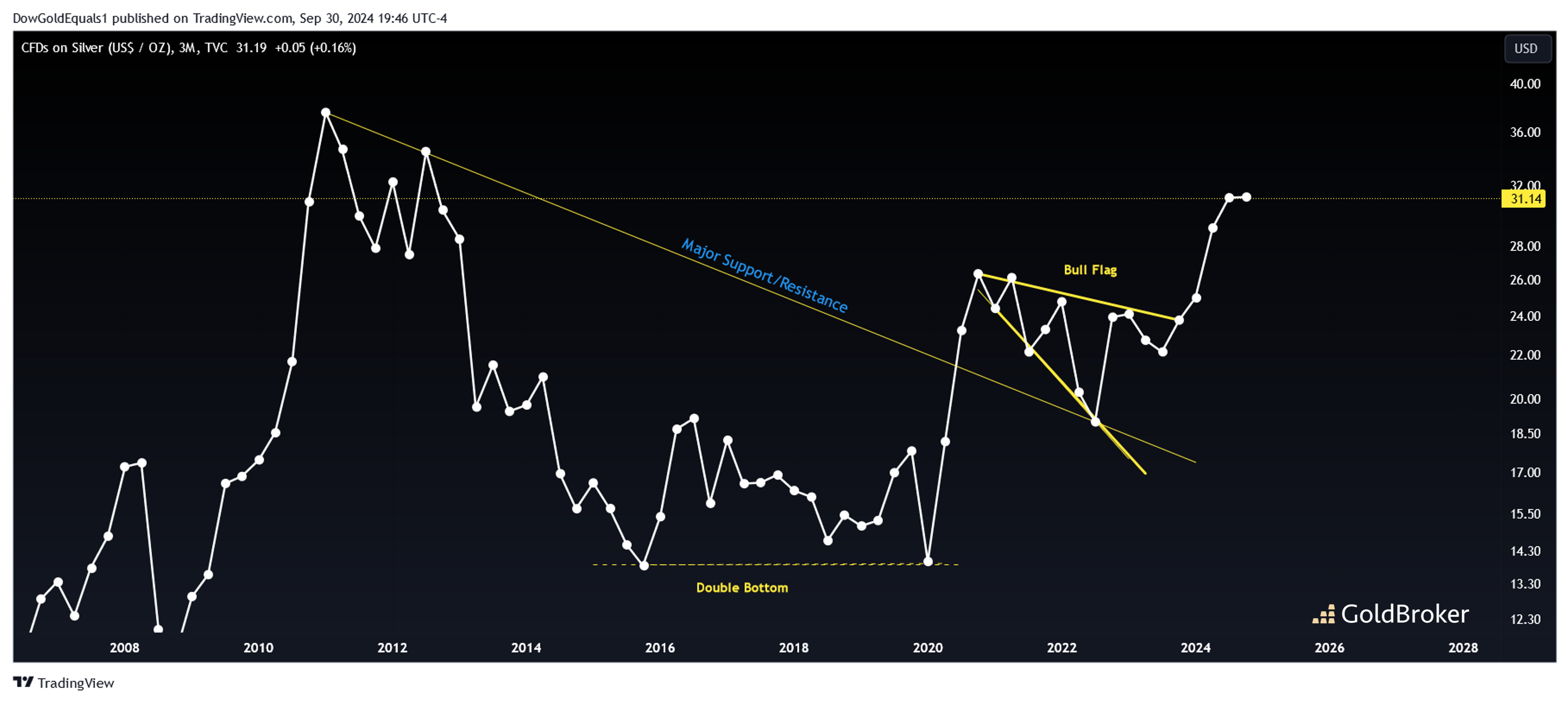

This week, we'll look at gold and silver and see that each are at some very interesting inflection points. Starting with silver, we see that it has just closed the quarter at $31.14, its highest close in 12 years and its 5tth highest quarterly close of all time! Silver is up about 65% off its quarterly low set in 2022 and shows little signs of slowing down. The next target of interest is its all time high quarterly close of $37.58, and should it be able to top that, there is very thin air above that.

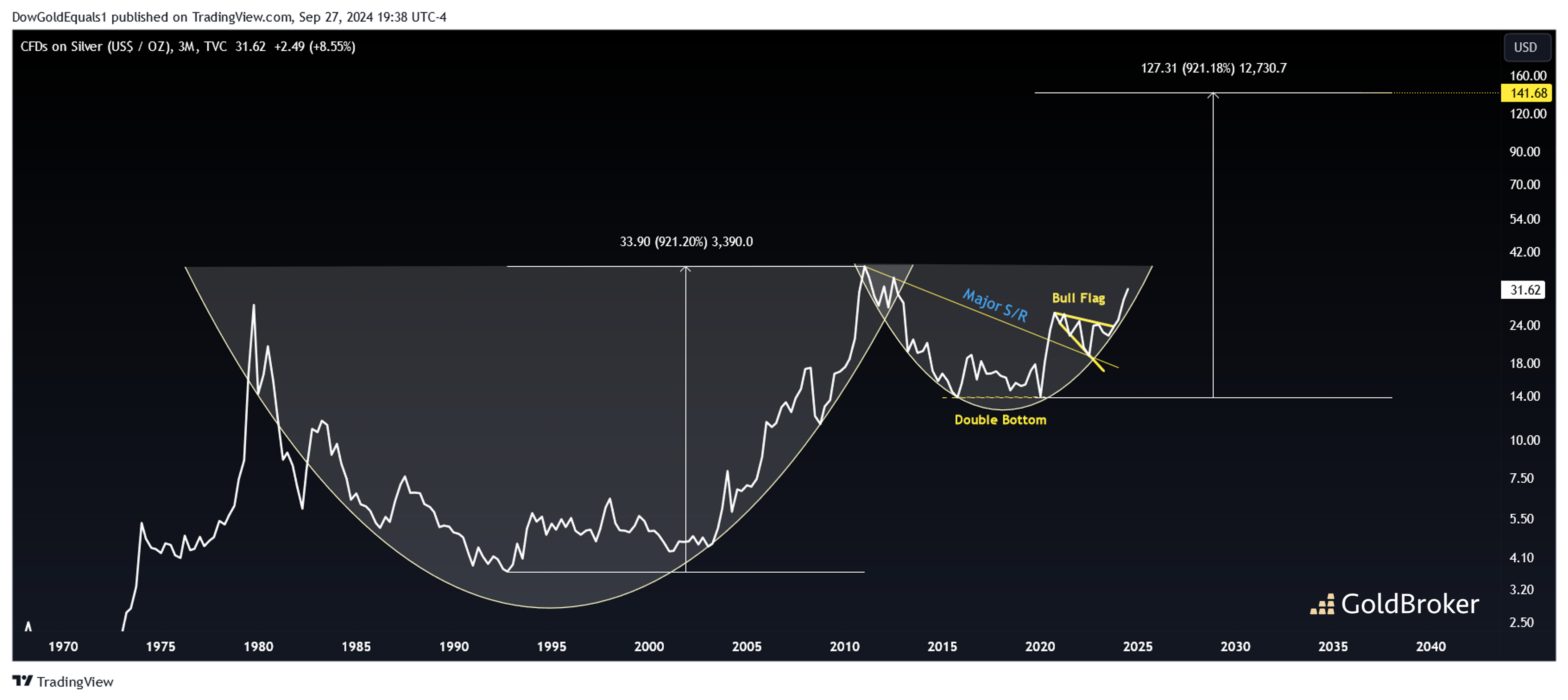

Taking a broader view, I remind you that the current move in silver appears to be an attempt to complete a handle on a C&H pattern that dates back to the 1980 high with a measured move on a quarterly close around $140. Silver's future over the coming years looks incredibly bright.

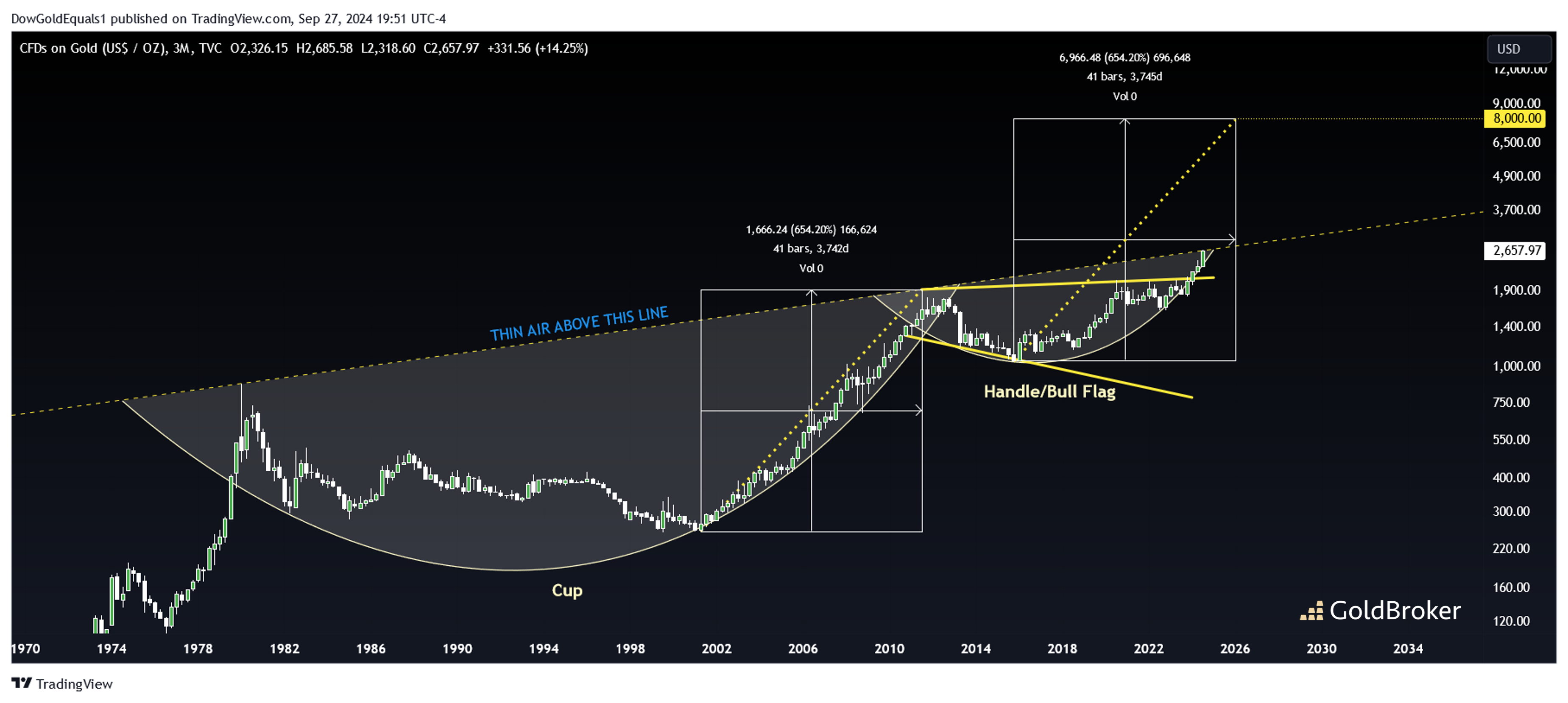

Gold came into an historic resistance line this week that connects its 1980 and 2011 tops, so it's no surprise that price bounced off the $2,665 area and may consolidate for a while. We now have what I feel to be a compelling slanted C&H pattern playing out. However, for those who prefer a more classical approach to their technical analysis, I would suggest considering the huge bull flag that dates back to 2001. The measured move on the flag is around $8,000, and it would seem that a break of the C&H neckline would provide a huge accelerant in moving price in that direction. Indeed, it is a good time to be a metals bull!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.