We’ve seen earlier that mining shares – being first and foremost shares (high volatility, risk of 100% loss) – cannot be put on the same level as physical gold. Neither is the case with ETFs or gold trackers, which expose the saver to at least six risks (ownership risks, multi-ownership risks, intermediation risks, redemption risks, risks arising from conflicts of interest between custodians, and exchange risks) that may be avoided with physical gold.

But that doesn’t tell you, however, what kind of returns your clients can reasonably expect when buying this asset class. We’re going to try to answer this question today.

“Past performance does not entail the same future performance”: True, but let’s distinguish between short and long term

As you very well know, by law, this warning has to appear on a plethora of documents. This warning is there to protect the saver from aggressive sales pitches, in a financial galaxy with all kinds of “black swans” looming and in which nobody has a crystal ball.

However, it’s hard to imagine that hundreds of thousands of professionals would be paid to produce financial analyses, if the statistical measures were of no interest to help grow a financial portfolio.

It goes without saying that there is no reason to expect an asset to reproduce the same behaviour month to month or year to year.

However, average performance gets more significant as the period being considered is longer. But even then, excesses (up or down) may subsist (typically during periods in which central banks overflow markets with liquidity), which can delay the asset’s inevitable return to its mean historical value. So we could say that “past performance does not entail the same future performance,” but that it influences it a great deal.

With this in mind, I think it would be interesting to look in the rear-view mirror to get an overview of the performance we can expect in large asset classes available to the French savers – and gold in particular.

The annual IEIF study: a must-read for wealth management advisors and French savers

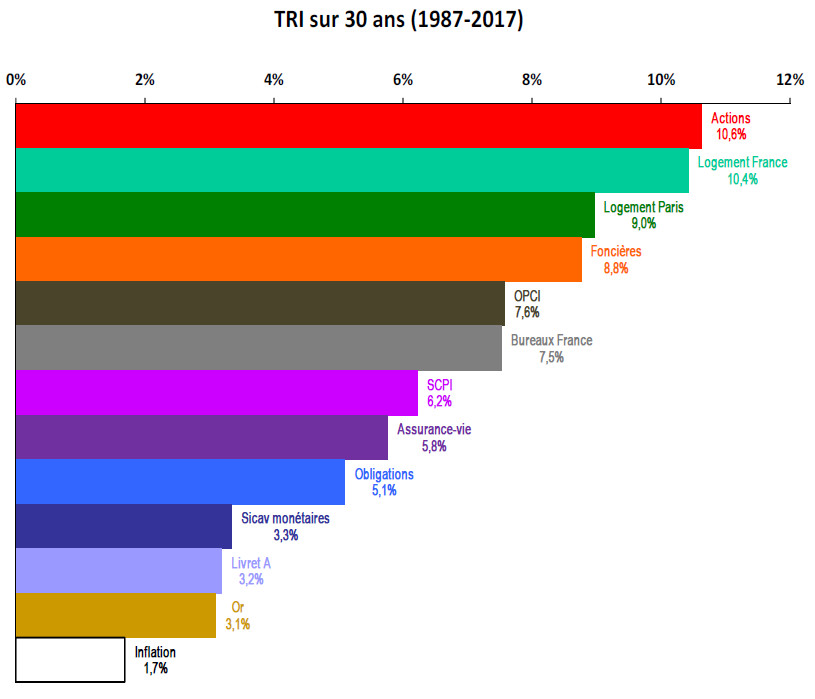

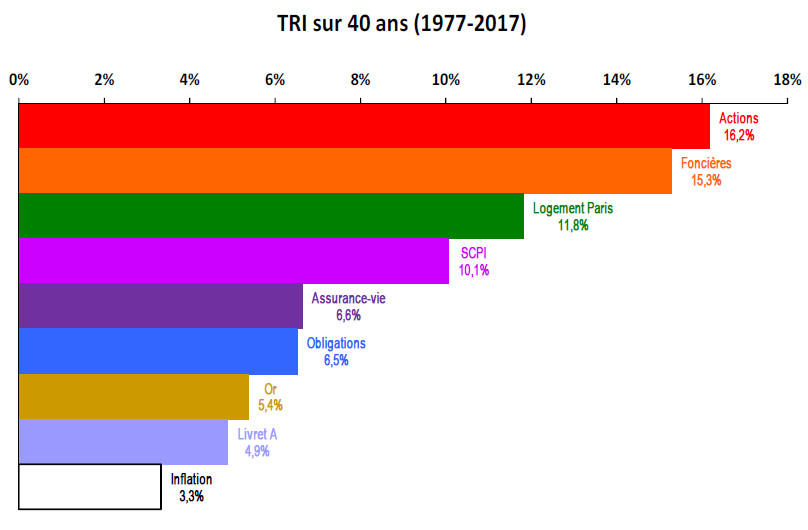

This is what Charles-Henri de Marignan, a real estate analyst with the Institut de l’épargne immobilière et foncière (IEIF) has studied. He publishes an annual report titled (transl.) ’40 years of performance comparison: Long-term investments: Real estate, monetary investments, life insurance, bonds, stock market shares, and gold’, and the last one was published mid-June.

The study is particularly interesting for wealth management advisors who have clients residing in France. As a matter of fact, it is one of the only regular publications that compare gold in euro (not in dollars) with other asset classes of the national market, whether it be stock, bonds, monetary investments, but mainly asset classes that have national real estate as underlying assets.

On trade matters, this study can serve as a very useful tool to show your clients what kind of returns they can expect from different asset classes over the long or very long term – within the limits, of course, of the warning expressed in the preamble.

Performance comparison of investments over short, medium and long periods

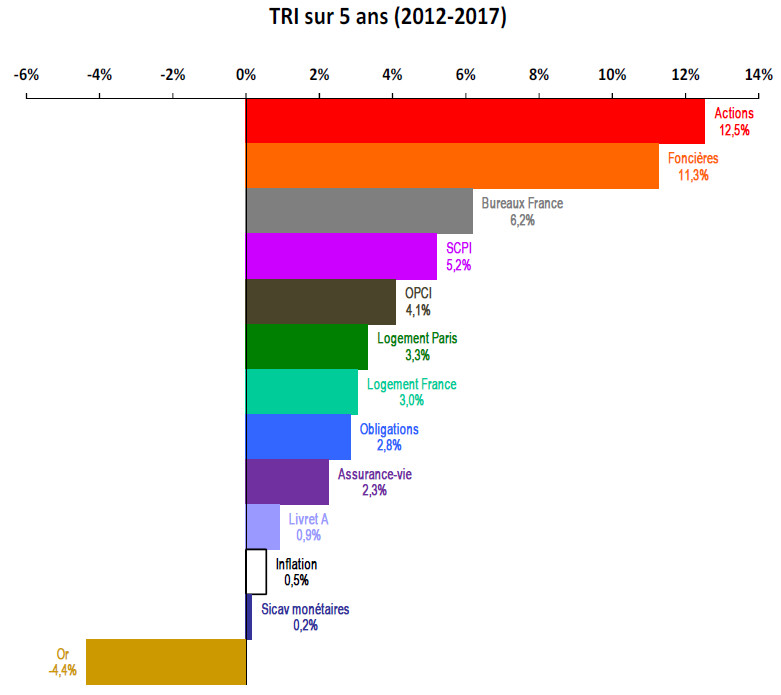

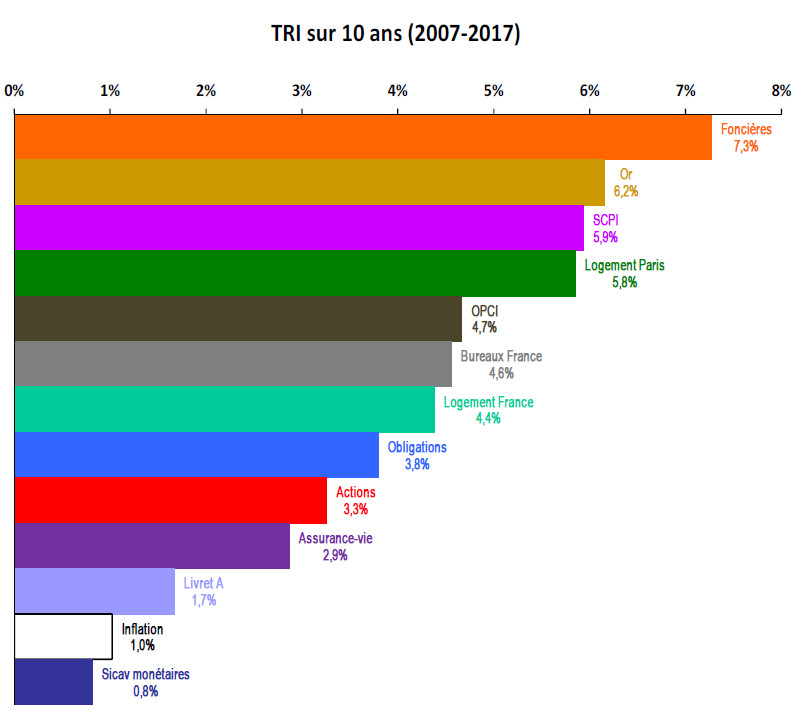

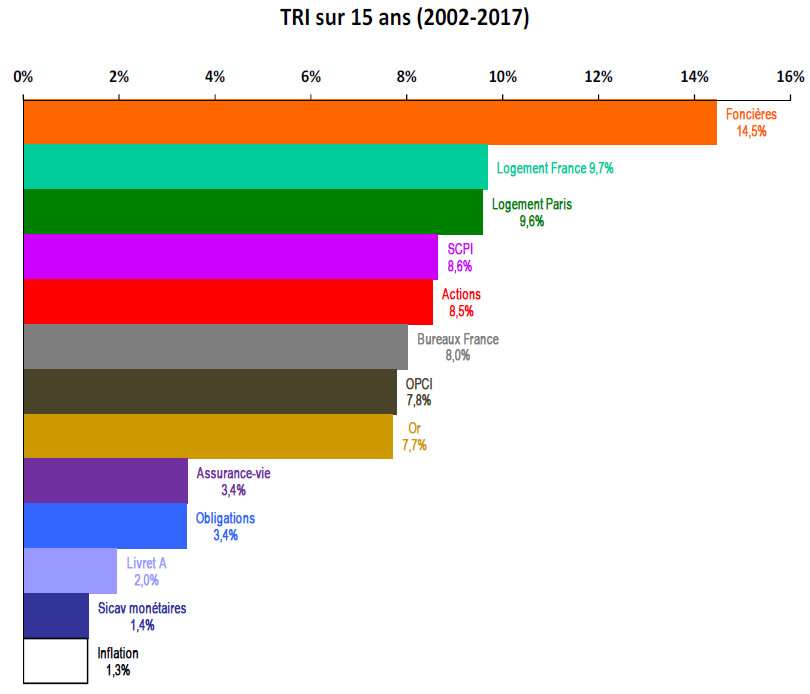

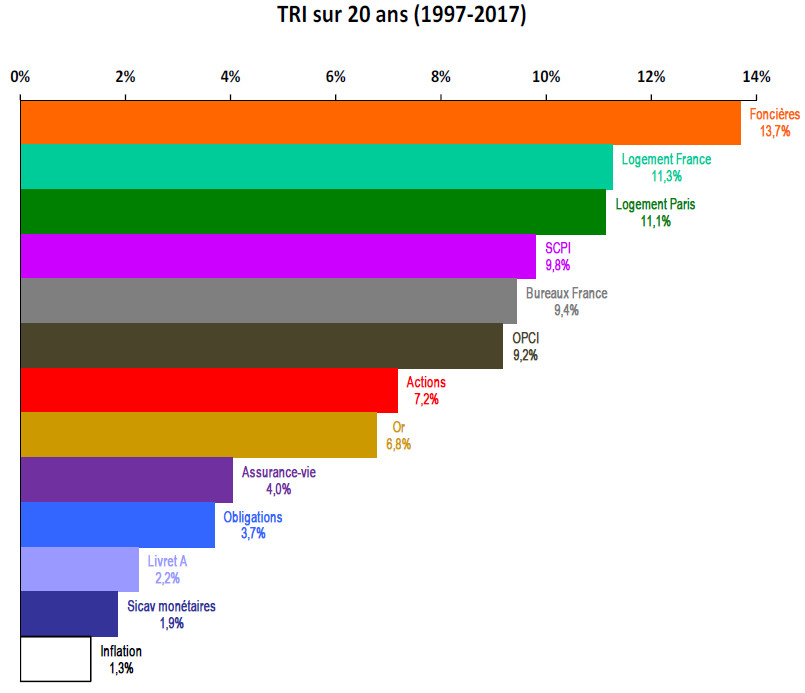

Here are the results from this private report that the IEIF was kind enough to let me share with you. Please note the report doesn’t take into account taxation, which may differ with each taxable household.

Let’s first repeat something quite obvious: results depend strongly on the entry point. Since the most volatile assets may register very strong variations on the very short term, TRI (IRR : Internal rate of return) charts may vary a lot from year to year.

As for results, we can observe that, for long periods (40, 20 and 15 years), stocks and real estate in any form make the top of the list..

Here’s what Charles-Henri de Marignan writes about gold: “Gold has a particular behaviour: it is very volatile and its performance varies a lot depending on the length of the period (...) it’s the only investment to have performed negatively in the ‘80s and the ‘90s (...) last of the class over 5 and 30 years, it takes second position over 10 years.”

Gold is not a safe-keeping investment – It is insurance against crises

This is exactly along the lines I wrote in a preceding post about gold’s financial properties: “Over the long term (1949-2009), gold has been a bad financial investment for the French saver (low returns, high level of risk, low purchasing power, negative risk premium and no regular income). On the other hand, gold constitutes an excellent means of protection against cyclical and, a fortiori, structural risks of instability, since it becomes quite attractive in periods of financial, economic, political or social crises.”

An INSEE study published in 2002[1] covering the period from December 1913 to December 2000 indicates that on the very long term, gold barely preserves the real purchasing power of savers.

More out of curiosity than for real wealth preservation interest (because, as Keynes said, “in the long term, we're all dead”), let’s see how the yellow metal has preserved purchasing power over history. The gold solidus – corresponding to 15 days of a Roman soldier’s pay – weighed 5,4 grams when it was created. For comparison purposes, the Napoléon, weighing 6,45 grams of raw gold (or 5,81 grams of fine gold), is worth around €200, as I’m writing this, or about a sixth of the net guaranteed minimum wage (€1,149.07). A coin weighing 5-6 grams of fine gold has thus lost 65% of its value since the solidus days, if we compare Rome at that time with today’s France under Emmanuel Macron.

In other words, as I wrote in my book, “Outside of the extraordinary hypothesis of a crisis lasting for several decades, physical gold is not a “generational” investment. It is meant to be sold at the right time rather than being transmitted.”

Consequently, after having looked in the rear-view mirror, it seems pertinent to ask what level could the yellow metal reach in the next crisis.

Trying to get a glimpse of the future with the In Gold We Trust report, the world reference in precious metals market analysis

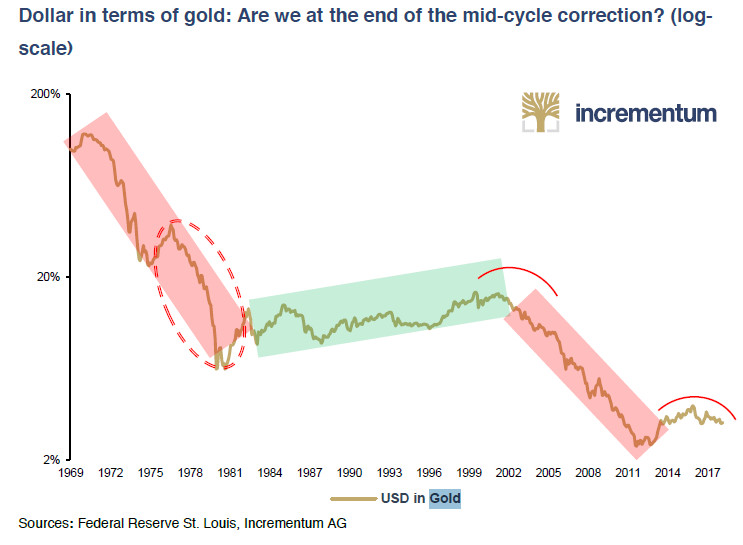

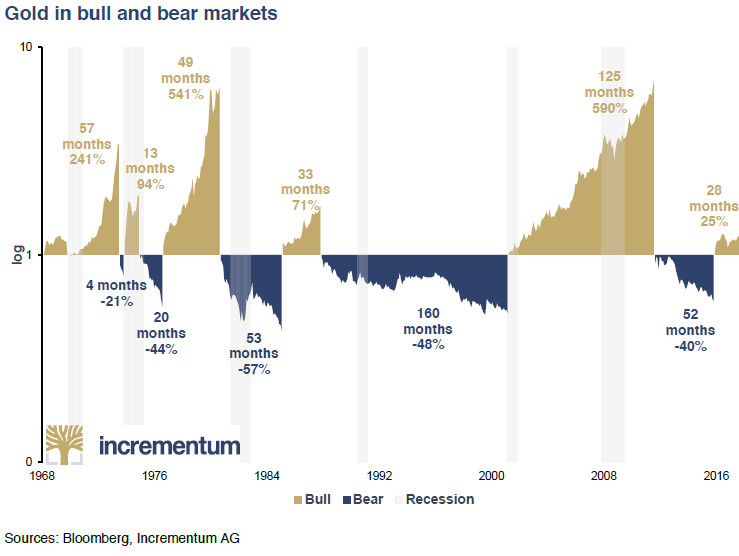

In 2007, Ronald Peter Stöferle started writing what has quickly become the world’s reference report on gold, silver and mining stocks. Since 2014, this report has a co-author, Mark J. Valek, his associate with Incrementum, a wealth management company from Liechtenstein. It is a must-read (available in English and German) for anybody closely interested in these sectors.

This 230-page publication is dedicated to the precious metals denominated in US dollars, but most of the thoughts developed remain particularly pertinent for the French saver, with lots of forward-thinking. For the French wealth management advisor, it thus constitutes the ideal complement to the IEIF report.

How high could the yellow metal rise with the next crisis? Here’s the answer from Ronald Peter Stöferle and Mark J. Valek

For the two Austrians, gold is in a similar phase to the mid-cycle correction it experienced during the large bull market of the ‘70s. “The short-lived strength of the US dollar reminds us of the period 1974 to 1976, when during a disinflationary phase, gold was being sold off and the US dollar appreciated significantly. In our opinion, the similarities of the current development to that mid-cycle correction are striking.”

If they are right and “we are currently in the early stages of a new gold bull market, which has been temporarily slowed down by the election of Donald Trump,” gold could very well hit new all-time highs, which would alter the next charts in the coming IEIF reports - because, in terms of performance, “even in its weakest period of increase, gold gained more than 70%,” the authors write.

In order to fully profit from such an opportunity, one must of course turn to a commercial partner who can satisfy a number of criteria, as we’ll see in the next post.

[1] Alice Tanay, "Les actions plus rémunératrices que les obligations et l’or au XXe siècle", INSEE première n° 827, february 2002.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.