Fire Alert

This chart shows how the euro is about to fall against the dollar.

Will Deutsche Bank create a systemic crash next week?

If it is not DB that is going to launch a panic on the markets, will it be Italy exiting the Eurozone?

Could an escalation of war in the Middle East generate a tremor on Wall Street?

A major event is due in the days to come

Whatever the nature of this event, it will occur during the week starting Monday 19th November.

It will drive the rise of the dollar in a panic mode.

This violent move on the FOREX should generate a crash on every stock exchange of the planet.

Even if it seems impossible today to see gold under $1200 or silver under $14, this crash will enforce all traders to search for cash to answer at their margin calls. They will have to sell even their most solid assets, as it has been the case during 2008. Precious metals will go down and reach their bottom, as it has been announced here in September.

Stock markets grew with the help of very low yields for years. Cheap credit allowed companies to buy back their stocks and speculators to bet with leverage. This system can work as long as the Federal Reserve feeds the machine with new freshly printed money. As soon as the Fed stopped its QE and started tapering, the engine stopped. As a tanker that keeps going for a while on its momentum, Wall Street went on for a few months trying to rallye, but the tanker is due to stop. The bubble is about to burst.

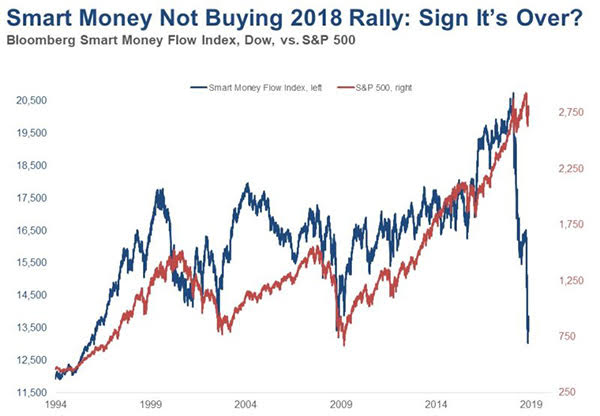

Bloomberg published that chart showing that "smart money", ie the insiders, sold their assets early last December and in January 2018, and secured their capital elsewhere since.

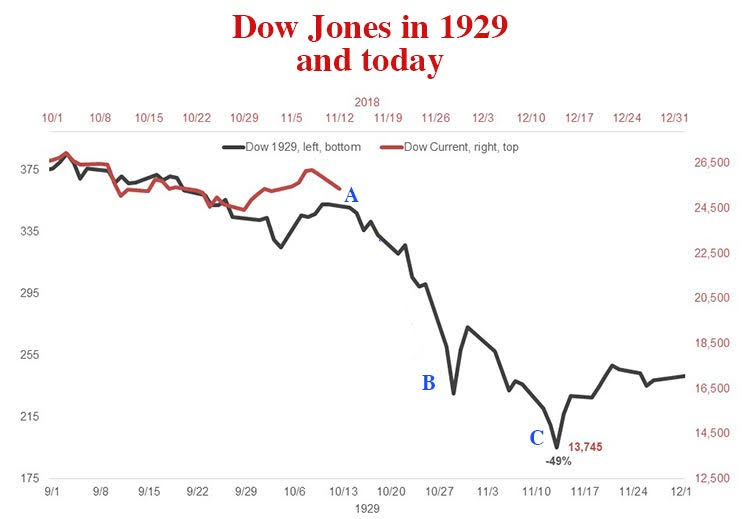

Harry Dent thinks that the coming crash could be similar as 1929. This economist thinks that a 49% decrease of the Dow Jones is possible.

It took only two weeks in 1929 to fall from A to B and two more weeks to reach C.

If the DJIA follows the 1929 chart, Christmas could be very sad for most of the shareholders.

On the 3rd of October 2018, crude oil was at $77. On the 13th of November, the WTI’s price had fallen to $55: -44% in seven weeks.

The price of oil is essential for the balance of the petrodollar system, implemented by the US oligarchy during the seventies. The deal with OPEC implied a sharp rise in the price paid to oil producers, whereby part of the difference had to be invested in US Treasury Bills, which insured the dollar some stability, as long as oil was exclusively traded in USD.

A big half of the price of crude oil is the fruit of the speculation set up by the dominant banks to maintain the whole system based on debts. If the price of a barrel collapses, it is like removing the base stone of an inverted pyramid.

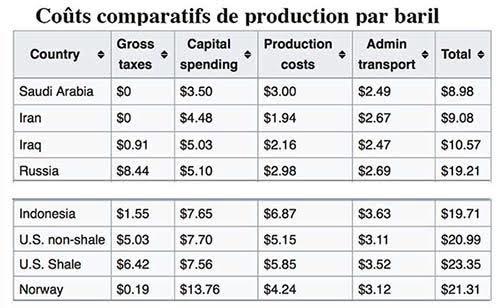

Underneath, you have the real production costs of a barrel of oil. They are very far from current prices.

Last month, the Global Anticipation bulletin GEAB wrote about the different scenarios for oil prices, especially after the exit of the United States from the Iran agreement. All scenarios led to a drop in oil prices except for one. This last possibility only led to a rise in oil if the financial oligarchy triggered a war, to artificially trigger a rise in prices.

Will they play this last card?

The imminent rise of silver

You and me, we are just interested in the rise of silver.

It has been demonstrated here and there and here again, that there has been a systematic collection of silver-metal for 10 years, with a very strong acceleration in the last two years. Some very strong hands have both encouraged the downward speculation of paper-silver, while picking up physical silver, which, as everyone knows, is a rare metal.

The example, which comes to mind immediately, is the bank JPM, which role as manipulator of the silver market has been vilified on forums and blogs. Its multiple roles as custodian of the silver stocks of SLV, Comex and LBMA, and its overwhelming dominance in the short saling of silver-paper, allowed JPM to build up a huge physical silver stack.

It is possible, if not likely, that the short-selling of silver on COMEX and LBMA are forward sales of silver reserves still in the ground of a few different mines. These over-the-counter (OTC) sales are not recorded as they should to the market authorities. Given the current open interest of silver on COMEX (1,223Moz), which exceeds one year of mining production (850 Moz) and the 2,500 Moz of EFP (exchange for physical) issued by COMEX the last 11 months, which represents three years of mine production... without even mentioning what is happening in the opacity of LBMA's exchanges, underground silver reserves could only justify these aberrant ratios between real existing physical silver and synthetic paper-silver sold on the markets.

If this analysis is correct, these forward sales of metal still in the ground by the mining companies make that the titles of mines are completely empty shells. These companies will in no way benefit from the rise in metals prices, as they sold their reserves at a very low price in recent years. These companies' stocks should collapse on the market and never recover, when the facts will be revealed.

Here again, JPM has been among the first banks to develop gold and silver mine production hedging in the 1990s. The bank continues to encourage this practice (see here), while serving as a rating agency for mining companies (read this article). There is a major anomaly in the system, like an elephant in a corridor, and yet, despite the successive investigations of the market authorities on the role of JPM, the bank has left systematically bleached.

That seems to be the raison d’État.

At the end, JPM allowed you to buy your silver at a very cheap price, so you should thank the banksters you used to hate, in the weeks to come.

The corner of silver

During the next two weeks, as the stock market bubbles will be bursting loudly, speculators at bay will be forced to sell the physical gold and silver they had hoarded, waiting for a upside reversal of precious metals. In a few days, the prices of gold and silver will reach their bottom. Gold could drop to $1000 and silver around $12, the goal designated in May by the exit of the trading triangle.

"No Bid"

When all the "weak hands" have sold their physical silver, no one else will want to sell any ounce of silver.

In this case, auctions will rise and this rise could be extremely brutal. COMEX Rule 589, published in december 2014, provided for this scenario. If the bidding on the silver goes up by $3, without anyone agreeing to sell at this price, the market pauses for two minutes, then the auction resumes. In 10 or 12 minutes, the price can go up to $12. As the daily increase limit is reached, the market will be closed until the following day, without any fixing. Without fixing, no one will be able to buy or sell physical silver. The next day, the same scenario will be in play, the auction will resume with the initial price + $12 of the day before and if no one wants to sell, the price will rise again by $12.

12+12+12...

I expect that the bottom of silver will be reached in the last days of November and that the rule 589 should be applied in the first trading days of December, for a vertiginous rise, as no one dares to evoke aloud. At what level will this rise stop? No one can say it. But the end of the year will certainly be memorable for those who have accumulated physical silver, hoping that one day it will become a precious metal, even a monetary one.

Of course, the gold price will also rise, but silver' will be the most impressive. The gold/silver ratio that is today of 1/85, will fall like a stone.

It is therefore much more interesting to have silver today than gold.

Towards the monetary reform

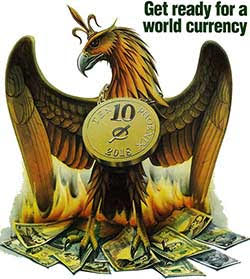

In 1988, The Economist announced a major monetary change to come "in about thirty years"? The author had stated in the body of the article, "around 2018, when the phoenix rises, welcome it." To drive the nail in, on the cover, the gold coin around the neck of the phoenix was vintage 2018.

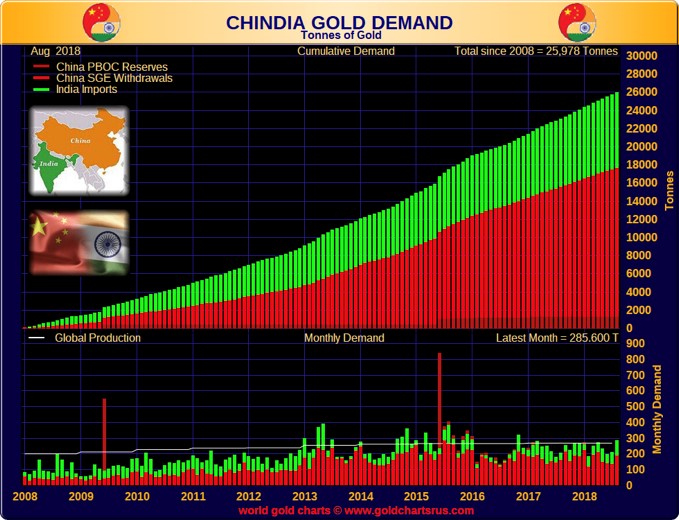

We are nearing the end of 2018 and we have seen that gold and silver have been conscientiously raked by very big hands including China, for 9 or 10 years. All central banks, which were net sellers of gold until March 2009, have become net buyers since then. Germany, Austria and the Netherlands repatriated their monetary gold reserves. Hungary just increased its gold reserves tenfold, last month. China and India have been importing gigantic amounts of gold for 10 years.

During the 2008 systemic crash, the Washington G20 was called the "New Bretton Woods". In March 2009, China formally requested a reform of the international monetary system and defined the system that was desired. They suggested setting up the BANCOR that Keynes had proposed during Bretton Woods, that is to say a basket of national currencies, which would be guaranteed by a reserve of real assets in the form of commodities. Even if this has not been explicitly written, at the head of these commodities are inevitably found, the two universal monetary stallions since 6000 years, ie gold and silver.

In order for gold and silver to guarantee international trades, even 20% or 25% of it, the price of the ounces must be valued at a whole new level.

It will not be done in a few days. Nevertheless, it is reasonable to assume that the composition of the SDR basket will be extremely different when it will be announced by the IMF in October 2020.

The first act of this very exciting saga will probably begin next week with the collapse of the stock markets, but look forward with hope to the next events.

And according to the advice given in 1988 by The Economist, welcome the phoenix, which will rise from the ashes of Wall Street in the coming weeks.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.