Silver is poor man’s gold. What is then platinum with respect to gold? In a recent article (The Gold/Silver Ratio - Gold, Silver, and their Relationship) I looked at the relationship between gold and silver, the eternal couple. Let us look now at the relationship, if there is one, between gold and platinum. Is platinum “white gold”, or “little silver” as the Spaniards call it, or is platinum different from gold and silver. Gold and silver but also copper have been for thousands of years monetary metals; not chosen by decree but by experiment through trial and error. They were also found together in the Earth’s crust as Electrum (a naturally occurring alloy of gold and silver, with trace amounts of copper) taking different colors going from red to white depending on the concentration of each metal. Its name derives from the Spanish word platina, which is literally translated into "little silver". Being a heavy metal, it leads to health issues upon exposure to its salts, but due to its corrosion resistance, it is not as toxic as other metals. As a pure metal, platinum is silver-white in color, lustrous, ductile, and malleable but has an extremely high melting point (1,768-Celsius vs 1064-Celsius for gold and 962-Cesius for silver). Platinum is more ductile than gold, silver and copper, thus is the most ductile of pure metals, but gold is still more malleable than platinum. Platinum is obtained commercially as a by-product from nickel and copper mining and processing.

Platinum is a much more recent discovery contrary to gold and silver whose history goes beyond 5000 years. Pre-Columbian Americans near modern-day Esmeraldas, Ecuador used the metal to produce artifacts of a white gold-platinum alloy. The first European reference to platinum appears in 1557 in the writings of the Italian humanist Julius Caesar Scaliger as a description of an unknown noble metal found between Darién and Mexico, "which no fire nor any Spanish artifice has yet been able to liquefy". In 1741, Charles Wood, a British metallurgist, found various samples of Colombian platinum in Jamaica, which he sent to William Brownrigg for further investigation. In 1750, after studying the platinum sent to him by Wood, Brownrigg presented a detailed account of the metal to the Royal Society, mentioning that he had seen no mention of it in any previous accounts of known minerals. (1)

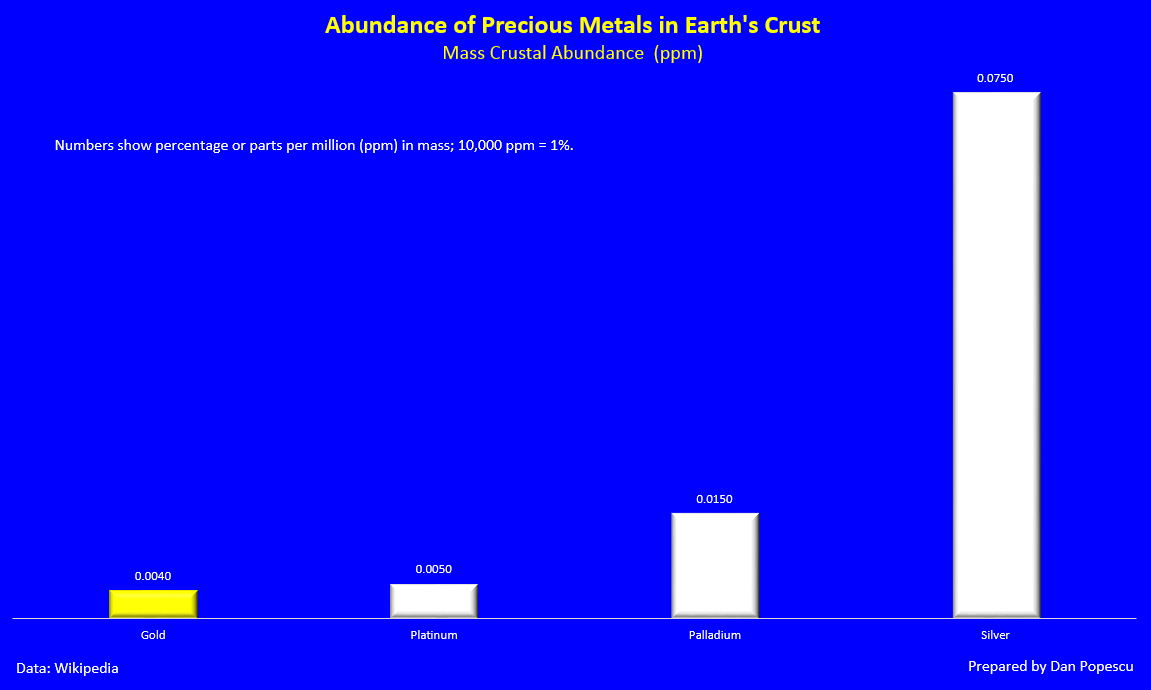

Even though platinum is 1.67 times more abundant than gold on the Earth’s crust the miming supply of platinum to the market is 15.5 times less than that of gold. This shows that it is much harder to extract platinum than gold.

Chart #1: Abundance of Precious Metals in Earth’s Crust

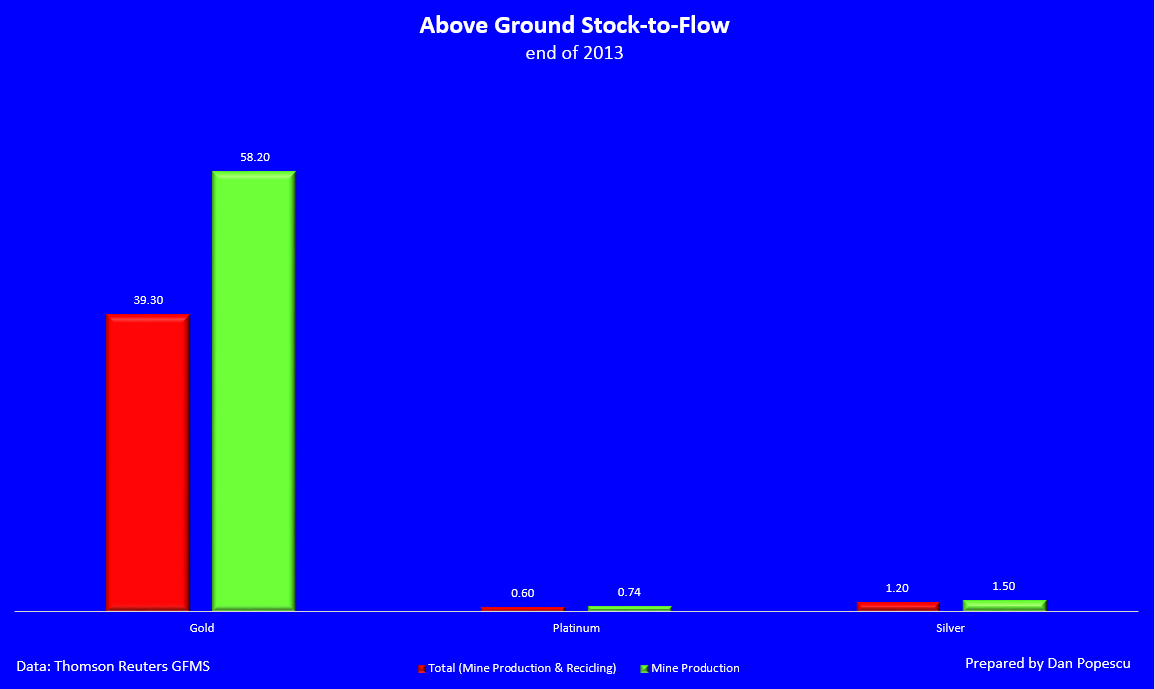

If we compare the Stock-to-Flow of platinum to that of gold, we clearly see that there is close to 60 years of aboveground gold stock while at the same time there is only 9 months of aboveground platinum stock. This shows that the mining supply of platinum has approximately 60 times more impact on price than it does for gold while the aboveground stock of gold has a lot more impact on price. Not only there is a lot more gold than platinum stock but also the gold market is very liquid and gold can be brought to market on short notice and at very low cost.

Chart #2: Above Ground Stock-to-Flow

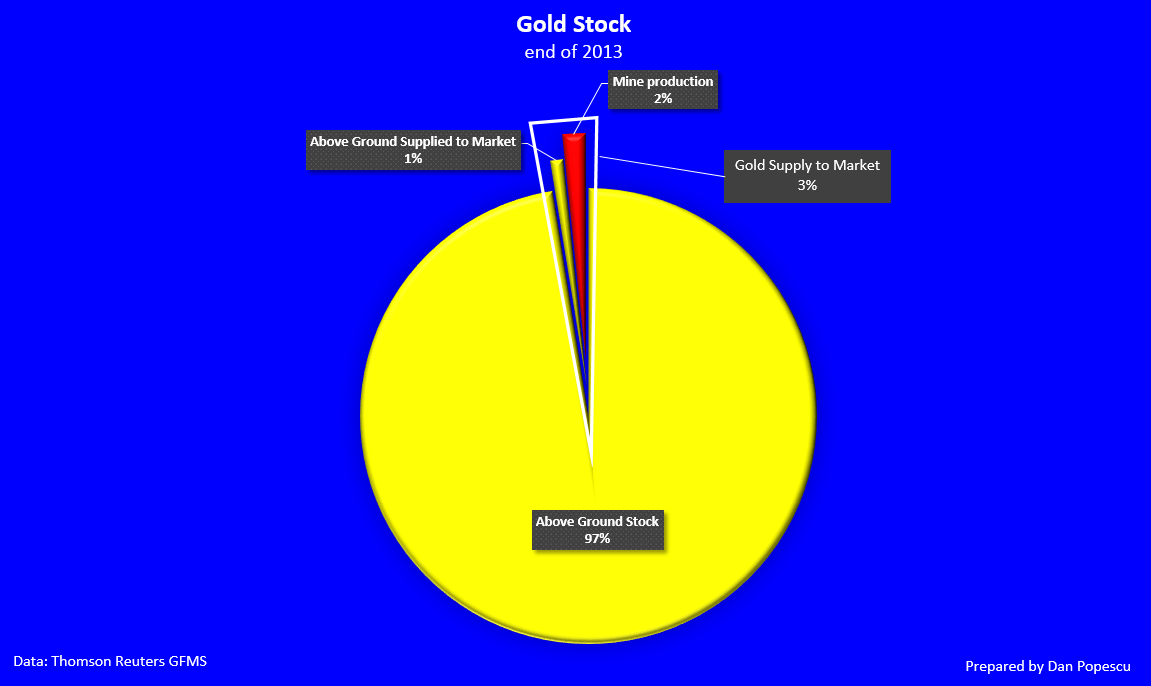

Chart #3: Gold Stock

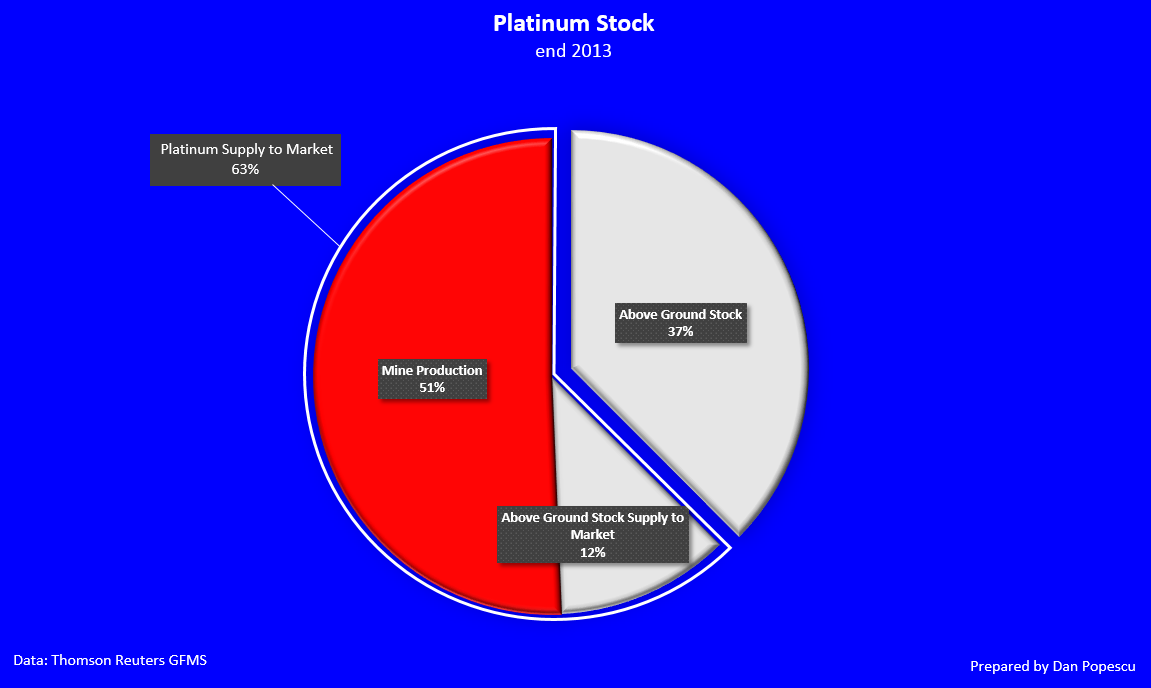

Chart #4: Platinum Stock

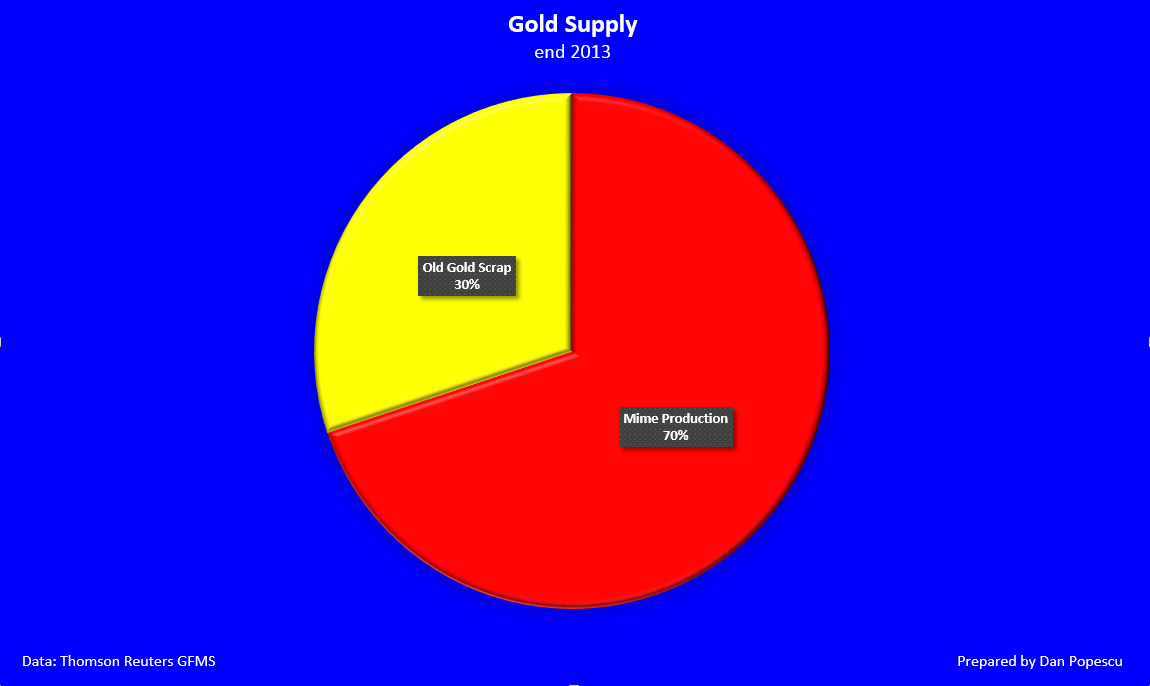

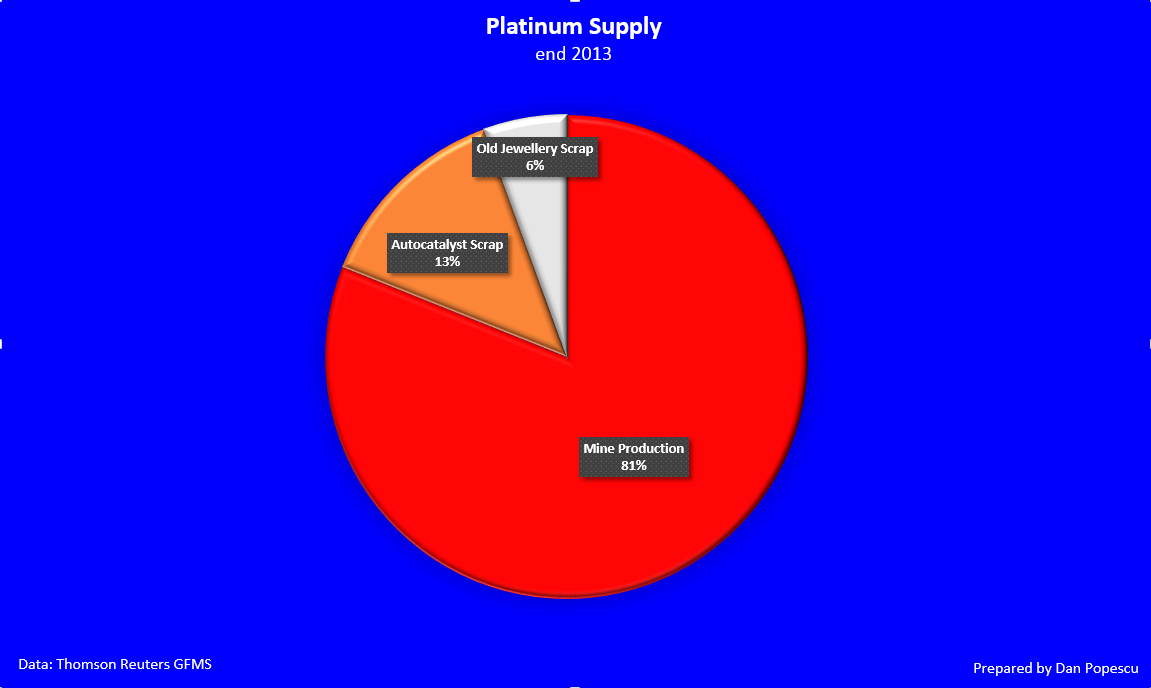

Gold mine production represents 70% of total supply but with a very large above stock supply versus 81% for platinum with almost no aboveground stock. In 2013, 84.79% of all platinum supplies came from South Africa and Russia (71.91% South Africa, 12.88% Russia, Zimbabwe 6.88%). As for gold, the largest producer in 2013 was China with only 14.50% followed by Australia and Russia with 8.80% and 8.23% respectively.

Chart #5: Gold Supply

Chart #6: Platinum Supply

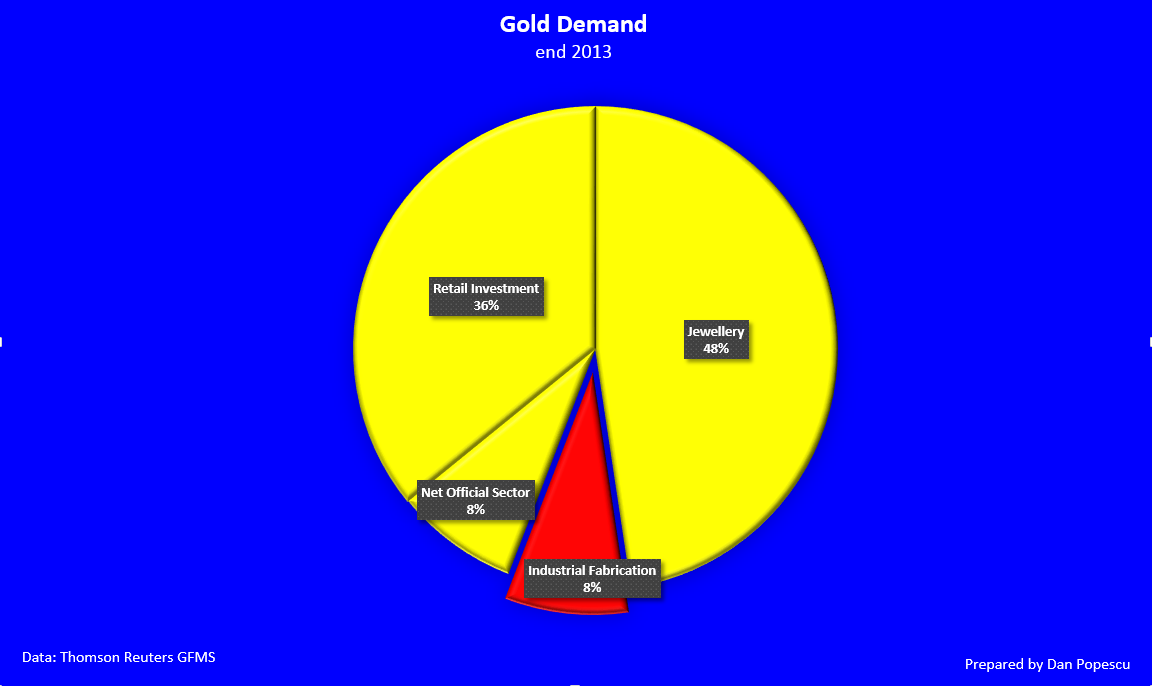

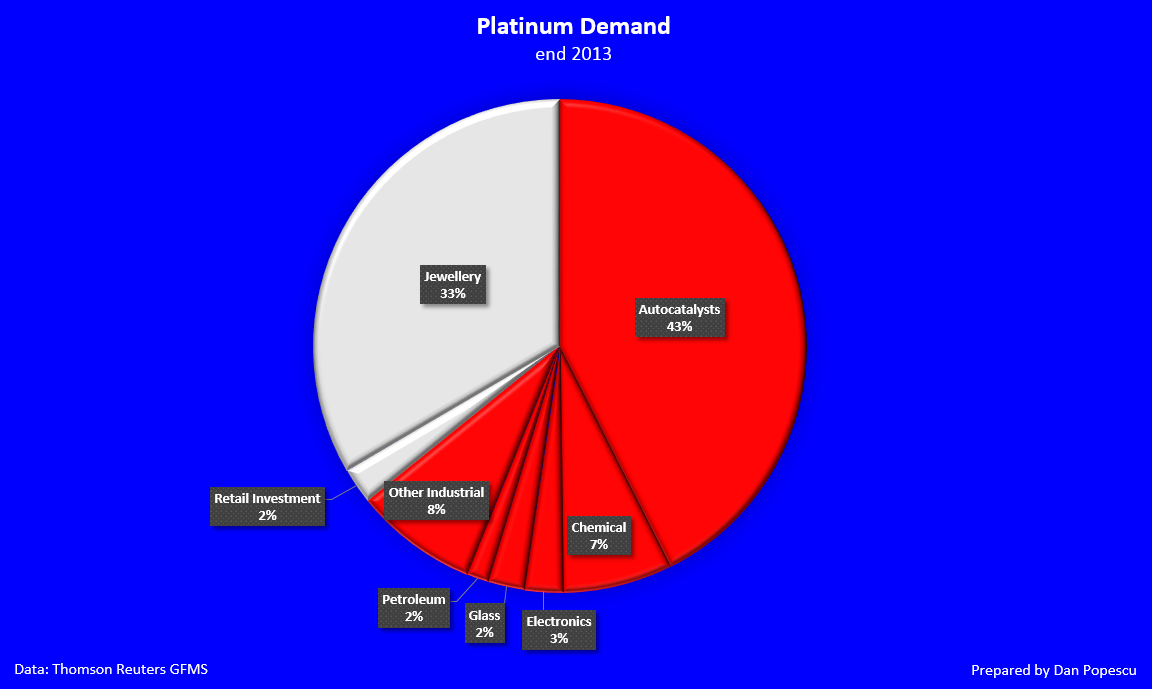

If we look now at the demand of gold and platinum we can again see major differences. 92% of the total demand for gold is investment and jewelry. I always had a problem in differentiating investment and jewelry demand when it comes to gold. In the Middle East, India and China, high carat gold (over 20 carats) is mostly for investment purposes or better said wealth preservation even if it is in jewelry form. Gold is well-preserved and taken care with the intention of returning it to market one day. Industrial demand is on the other hand wasted or very hard and costly to recover and recycle. As for platinum, we can see that only 35% represents investment and jewelry demand while 65% is industrial and therefore wasted. Only 19% (6% jewelry and 13% auto catalyst scrap) returns to market.

Chart #7: Gold Demand

Chart #8: Platinum Demand

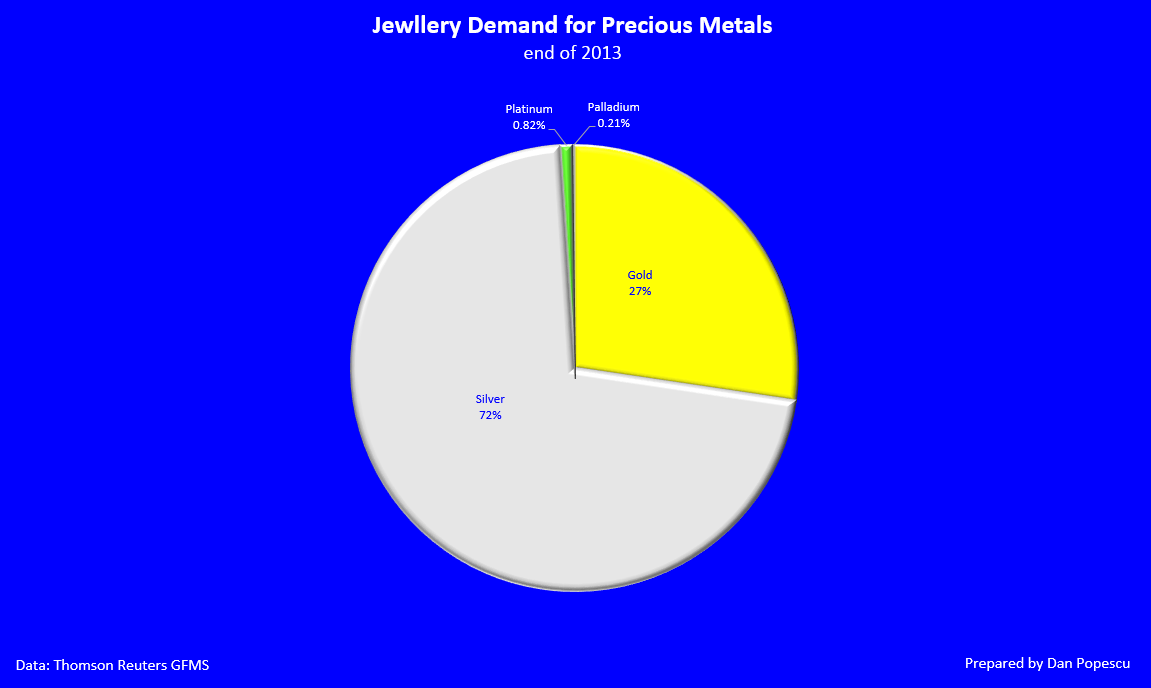

Jewelry, which is a disguised form of store of value still, has not adopted platinum. As we can see in chart #9, the jewelry industry is dominated by silver with 72% of the demand and gold with 27%. Platinum and palladium together represent only 1% (0.82% for platinum and 0.21 for palladium).

Chart #9: Jewelry Demand for Precious Metals

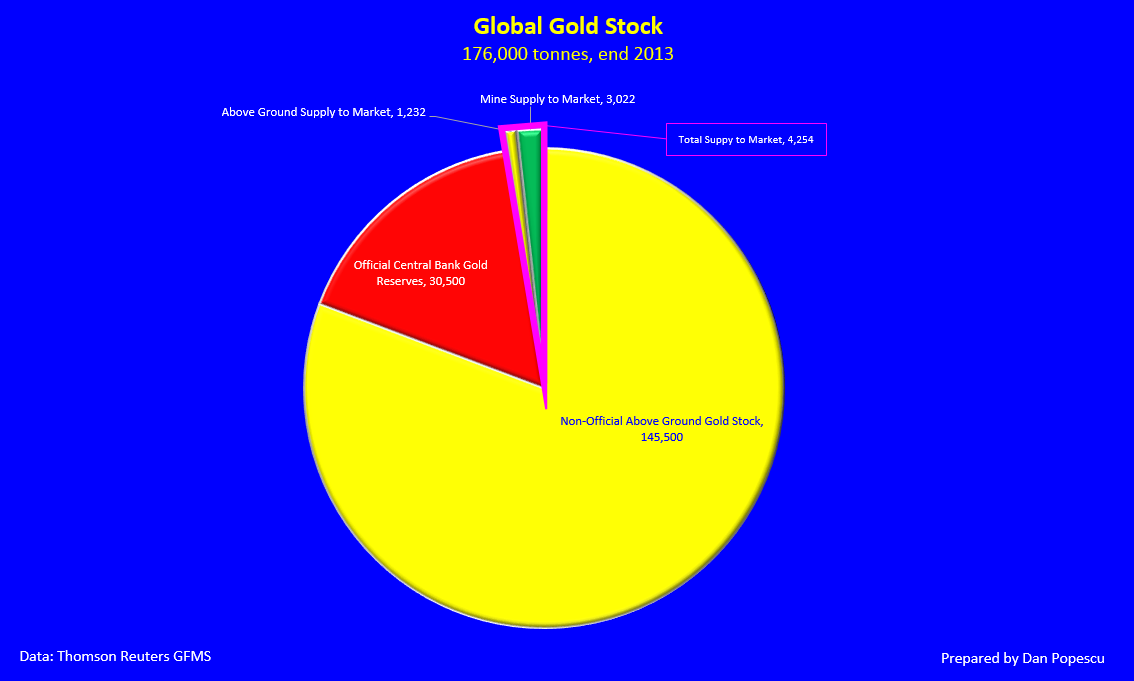

In addition, we must not ignore the official demand and supply. In the case of gold, central banks hold more than 30,000 tonnes of gold, 17% of the global gold stock, while at the same time they own no platinum. Gold is still a monetary metal while platinum is not and has never been. Silver on the other hand has been a monetary metal and as poor man’s gold it is strongly influenced by monetary issues through its close relation to gold. However, even if platinum has never been a monetary metal, we should not exclude the possibility of platinum playing a role in a future collapse of the present dollar based monetary system. We have seen very recently in India that, when the government banned the importation of gold, a sharp increase in the demand for silver and platinum occurred. Platinum is a precious metal and under the right conditions it can be an alternative to gold. Platinum also requires less space to store than silver for approximately the same price as gold.

Chart #10: Global Gold Stock

Autocatalysis represents a very large part of the demand for platinum at 43%. There are justifiable fears that any alternative to platinum in the fabrication of autocatalysis will collapse the price as it happened with silver’s loss of the photography industry. Some in the financial industry even predicted silver’s price would go to zero. I still hear regularly on financial networks economists saying that gold is useless. If those economists had spent just a few months in a chemistry and physics class, they would have learned of the exceptional physical properties of precious metals. If gold, silver and platinum ever get close to the price of copper, their industrial demand will explode. It is their price that makes them little used in industry not their lack of usefulness. We have seen what happened with silver when photography stopped using silver. It did not take long for other applications to compensate the loss from photography. Recently I read an article on a MIT research (2) to develop an alternative to platinum for autocatalysis. This threat is real and if it happens in the short term will influence and maybe even collapse the price of platinum as it did for silver.

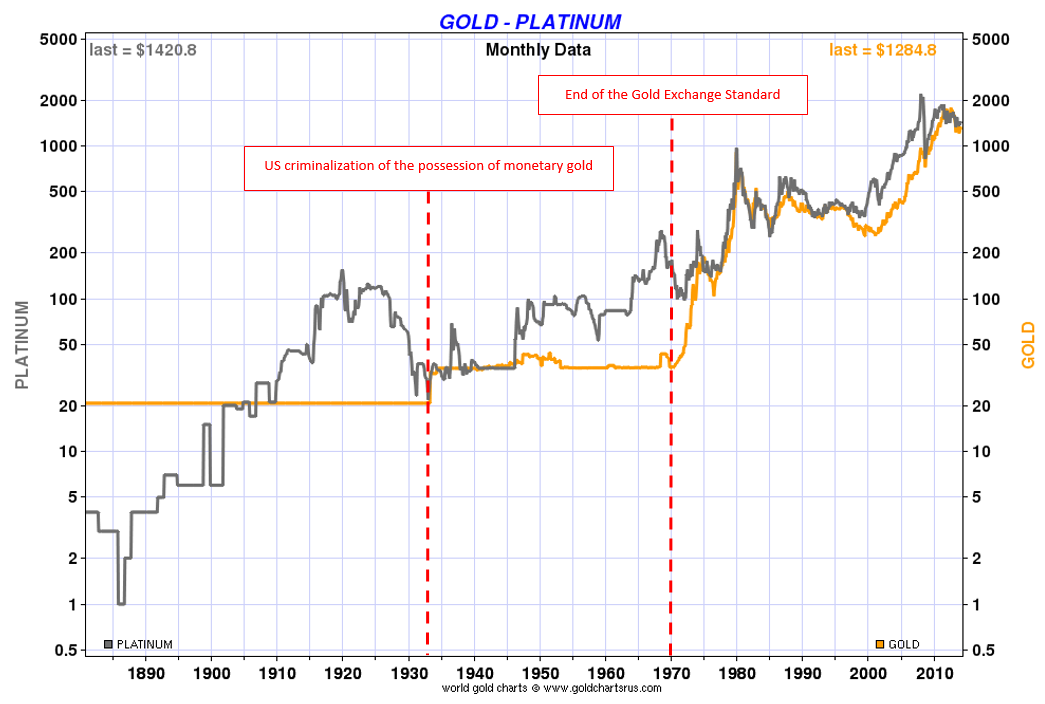

Let us look now at the price performance of platinum versus gold. We have to remember that the price of gold has been fixed in some form or another until 1971 while at the same time the price of platinum was determined by the market. We can see both on the arithmetic chart and the logarithmic chart that platinum moved up more gradually adjusting to inflation while gold exploded once the fixing was abandoned catching up with platinum. The logarithmic chart shows clearly the different evolutions of gold and platinum prices.

In chart #11 we can observe that since 1970, both gold and silver were strongly correlated but with platinum a lot more volatile. Platinum outperformed gold on the way up in 2008 but also crashed a lot more during the financial crisis.

Chart #11: Gold vs Platinum Price Since 1880 - arithmetic

Chart #12: Gold vs Platinum Price Since 1880 - logarithmic

Chart #13: Gold vs Platinum Price Since 1970

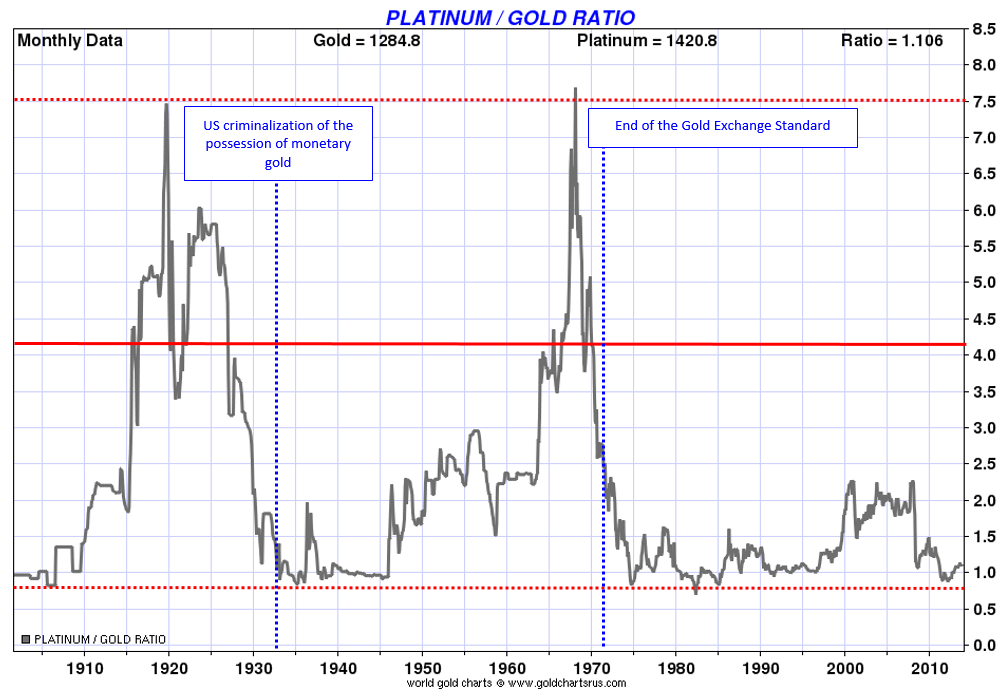

Since gold is money and platinum is a commodity, let us look at platinum’s price measured not in fiat currency but in hard cash, gold (graphs # 14 & 15). We can see now, without the illusion of inflation, the major cycles of industrial demand for platinum. As Roy Jastram said in his book, The Gold Constant, it is not gold that moves toward commodity prices but rather commodity prices that return to gold.

Chart #14: Platinum Priced in Gold Since 1900

Chart #15: Platinum Priced in Gold Since 1970

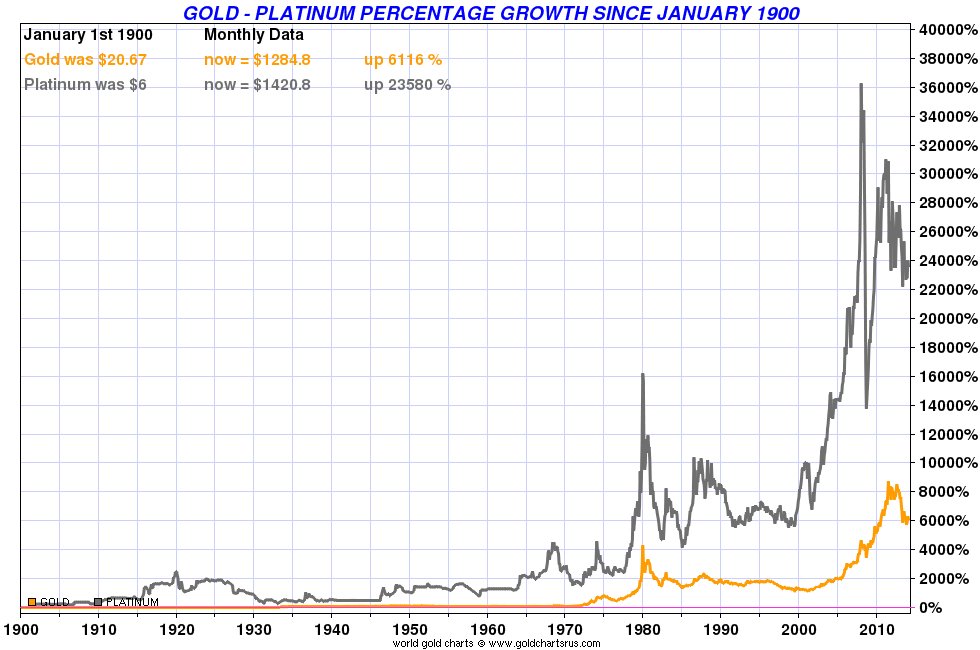

In chart #16 we can see that since 1880 platinum has increased in price by 23,580% while gold only by 6,116%.

Chart #16: Gold vs Platinum Percentage Growth Since 1900

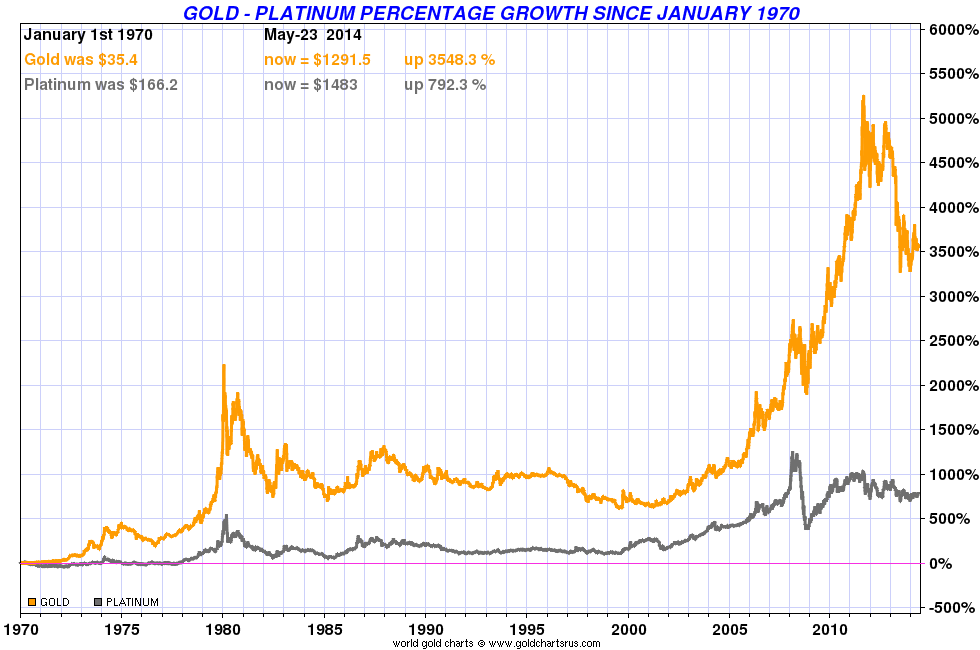

However, since 1970 platinum has underperformed gold with gold up 3,548.3% and platinum only 792.3%.

Chart #17: Gold vs Platinum Percentage Growth Since 1970

Since 2000, even after the major drop since 2012, gold is still outperforming platinum with 348.8% versus 237% for platinum.

Chart #18: Gold vs Platinum Percentage Growth Since 2000

Chart #19: Gold vs Platinum Price Since 2008

Platinum is certainly not gold nor silver, but its price does follow gold as silver does but with a lot more volatility. Just take a look at what happened in 2008 (charts #18 and #19). Gold has at least 5000 years of history and on almost every continent, while platinum has only 300 years, and not all over the world. You can go into any city, town and even village and exchange your gold for something without too much problems. Even in the USA, you will find a jeweler who will buy your gold. You would not be able to do it with the same ease with platinum.

During periods of sustained economic stability and growth, the price of platinum tends to be as much as twice the price of gold, whereas during periods of economic uncertainty, the price of platinum tends to decrease due to reduced industrial demand, falling below the price of gold. Gold prices are more stable in slow economic times, as gold is considered hard cash and gold demand is not driven by industrial uses.

Platinum coins are also minted by several countries including United States, Canada, Australia and China. In 1928, Russia began minting with the 3-rubles coins. The 6-ruble coins and the 12-ruble coins were added in 1829 and 1830, respectively. However, even though gold and platinum are close in price, platinum coins are a lot less marketable than gold coins.

1928 Russia 3-ruble platinum coin vs 2013 United States 100-dollar platinum coin

Lydia (today part of Turkey) 550 BC gold coin vs United States 2013 AD 50-dollar gold coin

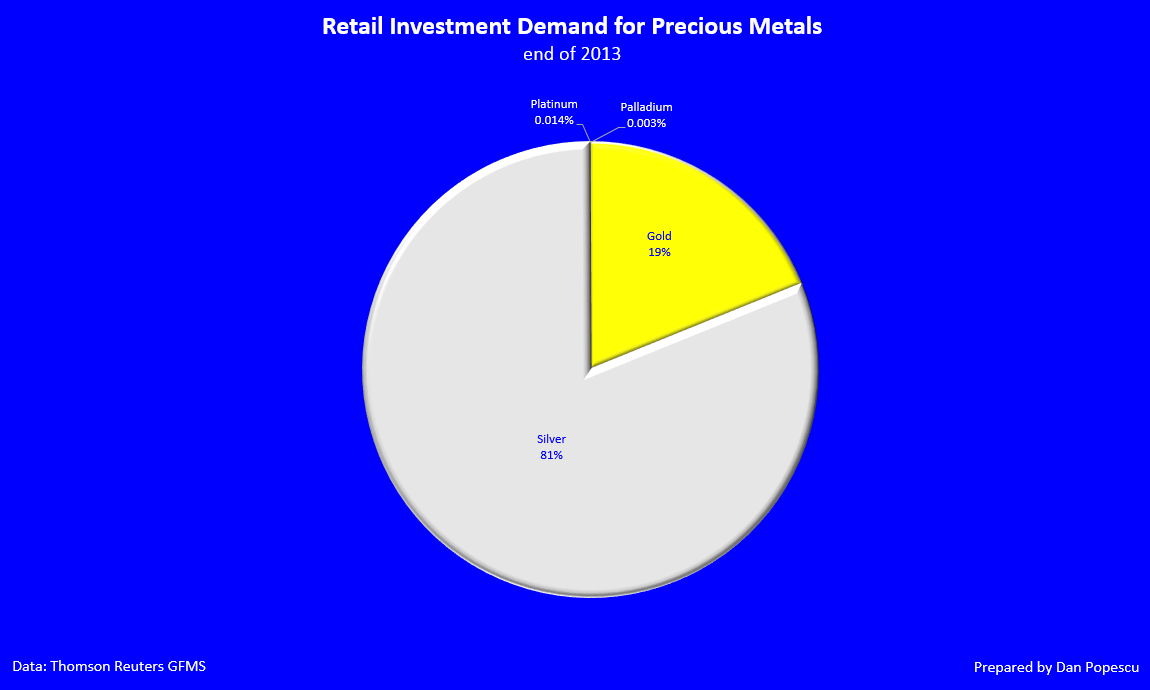

Gold maintains its value even though most of the stock ever mined is still in existence while platinum’s stock is nonexistent due to waste through industrial usage and very low mining supply. Platinum competes in investment demand, as an alternative to gold, with silver that is much more marketable and was a monetary metal for centuries. Both platinum and silver have different attributes as alternative to gold as an investment. Since gold is a widely traded asset, gold in both pure and alloy form is a lot easier to sell than platinum. In 2013, silver dominated the retail investment demand with 81%, followed by gold with 19% and platinum and palladium last with an insignificant amount of 0.014% and 0.003% respectively.

Chart #20: Retail Investment Demand for Precious Metals

Platinum has never been a unit of account, a medium of exchange or a store of value while gold has been all of them for centuries. Therefore gold is money while platinum is an industrial commodity but with a strong correlation to gold almost since its discovery.

Platinum vs Gold Ratios:

Crustal Mass Proportion (Relative) Ratio 2.73/1

Crustal Mass Abundance Ratio 1.67/1

Historical Price Ratio 4.10/1

Price to Global All-in Costs Ratio (platinum vs gold) 1.17/1

Ratio of Price to Global All-in Costs - 0.93 (platinum) 0.80 (gold)

Current Price Ratio 1.14/1

Total Supply Ratio 1/19.6

Mining Supply Ratio 1/15.5

Stock-to-Flow Ratio - 0.74 (platinum) vs 58.20 (gold) Platinum/Gold 1/78.6

Biography:

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.