In 1913, when the Federal Reserve was created, the American money supply (M1) did not exceed $3.5 billions.

In 1918, the money supply had doubled, due to the war in Europe which enriched the United States. M1 was $7 billions.

It was in 1920 that we saw the very first billionaire in the person of John D. Rockefeller (source), whose Standard Oil was the first company to benefit from the boom in the automobile sector and therefore from the consumption of oil.

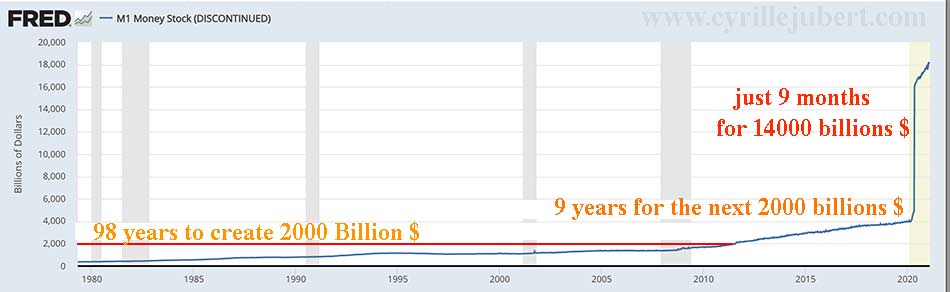

On July 25, 2011, the M1 money supply for the first time reached $2,000 billions.

On March 1, 2020, the M1 money supply was still only $4,027 billions. It had doubled in 9 years.

On December 31 2020, just nine months later, the M1 money supply reached $18,000 billions.

The Senate voted at the end of the week a new budget of $1,900 billions of stimulus.

Enough to last 2-3 more months…

9 months of money printing madness

- To give the illusion of an economy running normally.

- To buy corporate debts to avoid a bond crash.

-To buy the securities of companies via Black Rock to avoid a deeper and deeper stock market crash. Analysts are talking about "nationalization" of Wall Street.

- To distribute a minimum income each month to all citizens, in this case $600.

- To finance the administrations and the functioning of the State.

- To pay interest on public debts.

- To replace the foreign buyers of the American public debt, which no foreign central banks wants any more.

The whole American economy in 2020 has been an illusion because the whole system is bankrupt.

"The King of Bankruptcy"

"Wilbur Ross Jr. is one of the largest fortunes in America. In September 2017, Forbes estimated his jackpot at $ 2.5 billions. Wall Street figure, he is nicknamed the" king of bankruptcy "because it made its reputation by buying disaster-stricken companies for a pittance... to restructure them with massive layoffs and resell them a few years later while pocketing a nice capital gain.” (source)

As we have seen time and time again, Ross spent much of his 24-year career as an executive of Rothschild & Co in New York City, where he handled the 25 biggest bankruptcies of the century. This is how Ross met Trump, helping his client to avoid the bankruptcy of his companies and his personal bankruptcy. Ross then made a fortune by creating his own company WL Ross & Co, specializing in the restructuring of failing companies.

Wilbur Ross, for the past 4 years, has remained Donald Trump's Secretary of Commerce. He is at the origin of the “Trade War” against China, where he most likely used his gifts as a negotiator at the highest level to manage the bankruptcy of the United States and to work on the next phase, which might include the monetary reform announced by The Economist in 1988.

Japanese Zombies

In an email sent to my readers in 2017, I wrote :

"You remember the different episodes on the zombies on December 10 and 12, 2014, then on March 4, 2015. The Bank of Japan, which is fully printing the controllers, bought completely on the one hand the shares of ETFs in the Nikkei, up to holding more of the majority, but also buying the Treasury Bonds issued by the government, in such quantities that the big banks of the planet have moved away from this market, completely tampered with.

The BoJ reputed to hold the equivalent of 100% of GDP in the form of Treasury Bills (JGB) has proposed to buy out unlimited 10-year JGBs at a rate of 0.11% (source).

The BoJ is demonstrating that there are no limits when it comes to trading money by being alone in the driver's seat.

However, the IMF had warned Japan that its Treasury bills and currency could be downgraded. All of this leads directly to hyperinflation, through the loss of confidence in the currency."

What is happening in the United States today is a replica of what happened in Japan… But also of what is happening in Europe.

The ECB is also printing hundreds of billions of euros to buy corporate debts and EU state Treasury bonds.

However in 2020, thanks to the sanitary crisis and the shutdown of Western economies, the states covered the loss of turnover of the companies brutally stopped (Air France made a deficit of €7 billions) and with the sharp decrease in consumption, less VAT receipts and less tax on profits, the states are in very serious difficulty. But fortunately the European Central Bank prints and covers everyone.

So, it's a fact, the whole system is currently bankrupt.

Someone will soon have to press the "reset" button to switch to whatever new system it is.

Silver

An ounce of silver in 1913 was worth $0.50 while the money supply was $3.5 billions.

Logically, in 1918, a silver ounce was worth $1 as the money supply had doubled to $7 billions.

We will simplify and integrate the $1,900 billions that has just been voted by the Senate into the existing $18.100 billions, to give a round figure of $20,000 billions.

$20,000 billions divided by $7 billions, the money supply has been multiplied by 2.857 since 1918, when silver was worth $1 on that date.

Make the math. It leaves a good margin upwards.

Gold was worth less than $20 in 1918. Today, an ounce of gold should cost $57,000.

Note that the Gold/Silver ratio in 1918 was 20.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.