Gold is poised to reach record levels, ending a period of price lateralization that has lasted more than five years. This comes against a backdrop in which interest rate hikes by the US Federal Reserve appear to have peaked.

At a time when bonds are at their most volatile, what asset can provide healthy diversification in a global portfolio?

In this article, we'll clarify the current situation.

Is the policy of raising interest rates a closed chapter?

Following the year 2020, marked by a very accommodating monetary policy to stimulate the post-COVID economy (objective achieved), but faced with inflation problems stemming from the drastic increase in the money supply, the Fed implemented a restrictive monetary policy. This policy aimed to raise interest rates and reduce the Fed's balance sheet by not renewing maturing bonds.

Since 2022, a completely different tune has been playing, as we have just witnessed one of the most rapid monetary tightenings in history.

The repercussions of this monetary tightening, such as the credit crunch and its impact on economic activity, have prompted the Fed to adopt a more moderate approach so as not to damage the country's economic health.

Through these various rate movements, we are also observing a positive correlation between inverted 10-year bond yields and gold prices.

In other words, a fall in interest rates is particularly favourable for gold. This trend is set to continue, as the market anticipates numerous interest rate cuts between now and 2025. Pricing that makes sense, as the Fed currently has no need to raise interest rates. What is needed is to see rate hikes feed through to the real economy (on average, this takes 12 to 18 months).

Projected interest rates

Central banks are gold lovers!

Central banks have significantly increased their gold reserves this year.

According to the World Gold Council, countries bought 337 tons in the third quarter of 2023 after accumulating 175 tons in the second quarter, an amount that exceeded the initial estimate of 103 tons.

This massive acquisition of gold, mainly led by China, Poland, Singapore and undisclosed purchases, brings total purchases for the first nine months of the year to 800 tons.

This buying frenzy has not only supported gold prices, which recently topped $2,000 an ounce, but has also helped to offset investor selling amid global monetary tightening.

Central Banks' demand for gold

Why are central banks buying gold?

Central banks around the world are turning to gold to strengthen and secure their financial reserves.

This strategy aims to diversify their assets and reduce dependence on traditional currencies, which are unfortunately prone to volatility and inflation.

Recognized as a safe haven in times of economic uncertainty, physical gold offers unique stability thanks to its intrinsic value and its history as a store of value going back thousands of years.

The growing popularity of gold reflects the search for financial security and the desire to hedge against global economic uncertainties.

The subject of recession is not over yet

The prospect of a recession could begin to cause concern on the stock markets, while at the same time providing a significant advantage for gold.

In fact, indicators of manufacturing activity show data consistent with previous recessionary phrases. Moreover, households are being strangled by ever-increasing interest payments.

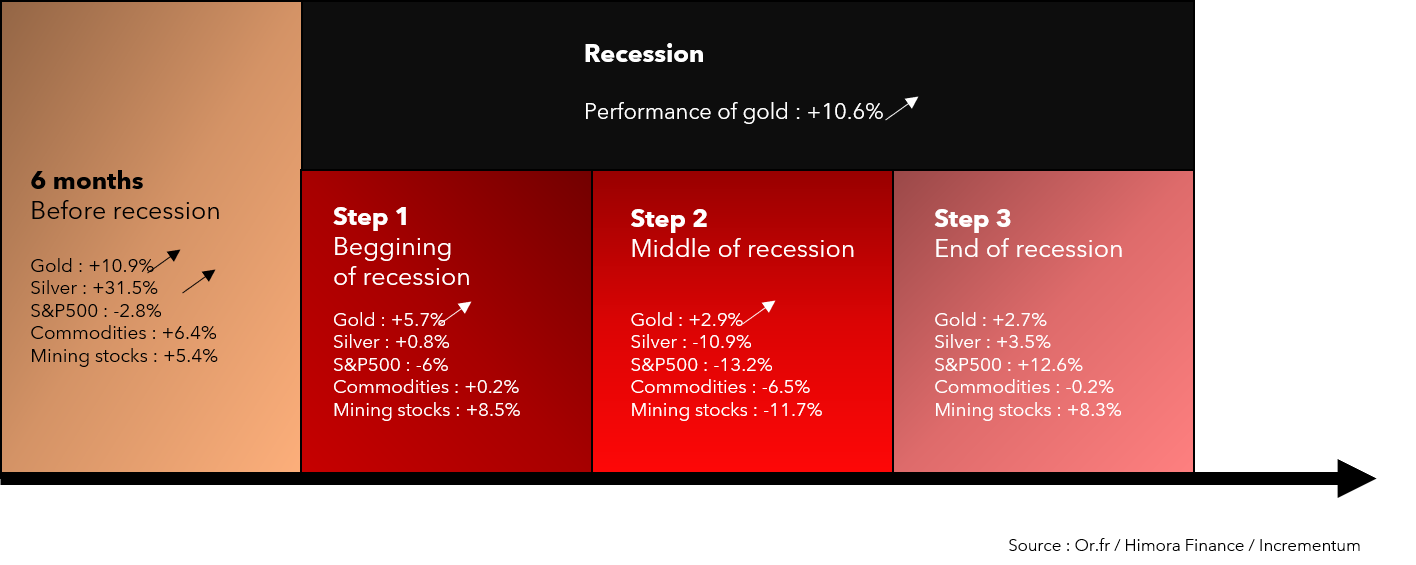

In times of recession, gold tends to outperform other assets statistically, making it a potentially attractive choice in this context.

Gold's performance during a recession

Conclusion

At the time of writing, gold is approaching its all-time highs. Although the $2,000 barrier seems hard to break, it will be worth keeping an eye on gold, which makes it a prime asset in a context close to recession. This is all the more relevant given that bonds, which are generally included in balanced portfolios, are more volatile than gold. This observation also comes at a time when valuations are hardly attractive.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.