There is no longer any doubt: the dollar is on the verge of losing its status as an international trade currency across a large part of the globe. The BRICS want to return to a gold-backed currency. The revolution of 2023 will be as significant as that of 1789 in the overthrow of the established order.

But first, let's backtrack a bit…

On February 15, 2006, in its bulletin GEAB, the European laboratory for political anticipation wrote:

"We estimate to over 80% the probability that the week of March 20-26, 2006 will be the beginning of the most significant political crisis the world has known since the Fall of the Iron Curtain in 1989, accompanied by an economic and financial crisis of a scope comparable with that of 1929. This last week of March 2006 will be the turning-point of a number of critical developments, resulting in an acceleration of all the factors leading to a major crisis, disregard any American or Israeli military intervention against Iran. In case such an intervention is conducted, the probability of a major crisis to start rises up to 100%.

The announcement of this crisis results from the analysis of decisions taken by the two key-actors of the main on-going international crisis, that is the United States and Iran:

- On the one hand, there is the Iranian decision to open the first oil bourse priced in Euros on March 20, 2006 in Teheran, available to all oil producers of the region ;

- On the other hand, there is the decision of the American Federal Reserve to stop publishing M3 figures (the most reliable indicator on the amount of dollars circulating in the world) from March 23, 2006 onward).

On February 1, 2021, the US Federal Reserve stopped publishing M1 and M2 monetary data. Today it is impossible to know the real quantity of dollars circulating in the world. The Fed can print at will as needed, to avoid a default on the short-term debts of this or that bank or nation.

Many events have taken place since April 2006. The first was the systemic crisis of 2008 and the G20 summit in Washington in November, during which most major nations called for a change in the international monetary system.

As early as 2009, the four leaders of emerging countries (Brazil, Russia, India and China - BRIC) began to structure themselves with a view to emancipating themselves from the Western financial system. The first official meeting of the BRICs took place in June 2009 in Yekaterinburg, Russia. The following year, South Africa joined the group, whose acronym became BRICS. In 2013, the New Development Bank (NBD) was created in an effort to break away from the financial neo-colonialism of the World Bank and IMF.

At the post-2008 G20s, emerging countries demanded more votes in both organizations, but the U.S. Congress refused to endorse these changes. It takes 85% of the vote to change the order of things at the IMF, but the United States holds 17%, which allows them to block any significant change. Washington used and abused its right to vote. So much so that IMF Director Christine Lagarde had to issue an ultimatum to Congress on April 14, 2014 to get a very slight change in the status quo. The following year, in 2015, the yuan was added in the SDR basket and China doubled its voting power from 3.8% to 6.1%. But the United States did not relinquish its veto rights, and the BRICS' desire to create a parallel system was strengthened.

In March 2009 China published a letter of intent on the future monetary system, with a reference to the Bancor proposed by John Maynard Keynes at Bretton Woods in 1944. This currency was to be made up of a basket of the world's major currencies, like the IMF's SDR, and be stabilized by a basket of 40 commodities, weighted according to their scarcity. Since then, I have been tracking down any mention of such a system in the news.

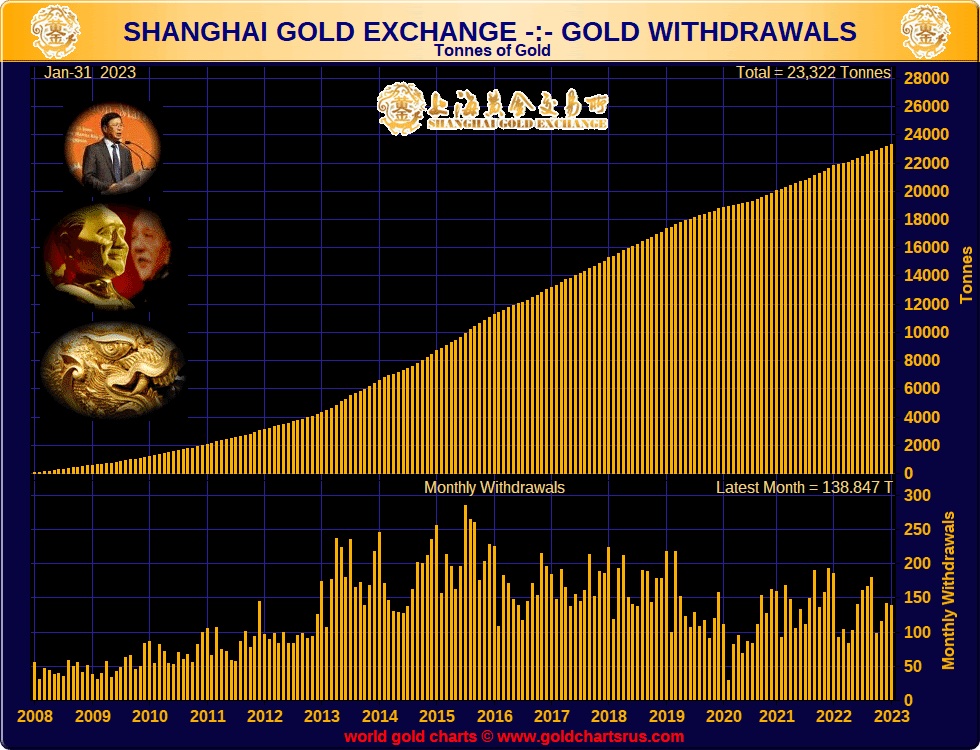

As early as September 2009, China encouraged its citizens to invest in gold and silver. This chart shows the volumes of physical gold traded on the Shanghai Gold Exchange (SGE) and gives an idea of the existing stocks of yellow metal in China. The dollar is clearly losing its status as the currency of international trade. The BRICS want to return to a gold-backed currency.

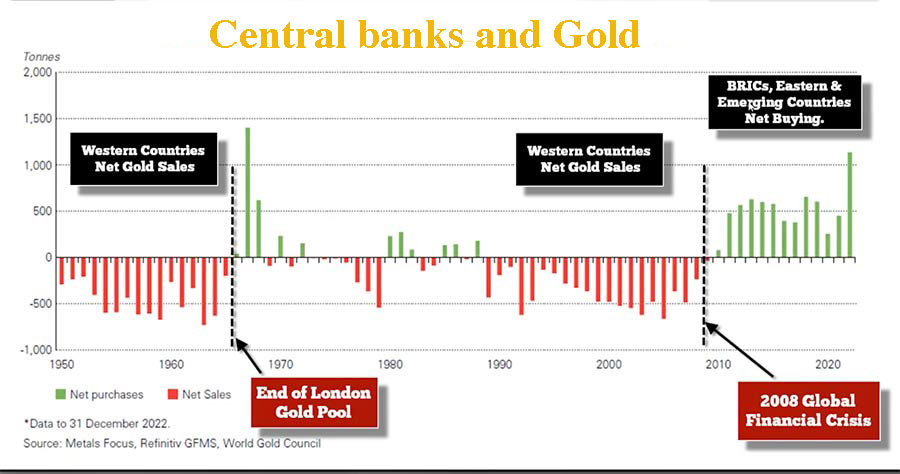

At the same time, the policy of the main central banks towards gold took a 180° turn. Almost immediately after the November 2008 G20, central banks that had been net sellers of gold for over 20 years became net buyers. The year 2022 has seen a very sharp increase in these gold purchases, for reasons we will see below.

The United States, by cutting off Iran's access to the SWIFT network in 2018, pushed China and Russia to develop their own interbank messaging systems. These systems were already operational when the West did it again by depriving Russia of SWIFT in February 2022.

It is worth remembering that any international transaction in dollars must go through an American bank. As a result, the United States tracks almost all exchanges between the various players in world trade.

In February 2022, the United States and its allies froze Russian financial assets in Western banks. This sanction made all the other nations realize that Washington could ruin them overnight and that holding dollar assets in the United States or the European Union was risky, if one did not slavishly comply with U.S. policy. As always, it is not the event that counts, but the exploitation of the event. China and Russia have made sure that many countries get the message, encouraging them to de-dollarize as much as possible. The easiest way to do this is to use their dollars to buy gold, which explains the massive gold buying movement by central banks in 2022.

After the first round of Western sanctions and the fall of the ruble, Moscow imposed that its oil be sold against gold, at a fixed price of 5,000 rubles an ounce. The ruble then soared against the dollar and the demand for gold in London soared, especially from Indian oil brokers. Indeed, paid in gold, the price of Russian oil was very cheap. Indian and Chinese traders have thus been able to buy oil and gas from Russia, which was banned in Europe, and then resell it at a high margin to the European Union. In 2022, India increased its purchases of Russian oil 33-fold over the previous year.

Western sanctions have strangled Europe more than Russia, plunging European nations into an energy and inflationary crisis. As everyone knows, inflation is a decline in the purchasing power of currencies.

In the 1970s, the economist Martin Armstrong realized that it was impossible to make reliable economic forecasts if you did not calculate yourself a certain number of data, including inflation, as each country uses its own recipes to minimize it. These different recipes evolve regularly to hide the reality more and more. According to Martin Armstrong, inflation in the United States in 2022 was actually 32% (see here). The American economy has therefore suffered greatly from the trade and monetary war with both Russia and China.

The petrodollar system, negotiated between the United States, the "Seven Sisters Cartel" and OPEC in the 1970s, required producing countries to sell oil and gas in American dollars. As a result, all energy-consuming countries had to hold large foreign exchange reserves in dollars to pay their bills. In 2018, China launched the Shanghai International Energy Exchange on which futures contracts are traded in yuan.

On Dec. 9, 2022, during the first visit by a Chinese leader to the Persian Gulf, Xi Jinping put a cat among the pigeons by pushing for oil and gas transactions to be settled in yuan rather than dollars. At the Davos forum in January, Saudi Finance Minister Mohammed Al-Jadaan said his country was now ready to trade in currencies other than the dollar or euro. We know that Russia already sells its oil and gas in yuan to China, or in gold to India.

Through the voice of its vice-president, Mahamudu Bawumia, Ghana announced on November 24 that the country would henceforth buy its oil in gold rather than in dollars.

We are witnessing the dusk of the petrodollar.

On February 14, 2022, The Cradle published an interview with Sergey Glazyev, a Russian economist and minister in charge of integration and macroeconomics for the Eurasian Economic Union. Glazyev revealed that for more than 10 years, Russia and the EAEU have been working together with China on a monetary reform project, which should soon see the light of day. This system is extremely close to Keynes' Bancor, with a basket of currencies stabilized by a basket of 20 commodities.

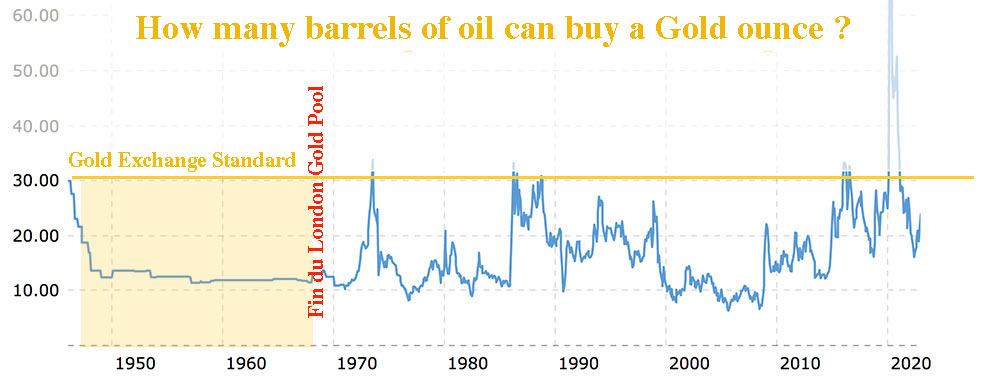

On December 27, 2022, in an interview for Vedomosti.ru, Sergyev Glazyev spoke about the development of this monetary project. After a reminder of the historical role of gold and silver as monetary standards, Glazyev stated that all commodities could be valued in grams of gold. Based on calculations by Credit Suisse's Zoltan Pozsar, he says Russia is considering valuing 2 barrels of oil at 1 gram of gold, which would automatically double the price of gold in dollars to $3,600.

Between Bretton Woods and the end of the Gold Exchange Standard in 1971, when the price of gold was fixed at $35 per ounce, the price of oil moved almost linearly. For one ounce of gold, one would get between 11.4 and 13 barrels of oil (WTI). So, one gram of gold would get 0.35 or 0.40 barrels of oil.

On December 28, Russia's largest bank, SberBank, announced that it had successfully completed its first transaction involving a gold-linked stablecoin. The transaction was conducted on the blockchain platform created by Atomyze, one of several issuers of digital financial assets (DFA) authorized by the Bank of Russia. This stablecoin is backed by a stock of gold and can be used as an exchange currency.

Russia and Iran have since interconnected their interbank messaging systems. According to Pepe Escobar the two countries would work on the creation of a stablecoin for their commercial exchanges, i.e. a digital currency guaranteed by gold, like the one recently launched by SberBank.

The discussions are multiplying behind the scenes. The dedollarization and remonetization of gold is accelerating.

In 2023, the BRICS group will define new criteria for joining the bloc and will decide on the admission of new eligible members. Saudi Arabia is a candidate to join the BRICS, but so are the United Arab Emirates, Algeria, Iran, Nigeria, Egypt, Turkey, Argentina, Indonesia and Thailand. The main oil-producing countries want to join the Union of Emerging Countries.

For Zoltan Pozsar, the G7 nations, which have dominated the monetary and financial world since Bretton Woods, have only been able to prosper thanks to cheap energy and cheap labour from emerging countries. Today, the clan of the 7 consumer countries finds itself in confrontation with the club of 5. The purely fiat currency, imposed by the United States and its G7 partners, can be manufactured in a few clicks and without any equivalent wealth creation. Countries rich in raw materials now aspire to obtain a real counterpart in their exchanges with consumer countries.

All this suggests a sharp rise in the prices of precious metals and all commodities.

In other words, the inflation has only just begun.

China is the world's largest gold producing country with 370 tons, and the third largest silver producing country with 3,400 tons. In China, the ratio of gold/silver production is therefore close to 1/9. In Russia, the mines produce only 4.3 times more silver than gold. All producing countries know that the current ratio of 1/85, imposed by the LBMA/COMEX coalition, is totally absurd. They will certainly work on readjusting this ratio, so it might be worth buying physical silver before that.

2023 will see social, monetary and financial upheaval on a scale similar to the French Revolution of 1789. Expect the expanded BRICS club to overthrow the order established by the US and the G7 .

Let's hope, however, that central bank digital currencies (CBDCs) are not assignats that will ruin people.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.