If you spend as much time on X as I do, you've likely run into a few analysts who chart the Dollar Index, DXY, as a means of predicting the future direction of the gold price. Their assumption is that if DXY is trending down, then gold will be trending up and vice versa. I'm here to tell you that this is a mistake. First, you must realize that DXY is not the US Dollar; rather, it is a ratio of the US Dollar against a basket of foreign currencies. This means that if the US Dollar is losing value, but the basket of currencies are losing value even faster, then DXY will rise. This in fact, has been what's been happening for many years and explains why gold and DXY can be moving up at the same time.

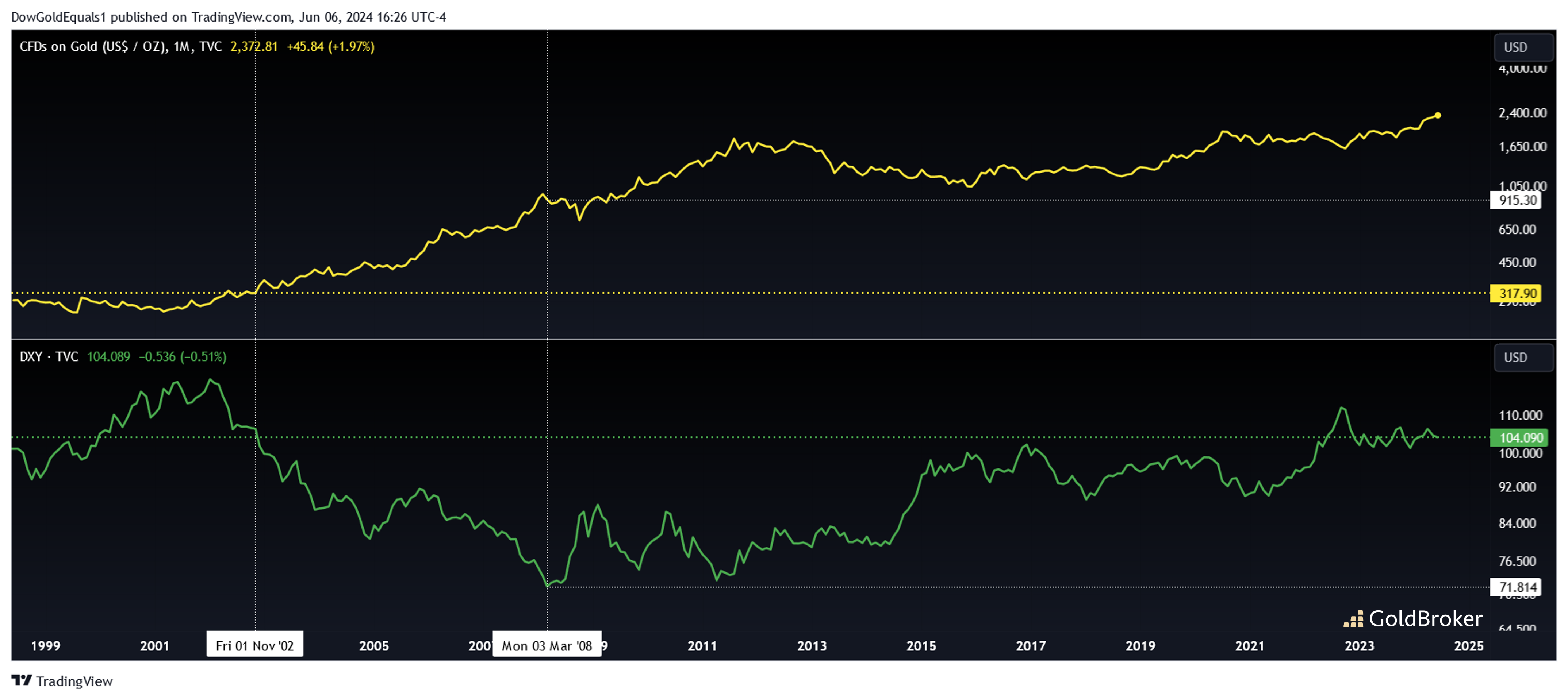

The first chart is a combo chart with gold on top and DXY on the bottom. First, note the levels of each going back to the Global Financial Crisis in 2008. DXY was around 72 and gold was around $915. In the decade and a half since, DXY has increased 45%, but gold has also increased 150%! Clearly, DXY has been a red herring for gold investors. Next, note that DXY's current value around 104 was also achieved way back in 2002 when gold's price was just $315. DXY is flat over 22 years, while gold is up more than 7X. So while you may find very small periods of time when DXY has an inverse relationship with gold, there is absolutely no inverse relationship over longer periods of time.

The second chart is a ratio of gold against DXY. When gold is in a bull market, it outperforms DXY. This is, in fact, the proper analysis if you wish to compare gold to DXY. What is fascinating about this chart is that the two wedges shown are exact clones of each other. The upper and lower trend lines are at the exact same angles! The breakout from the first wedge in the early 2000s led to a huge bull market in gold. Now, we see the second wedge breaking out, strong evidence that a sustained bull market in gold is once again upon us.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.