Peter Schiff's recent interview on Kitco is among his most virulent interventions. In it, the renowned economist openly criticizes the situation in the United States, warning of an imminent dollar crisis, a fall in purchasing power, and a brutal reversal of global capital flows.

According to Schiff, we are witnessing the gradual collapse of the American economic model based on consumption on credit and external financing. The United States has lived beyond its means for decades, benefiting from foreign investment and its status as a reserve currency. But this system is faltering: the dollar, Treasury bonds and US equities are falling in tandem, a sign that the classic flight-to-safety dynamic has broken down.

The analyst anticipates a stagflation in the United States, much more brutal than that of the 1970s: a prolonged recession coupled with persistently high inflation. Such a shock could erode confidence in US debt, forcing investors the world over to turn away from dollar-denominated assets. A “liberation”, in his view, that would usher in a new period of global growth - outside the US.

Is this observation exaggerated? Is the US really on the brink of a severe recession?

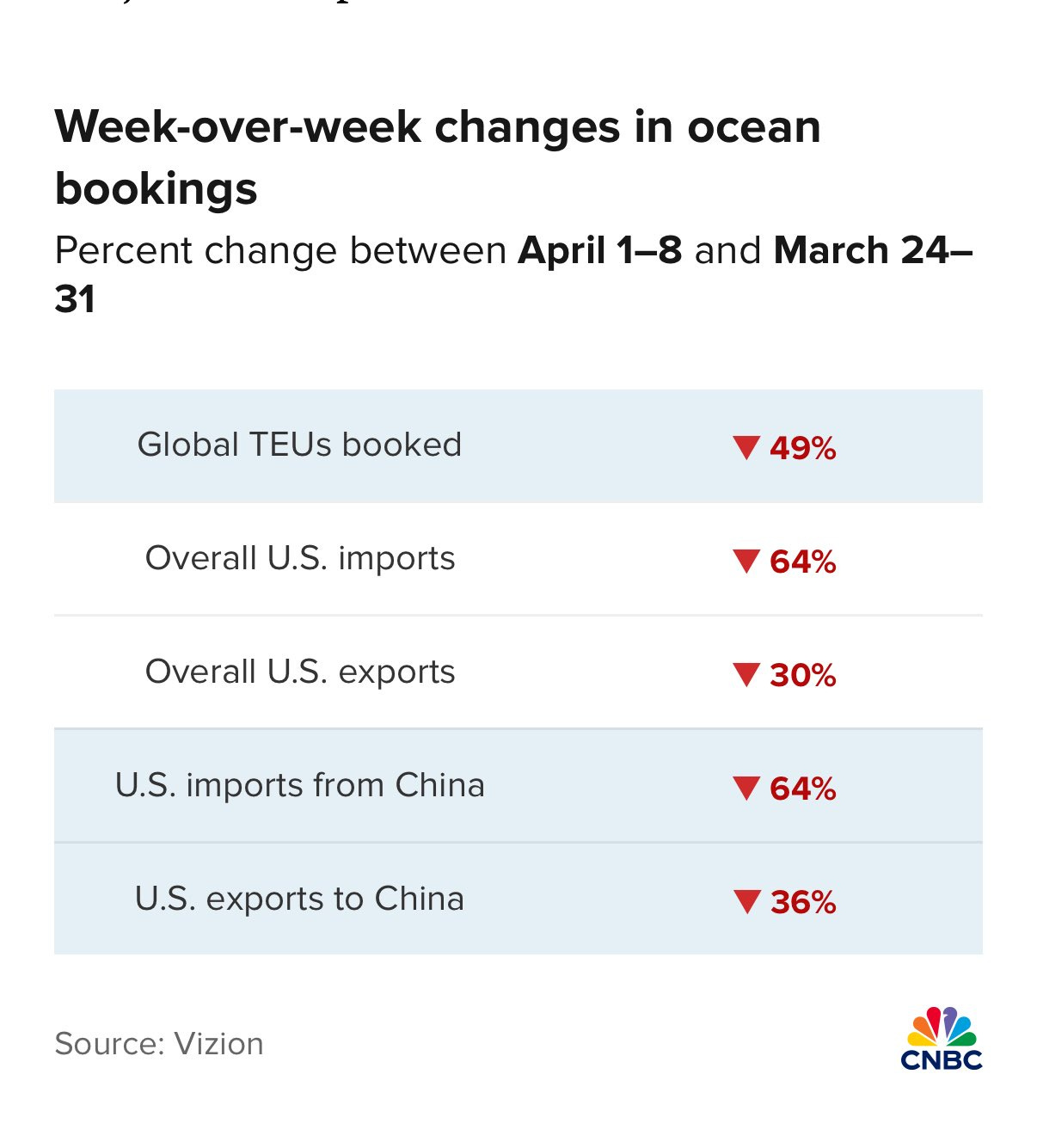

In any case, the latest US foreign trade data provide food for thought. Last week, maritime imports from China plummeted by 64% in one week. More broadly, US trade — both imports and exports — has collapsed in the space of a few days.

Although this can be partly explained by an anticipatory effect - companies having massively stocked up before the new tariffs came into force - the signal is still worrying. The brutality of these data is reminiscent of the logistics shock to international trade caused by the Covid crisis.

Such a slowdown could mark the start of a broader contraction in global demand, reinforcing the idea of a cyclical downturn in the USA.

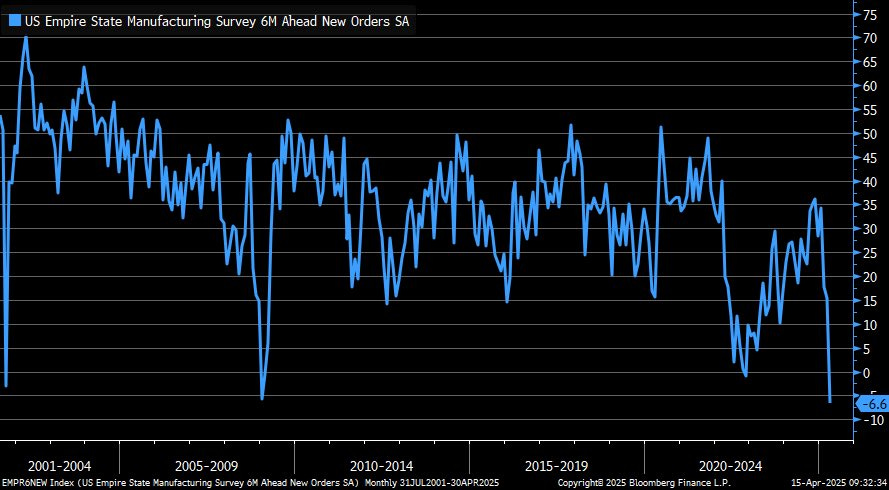

This scenario is supported by a key leading indicator: the US State Manufacturing 6-Month Ahead New Orders. This index, which measures expectations of new orders in the manufacturing industry, forecasts an unprecedented fall in the next six months - even worse than during the 2008 crisis or during Covid.

The survey of purchasing managers nationwide reached a level of pessimism unseen since the creation of this indicator. American manufacturers themselves are preparing for a violent downturn in demand.

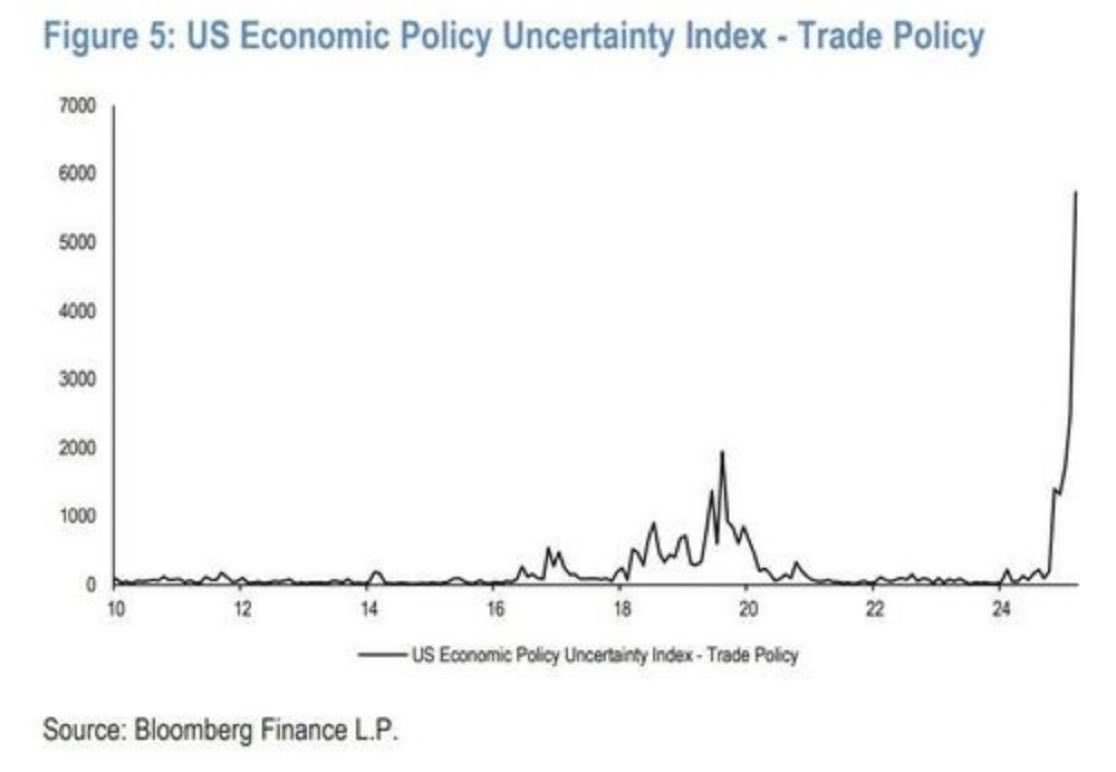

The anticipation of a collapse in demand is part of an economic context marked by growing uncertainty. Rarely has the US economy evolved in such an opaque environment. The current administration is sending out contradictory signals and making clear-cut decisions, contributing to a climate of widespread instability. In the short term, this political and regulatory uncertainty is eroding the confidence of economic players and slowing down investment decisions. The chaos generated by rate hikes and geopolitical tensions creates a widespread wait-and-see effect.

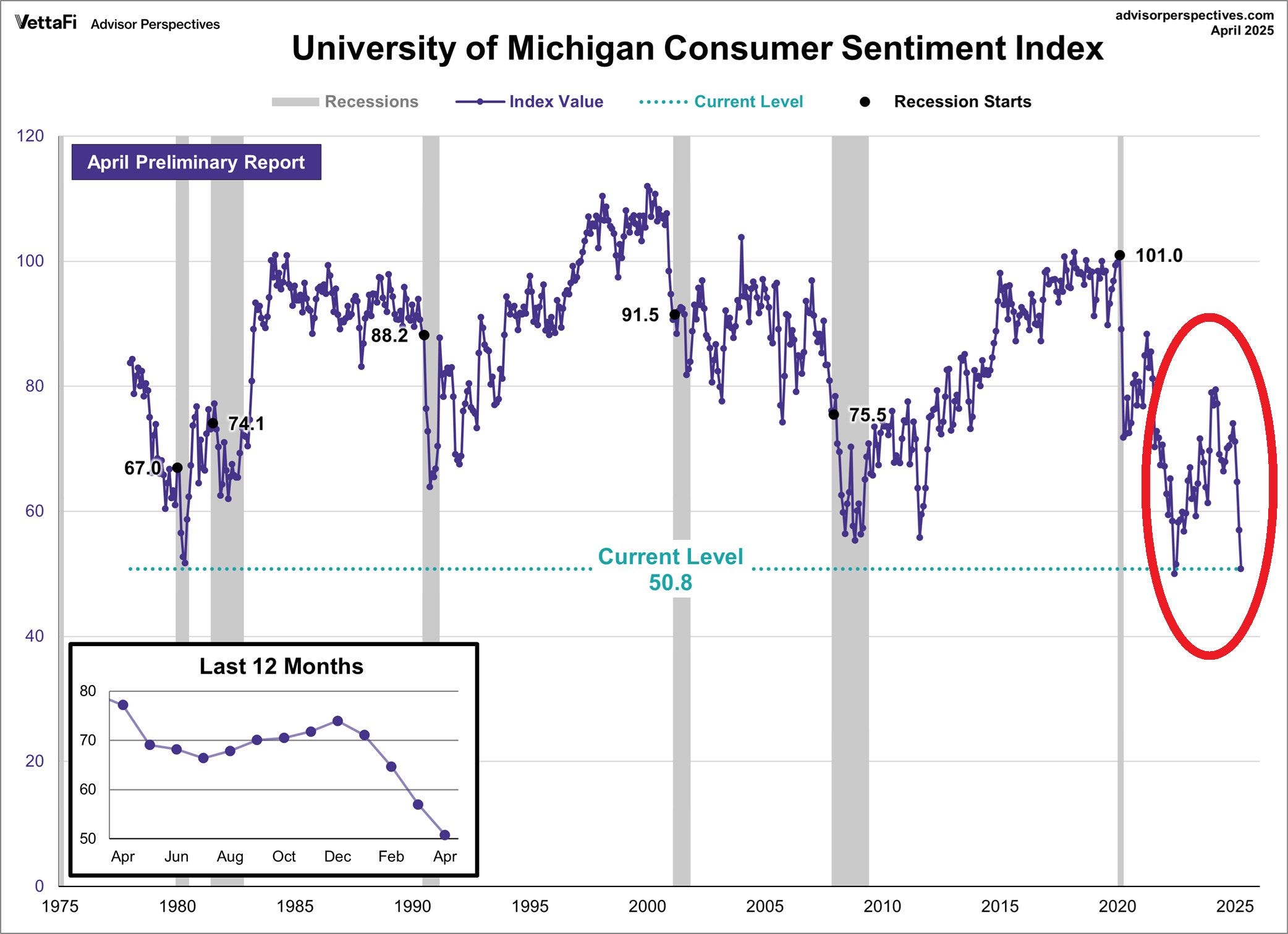

This ambient instability is also weighing on consumer morale, whose confidence has just plunged to historically low levels. Not since the great financial crisis or the impact of Covid has household sentiment been so shaken, revealing deep concern about the country's economic future.

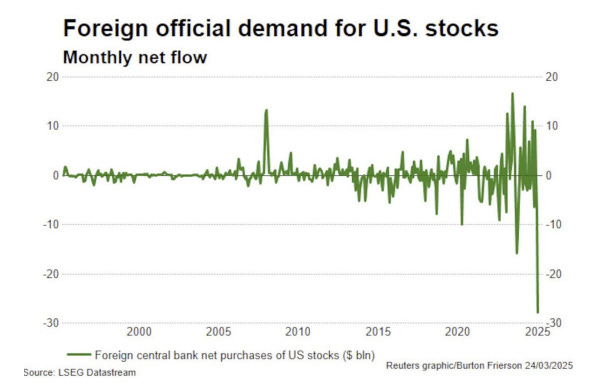

The threat of a sharp slowdown in US consumer spending is leading to a massive withdrawal of foreign investors. Worried about the prospect of a recession, they turned away from dollar-denominated assets, triggering an unprecedented wave of sales. Bonds, equities and even Treasuries are being liquidated on a massive scale - a strong signal of the loss of confidence in the economic resilience of the United States.

This rush out of the U.S. is accompanied by intense pressure on the dollar. The DXY index, which measures the value of the greenback against a basket of major currencies, has just fallen through the symbolic 100 threshold - a clear signal of the markets' loss of confidence in the US currency. This decline is part of a general move away from dollar-denominated assets, amid fears of an increasingly imminent recession.

Gold is the big winner in this movement.

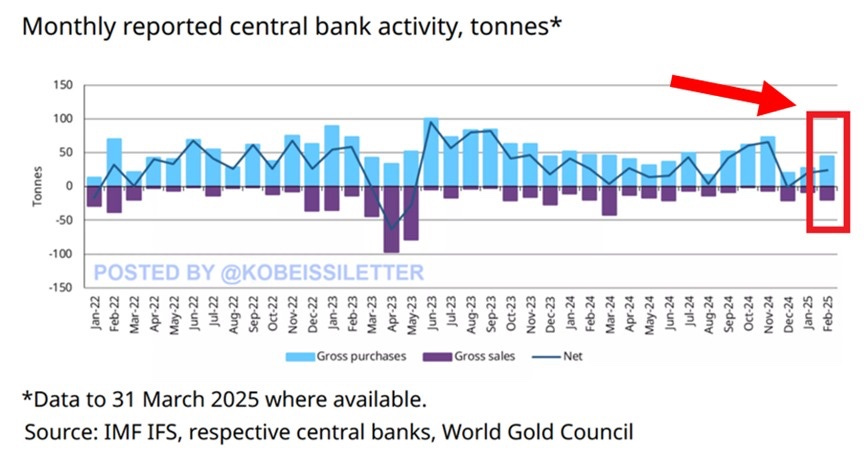

Peter Schiff points out that central banks are buying gold on a massive scale, replacing the dollar. In his view, they are anticipating a new monetary system in which gold will once again become the world's main store of value. He estimates that the price of gold could reach $5,000 to $20,000 in the coming years - not because gold is appreciating, but because the dollar is losing its purchasing power.

In February, net gold purchases by central banks reached 24 tons - the highest level since November 2024. This is the 20th month of net purchases out of the last 21, according to data from the World Gold Council.

It also marks the prospect of a 16th consecutive year of strengthening official reserves. In three years, central banks have accumulated 3,176 tons of gold.

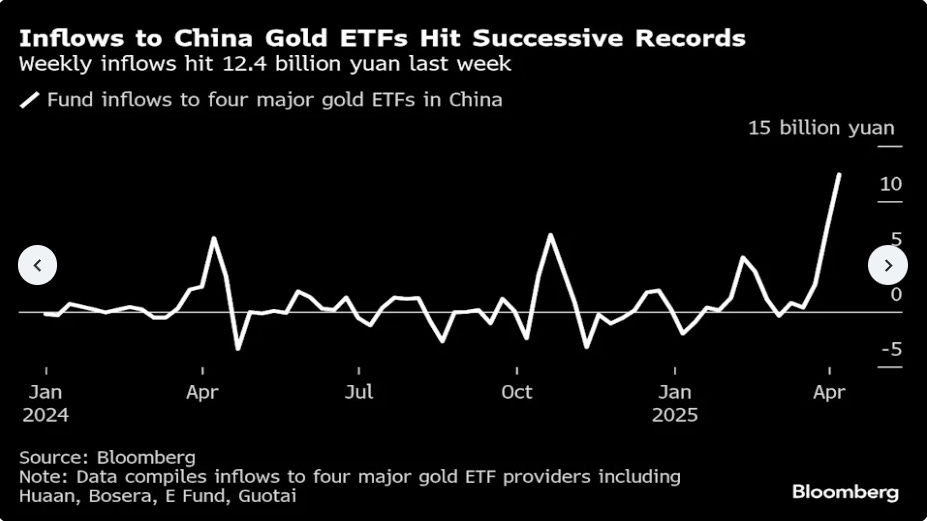

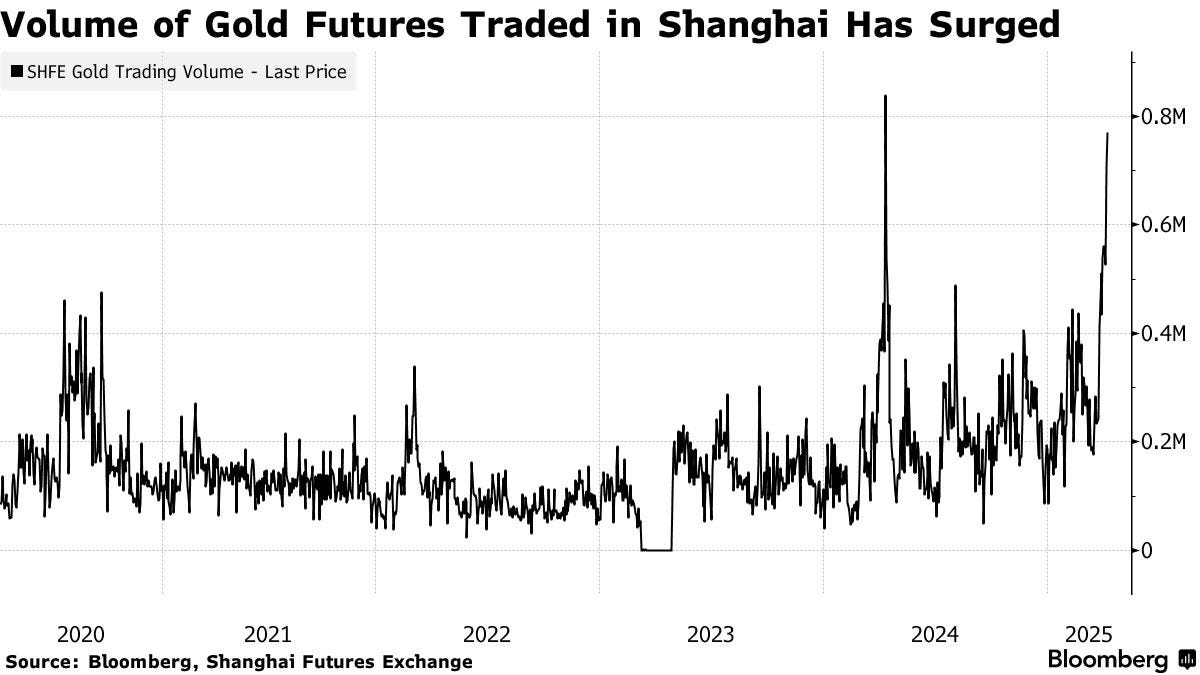

Central banks are not the only ones to buy gold: soaring prices have triggered a new gold rush in China. Investors, financial institutions, refineries and private individuals are turning to gold on a massive scale, whether through bullion, bank accumulation plans, or ETFs. This renewed interest can be explained by the loss of confidence in dollar-denominated assets and the growing uncertainty linked to persistent trade tensions between Beijing and Washington. As a result, gold is establishing itself as a strategic and sustainable safe-haven asset, far more than just a speculative bet.

Record flows into gold-backed ETFs pushed the local gold premium to $20 an ounce. At the same time, volumes of gold futures traded on the Shanghai Stock Exchange surged to their highest level in a year.

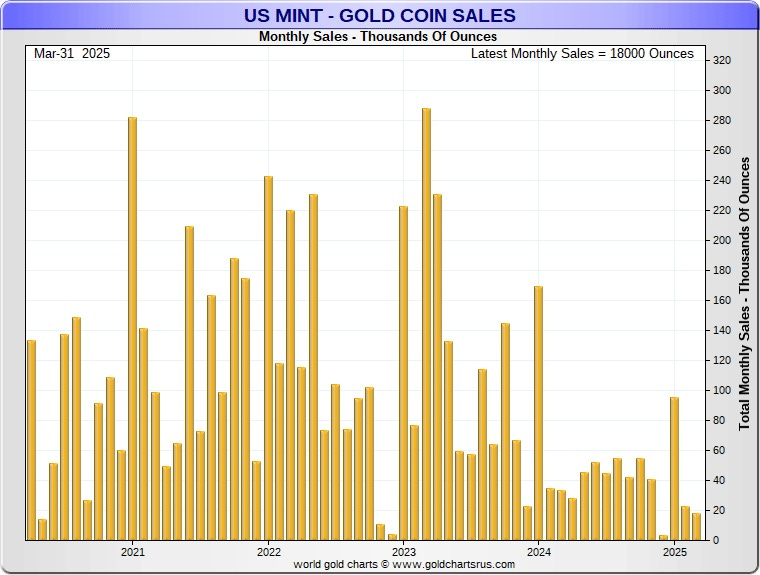

The gold rush in China is taking place with total indifference on the part of the American public, still focused on assets that are losing ground. While the dollar is depreciating rapidly, symbolizing a global decline in confidence, American retail investors remain paralyzed, unable to benefit from gold's spectacular rise.

This discrepancy illustrates the profound asymmetry in expectations between East and West. In China, gold has already become a strategic pillar once again, embraced by households, central banks and institutional investors alike. Meanwhile, in the West, investors, still distracted by other economic narratives, are missing out on a historic opportunity.

In his interview, Peter Schiff also points out that shares in gold mining companies are historically undervalued, due to private investors' disinterest in gold, who have turned to bitcoin. In his view, mining companies today offer greater upside potential than physical gold, not least because of higher margins, aided by relatively low energy costs and a high selling price for the yellow metal.

If his forecasts prove correct, we could see a profound change in the behavior of financial markets in the coming weeks. On the one hand, traditional equities are likely to be sold on every rebound (“sell the rip”), as investors begin to anticipate a severe recession, persistently high interest rates and a structurally weaker dollar. On the other hand, mining stocks, particularly gold producers, could benefit from renewed interest: every dip will become a buying opportunity (“buy the dip”).

This could be explained by gold's return to favor as a safe-haven asset, but above all by the growing appeal of tangible assets capable of generating cash in an inflationary environment. Miners, long neglected, combine operational leverage, low valuations and direct exposure to rising precious metals prices. If Schiff's scenario materializes, investors could quickly and massively reallocate their capital to the mining sector, which is still largely undervalued. Having missed out on the rise in physical gold prices, they will be looking to capitalize on the opportunity in mining stocks.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.