It Is Decision Time For Gold

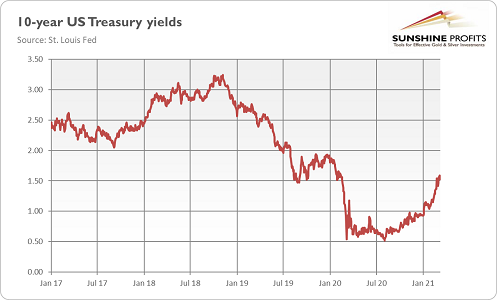

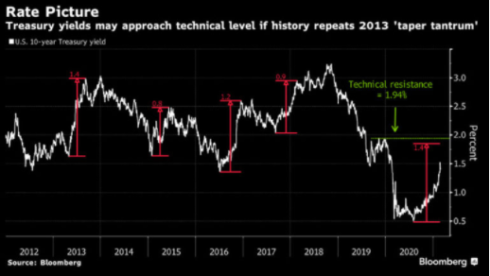

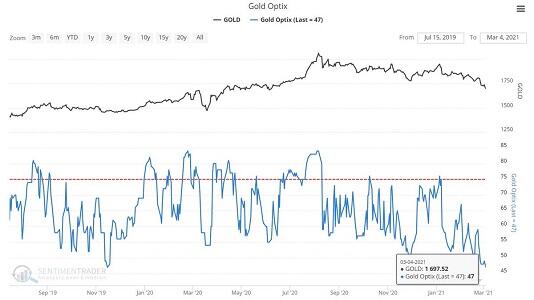

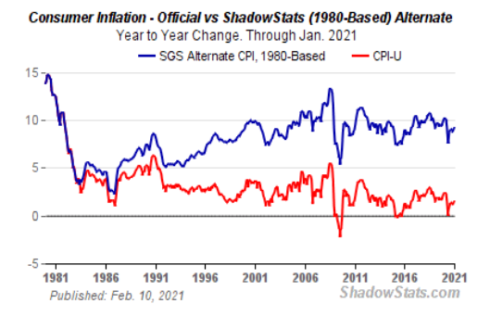

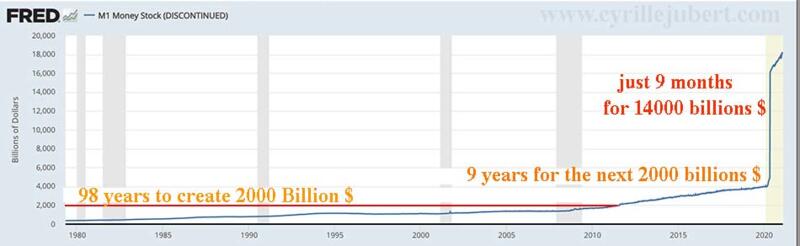

Since January, gold has come back to the bottom of its consolidation flag, then in fact regained its bear trend set off in this dollar short squeeze. This was decision time for gold, at a crucial moment where we are witnessing a exhaustion of the dollar short squeeze and a cracking of the entire...

Read article