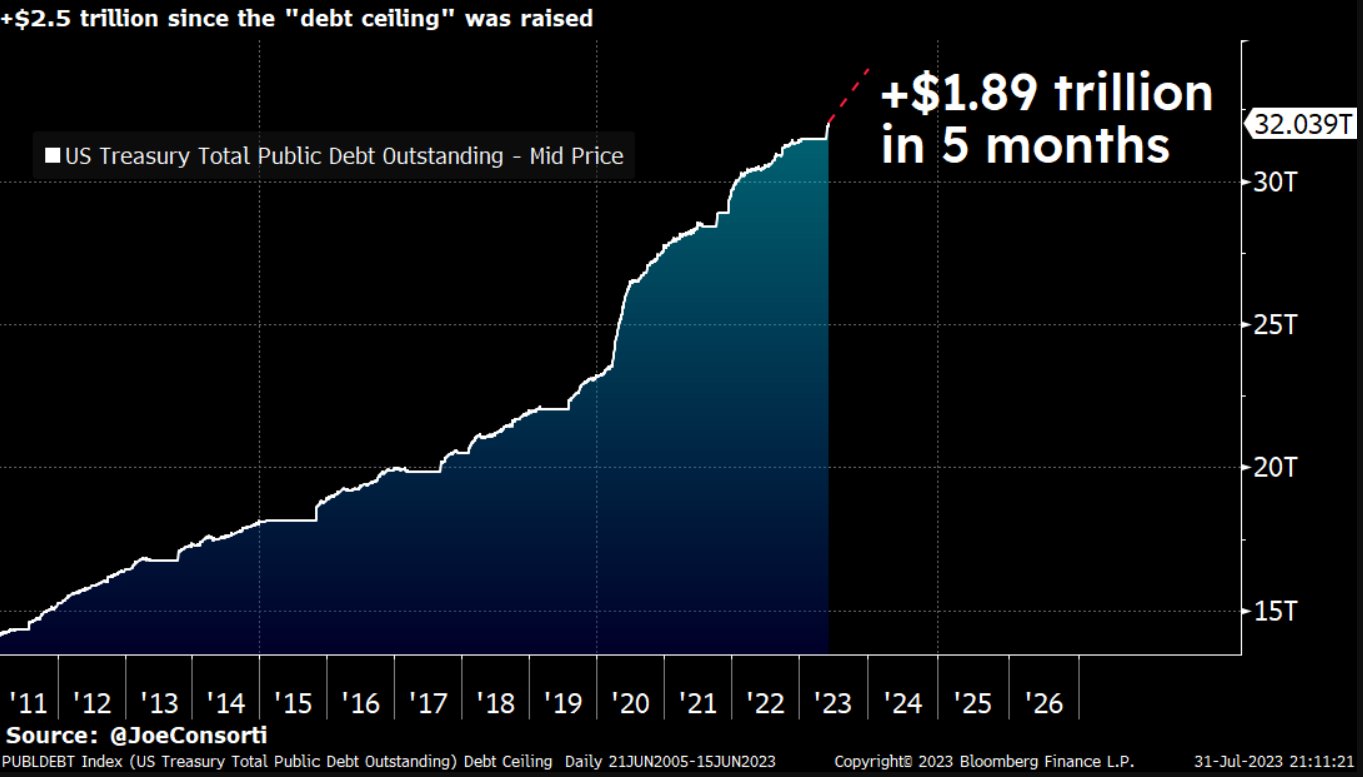

- Since the resolution of the recent debt ceiling "crisis", the US national debt has soared by over $1.8 trillion.

- A situation that raises concerns about its long-term sustainability.

To understand the scale of the increase in U.S. debt, it's useful to compare it with U.S. financial history.

It took the U.S. 209 years to accumulate its first $1.8 trillion in debt. This period covers many major historical events, including several wars, the Great Depression and numerous other economic crises.

However, after an agreement described as "historic" on the debt ceiling, we saw this colossal sum added to the national debt in a record time of 8 weeks.

This acceleration of debt is alarming. Not only does it underscore how quickly debt can accumulate, but it also highlights the challenges the U.S. will face in managing this debt in the future.

If this trend continues, the debt burden could become unsustainable, with potentially serious consequences for the US economy.

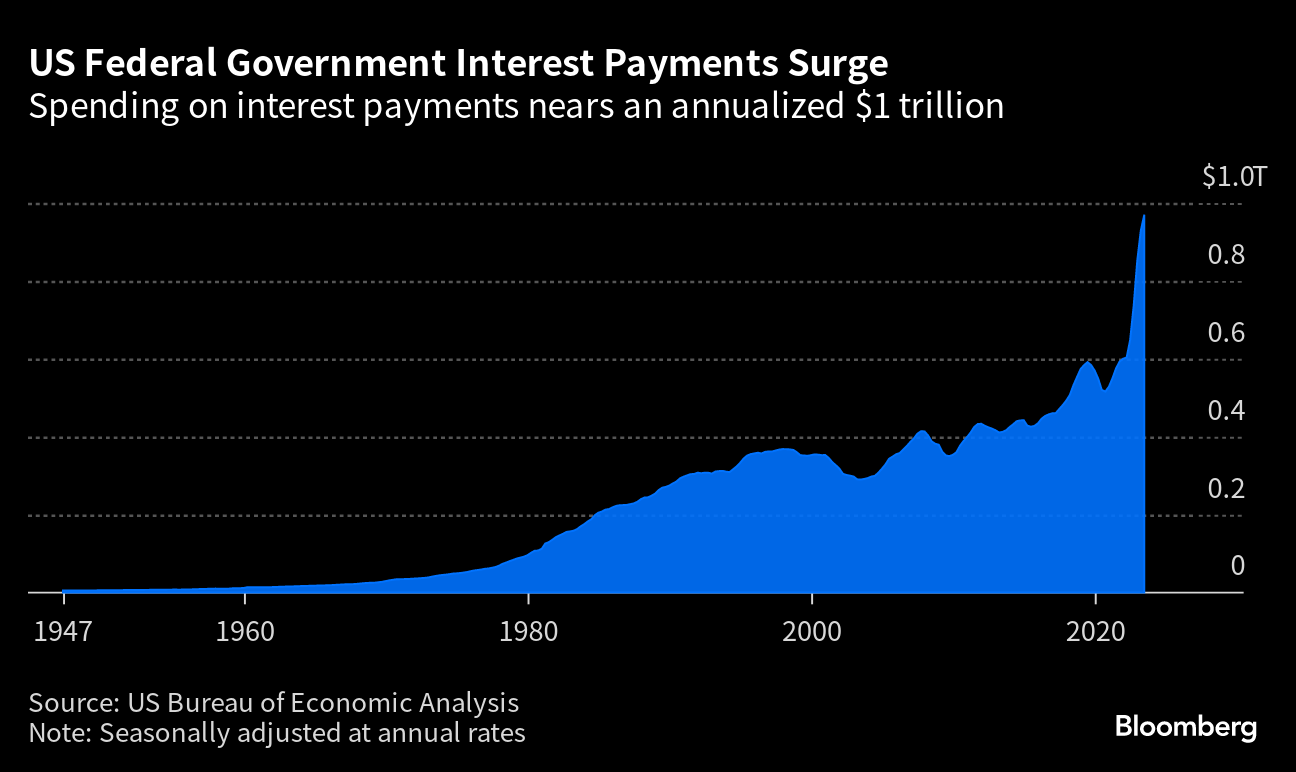

Beyond the debt itself, the recent rise in interest rates is creating a vicious circle.

To reduce inflation, the Federal Reserve was forced to raise interest rates to a level not seen for over 20 years now. Interest payments on the debt have risen by 25%!

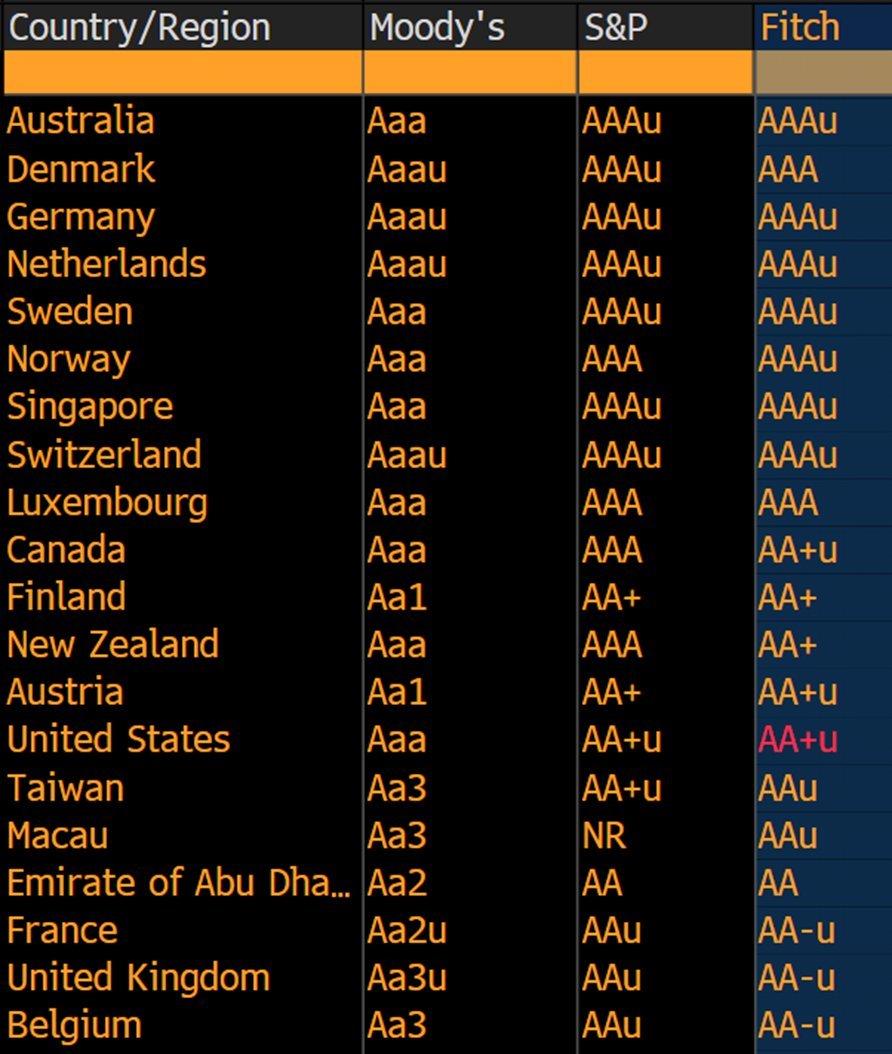

Fitch has downgraded the United States from AAA to AA+.

After almost exceeding the debt ceiling a few months ago, this may be the signal of the next major financial crisis for the United States.

What does this mean for the United States?

- A potential increase in the cost of borrowing due to a drop in the confidence of potential lenders. The more risky a bond is considered, the more its issuer will have to raise its rate.

- Lower investor confidence means a potentially weaker dollar. For the financial markets, it's the perfect excuse and the ideal timing to take some profits after a rally that has lasted uninterruptedly for over six months.

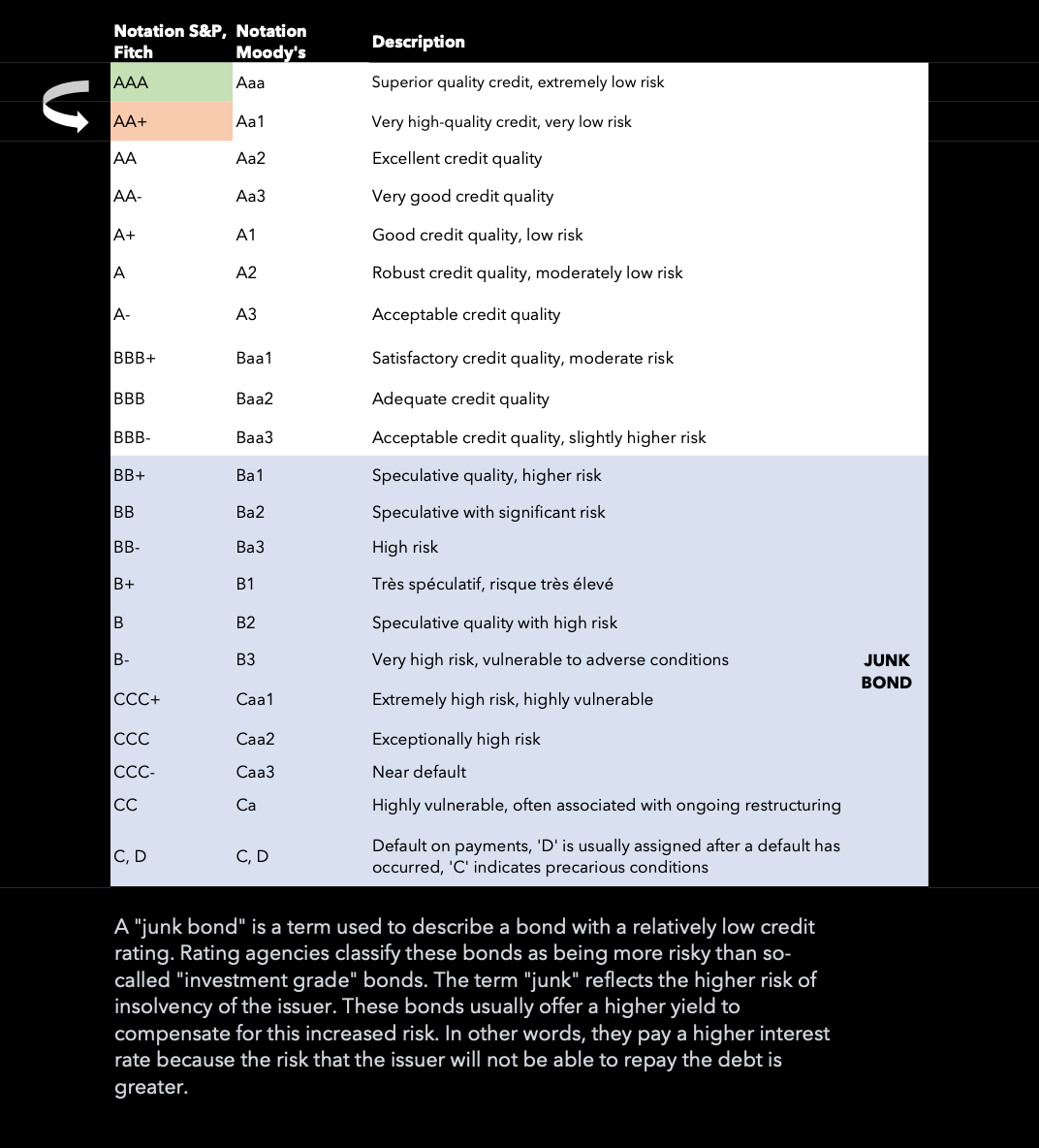

We have listed the different credit ratings and their meanings below:

The lower the credit rating, the higher the interest rate on the related bond, since the lower the rating, the riskier the bond.

Original source: @HimoraFinance

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.