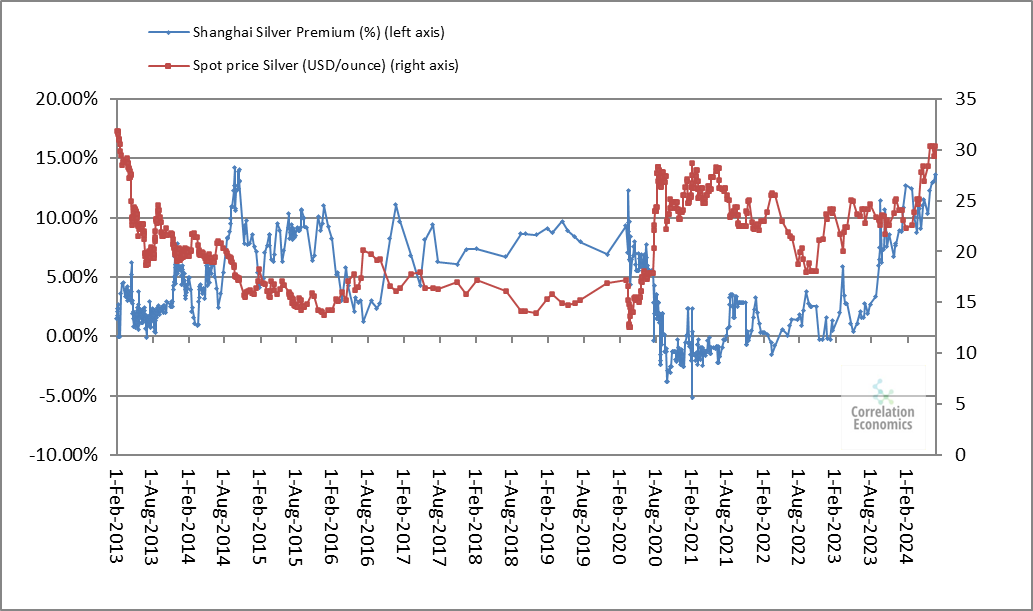

In China, silver premiums continue to reach historically high levels:

An ounce of silver now trades at a premium of around 15%.

This pricing divergence between the Chinese and London markets has enabled silver to avoid sharp corrections over the past two years.

What's more, the premiums on gold between these same markets have been the main cause of the surge in gold prices over the past year:

In June, requests for delivery of physical silver on the Shanghai Stock Exchange rose sharply, up 46.5% year-on-year to 337 tons. The unexpected last-minute addition of more than 300 tons to Chinese silver stocks averted a potential shortage of reserves, but the tension remains palpable.

In this rush for physical silver, there was no significant addition of shorts. On the contrary, Open Interest in the silver futures market has actually fallen significantly.

Silver is the hottest metal of the summer!

Silver's good form is having a direct impact on the mining industry, which is racking up record after record.

Mining companies have been "plugged in" to silver prices since 2011:

For the past thirteen years, the charts of the GDX index and silver metal have been juxtaposed. This remarkable chart configuration is the result of the predominance of trading algorithms and passive funds in this sector since 2011.

What does a gold mine have to do with the price of silver? On the surface, none, but since 2011, the prices of the two assets have been interconnected, with one influencing the other. This is the dynamic of a market largely influenced by passive funds. What's good for silver is good for mining, and vice versa.

It's also a sign of disinterest in the sector: when algorithms dictate the rules and ETFs are the main shareholders of mining companies, it reflects a lack of demand for thematic funds. The awakening of investors could eventually change all that...

The rise of silver is therefore excellent news for mining companies!

Not only has the March rebound been confirmed, but it even seems that some mining stocks are beginning to break through their downward supports, which have been in place for over ten years. Breaking such long-standing resistance has the potential to propel several stocks higher.

It's true that, with precious metal prices so high, the cash flows generated by these mining companies are likely to break records this quarter.

Especially as oil prices have remained well below last year's levels. In fact, oil has fallen while gold has risen, a situation which is obviously very favourable for mining companies.

The sector as a whole is at a turning point. The leading mining index, the GDX, is about to break through the bearish resistance it has held since 2011:

Will the good quarterly results, expected to rise sharply, trigger the breakout movement that gold bugs have been waiting for for over thirteen years?

Will these results finally propel the mining sector into a new upward cycle?

In any case, the first figures published confirm the sector's good health.

China's Zijin Mining is forecasting a 50% increase in first-half net profit, to 15.5 billion yuan (2.13 billion USD), thanks to increased precious metals production and high world market prices.

The Chinese company is unlikely to be alone in announcing spectacular results this quarter.

Goldman reports a change in hedge fund behavior towards the sector. Hedge funds increased their purchases of commodity-related equities, particularly in the energy and materials sectors, despite the decline in the shares of major energy companies. Global equities recorded net buying for the first time in three weeks, mainly in Europe and Asia, while Chinese equities sold off for the fourth week running. Buying mining stocks in a declining Chinese market is remarkable.

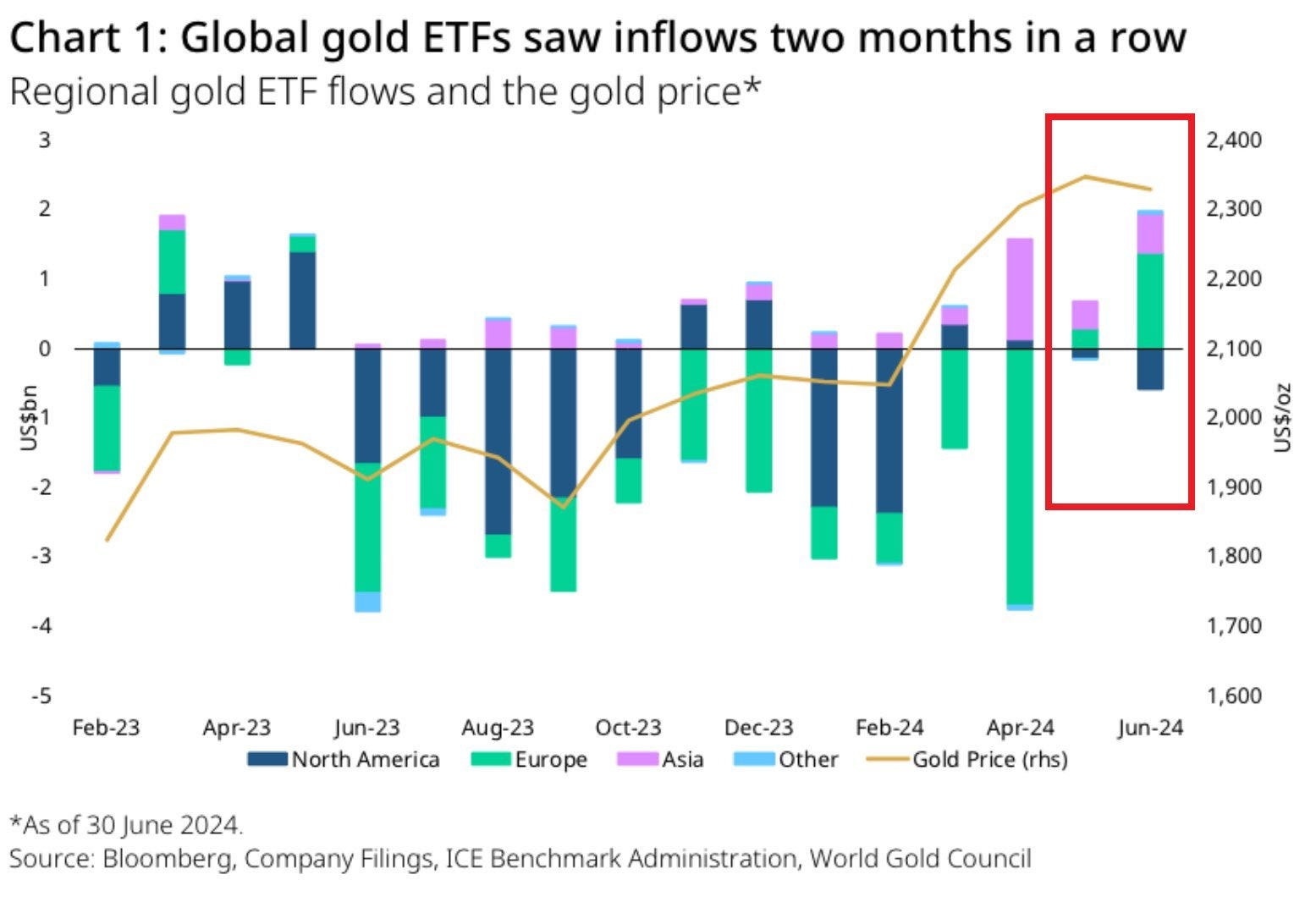

There has also been a shift in ETF investment behavior, with a notable pick-up in inflows over the past two months, mainly in Europe:

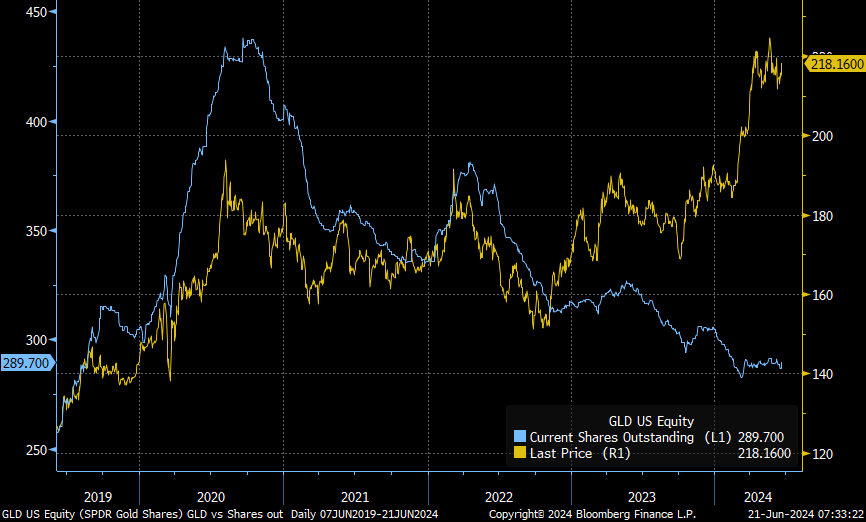

ETF GLD outstandings seems to have stabilized after falling steadily over the past four years. With this renewed interest in Europe, it's very likely that we'll also see a revival in American ETF investment over the next few quarters:

Gold will probably continue to rise until ETF outstandings reach their highest levels, which is still a long way off.

Especially as demand for physical gold remains very strong.

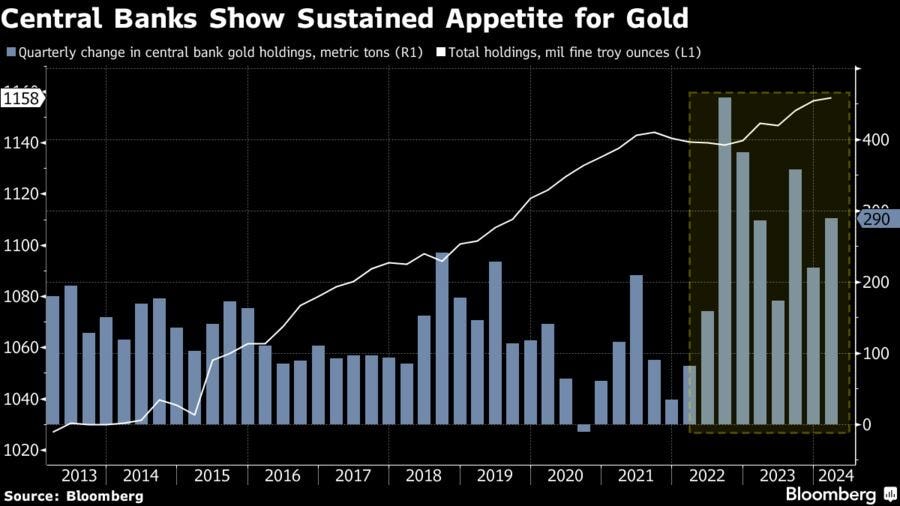

Despite the high price of an ounce of gold, central banks continue to buy precious metals on a massive scale:

China announced that it had stopped buying gold for the second month running.

As reported over the weekend, the People's Bank of China kept its #gold reserves at 2,264 tonnes in June - the second consecutive month it remained unchanged. Gold still accounts for over 5% of total reserves. pic.twitter.com/g6kQi6rnYX

— Krishan Gopaul (@KrishanGopaul) July 8, 2024

In contrast, the Reserve Bank of India (RBI) increased its gold reserves by more than nine tons in June, bringing the total to 841 tons this year, according to the World Gold Council. This is the biggest increase since July 2022.

Calculations using weekly data published by the Reserve Bank of India suggest that it added over 9 tonnes of #gold to its reserves in June. This is the highest monthly purchases since July 2022. YTD net buying now totals over 37 tonnes, lifting total gold holdings to 841 tonnes. pic.twitter.com/wB3h17Umyk

— Krishan Gopaul (@KrishanGopaul) July 5, 2024

Gold purchases by central banks have contributed to the rise in the metal's price this year. A WGC survey reveals that many central banks are planning to buy gold because of increased geopolitical and financial risks. India, along with China and Turkey, is among the main buyers.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.