On April 9, the price on an ounce of gold exceeded $2,350, reaching an all-time high after a series of recent record highs, and the upward trend continues!

As a reminder, an ounce weighing 31.1 grams was worth $35 on August 15, 1971, when Richard Nixon decided to leave the Bretton Woods Agreement, then $280 on January 1, 2000, before soaring again. Should we welcome the remarkable rise in the price of gold, or should we consider the collapse in the value of the dollar? Both, and investors who have bet on gold, particularly since the early 2000s, have done very well.

But why is gold rising at a time when inflation is falling in the United States and Europe, and central banks are celebrating, reassuring and announcing interest rate cuts? Inflation has been brought under control without sinking into recession, so isn't everything working out for the best?

If gold is still rising, it means it doesn't believe in this scenario. As we know, the yellow metal has flair: it began a long climb in the early 2000s, in response to the Fed's accommodating monetary policy, which began to reduce interest rates following the crash of technology stocks in January 2000 and the attacks of September 11, 2001. Anticipating "asset inflation" (limited to real assets such as real estate, equities and art), gold perfectly protected its holders. More recently, gold has been climbing since the end of 2019, heralding the inflation (this time in consumer goods) that took off in mid-2020.

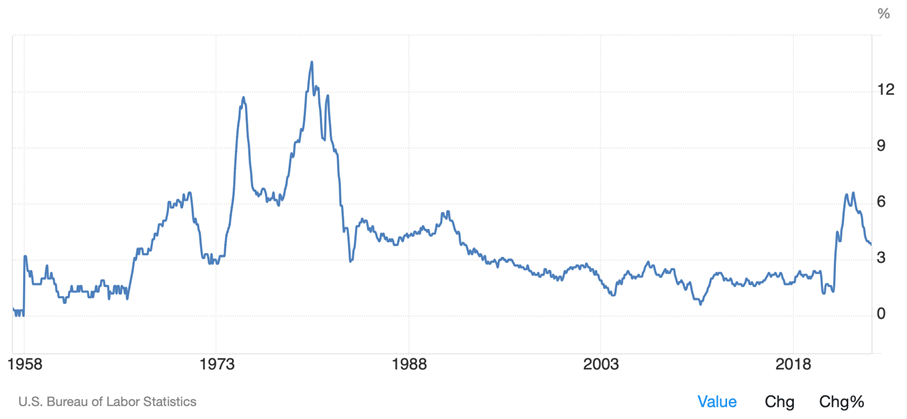

Inflation has eased, undoubtedly, but remains at a significant level, higher than during the Covid period. Above all, the astronomical budget deficits in the United States and several European countries, including France, could force central banks to start printing money again. The announced rate cuts are likely to be hasty. As a result, inflation is likely to pick up again. Western countries experienced a similar situation in the 1970s, with an initial surge in prices in 1973-1974, which was quickly contained. At the time, many people thought the worst was over. However, inflation rose again in 1978-1980, peaking at 13.5% in the United States.

Gold prices had anticipated this second wave by starting to rise in September 1976, after a period of decline.

Inflation in the United States

The Fed's governor at the time, Paul Volcker, was forced to raise the key rate to 20% in order to significantly reduce inflation. Even half that would be inconceivable today, given the scale of public and private debt. The whole economy would collapse! So, how will we get out of a second wave if it happens? Nobody really knows…

The two waves of inflation in the 1970s were triggered by the oil shocks of 1973 (following the Yom Kippur War) and 1979 (linked to the Iranian revolution). Today, there is no real major shock, but energy remains expensive, especially for Europe (few resources, costly energy transition, boomerang sanctions against Russia). What's more, the price of a barrel of oil is rising again, and has just passed the $90 mark…

It's still too early to know whether a second wave of inflation will occur, but gold seems to suspect it...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.