In Europe, many countries have been seething since 2015, when the first major wave of refugees reached Germany and Austria in particular. In the US, it was the election of Donald Trump as President in November 2016 that brought the deep divide between Republicans and Democrats to everyone’s attention. A few months earlier, to the surprise of many, the UK had opted for Brexit, an exit from the EU. Only a few years have passed since then, but the density of crises has increased rather than decreased: Covid-19, the climate crisis, inflation, the war in Ukraine, the energy crisis, and finally Hamas’ terrorist attack on Israel and its response.

2024 will see a number of important elections in these times of multiple crises: presidential elections in the USA, elections to the European Parliament, and three state elections in eastern federal states in Germany (in each of which the AfD is leading in the polls by more than 30%). 2024 could be the year of major social and political upheavals.

Because business and investment always take place in a specific political and social environment, in this article we want to look at investment as a topic in a broader sense. Over the course of dozens of events and hundreds of client visits, we exchanged views with professional market participants such as asset managers, fund managers and private investors, as well as with private clients and representatives from a wide range of media. In the course of many discussions, we have been able to diagnose, roughly speaking, three different world views with regard to the assessment of the overall economic situation. We want to outline these below and, based on this, the respective affinity for a gold investment:

- “Believers in the system”

Among these are, for example, financial analysts and market commentators who believe that the interventionist Keynesian economic policy, which has been implemented in the wake of the global financial crisis, is in principle correct and necessary. According to their view, the economy is in a recovery process which, due to unforeseeable regional economic difficulties, such as the euro area debt crisis, slowing growth in China, the aftermath of the Covid-19 crisis, interest rate shock etc. has been developing at a slower pace than expected. All in all, the “patient” that is our global economy, is however on the way to regaining his health, and the financial markets are in the process of gradually sounding the “all clear”. The supervisory authorities have moreover learned much-needed lessons from the crisis and have lowered systemic risk by implementing better regulations.

Representatives of this camp are increasingly critical of the fact that expansive monetary policy has lately been “the only game in town”. According to believers in the system “secular stagnation” or the “new normal” are the paradigms which best describe the current phase of weak growth. This state of affairs is supposed to be countered by more stimulus, such as fiscal stimulus measures, and/or “helicopter money”. They also consider a rapid and radical energy transition to be indispensable, whatever it takes. Gold allocation in the portfolios of this group has been extremely low, effectively zero over the past decade. It could even happen that gold could get a public reputation problem from this group, who are very influential in state and public institutions, as gold could increasingly be branded as the asset of potentates and conspiracy theorists.

- “The Sceptics”

This camp comprises people who harbor doubts about the sustainability of the extreme economic policy measures that have been taken and deemed necessary to overcome the global financial crisis, the sovereign debt crisis in the eurozone and the coronavirus pandemic. After these crises, many of them instinctively came to the conclusion that fighting a debt crisis with even more debt, and extravagant monetary policy measures, is probably not an appropriate therapy. This group includes, inter alia, hedge fund managers and traditional asset managers who are often unable or unwilling to communicate their critical assessments, especially publicly. Sometimes a schizophrenic situation arises in which fund managers position their private portfolios in a much more crisis-proof way, with a higher allocation to gold.

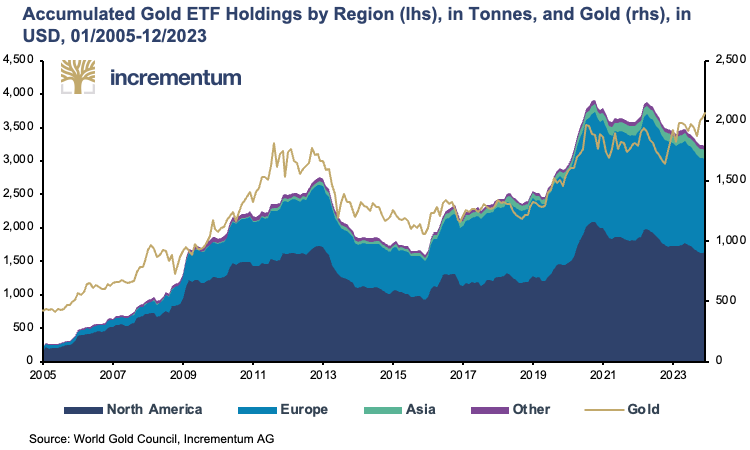

With respect to gold allocations within the portfolios managed by this group, many have acted in a pragmatic manner: In the years after the global financial crisis, they accumulated a lot of gold. But from 2013 onwards, these positions were reduced, and in some cases even sold in their entirety, often on account of performance pressures. From 2016 onwards, ETF inflows were on the rise again. This significant increase in ETF inflows indicate that, inter alia, these skeptical investors have partially returned to the market. ETF holdings more than doubled by October 2020. Since then, interest in Europe and the US has been on the decline, while demand from Asia has increased slightly.

In recent years, due to the current “investment emergency” and the pressures exerted by reporting structures and benchmarks, many sceptics have joined the bandwagon in traditional “risk-on” asset classes like (technology) stocks, private equity, real estate, high yield bonds etc. However, in many cases this was done half-heartedly, in order to “ride the wave”.

It is remarkable how many market participants are questioning the sustainability of current economic and monetary policy measures behind closed doors. It is also worth noting that the group of sceptics has, in our assessment, gradually grown in recent years and has likely become the largest group.

We believe the sceptics could play a particularly important role as marginal buyers in driving the future gold price trend: Many of them have not yet invested in gold, but are keeping an eye on it from the side-lines. As soon as the “slow recovery of the economy” narrative no longer holds up, they will be among the first to shift portfolio allocations in favor of gold.

- “Critics of the System”

Members of this group are convinced that the monetary architecture is systematically flawed. Criticism of the system can be formulated on the basis of several schools of thought, or at times even based on common sense. In our opinion, the most consistent critical assessment of the status quo can be performed by employing the analytical methods of the Austrian School of Economics. Austrian theory systematically explains why the forecasted economic mini-recovery is neither sustainable nor self-supporting.

People who have come to adopt this critical stance have one thing in common: It is almost impossible for them to regain faith in the system. Thus, there is a one-way street into this camp, and the growth of this group is almost inevitable.

We are making no secret of the fact that we belong to the third group. We only regard criticism of the system as serious if it results from investigations free of value judgements. Our findings are based on the methodological framework of the Austrian School. We want to emphasize that we are opposed to system rejection, for mere ideological reasons. Simply being against the system is a childish attitude of defiance that will not improve anything.

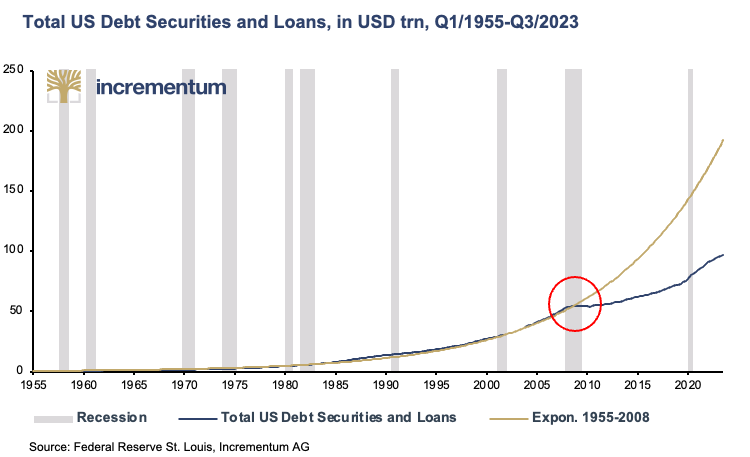

The instability of credit expansion induced growth, which we routinely criticize, is impressively illustrated by the following chart. Since 1959, “total credit market debt” – the broadest debt aggregate in the US – has increased by 12,800%, bringing the annualized growth rate to 7.4%. In every decade, outstanding debt has – at least – doubled. In order to trigger credit-induced GDP growth again – after the volume of total outstanding debt dipped slightly for the first time in 2009 – the Fed implemented a series of never-before-seen monetary policy measures.

Currently, the US federal government, in particular, is piling up the debt burden through persistently high budget deficits. In the fiscal year 2023, which concluded in September 2023, the deficit reached 6.3%, compared to 5.4% in the fiscal year 2022. In the two pandemic years 2020 and 2021, the deficit even reached the double-digit percentage range, at 15.0% and 12.4% respectively. In the first quarter of the current fiscal year, there is no sign of a reduction in the spending orgy.

This inevitably leads to a rapid increase in US debt. This debt is now over USD 34 trillion and the latest trillion was added in only 14 weeks. As around a third of US debt has to be refinanced within a year, interest payments will continue to rise. More than a third of federal taxes already have to be spent on servicing interest alone.

There is no reverse gear that can be engaged in today’s monetary system – the money supply has to be increased incessantly – which in turn means that the amount of credit in the system continually rises as well.

Critics of the system know: The fact that the steady expansion in the volume of outstanding debt has run into snags in recent years, characterizes the current (critical) phase in the monetary system’s evolution. Over the medium-term, these record levels of debt will either be dealt with by defaults, financial repression, or a forceful reflation, possibly in the form of “helicopter money”.

Conclusion

In light of this critical assessment, we advocate more strongly than ever for a strategic allocation to physical gold in long-term investment portfolios. This is because one of the most important portfolio characteristics of gold is and remains that it has no counterparty risk.

Precisely because gold is such an important part of the financial safety net against severe systemic crises, any efforts by governments, authorities or interest groups to demonize gold as an asset of extremist groups or rogue states, and therefore to regulate it more strictly, should be resolutely opposed. The current monetary system is not facing a crisis because citizens could switch to gold, but rather because citizens are increasingly switching to gold, precisely because the current monetary system is bound to face a crisis sooner or later. Bad-mouthing gold does not prevent a crisis, it exacerbates it, because it deprives the population of the golden safety net. Without a safety net, people are known to fall deeper and harder.

Original source: VON GREYERZ AG

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.