Another intense week on the economic and geopolitical fronts. Over and above the systemic shocks caused by the introduction of tariffs and the muscular statements fanning the flames of a growing trade war, let's take a step back to analyze the new balance of power established by the Trump administration.

The US economy faces a number of structural imbalances that threaten its long-term stability. Between financial market volatility, over-consumption, persistent inflation, an imbalance between production and consumption, as well as bond market instability, the current administration is seeking to redress the situation.

To achieve this, it is relying primarily on three strategic levers. Firstly, it is intervening on the bond market, by adjusting the issuance of Treasury bills and influencing interest rates to stabilize the financial system. The shock policy also aims to restore the safe-haven role of US Treasuries. For the time being, this strategy has succeeded in bringing the 10-year yield below 4.5%, thus neutralizing the upward momentum that had set in at the end of 2024:

Secondly, this new policy imposes tariffs to curb the import of foreign goods and services and thus encourage the consumption of local products. On February 1, 2025, tariffs of 25% were applied to imports from Canada and Mexico, with the exception of Canadian hydrocarbons, which are taxed at 10%. On February 10, taxes of 25% were introduced on imported steel and aluminum. On February 26, Trump announced 25% tariffs on European products, including automobiles. In response, Canada and Mexico implemented similar 25% tariffs on US products. China reacted by imposing additional taxes of 20% on certain products from the United States. The European Union, for its part, announced a proportional response to the American measures.

Finally, another lever of this policy is to weaken the dollar, with the aim of improving trading conditions and encouraging domestic production rather than the accumulation of dollars abroad, which stimulates over-consumption and widens the trade deficit. Here too, the first few weeks of the Trump presidency have succeeded in breaking the dollar's bullish momentum:

This change of direction marks a break with the predominant economic logic of recent decades. Rather than opting for a classic Keynesian stimulus, which would encourage consumption and public investment, the administration chose the opposite approach. This strategy aims to reduce excessive financial flows and encourage production rather than demand.

This new policy caused a tectonic shift in the global economic balance. In the United States, this shock further aggravated the situation of stagflation. The upheaval caused by higher tariffs is already leading to significant changes in corporate and consumer behavior.

Numerous testimonials from leading entrepreneurs reveal that the current economic situation is leading to a marked slowdown in business transactions. Some current agreements are being delayed indefinitely, while others are being cancelled altogether. This uncertainty is also prompting companies to review their supply chains, reducing their dependence on American suppliers. Faced with new trade barriers, tariffs and rising costs, many economic players are now turning to overseas alternatives, which could weaken the competitiveness of certain domestic industries. This phenomenon highlights the direct consequences of changes in economic policy and their influence on companies' strategic choices.

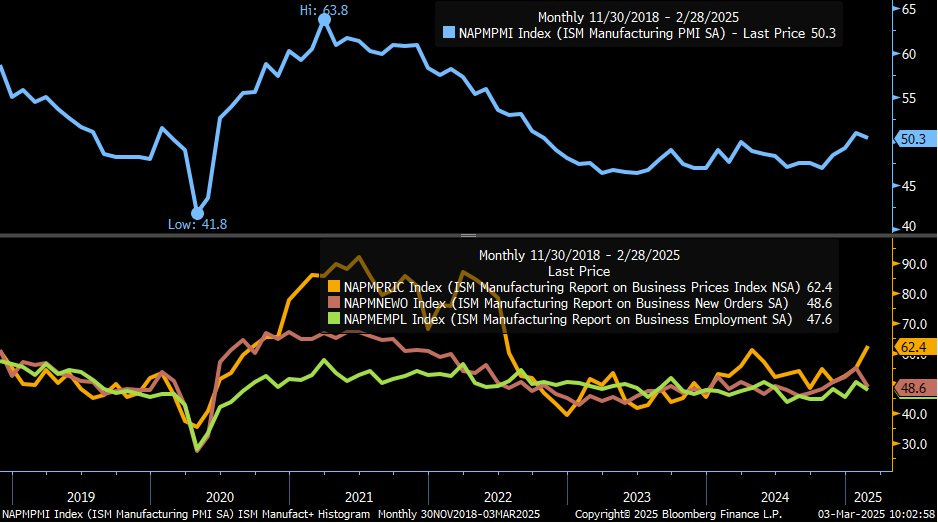

The ISM figures for February disappointed in terms of activity, while surprising on the upside regarding prices:

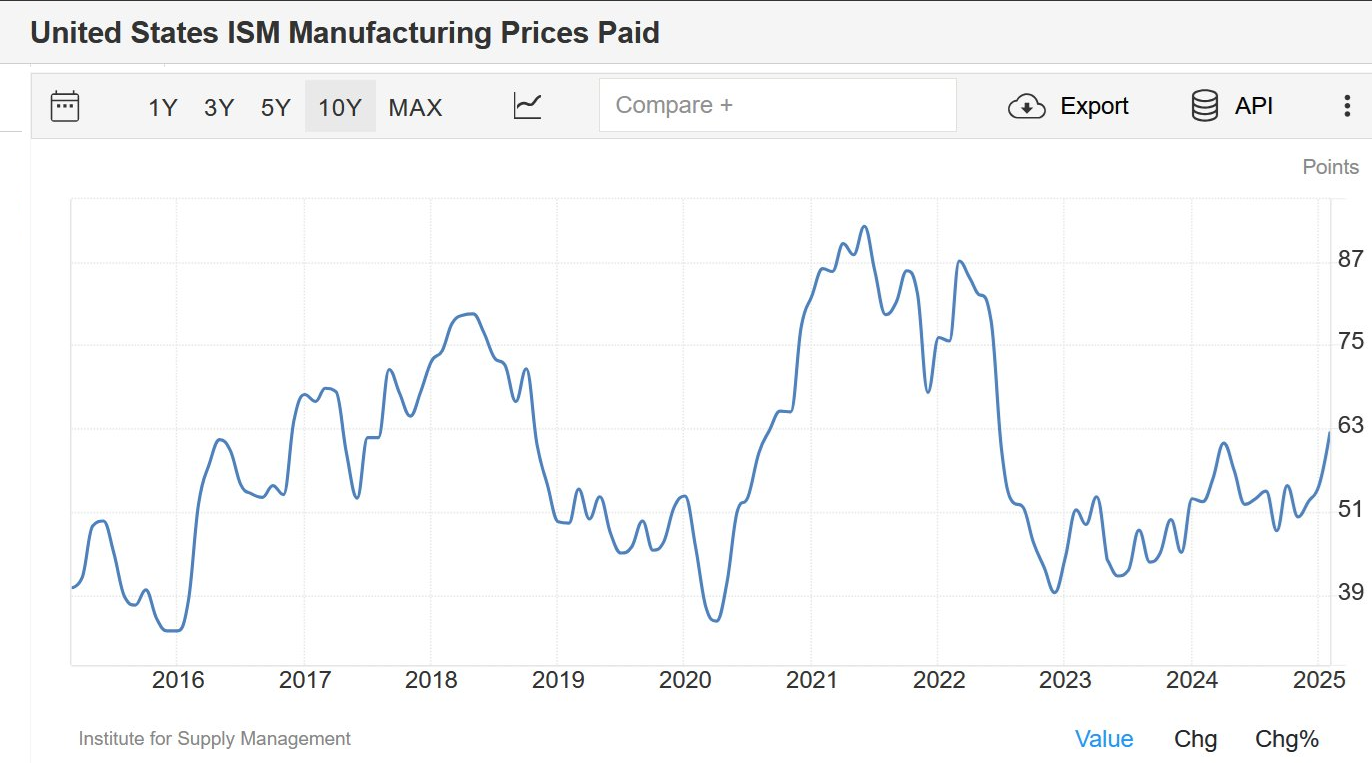

The overall index fell to 50.3 from 50.9 the previous month, signalling a slowdown. The new orders component dropped to 48.6 (from 55.1), indicating weakening demand, while employment fell to 47.6 (from 50.3), revealing a contraction in the labor market. By contrast, the prices paid indicator rose sharply to 62.4 (from 54.9), highlighting persistent inflationary pressures:

This contrast between slowing activity and rising costs shows that stagflation is now firmly entrenched in the USA.

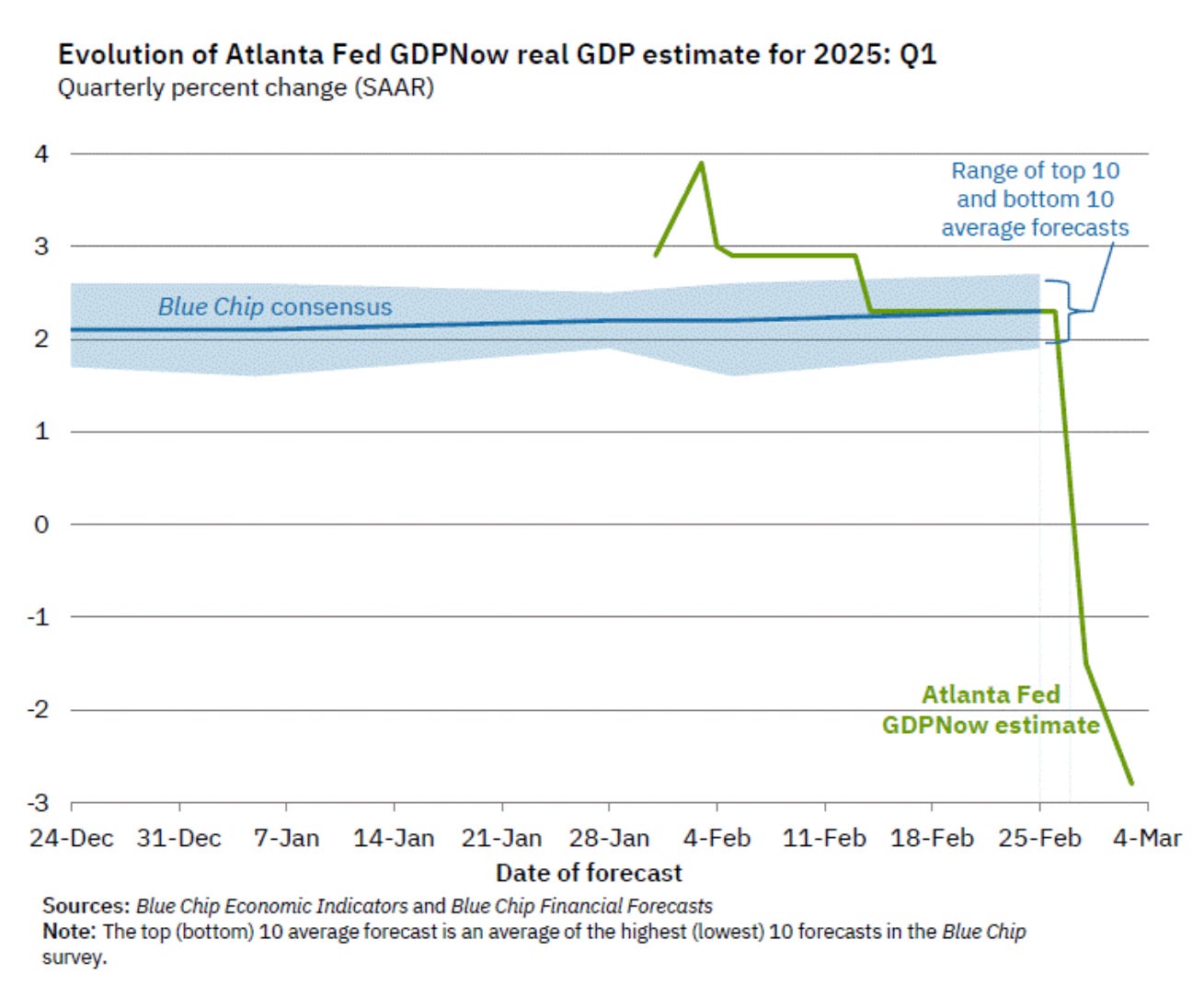

Stagflation is likely to worsen considerably, according to the latest projections from the Atlanta Fed, which has drastically revised its GDP forecasts for 2025. In the space of a week, the institute has gone from an estimate of +2.5% to -2.8%, a radical change of perspective. It is no longer a simple slowdown that is forecast, but a rapid collapse in economic activity, confirming the growing tensions between persistent inflation and a reduction in growth. This abrupt revision suggests that the effects of recent economic policies, notably higher tariffs and financial market instability, are already beginning to weigh heavily on the US economy.

However, one of the most striking effects of this transition could be an abrupt adjustment in US financial markets. According to Minsky's theory, periods of prolonged stability lead to excessive risk-taking and eventually to crisis. After years of ultra-expansionary monetary policies and massive debt creation, this paradigm shift could lead to an abrupt clean-up of the financial system. Growth stocks are particularly vulnerable in this context of high interest rates and growing economic tensions. These companies, whose valuations depend to a large extent on future earnings expectations, are particularly affected by an environment of rising capital costs and worsening economic prospects.

The Nasdaq, with its high concentration of technology and innovation stocks, has significant downside potential. The correction could be all the more severe as the market has, in recent years, overvalued these assets in an ultra-accommodative monetary environment, which is now a thing of the past. If the current trend persists, the Nasdaq could suffer a severe revaluation, accentuated by capital outflows towards assets considered safer, such as bonds or commodities.

The current strategy seeks to rebalance the US economy by redirecting consumption towards domestic production, at the cost of an adjustment that could prove painful for markets. The question is whether this transition will take place in a controlled manner, or whether it will trigger deeper instability.

The economic consequences for Europe are even more worrying. Faced with the reshuffling of geopolitical alliances and the introduction of new tariffs, the Old Continent is being forced to make a massive budgetary effort, resulting in higher public spending. In just a few weeks, German fiscal discipline was shattered, and the “whatever it takes” principle spread beyond the Rhine. The German Bund soared, but the rise in interest rates was no longer confined to Germany: it now affected all European countries:

In the USA, inflation is set to rise again due to disruptions in supply chains. But for Europe, the situation is even more critical: in addition to these supply tensions, it will have to contend with soaring interest rates, a further factor in inflationary pressure. The risk of worsening stagflation is therefore becoming a major one, threatening growth, budgetary stability and the purchasing power of Europeans.

Stagflation in Europe and the United States is one of the main drivers behind the rise in gold prices. This phenomenon, which I wrote about six months ago, comes as a shock to many observers.

Until recently, the very hypothesis of stagflation was widely disputed by many economic experts and publications. In Le Monde Économique, for example, several analyses questioned the possibility of a scenario combining economic slowdown and persistent inflation: Stagflation, really?

Just over two years ago, the newspaper Les Echos highlighted several elements that seemed to mitigate the significance of stagflation:

“It's understandably tempting for individuals to 'liquidate' their life insurance policies and invest everything in gold as a hedge against inflation. But beware of preconceived ideas and shortcuts.”

“Today's economy and finance are radically different from fifty years ago, and a yellow metal surge of the same magnitude is unlikely.”

Since this article, gold in euros has risen from €1,600 to €2,700:

French 10-year yields have doubled:

And those who didn't buy physical gold, thus missing out on a spectacular rise, or sell their life insurance policies, must now regret the days when French rates were still at 1.25%. Today, the rise in interest rates is weighing heavily on the mark-to-market value of euro fund contracts, which is plummeting as French bond yields rise. This phenomenon, once overlooked, is becoming a painful reality for many savers, who are seeing the real value of their investment erode inexorably.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.