Looking Behind the Labels

Regardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles.

Not all those of the extreme left, for example, are all that “woke” and not everyone on the far right, to be fair, is a “domestic terrorist.”

Nevertheless, words are often misused and abused to place, as well as burry, otherwise nuanced realities behind simple phrases, as we’ve seen in everything from the “Patriot Act” to “Monetary Stimulus.”

Financial Fiction Writers

So many of the fancy words and phrases tossed about by our financial elites come in such deliberate yet pear-shaped tones of calm, authority and wisdom.

Even the title, “Federal Reserve,” is one loaded with irony for what is otherwise a private bank…

Many of the economic labels and euphemisms disguised as sound policy are now part of a global vernacular, from “quantitative easing” and “Fed accommodation” to “Modern Monetary Theory.”

These are carefully chosen labels. So confident, so academically comforting…

But for those familiar with basic math, economic history or the modern wave of policy hypocrisy masquerading as “forward guidance,” such terms, as well as the deeper truths behind them, have all the tragic irony of an Orwellian dystopia.

In short, they can be used to simplify, and thereby control, an inaccurate public perception.

From 1984 to 2021

Orwell called out this trick in 1949.

His infamous novel, Nineteen Eighty-Four, for example, included a “Ministry of Truth” which was nothing more than a ministry of lies, or “thought crimes” which were nothing more than honest ideas.

And as we turn from the 1949 novel of 1984 to the non-fiction of 2021, the plot thickens to a reality that is indeed stranger than fiction.

In short, we, like our yield curves, are being “controlled.”

Or more to the point, lied to.

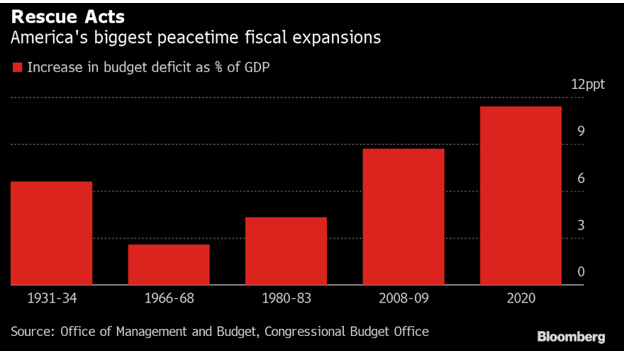

For example, taking a fatal debt binge like this…

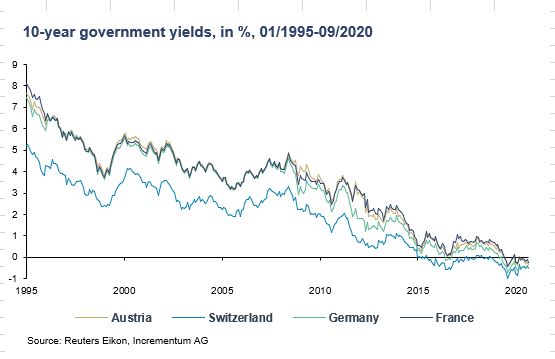

…or the disastrous, $18T+ monetization of global sovereign bonds now offering negative yields like this…

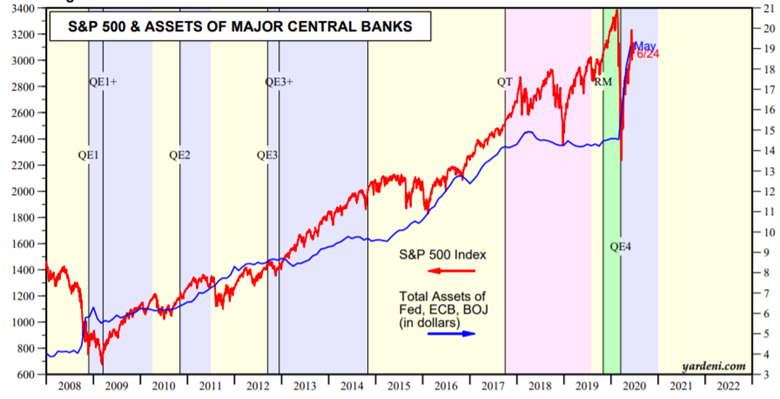

…or the death of honest price-discovery and the rise of record-breaking stock bubbles like this…

… and then calling that “fiscal stimulus,” “accommodation” or a “rescue,” sure as hell smacks of both tragic irony and open double-speak, wouldn’t you say?

“Yield Curve Control”—The Latest Term of Bad Art

As for other fancy phrases masking otherwise really stupid ideas, let’s add one more term of art to the embarrassing pile, namely that economically seductive (and hence popular) policy otherwise known as “Yield Curve Control,” or YCC.

“Yield Curve Control” –it does have an appealing ring to it, doesn’t it?

It literally includes the word “control,” as if the label, as well as policy, truly offered the comfort of genuine control.

But alas, and once again, we can drumroll the irony, for the very need for so-called “Yield Curve Control” masks the underlying truth that something is fatally and dramatically out of control…

In short, don’t judge a policy by its label or an expert by his/her title.

The only thing Yield Curve Control truly controls are those who blindly trust it.

YCC, once objectively unpacked, is not nearly as kind to history, markets, the economy or your portfolio as its debunked policy peddlers (aka “experts”) would like you to believe.

A Brief Primer on Crazy

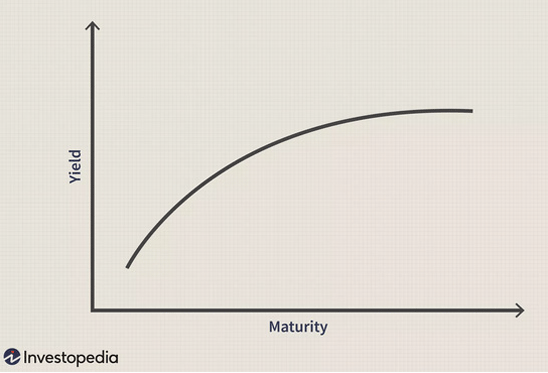

As most investors know, yield curves refer to the rising yields one should expect for the longer dated bonds one holds.

That is, one would expect much more yield for the risk of holding a 10, 20 or even 30-year bond than the yield one would get from a 2-month bill or a 5-year note, right?

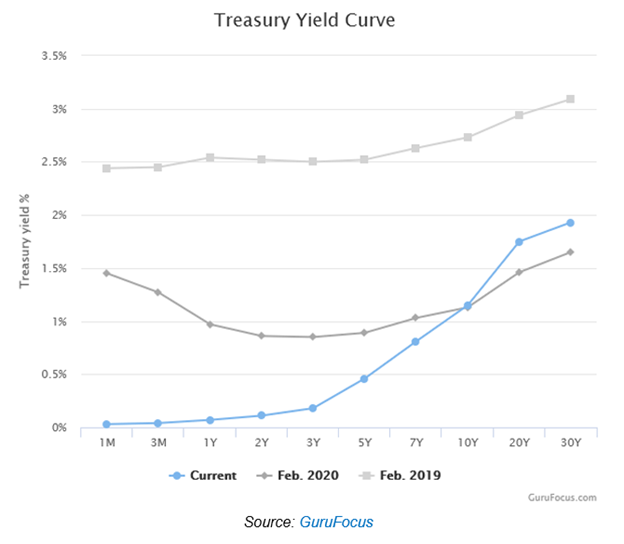

That’s why a normal yield curve would look something like this.

Seems simple enough, right?

But as most bond buyers know, nothing about current credit markets makes sense when central banks rather than actual investors (or natural supply and demand forces) determine (i.e. “control”) the price of bonds and hence the direction of their yields.

That would explain why yield curves were inverted rather than up-ward sloping across the globe as we entered the COVID crisis in early 2020.

And that would further explain why today, an investor holding a 30-Year Treasury (at 1.93% yield) only gets 190 basis points of extra yield for the risk than the holder of 1-month Treasury bill (at .03% yield.)

So little reward for so much duration risk is embarrassing.

To refresh: Yields go down as bond prices go up. And yields go up when bond demand, and hence bond prices, goes down.

Rising yields, moreover, lead to rising rates, and rising rates are what kills debt-driven asset bubbles otherwise mislabeled as an “economic recovery.”

Trying to Control a Broken New Normal

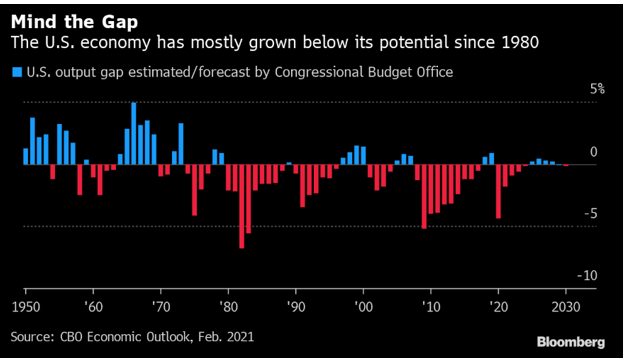

In an expert-distorted new normal wherein every major nation is staring down the barrel of record-breaking (and unsustainable) debt levels against tanking GDP, the need to issue record-breaking levels of new IOU’s to appear “recovered” has skyrocketed.

To manage such a global ruse, it is essential for these debt-addicted (and failed) policy makers to keep the price (i.e. interest rates) of their debt down—which means they need to keep the yields on their bonds under “control” by keeping bond demand, and hence bond prices up.

The problem is, smart investors don’t like buying IUO’s from broke borrowers. Or if they do, they expect higher yields for the risk of lending to a bad credit.

But that’s a big problem for the guilty policy makers in broke country codes like the US, the UK, Japan or the EU.

Those debt peddlers hiding behind ministerial titles need a perpetual supply of suckers (i.e. buyers) of their IOU’s to keep rates and yields in control.

The fact is, those natural buyers just aren’t there.

The central bankers’ brilliant solution?

Simple: They buy their own sovereign debt with money created out of thin air and give this desperate “policy” a reassuring title like “Quantitative Easing”—which in actual fact is little more than financial fraud and glorified counterfeiting all committed with an extra dash of sovereign immunity.

See how policy labels can be so deceptively clever?

But such “easing” is an instrumental component of that other equally misleading (and desperate) policy of “Yield Curve Control.”

Deception American Style

As of this writing, we now have totally artificial as well dangerously price-distortive yield controls (and curves) around the world.

By way of example, consider the yield curve for Uncle Sam’s U.S. Treasury bonds.

Note how little yield one gets for buying US debt?

Note as well that the curve doesn’t even begin to “steepen” until about year 5.

And for those who wish to hold an American IOU for 30 years, you get a whopping 1.93% yield, which, when adjusted for inflation, means you get less than zero return for three decades of allegiance to Uncle Sam.

Pretty crappy, no?

Feeling a bit “controlled” yourself?

Ah, but it gets worse.

If you track the current yields on bonds of greater than 10-year duration (the blue line above), you’ll also notice that the yields are in fact higher today than where they were one year ago (the green line above).

Uh-oh.

These rising yields mean that bond prices on the long end of the curve are falling (by 5%), which confirms that even the Fed is not able to fully control its own “Yield Curve Controls.”

Although the Fed can set rates for shorter term bonds, it can’t set the rates for the longer-dated bonds.

Instead, those yields are normally determined by actual bond buyers.

Imagine that, actual supply and demand.

As that demand pool (i.e. real buyers) weakens, bond prices naturally fall and thus yields and rates naturally rise.

But remember, broke nations can’t afford rising yields and rising rates, which means they resort to creating fake money to buy their own debt.

Unfortunately for Powell, that’s a lot of debt (trillions and trillions) to buy, which means a lot of fake money (trillions and trillions) needs to be perpetually created to “buy” that debt.

But printing fake money to pay for real debt is not only a rigged policy, it’s a policy inherently rigged to fail.

Deception Has Gone Global

Just ask the Japanese.

They’ve been mixing QE with YCC for years, and today’s yield on the 10-Year JGB is now an openly embarrassing zero…

Yep. Zero.

In fact, the Japanese central bank buys just about every bond the government issues.

There are literally days on the Japanese government bond market where not a single trade is made. Not one.

Now that’s what I call control.

But is that capitalism folks?

That’s a rhetorical question.

Other central banks in other debt-ravaged countries are equally desperate.

This means they are committed to the equally insane yet euphemistic policy of “Yield Curve Control.”

In the EU, yield curve control is official policy. In Australia too.

The Dark Side of Yield Curve Control

Of course, such artificial rate controls are temporarily good for nations destroyed by years of debt-addicted policies authored by experts who now seek to hide (and blame) years of failure behind a recent COVID mask.

But how good is YCC for investors, currencies and the very notion of free market price discovery?

That, of course, is another rhetorical question.

YCC is slowly but surely destroying all of the above.

YCC not only kills honest price discovery for bonds, but for all risk assets, from stocks to inflated real estate prices.

Today, investors desperate for any kind of yield are getting less yield for junk bonds (!) than they used to get for Treasuries bonds, when risk was priced without Fed “control.”

The following chart is a jaw-dropper and proves just how distorted credit markets have become.

The artificial control (repression) of yields and rates means cheaper debt, and hence more binge borrowing (and hence price inflation) on everything from over-priced homes to over-pumped stocks driven by easy and cheap debt rather than old fashioned things like, you know…profits and earnings.

Furthermore, because the world is still pegged (trapped) to the USD and the hegemony of the US Treasury Bond, the “controlled” distortions in the US create distortions (and asset bubbles) around the world.

An Unhappy Ending-Losing Control into a Perfect Storm

The consequent and record-breaking over-valuations in risk assets which YCC has unleashed creates the perfect storm as well as set up for a perfect financial crisis the moment yield curve controls run out of control, which as the chart above confirms, is already happening.

The only options central bankers have left are bad ones.

- They can further “control” the slowly rising long end of the yield curve by printing trillions more fiat currencies—which means a dramatic (and further) debasement of the same; or…

- They can abandon the currency debasing YCC madness, thereby naturally allowing bonds to sink and yields (and hence rates) to skyrocket, thereby ushering a total blood bath in stock and bond bubbles reliant on low yields and cheap debt.

See the dilemma?

The “experts” (another euphemism…) are thus caught between a market-crushing rock and a currency-killing hard place of their own doing.

Speaking of experts, I hear Biden, like all his predecessors, red and blue, is shrugging off warnings of what another $1.9 trillion in “stimulus” (i.e. debt) will do to an already debt-soaked nation.

But hey, just toss it on Uncle Sam’s bar tab of debt and issue some more IOU’s for quick Fed absorption, as the US is now a nation mislead to believe that more is more—and that more debt is a substitute for income or growth.

As always, and as expected, all conversations as well as really bad policies lead back to gold, which unlike the yield curve controlled (i.e. debased) USD, remains an actual store of value.

Since 1971, the USD, when measured against a milligram of gold, has lost 97% of its value.

Thus, when thinking of fancy labels and proper nouns, which of the two—gold or the greenback– would you still want to label as real money?

That too, is a rhetorical question.

Original source: Goldswitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.