For the past 3 years, we have been faced with the largest monetary injections in history. These liquidity injections are not without consequences for your long-term purchasing power.

In this article, we'll look at the reasons for long-term currency devaluation, and at ways of protecting yourself against it in the long term.

Why do we need these monetary injections and what are the long-term consequences?

Political and central bank leaders point to the positive short-term effects of monetary injections on the economy. However, the long-term effects are rarely mentioned.

When an economic crisis occurs, central banks may have to support the economy with injections of liquidity, as was the case in recent years during the subprime and Covid crises: during these two crises, central bank balance sheets more than doubled.

We can distinguish between two types of monetary policy:

- Dovish monetary policy: Its aim is to promote economic growth by easing financial conditions (lowering rates).

- Hawkish monetary policy: Its aim is to ensure price stability by tightening financial conditions (raising interest rates).

In order to revive economic growth slowed by the global Covid-19 pandemic, the choice has recently been to adopt a dovish monetary policy.

The result of this monetary policy is that central banks have doubled their balance sheets and flooded the markets with liquidity, triggering one of the biggest speculative bubbles of the last twenty years.

In fact, we have seen parabolic rises (now completely wiped out) in most of the biggest speculative assets on the market:

- Cryptocurrencies.

- Shares of unprofitable companies.

- Shares in companies that have recently gone public.

- Shares in soon-to-be-bankrupt companies (such as Gamestop, which has been causing a stir on the web).

The party's over, and central banks are now facing the downside of the monetary policy they implemented a few years ago.

Inflation is out of control in the United States and is beginning to paint a bleak picture of the economy.

This is because the Fed has been forced to raise interest rates drastically in order to slow inflation, which has been out of control since April 2021 and is jeopardizing monetary stability.

As explained in this tweet (in french), the vicious circle is here to stay, and the incompetence of certain members of these institutions is not getting any better:

▫️ Jusqu’à quand cela va-t-il durer ?

— Slimane Himora (@HimoraSlimane) April 16, 2023

🏦 Le cercle vicieux des banques centrales et de la dépréciation de la monnaie depuis la fin de l’étalon or sur le dollar.

- Économie faible, en ralentissement

↪ QE (augmentation de la monnaie en circulation - baisse des taux)

↪ Hausse… pic.twitter.com/opKgJLwDtO

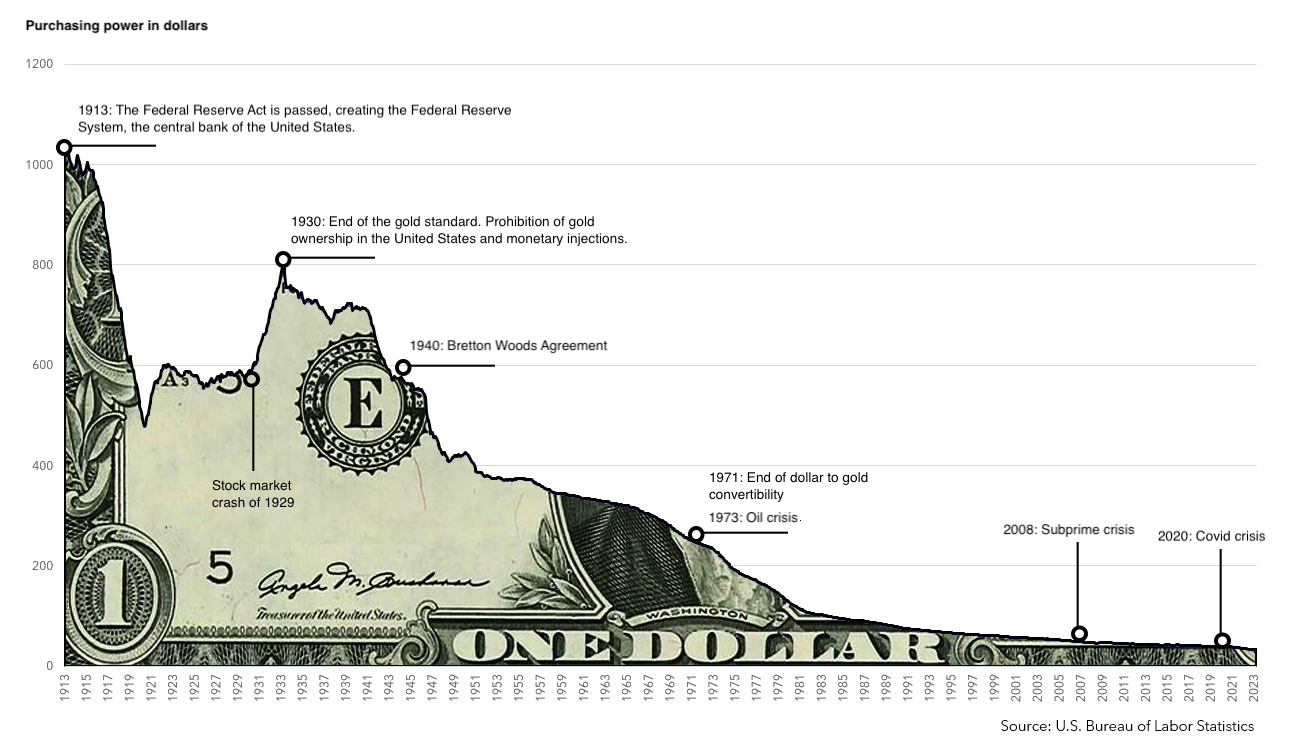

These injections of liquidity have a major impact on inflation and therefore on long-term purchasing power, as illustrated in the chart below:

The more money in circulation, the less it will retain its value.

In most cases, when the quantity of money in circulation increases rapidly, this naturally leads to higher inflation.

This inflationary rise leads to a real decline in purchasing power. In other words, each unit of money allows you to buy fewer goods or services than before...

So imagine having €100,000 in cash in your bank account…

Without even mentioning the current banking crisis, you wouldn't think of letting that cash sit in a bank account for several years, as its value depreciates every year...

Historically speaking, currency devaluation has accelerated dramatically since the end of the gold standard during the Great Depression of the 1930s. Under this system, the value of a currency was directly linked to a fixed quantity of gold in circulation.

The gold standard made it more difficult for governments to over-create money, which made it much easier to stop, and subsequently accentuated the devaluation of the dollar.

The trivialization of liquidity injections into the economy is unlikely to slow down the currency devaluation machine, which has now been running for almost a century.

This solution is short-termist and merely delays the deadline.

How can we protect ourselves against currency devaluation?

As a market operator, I would normally have told you that the financial markets offer protection against currency devaluation.

But the risk premium on equities is currently at its lowest level in over two decades, and it now seems unattractive to be positioned in the stock market.

Gold price adjusted from inflation

Unlike fiat currencies, physical gold has an intrinsic value that has been recognized for thousands of years (the first gold coins were minted in 212 AD in the Roman Empire). It has proven its relevance over time.

Gold is an excellent hedge against the depreciation of the dollar and fiat currencies, as we can see from this inflation-adjusted gold chart.

As the quantity of gold on earth remains limited, the yellow metal will continue to appreciate strongly over time.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.