China is currently trying to slow down the gold-buying craze: The Shanghai Gold Exchange (SGE) raised margins on its futures contracts and drastically limited the number of contracts per participant after the close of trading last Friday, forcing the liquidation of many long speculators.

This decision appears to be coordinated with the COMEX's second margin hike.

China clearly has no interest in letting the gold prices increase too quickly.

The impact was immediate: gold and silver fell considerably in the space of 48 hours, and this time the declines are also occurring in Asia while London is closed.

After peaking at $2,500 in Shanghai, the price of gold is consolidating around $2,300 following last month's breakout. Most analysts now expect gold to return to test this breakout around $2,100:

This consolidation has had little impact on mining companies, which is a bad sign for those anticipating a sharper downturn. For the time being, the momentum of the rally in mining companies relative to gold has not been interrupted:

On the other hand, gold's decline is barely perceptible when measured in yen. Gold in Japanese currency (JPY) still seems unable to break free from its worrying exponential trajectory:

Japan continues to sink into an unprecedented monetary crisis.

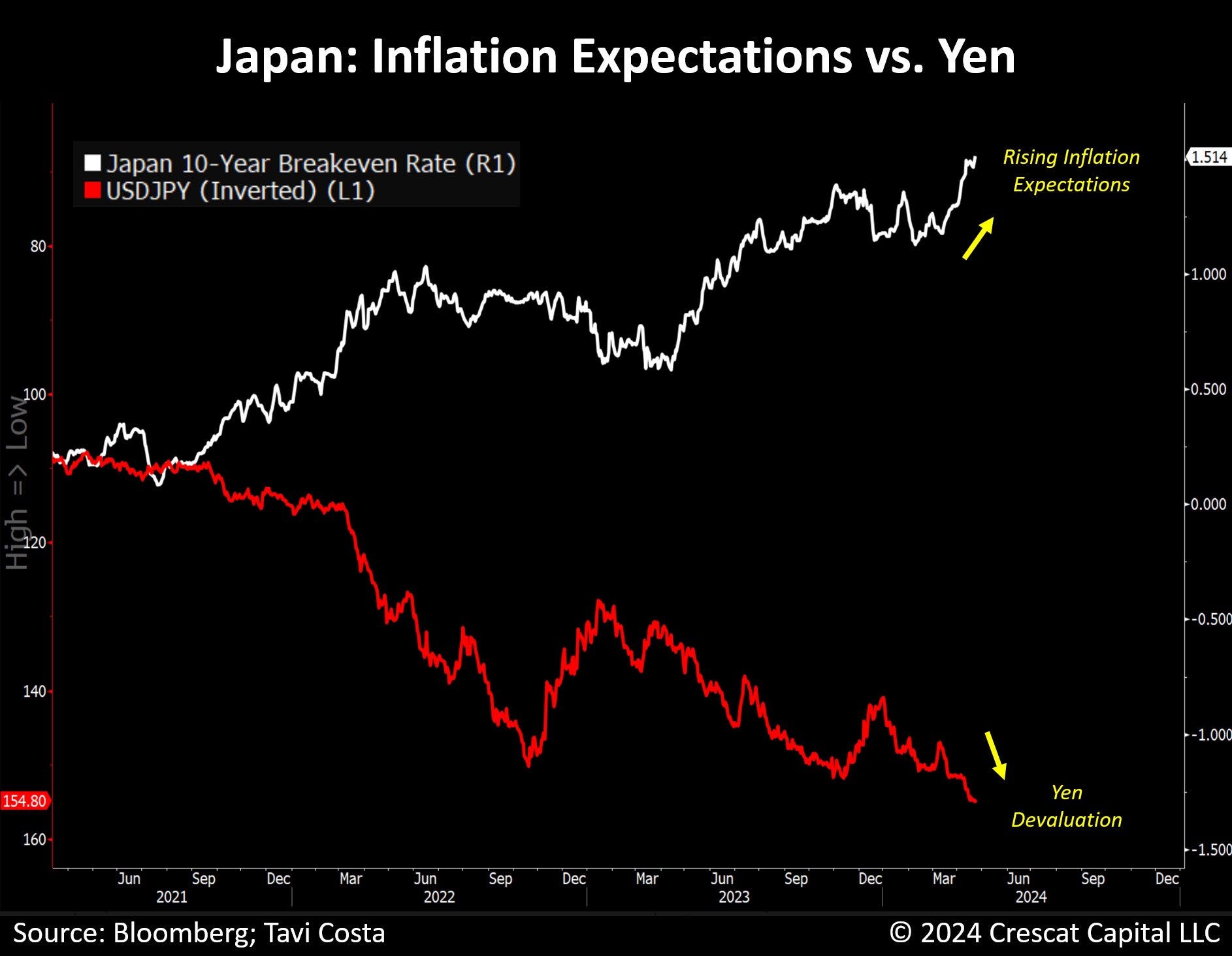

This week, Otavio Costa published a chart that has gone viral:

According to Crescat Capital's renowned economist, the Bank of Japan is caught in a trap. As inflationary expectations rise, the yen continues to depreciate. The chart he recently published shows this almost perfectly negative correlation.

This phenomenon reveals the dilemma of an economy plagued by excessive indebtedness, requiring the maintenance of accommodative monetary policies despite structural inflationary pressures.

In other words, the BoJ finds itself in a bind, forced to allow inflation to progress while the Japanese debt situation spirals out of control.

Intervention on the foreign exchange markets is aimed solely at slowing the yen's irreversible slide.

It remains to be seen how Japanese civil society will cope with this predicted loss of purchasing power, especially at a time when energy costs are rising again.

Resistance on the Oil/USDJPY chart looks set to be tested again:

With inflation on the rise, any surge in oil prices in Japan this time around would have a far greater impact than in 2022.

The increase in energy costs is also starting to boost inflation in the United States.

In my last article, I touched on the subject: the recent manufacturing PMI indices reveal a further rise in prices in March, the strongest in 20 months. This week's figures show that this rebound in inflation is accompanied by a drop in manufacturing activity, which once again falls into contraction territory below the 50 threshold. While services activity remains in positive territory, manufacturing activity is showing signs of contraction:

Europe is no longer alone. Stagflation is also resurfacing in the United States. This time, it is more worrying: wages in the service sector are unable to keep pace with rising energy prices. In contrast to 2022, real wages are falling more sharply on the other side of the Atlantic.

If this trend continues, the price of gold should continue to benefit from this highly favorable environment.

Western investors are still very timid about gold. It has to be said that markets remain attached to stratospheric valuations.

In March, gold outperformed the stock markets, but the SPY/Gold chart has yet to break the uptrend it began in 2011:

As long as the markets continue to outperform gold over the long term, few generalist funds will be inclined to increase their exposure to the yellow metal.

On the physical market, recent record prices have not dampened central bank gold purchases.

According to weekly data from the Reserve Bank of India, its gold reserves rose by 5 tons in March, to 822 tons. Net purchases since the start of the year stand at almost 19 tons, surpassing net purchases in 2023, which stood at 16 tons. India has clearly moved up a gear in accumulating physical gold for its monetary reserves.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.