The global economy is currently going through a long period of transition.

After a recession observed during the Covid pandemic just three years ago, some leading economic indicators are starting to turn red again.

After a long period of stabilization, we are also witnessing a historic inversion of the yield curve and an upturn in commodity prices, which could trigger a new wave of inflation at a time when producer prices are back to their lows.

This situation could prove favourable for gold, but unfavourable for equities, which are also suffering from high valuations and have never been so unattractive compared to US government bonds, or even the yellow metal.

Stocks at unattractive levels!

The rally that has been underway for almost fourteen years now (+585% for the S&P500 and +400% for the CAC40, dividends reinvested) may soon come to a halt.

Since the financial crisis of 2008, stock markets have enjoyed almost uninterrupted growth, fuelled by historically low interest rates and highly accommodating monetary policies.

However, this trend appears to be reversing with the Fed's tightening of monetary policy in 2022.

Equities have become expensive once again following the speculative bubble in large-cap stocks, driven mainly by the speculative wave around artificial intelligence.

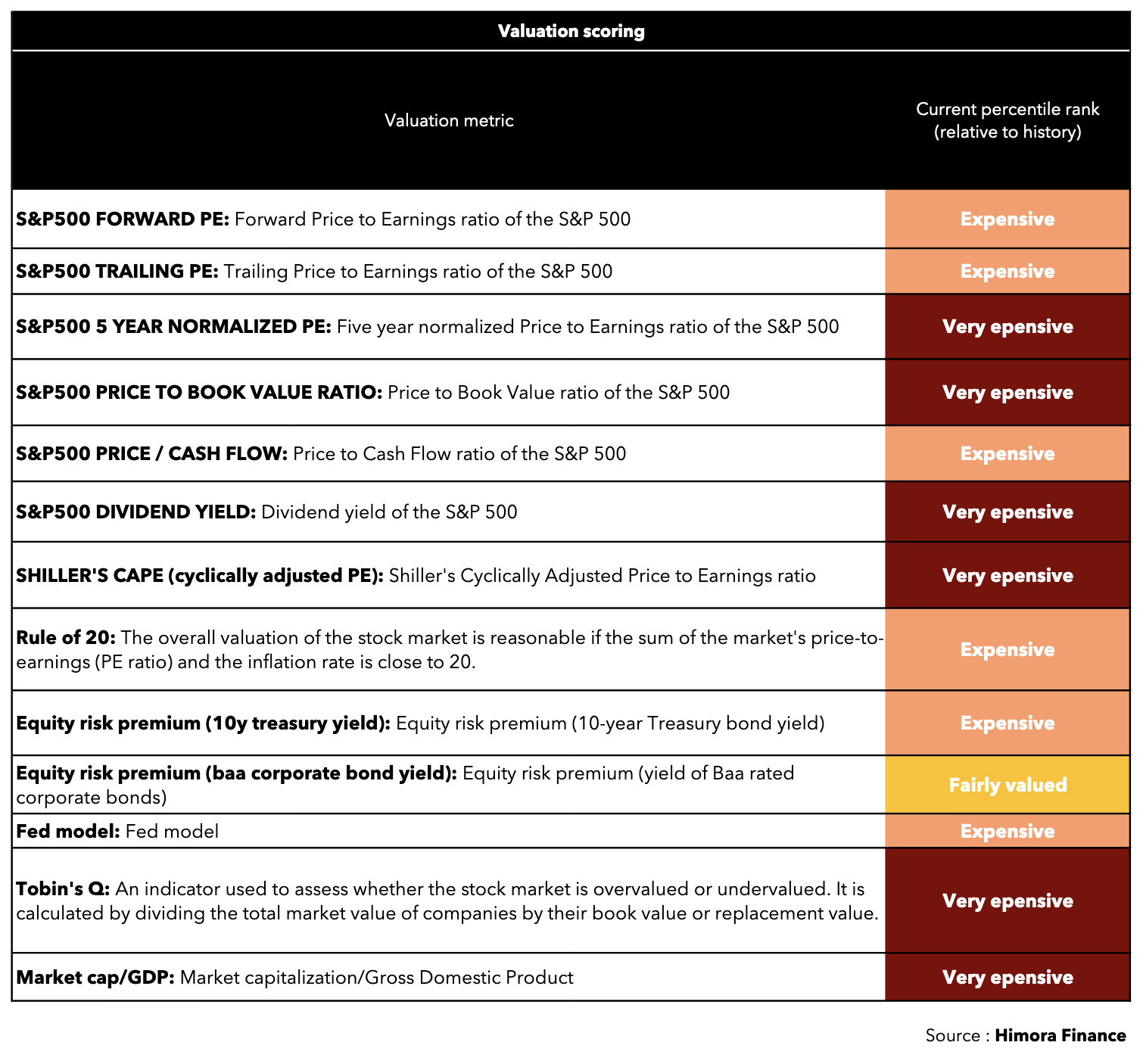

Stock market valuations are now at record levels, with no real justification for this.

The bottom line is clear: the equity market currently offers few opportunities.

The risk premium, which measures the additional remuneration investors demand for holding equities rather than risk-free bonds, is at an all-time low, which also suggests an arbitrage in the direction of bonds. Government bonds... Let's talk!

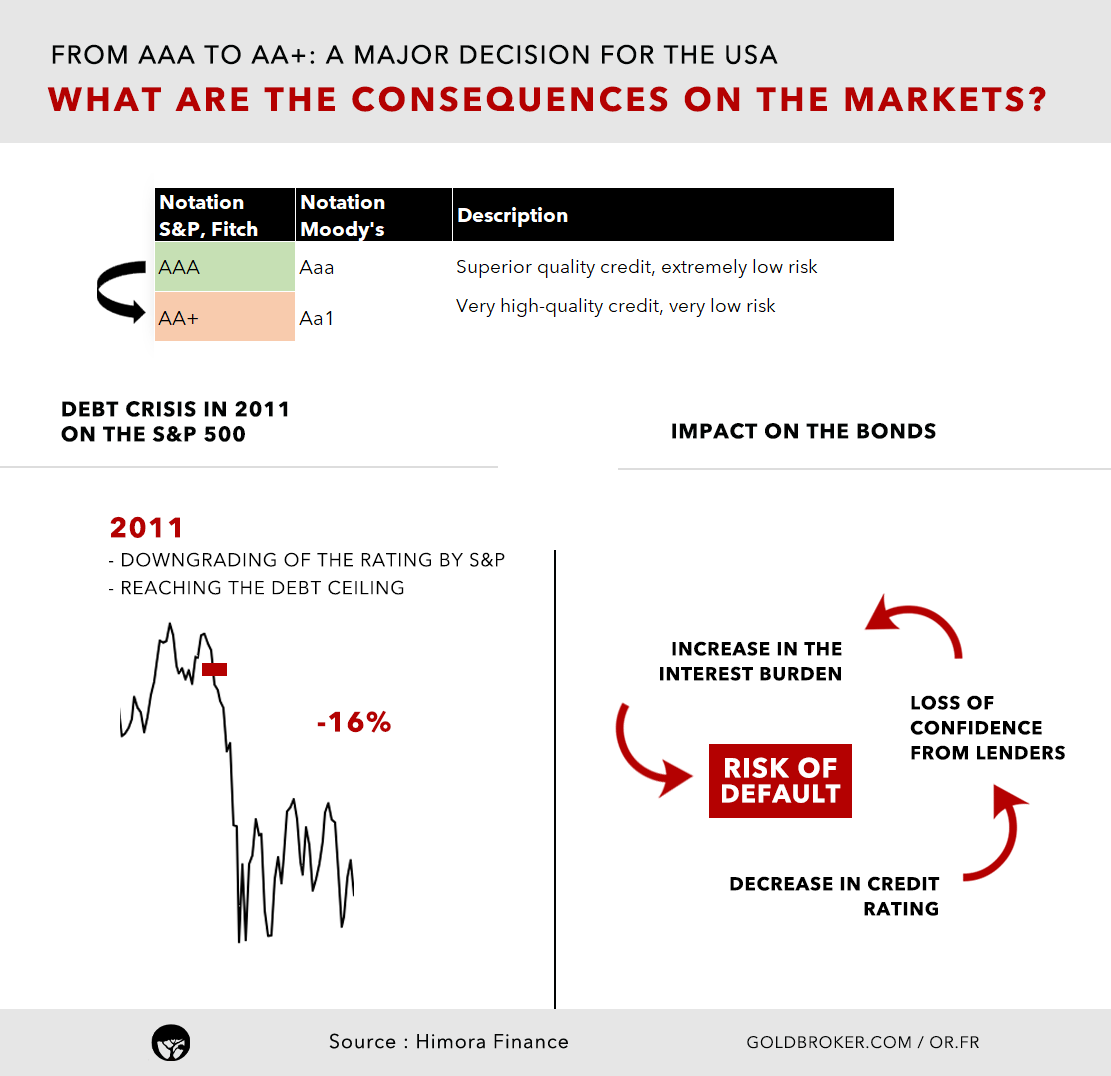

Tuesday August 1, Fitch downgraded its US credit rating, which could lead us to reconsider an arbitrage in this direction.

Towards a second wave of inflation... and a possible recession

In addition to these factors, a second wave of inflation appears to be on the horizon.

The recovery in commodities, a key driver of inflation, is already underway. Oil, copper, soybean and other commodity prices have all been on an upward trend in recent months.

Oil has even entered the technical overbought zone once again!

This rise in commodity prices is partly due to a still-resilient US economy and the various macroeconomic events of the moment. This rise in commodity prices could lead to higher inflation.

As a reminder, the components of inflation that have fallen the most over the last four months are energy and food, mainly thanks to the fall in all commodity prices.

At the same time, we are witnessing an inversion of the yield curve. Historically, an inverted yield curve has often preceded an economic recession.

This means that investors are expecting long-term interest rates to fall, which could indicate weaker economic growth in the future.

Which arbitrage to choose in a portfolio?

In this context, gold could be a particularly attractive choice to complement a portfolio weighting in government bonds.

As discussed earlier in this forum, US government bonds will lose stature, and their reputation as a risk-free investment may well continue to erode.

Here's what this means for the US:

- A potential increase in the cost of borrowing due to a drop in confidence among potential lenders.

As if that weren't enough, interest payments on U.S. debt have risen by 25% following the increase in key interest rates... The situation seems critical here too, and it's not about to get any better.

In 2011, interest expense also soared. The riskier the bond, the higher the interest rate the issuer has to pay.

- Lower investor confidence and therefore potential weakening of the dollar.

Gold, a safe haven in times of inflation

As we all know, physical gold is a finite resource, and its value cannot be diluted by inflationary monetary policy, the main cause of the currency erosion affecting the dollar that we discussed recently.

Inflation is a phenomenon that causes your savings to lose value: $10,000 in the 2000s can now buy $5,500 today.

On the stock market front, gold tends to perform well after interest rate hikes.

In conclusion, as we head towards a possible new wave of inflation, investors should reassess their asset allocation.

Equities, which are currently expensive and could be affected by an inversion of the yield curve and rising inflation, may not offer the same returns as in the past.

Gold, on the other hand, could offer protection against inflation, making it an attractive addition to a diversified portfolio.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.