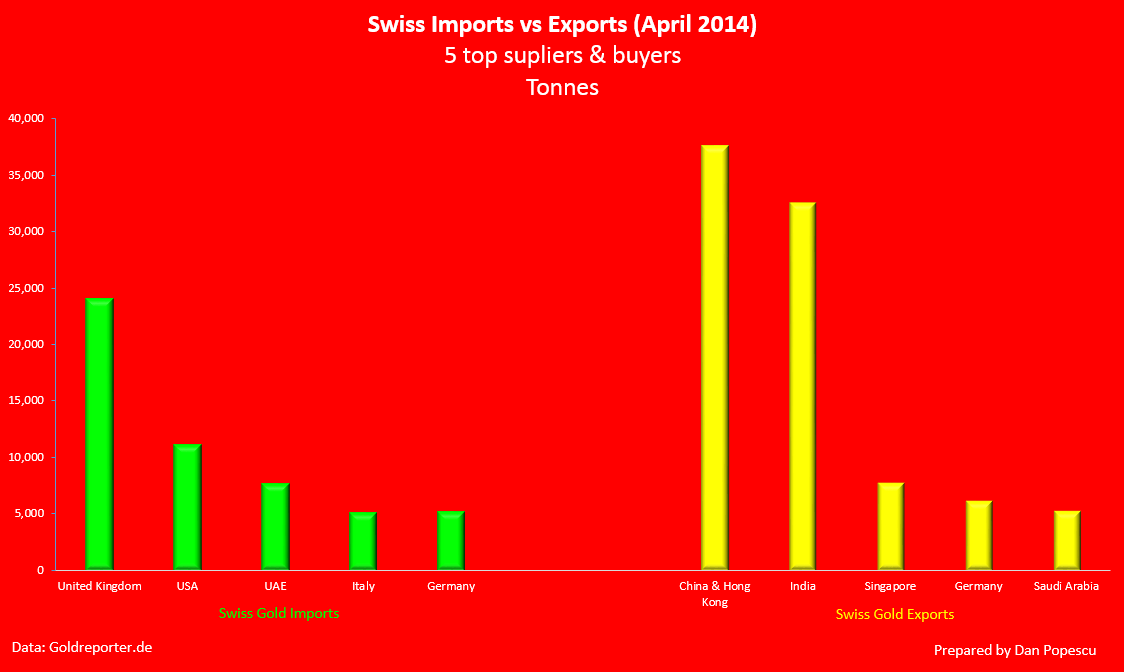

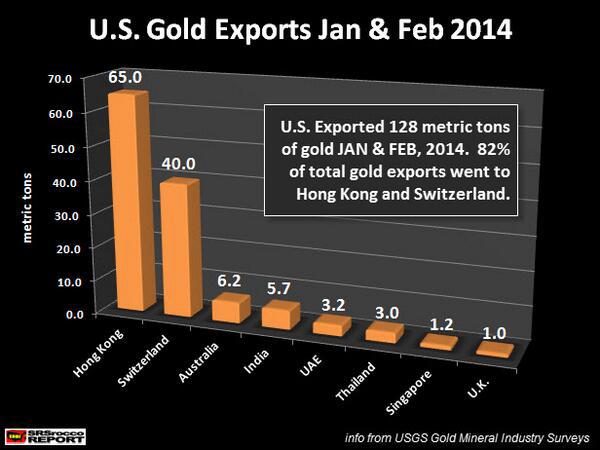

The bulk of gold supplies to the market continues to find its way from the West through refineries in Switzerland, where they are changed into 1 Kg bars and 0.9999 purity, and then on their way to the Far East. Switzerland is the major producer of the 1 Kg gold bullion bars preferred by Asian investors with 0.9999 fineness, as opposed to the wholesale standard of 0.995. In chart #11, we can see that most of the gold exported from the US is to Hong Kong and Switzerland.

Chart #11: U.S. Gold Exports Jan. & Feb. 2014

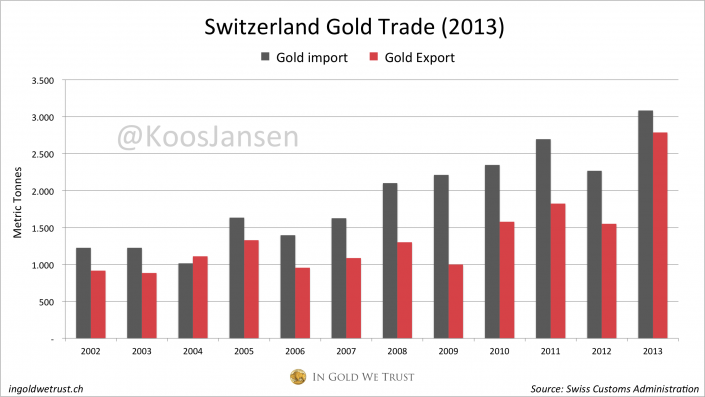

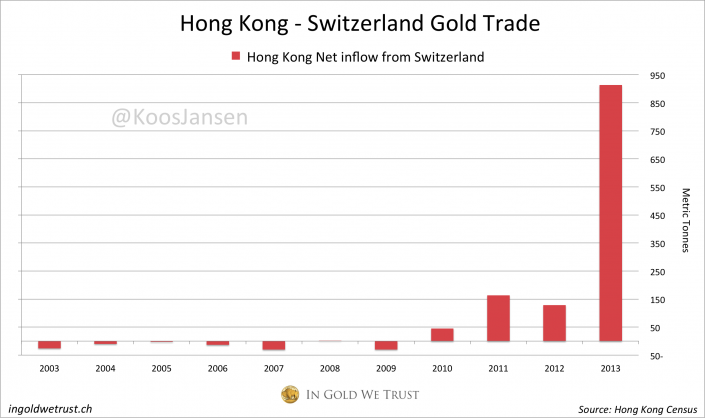

However, as we can see in the next charts (#12 & #13), a lot of the gold imported to Switzerland after recasting to Asian standards is re-exported, mostly to China and India. Observe, in chart #13, the 7.5 times increase in exports from Switzerland to Hong Kong in 2013 compared with 2012.

Chart #12: Swiss Gold Trade – Imports vs Exports

Chart #13: Hong Kong – Switzerland Gold Trade

In chart #14, we see the top five exporters of gold to Switzerland and the top five importers of gold from Switzerland. The United States and the United Kingdom are the top two exporters, and China and India the two top importers. Tourists from mainland China account for a large share of Hong Kong jewelry sales, but especially 24-carat gold. That is why, in this chart, I have combined China and Hong Kong together.

Chart #14: Swiss Imports vs Exports – 5 Top Suppliers & Buyers

Chart #15: Chinese Domestic Supply and Demand

In his monthly newsletter, Eric Sprott says that, “According to some estimates, China consumed over 4,800 tonnes of gold in 2013, implying that about 3,600 tonnes were drawn from global stocks (i.e. western vaults) to satisfy demand.” (13)

The World Gold Council says, in its report on gold and China, that “More generally, the Chinese traditionally regard gold as a form of money. Indeed, the character for gold in Mandarin 金 (jin) is also a synonym for money. This is an important fact when it comes to the motivations behind the purchase of jewelry… Demand in China for 24-carat articles is, to a large extent, driven by financial considerations and the recognition that, in extremis, ‘pure gold’ jewelry can easily be exchanged for cash.” (2)

China Gold “Ying Yuan”Coin 500 or 600 BC & China Gold “Panda”Coin 2014

Ying Yuan was one kind of gold coin issued by the mint of the Chinese state of Chu. The oldest ones presently known are from about the 5th or 6th century BC. They consist of sheets of gold 3-5mm thick, of various sizes, with inscriptions consisting of square or round stamps in which there are one or two characters. Thus we can conclude that, despite the late appearance of gold shops in China, gold started circulating as currency in many parts of the country as early as 2,500 years ago, almost at the same time as the first gold coin was minted in Europe by Lydia (today part of Turkey). "Ying” was the name of Chu's capital, while "Yuan" was the weight unit of currency. "Ying Yuan", also called "Yuan Gold", was cast into a plate and stamped with a small square seal.

In the last four years, we have seen a different attitude towards gold by government officials of the four largest countries in the world. China officials talk frequently of gold as money and of considering gold as an asset to back their currency in one form or another. In an article written by Sun Zhaoxue, president of both the China National Gold Corp. and the China Gold Association, he said “Individual investment demand is an important component of China’s gold reserve system; we should encourage individual investment demand for gold. Practice shows that gold possession by citizens is an effective supplement to national reserves and is very important to national security.” (9) He also said, “Increasing gold reserves should become a central pillar in our country’s development strategy. International experience shows that a country requires 10% of foreign reserves in gold to ensure financial stability, while achieving high economic growth concurrently.” (9) They also have openly encouraged their citizens to acquire gold. At the opposite side, Indian officials have restricted the importation of gold to protect the currency, but without any support from their citizens, who continued buying gold through the emergence of the black market.

In Europe, we have heard recently very positive statements from European Central Bank (ECB) officials on the value of gold as a reserve. This contrasts with the United States. Mario Draghi, ECB president, recently stated without hesitation, “For central banks this [gold] is a reserve of safety, it’s viewed by the country as such. In the case of non-dollar countries, it gives you value protection against fluctuations against the dollar.” (6)

Russia, on the other hand, has a different approach. While it fast accumulates gold for its official reserves and speaks regularly on its central role in the international monetary system, it has not encouraged its citizens to buy it as China does. Evgeny Fedorov, a lawmaker for Putin’s United Russia party in the lower house of parliament, said, “The more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound or any other reserve currency.” (8) At the other extreme, you find the United States who, at every occasion, is minimizing gold’s role. When asked in Congress by Representative Ron Paul if gold is money, clearly bothered, Ben Bernanke, Fed chairman, told the representative, “No. It’s a precious metal… It’s an asset.” (7)

According to Kenneth W. Hoffman, metals and mining analyst at Bloomberg Industries, “Based on conversations with officials in China and Mongolia, it’s evident that China feels they want as much gold, as much as the U.S.” (11) The US has 8,133.5 tonnes. How much do they have already? Nobody knows but 4,000 tonnes is certainly possible. President Vladimir Putin also told foreign journalists at the St Petersburg International Economic Forum 2014 that, "For us (Russia and China), it is important to deposit those (gold and currency reserves) in a rational and secure way." "And we together need to think of how to do that, keeping in mind the uneasy situation in the global economy." (12) This statement makes me speculate that discussions between China and Russia concerning gold reserves have been taking place.

China understands the old saying that “He who owns the gold makes the rules.” In his book, The Big Reset, Willem Middelkoop says, “They [Chinese] know, even from their own history, that gold has been used time and again to rebuild faith when a fiat money system has reached its endgame.” People’s Bank of China’s Zhang Jianhua said, in an interview, “No asset is safe now. The only choice to hedge risks is to hold hard currency – gold.” (9) Sun Zhaoxue also said in an article that, “Currently, there are more and more people recognising that the ‘gold is useless‘ story contains too many lies. Gold now suffers from a ‘smokescreen’ designed by the US, which stores 74% of global official gold reserves, to put down other currencies and maintain the US dollar hegemony.” (9)

I think that when China will announce their updated gold reserves, no matter what they are, it will be a major moment in the gold market, but also a major geopolitical event. I expect soon after to hear a chain of similar announcements from Russia, Saudi Arabia and possibly others. In 2009, Saudi Arabia made an announcement soon after China. When will that be? That is the question. China will choose the time that is the most appropriate and to have the biggest possible impact for their geopolitical aspirations.

Bibliography:

-

China has control of the Gold Price, Julian D. W. Phillips, Gold Forecaster

-

China gold market: progress and prospects, World Gold Council

-

Shanghai Gold Exchange International Board Another Blow To US Dollar, Koos Jansen

-

Bernanke Tells Congress: I Don't Really Understand Gold - Agustino Fontevecchia

-

Putin Turns Black Gold to Bullion as Russia Outbuys World - Scott Rose and Olga Tanas

-

China Seen by Bloomberg Industries Boosting Bank Gold Reserves - Debarati Roy

-

Putin says Russia and China need to secure their gold and currency reserves, Reuters

-

Connecting the Dots - Eric Sprott

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.