An Ode to Law School

In recent weeks, I’ve authored many reports pointing toward the certainty of both current as well as rising inflation ahead, which, of course, is favorable to the long-term price direction in gold.

That said, I also joked that the only thing certain in life is uncertainty; and yet I stuck to my inflationary certainty.

With this paradox openly confessed, one of my former law professors sent me a polite yet challenging email to make a contrary case for inflation, as he had taught me (and many others) to do as part of a 3-year legal education in seeing two sides to every fact pattern.

And so, in deference to a wise professor, as well as the humility of seeing more than one’s own certainty, let’s give deflation a fair look, as well as fair argument.

In the end, fortunately, the net result is the same for gold: Its best days are still ahead.

The Case for Deflation

Despite all the reasons discussed in preceding reports (i.e., money supply, commodity super cycles, deficit spending, and governmental credit guarantees to commercial banks) as to what we see as the current as well as future inevitability of rising inflation, there are many credible individuals, including those who strongly favor gold, who see a very different horizon.

That is, there are many who see a deflationary rather inflationary setting ahead.

The key arguments made by deflationary thinkers are not to be mocked or disregarded.

Their primary argument in favor of deflation boils down to one simple idea, namely: When economies and markets stall (or even collapse), this leads to dramatic slow-downs in consumer demand, and hence dramatic declines in consumer pricing—ie. deflation.

Needless to say, current economic conditions are anything but robust, which favors a deflationary premise.

By the turn of 2020’s in general, and during the global pandemic in particular, the world witnessed extreme levels of excess capacity (i.e. surplus rather than demand) in labor, manufacturing, retail and commercial real estate.

Banks this year, for example, are already telegraphing that in a post-COVID world, they will require 40% less office space as more and more systems have since been put in place to manage operations outside of traditional office settings.

All of these factors of excess capacity, from retail to commercial office space, one could sanely argue, point toward continued deflationary rather than inflationary forces going forward.

As to the staggering growth of the money supply unleashed by global central banks printing trillions of fiat currencies at record levels since 2008 in general, and the 2020 COVID period in particular, the deflation camp can further (and sanely) argue that such extreme money creation has not led to rising inflation, including hyper-inflation.

This, they legitimately argue, is for the simple reason that all those printed fiat currencies never enter the real economy, but remain contained within a closed-circuit loop of Treasury departments, central banks, commercial banks and Wall Street—not the real (i.e. Main Street) economy where money velocity truly can do its inflationary damage.

In short, so long as central banks act as insider-lenders of last resort to government treasury departments and overpaid CEOs, all that printed money is safely contained behind a Hoover-like dam of bank balance sheets, not the real economy where such levels of money growth would and can do their inflationary damage.

Fair enough. Good points.

In fact, these deflationary views, make logical sense, and it would be arrogant to simply discount them.

That said, there are some key mistakes, I contend, in the premises behind such logic.

In short, let me now switch hats from a deflationary defense to a deflationary prosecutor.

Holes in the Deflation Case…

First, the broader deflationary argument that all this central bank money can and will stay contained within a closed-loop circuit outside of Main Street is not factually the case.

By 2020, for example, the Fed pivoted from being a lender of last resort into a spender of last resort, making direct purchases into various credit ETF’s and even specific corporate bond issuances.

This means central bank money was beginning to leak outside of the foregoing “Hoover-dam” (cemented together by central banks, treasury departments and commercial banks) and hence directly into the real world.

Such a trend, by the way, is highly inflationary rather than deflationary.

Additionally, the deflationary camp ignores the massive (and rising) amounts of fiat currencies going directly into the real economy on the heels of unprecedented fiscal stimulus (i.e. deficit spending) as governments, most notably in the U.S., send trillions of dollars directly into the hands of consumers and businesses in the form of COVID relief checks, PPP loans and other “Care Package” policies.

Such “hand-out money” travels straight into Main Street.

Of course, trillions of dollars flowing directly into Main Street leads to an increase in the velocity of that money, which again, is an inflationary rather than deflationary force.

Finally, it is worth repeating to all deflationary thinkers that the very scale used to measure inflation in the U.S., namely the Consumer Price Index published by the creative writers at the Bureau of Labor Statistics, is an open charade.

As I’ve argued in prior reports, the real measure of CPI inflation by 2021 was closer to 9% not the creative and fictional 2% rate promulgated out of a truth-challenged (i.e. desperate) Washington DC.

Stated otherwise, inflation is not a debate; it’s already here.

In short, the deflation and inflation arguments, as well as debate, will continue to rage, and although I see a distinctly inflationary future, I am not blind to deflationary forces or those who foresee more of the same.

Does Gold Really Care About the Inflation/Deflation Debate?

As importantly, and perhaps most dramatically, we have to also raise an additional, and perhaps even blasphemous question when it comes to gold pricing, namely: Does gold even care about this inflation/deflation debate?

That is, it’s worth underscoring here that gold price movements in general, and the role of gold as counterforce to increased currency debasement in particular, is and can be relatively agnostic to whether the world turns inflationary or deflationary in the near or long term.

Yes, of course, inflation still matters, in so far is that gold prices rise highest when the rate of inflation exceeds the nominal yields on 10-Year government bonds.

Such negative real yields, as I argued in a separate report, are absolutely ideal settings for gold pricing.

But keep in mind, all that is required for such an ideal gold setting is not that inflation shoots to the moon (i.e. hyperinflation), but simply that inflation rates be higher than nominal yields/rates, which is a future I see as both inevitable and consistent—and hence a major tailwind for gold over the long term.

Are Rising Rates Really a Threat to Gold?

Despite hysterical fears of rising rates, which are a clear headwind to gold pricing, most realists have little to no doubts that in the near term, governments will continue to create liquidity to purchase bonds and hence keep nominal yields compressed.

This is because global government debt levels are at such record highs that their central banks will have no choice, at least near term, but to do “whatever it takes” to artificially keep the cost of that debt (i.e. rates and yields) down so that global governments, including in the U.S., do not become insolvent in a world of naturally rising rates.

And as for nominal rates, people may be scurrying, screaming and worrying about so-called “spiking” yields, but folks, 1.6% or even 2% yields on the U.S. 10-Year is hardly nosebleed territory (and still negative when adjusted for even mis-reported inflation).

Thus, compared to more normal eras, yields in this broken “new normal” are remarkably low, and for all the Realpolitik reasons discussed above, won’t be going much higher any time soon.

Given such historically low nominal rates, most informed investors see very little upside in bonds, and as such continue to buy silver and gold.

In fact, nominal yields would have to climb to at least 3% for gold investors to exit the precious metals space in large numbers, and we don’t expect nominal yields to reach such levels, again, because governments like the U.S. (or corporations on the S&P) could not afford such sustained rates.

In short, don’t fight a desperate Fed.

Furthermore, even if the central banks implode tomorrow under the weight of their own grotesque debt and mismanagement, and yields and rates were to shoot to the moon, so too would inflation, and hence so too would gold prices.

Either way: Gold wins.

In the meantime, most of us also know that the Fed serves Wall Street not Main Street. Always has; always will.

Needless to say, the current (and dangerous) stock market bubble is about the only thing the U.S. can brag about, and more low rates are the rotten wind beneath the wings of this rotten market, which the Fed will still fight to support, Main Street be damned.

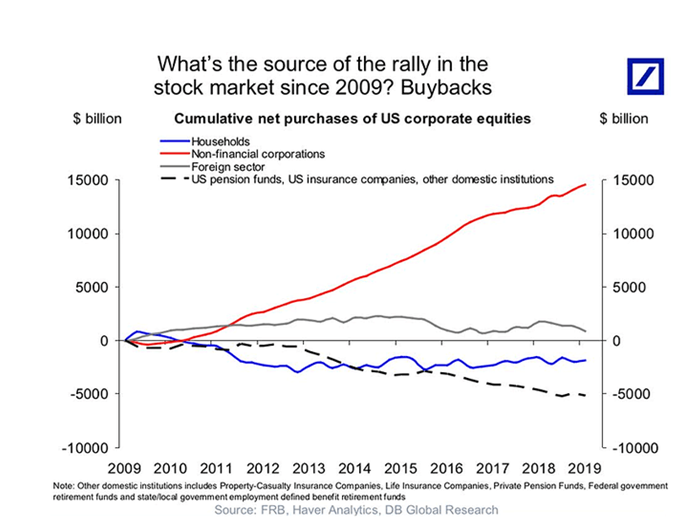

Don’t forget as well that CEOs within this rotten and rigged-system get paid based upon share price, not profits and earnings.

More artificial low rates, compliments of their Rich Uncle Fed, will thus help the spoiled nephews on the S&P continue to borrow cheap and buy back their own shares to make their otherwise zombie-like stocks rise on debt rather than free cash flow.

In case you think I’m just a cynic, see for yourselves:

Gold’s Real Tailwind: Direct Consumer Demand

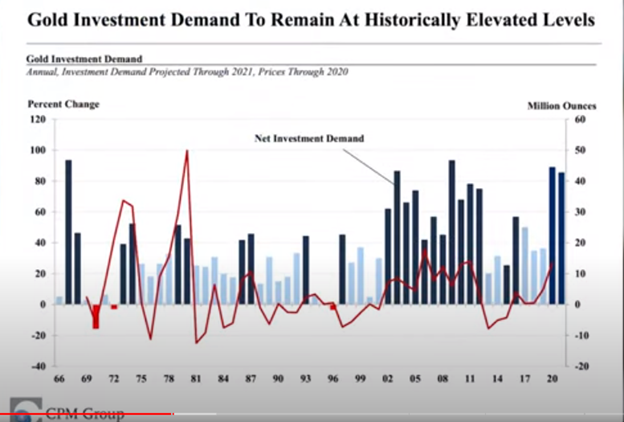

Furthermore, and with specific reference to gold pricing, the real driver for its price has been, and always will be, direct consumer demand.

Such demand is in fact driven by variables that go well beyond interest rates and inflation/deflation debates.

In fact, such demand is driven far more by emotion than math or lofty market reports like this.

More specifically, demand for gold rises when faith in political & social stability, economic policies and currency value falls further and further toward the basement of time.

And as we’ve all discovered over many years and many objective market reports, faith in each of these critical areas has sunk, and will continue to sink, toward further lows, as all debt-saturated systems do.

Such declining faith in the total mismanagement of the global financial system helps to explain why gold (despite all the maniacal enthusiasm for BTC and fears of rising rates or even muted inflation) continues to attract consumer demand.

In short, and despite all the complex technical, mathematical and academic discourse regarding inflationary and deflationary forces, faith in the financial system, or rather a growing lack of faith in it, will always be among the strongest forces behind gold demand.

Needless to say, our faith at MAM in the global financial system has been openly weak for decades, which is why we created our unique precious metals service in Switzerland years before this ever-growing storm in the monetary, commercial banking and currency systems began to make headlines.

Nor were we alone in this growing lack of faith, including our open lack of faith in paper currencies and the paper traded (in the futures markets) to mis-price the paper price of gold, which has nothing to do with actual demand for physical gold and hence physical gold pricing when measured against ever-debased currencies.

Strangely, this critical faith indicator, and the fact that the global financial system is so openly broken (from Elon’s Tweets to Powell’s double-speak, or from COMEX price fixing to the CPI lie) serves as a primary reason behind our confidence that gold will reach far higher highs in the years ahead.

Stated even more simply, as awareness of the growing mismanagement of the global banking, financial, economic and currency system increases, faith in the same decreases.

And from this lack of faith, our conviction in the golden days ahead for gold only rises with each passing day.

Original source: Goldswitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.