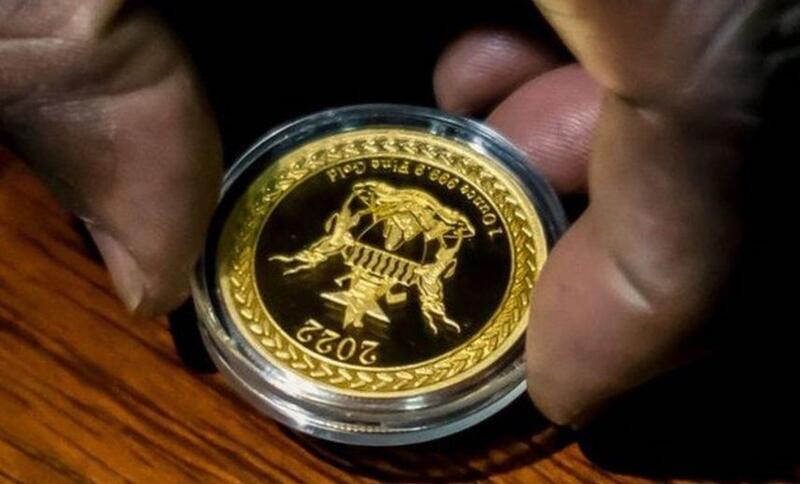

Zimbabwe Launches Gold-Backed Currency To Replace Collapsing Local Dollar

Zimbabwe has replaced its local dollar, which collapsed after less than 5 years in existence, with a new gold-backed currency. This is the latest step taken by President Emmerson Mnangagwa's government to end decades of monetary chaos.

Read article