Since the start of the year, we've seen a sharp rise in so-called "risk assets" such as tech stocks and cryptocurrencies. In this article, I'll explain the background to this meteoric rise.

On the other hand, Bitcoin's spectacular performance raises questions and fuels a current debate: Can Bitcoin replace gold as a store of value?

The origins of this year's rise in risk assets

First, we need to understand the reason for Bitcoin's recent rise before we can answer this question in any depth.

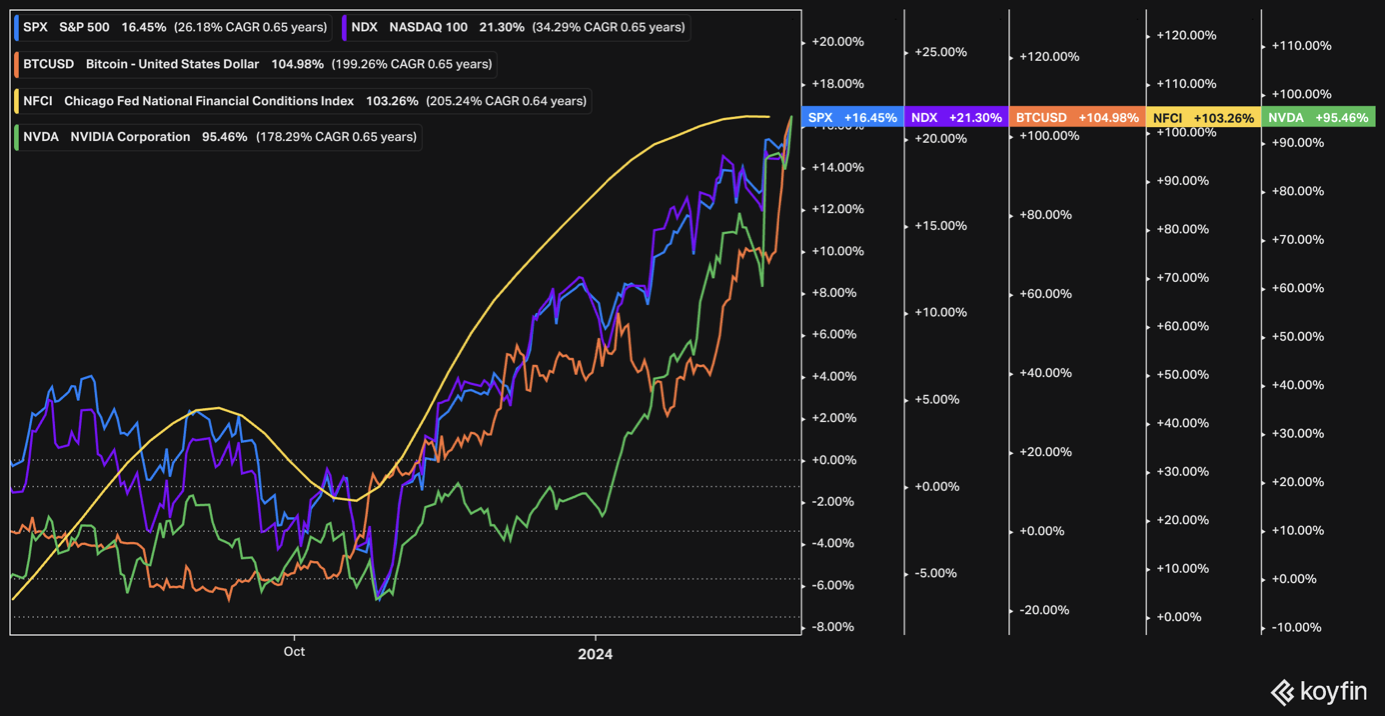

The current rally in the equity and crypto-asset markets dates back to October/November 2023. At that time, we were already seeing an easing of financial conditions.

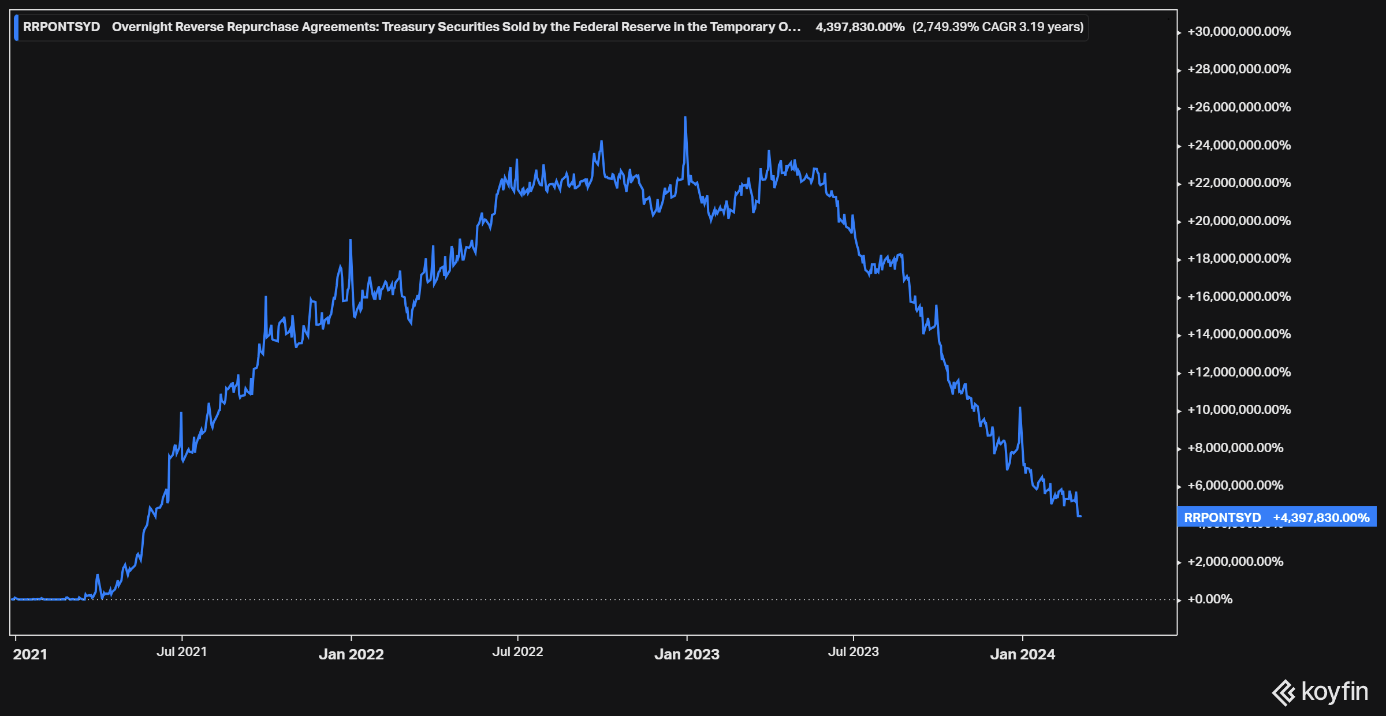

It's crucial to understand here that the Federal Reserve (Fed) is carrying out a de facto new quantitative easing (QE) program by reusing the excess liquidity created in 2020-2021 to purchase new bonds.

This type of open market operation is part of the Fed's toolbox for implementing its monetary policy.

What's more, this measure is inflationary, as we have seen over the last few decades and even more recently in 2021.

At a time when the battle against inflation is far from over, the Fed seems once again to be throwing fuel on the fire, which could stimulate investors' appetite for safe-haven assets such as gold.

Open market operations

In addition to the dollar's slight decline, the easing of financial conditions and the Federal Reserve's increase in net liquidity are factors that largely explain this movement, as we have been observing since November 2023.

Risky assets and the impact of financial conditions on their rise since November

Let's return to financial conditions. They offer an insight into the health of markets, credit, the economy and financial stability.

The components of the NFCI, which contribute to assessing financial conditions, are as follows:

- The spread between the 3-month LIBOR rate and the spread between the CME SOFR-Treasury forward rate.

- The fixed-rate spread between 30-year Jumbo and Conforming mortgages.

- CBOE VIX market volatility index.

- Markit's 5-year Investment Grade (IG) senior CDS index.

- Credit spread for A2P2/AA non-financial 1-month commercial paper.

These components are key measures used to assess financial conditions and the overall health of the market. According to BNP PARIBAS, the easing of these financial conditions would be perceptible with a 100 basis point drop in rates.

Bitcoin is not a store of value, but rather a risky asset

Until now, and in the absence of evidence to the contrary, Bitcoin cannot be considered a store of value in the strict sense of the word, unlike gold, which has performed this function since time immemorial. Rather, it is a risky asset.

Bitcoin currently has a strong positive correlation with Nvidia, Nasdaq100, S&P500 and others. What do they have in common? They're all risk assets correlated with each other, and dependent on market liquidity.

As we can see, Bitcoin closely follows the Nasdaq... So far, this doesn't give Bitcoin the status of a store of value. On the contrary, as we saw when Tech crashed in 2022 due to rising interest rates, the downward movements were significant and very rapid.

Bitcoin followed the same pattern and did not decouple from stock market indices. By way of comparison, over the period from November 2022 to August 2023, during which the market had to absorb the Fed's rate hikes, gold recorded a performance of +4%, while Bitcoin fell by -54%.

Gold vs. other risk assets during the market downturn in 2022/2023

What I expect from a store of value is that it maintains its stability, especially during the most complicated phases for stock markets, such as recessions or bear markets. This is very often the case for gold, a little less so for Bitcoin.

Conclusion

Bitcoin is a very young asset, barely sixteen years old since its creation after the 2008 crisis by Satoshi Nakamoto. As a result, the volatility of this asset is still very high today.

Despite outperforming gold, Bitcoin is not a store of value, and confirms its status as a risky asset. As long as all goes well on the markets, Bitcoin's performance will be all the better for it. But when the indices correct and a recessionary risk emerges, things could change very quickly, taking many retail investors by surprise.

What's more, gold price recently closed near its all-time highs and is poised to embark on a new uptrend cycle, even as we see a decline in flows into gold-linked ETFs. Some investors have turned away from gold in favour of Bitcoin.

This choice seems to be motivated primarily by speculation, among other reasons, but once again demonstrates that gold remains a long-term store of value.

A store of value vs. a risky asset

Let's not forget the potential catalysts that could trigger a new gold supercycle in the coming months, if not years:

- Government debt is at unprecedented levels, with interest on debt now totalling $1 trillion.

- The GOLD/SP500 ratio is currently at an all-time low.

- Persistent inflationary problems.

- Central banks continue to accumulate physical gold in their reserves.

- A potentially dangerous speculative market environment.

In short, despite exceptional performance in recent years, it is still premature to consider Bitcoin as a store of value. Consequently, it would be prudent for Bitcoin holders to consider investing in gold to fulfill this safe-haven role in the current context. The yellow metal is a tangible asset that allows you to secure your wealth with greater stability than cryptocurrency. The statistics speak for themselves: the value of gold has been firmly established for millennia.

Nevertheless, instead of systematically pitting the two assets against each other, it would be more beneficial to consider them as complementary pieces of an overall investment strategy. By including both gold and Bitcoin in a diversified portfolio, investors will be able to benefit from their distinct characteristics while mitigating some of the risks associated with a single type of investment.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.