[Article originally published on April 25, 2020]

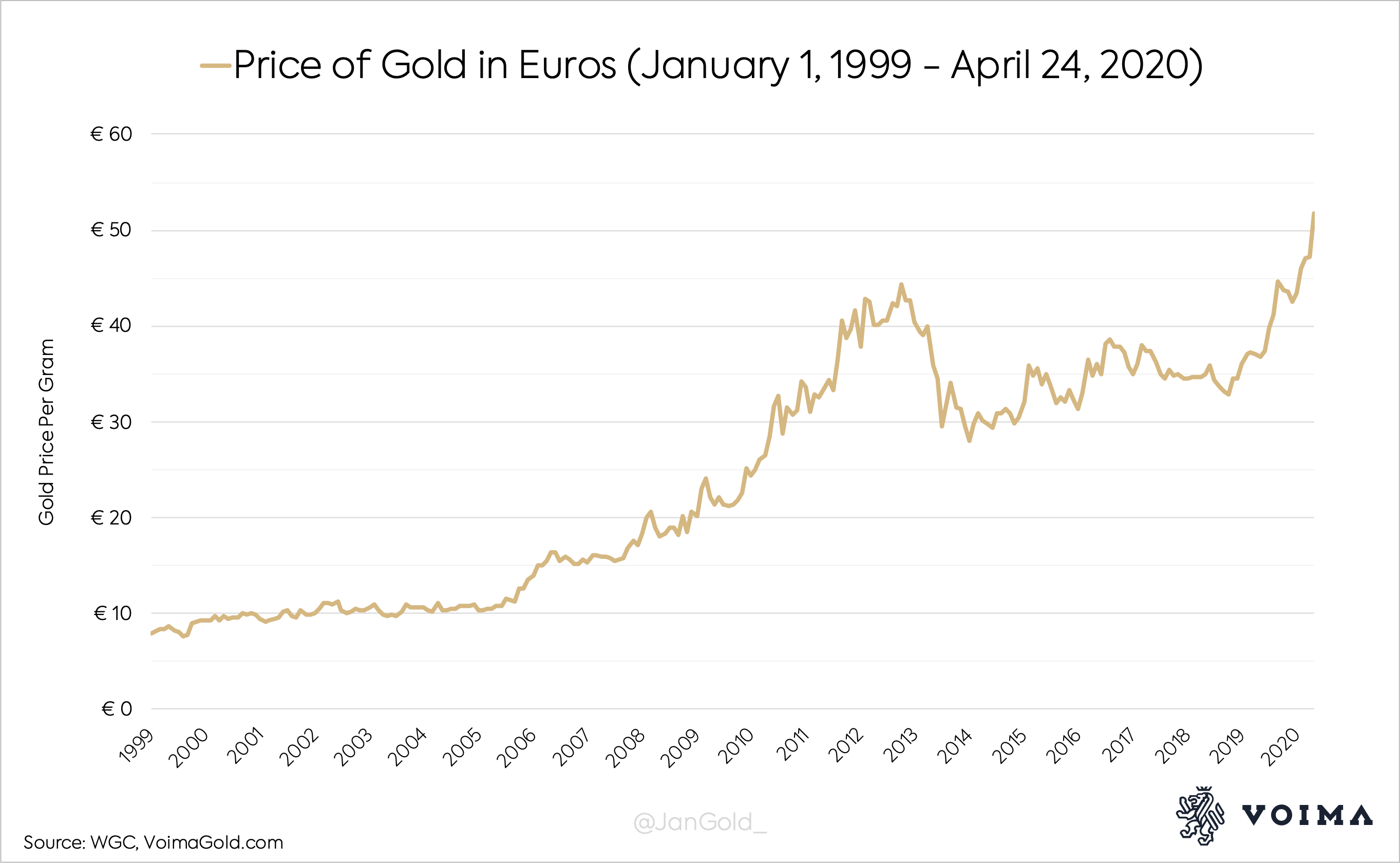

On April 23, 2020, the gold price breached €51,000 euros per Kg for the first time in history. The gold price in euros has increased by 555% since the euro was created in 1999. Put differently, since inception, the euro lost 85% of its value against gold.

Technically, the euro was launched on January 1, 1999, although euro notes and coins started circulating in January of 2002. The first gold price recorded in 1999 was €7,879 euros per Kg - or €7.88 euros per gram (we'll use euros per gram as the gold price in the remainder of this article). By now, the gold price has crossed €51 euros per gram, a new all-time high.

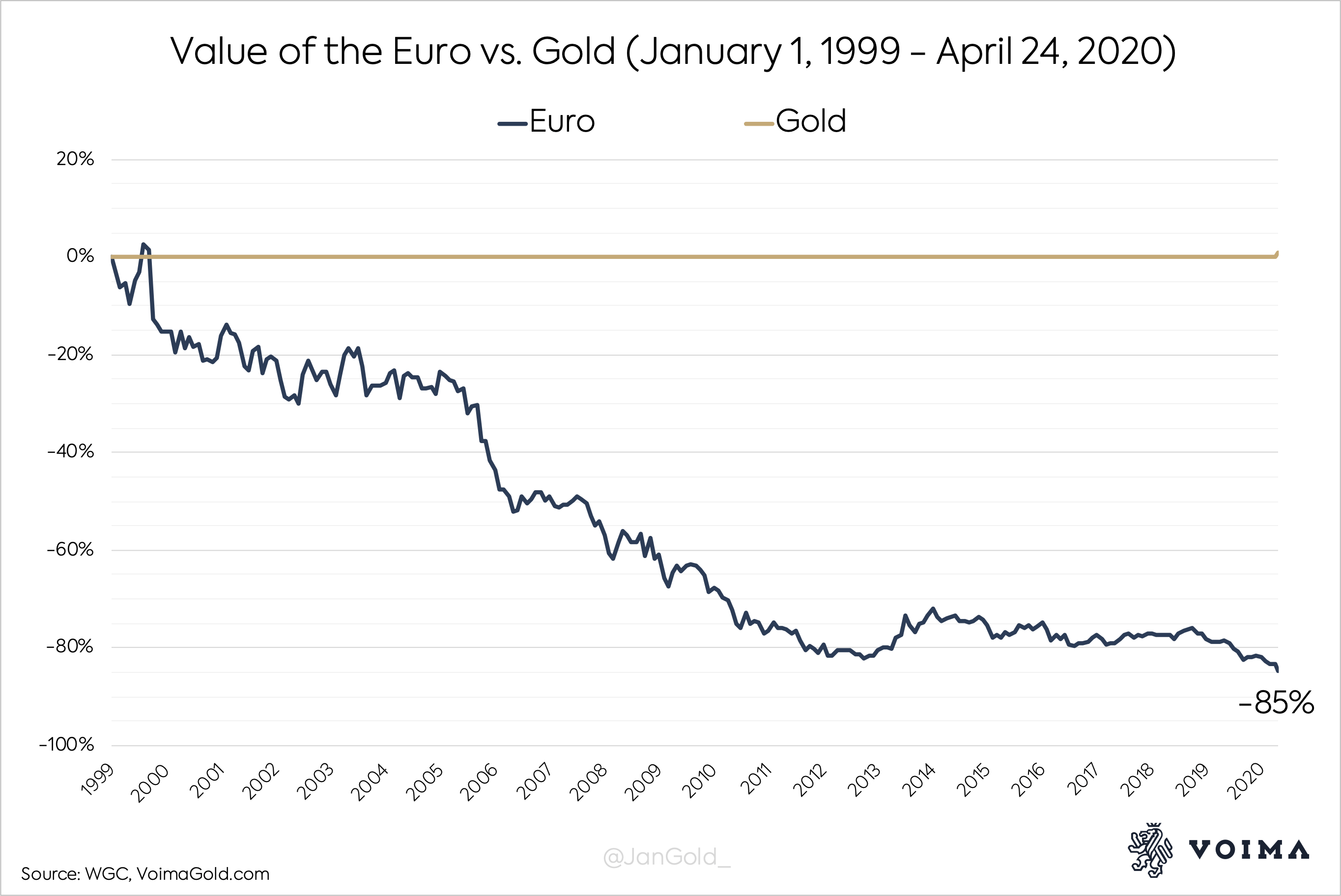

Over the course of 20 years, the price of gold in euros has increased by 555%. From a historic perspective, the euro is a young currency, but already lost 85% of its value against gold. This reveals the instability of fiat money.

To evaluate by how much the euro has devalued against gold, it must be measured in gold terms (because a currency can't devalue by more than 100%). In 1999, it took 0.13 gram to buy one euro; today only 0.02 gram. The result is that the euro lost 85% of its value versus gold. In the chart below, you can see the euro's descent versus gold since 1999.

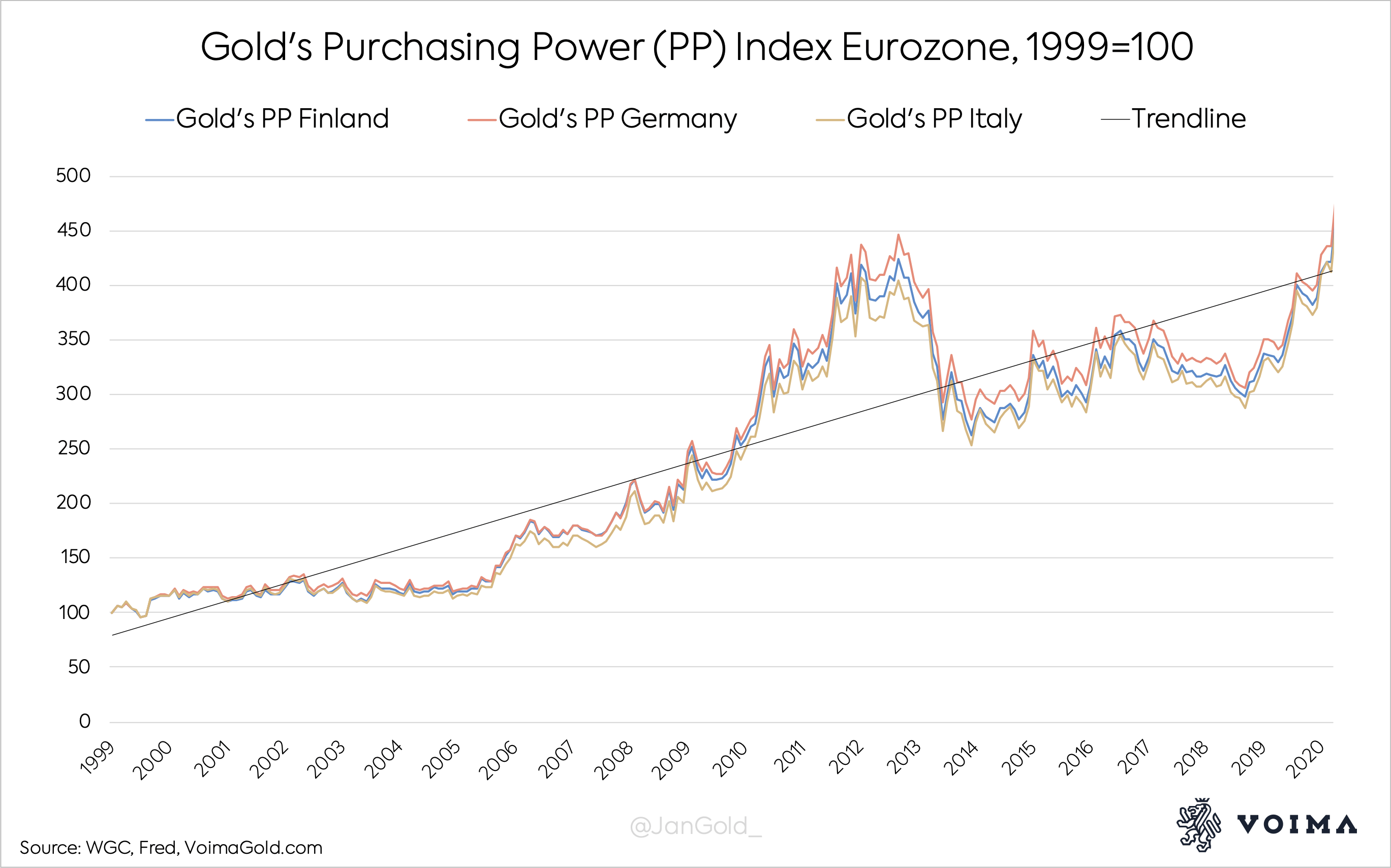

Measuring the value of currencies against each other is interesting, but most important is what this means for the purchasing power of currencies locally. The end goal of every participant in the economy is goods and services. What truly matters for a currency is its purchasing power. We will compare the purchasing power of euros versus gold in the eurozone.

Many people think that euros only lose purchasing power when a bank needs to be paid to store the euros. In other words, if the interest rate on a bank account is negative. This is called "the money illusion." In reality, one has to subtract consumer price inflation from the interest rate to arrive at the real interest rate. For the sake of simplicity, let's say the current interest rate for most savers is zero, minus one percent inflation, is -1%. Currently, euros approximately lose 1% of their purchasing power per year.

A friend just told me his bank account might be charged with “negative interest rates” in the future. Outraged he was. I told him inflation was eating away his money for years now, with interest rates at zero. It seemed he didn’t “want” to understand this is the same thing.

— Jan Nieuwenhuijs (@JanGold_) November 23, 2019

Now, let's have a look at gold. Over the past 12 months, the gold price has increased by 39%. Subtracted by 1% inflation, is 38%. In one year, the purchasing power of gold has increased by 38% in the eurozone (minus storage costs, that is). However, the gold price doesn't go up by 39% every year, it can even go down for some years. Nevertheless, gold's purchasing power has greatly increased over the past 20 years. Which is why physical gold should be seen as a long-term reserve asset.

To reveal gold's purchasing power in the eurozone, I have adopted an index. First, I divided the gold price by consumer prices, and then created an index with a base of 100 in the year 1999. I have computed gold's purchasing power index for Finland, Germany and Italy. Because consumer prices slightly differ for the selected countries, the purchasing power of gold in these countries is not exactly equal. Though, I found gold's purchasing power is roughly the same for the entire eurozone.

First and foremost, you can see gold's purchasing power has increased in the eurozone since 1999. This means that the price of gold has outpaced consumer prices. From the index number, you can see that gold's purchasing power, on average, has increased by a staggering 350% (450 - 100) over 20 years. The gold price can be volatile, at times, but over longer periods of time, it preserves its purchasing power, with the benefit that it doesn't have any counterparty risk, so it withstands every crisis.

Original source: SeekingAlpha

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.