I am going to try to explain a very technical aspect of the gold and silver market, albeit a very important one, if one wants to understand their price evolution. Vulgarization and over-simplification are always dangerous, and there is a risk that some things may be misunderstood. Anyhow, I hope I can bring some light into this topic.

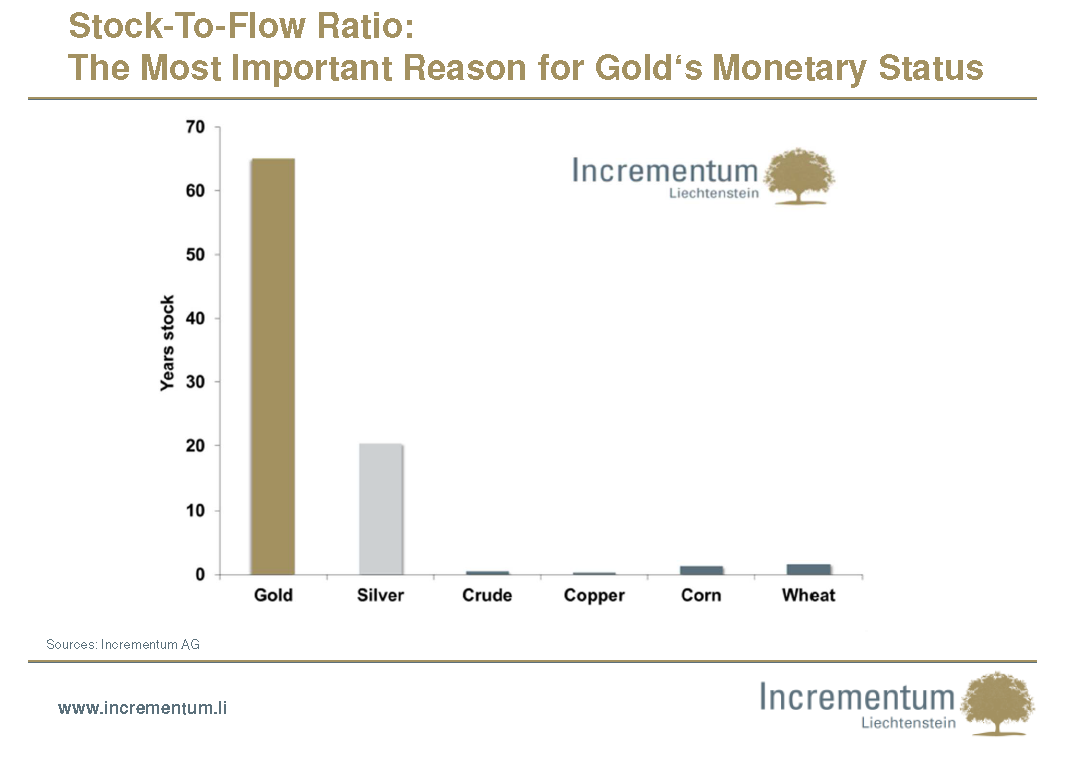

Backwardation and contango are terms used in the futures markets. Backwardation happens when the price of a future contract on a commodity (like gold) is lower than the spot price. In addition, contango happens when the price of a future contract on a commodity is higher than the spot price. Backwardation is the opposite of contango. In a normal situation, the market is in contango for non-perishable commodities to be delivered in the future and that carry storage costs. These costs include storage fees and interest lost on the blocked money, minus the profit from leasing the commodity, if it is the case (e.g. gold). Backwardation is not the normal situation and suggests supply shortages in the spot markets. However, several commodities’ markets are often in backwardation, in particular when seasonal aspects are factored in (e.g. perishable commodities). Backwardation rarely occurs in monetary assets like gold and silver, because there is always a large available inventory. There is the equivalent of 60 years of gold production and 20 years of silver available (chart #1).

Chart #1: Stock/Flow Ratio (gold, silver, oil, copper, wheat, corn)

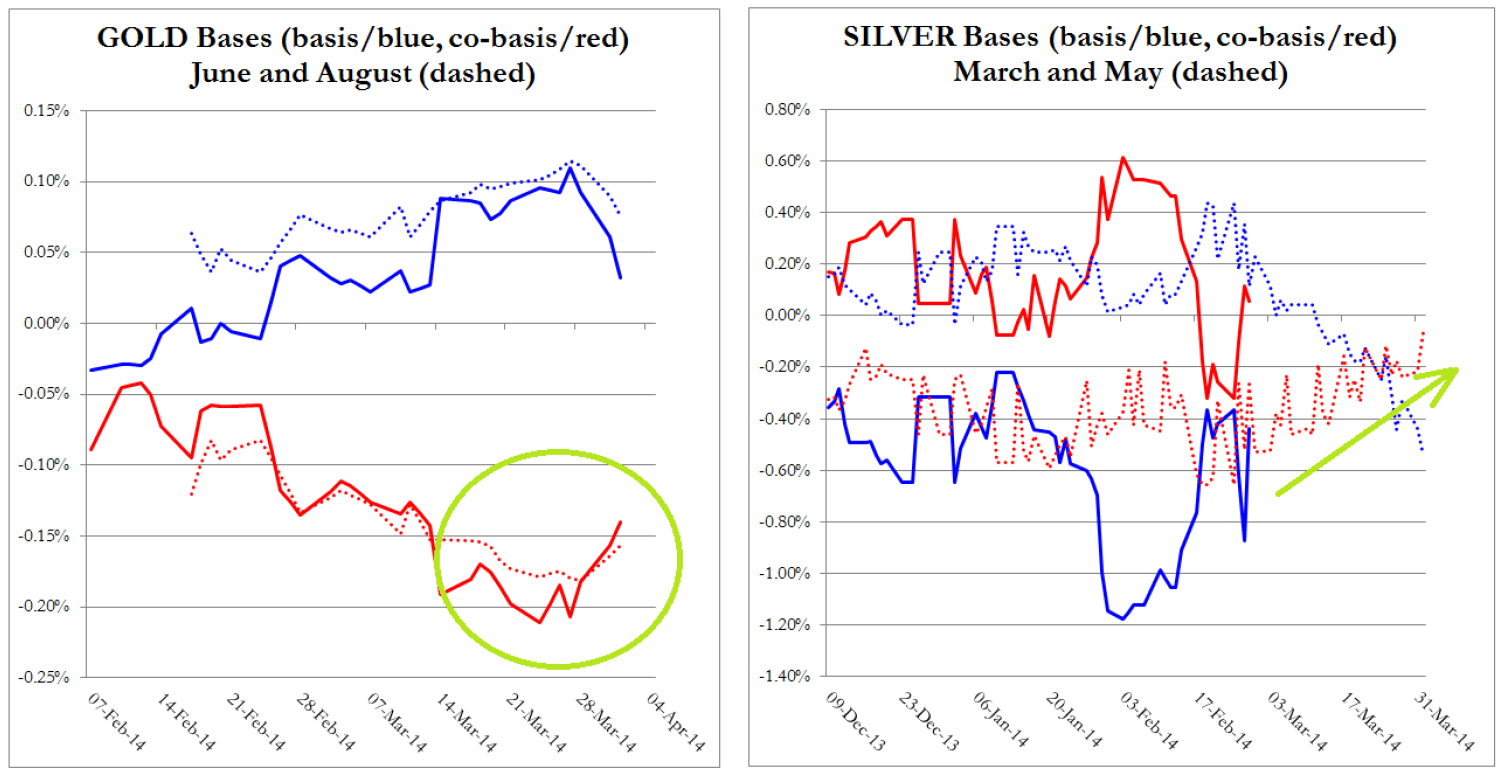

Sandeep Jaitly, from Gold Basis Services (Fekete Research), analyses the gold and silver basis and publishes an excellent monthly report. The gold and silver basis is the difference between the futures price and the spot price of gold or silver. Professor Fekete has shown the importance of watching the gold and silver basis for signs of global financial distress. The gold and silver basis indicates backwardation in gold and silver. Backwardation in gold and silver is the consequence of interest rate manipulation by the government. Backwardation indicates that people prefer to be holding gold and silver, rather than fiat money (paper money) from a country (dollar, euro, etc.). If paper money were reigning supreme, backwardation in gold and silver would disappear, but this does not seem to be the case now. The gold future contract, cheaper than the spot price, shows that interest rates on gold are more important than fiat money’s rates. The more gold and silver go toward backwardation, the more it shows that there is less gold and silver available to trade against dollars or other currencies. There will come a time when there will be no gold or silver available to trade against paper currencies. This will be preceded by a large increase in backwardation, all the way to permanent backwardation. A negative basis indicates a large shortage of available gold for delivery.

Gold backwardation indicated the extent to which gold leases cannot be extinguished by coaxing it from those holding physical gold. Why? Because there is a worry that the gold will not be returned to them.

Chart #2: Basis and Co-basis of Gold and Silver

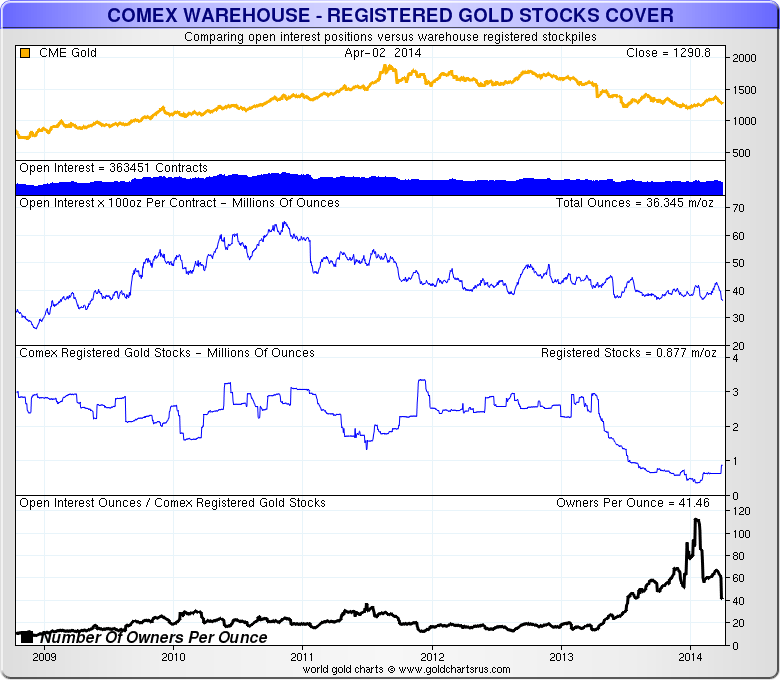

One thing of interest is that, on January 16, 2014, there were 112 futures contracts for each available gold bar. Today, April 2, 2014, this ratio is down to 41 (see chart #3). If trust in the international financial system and, thus, in paper money, disappears, then no one will want to lease or sell gold or silver. The futures contracts holders asking for delivery in physical gold or silver at the end of their contracts will not be satisfied. In addition, this could crash a futures market like the COMEX. Our current monetary system, based on debt (paper money), will be heavily damaged. This is why it is so important to analyze and follow this backwardation phenomenon for the gold and silver market.

Chart #3: COMEX Warehouse – Registered Gold Stocks Covered

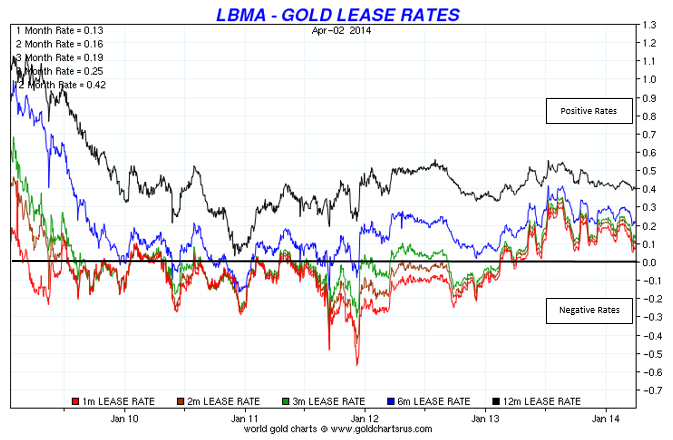

Chart #4: LBMA - Gold Lease Rates

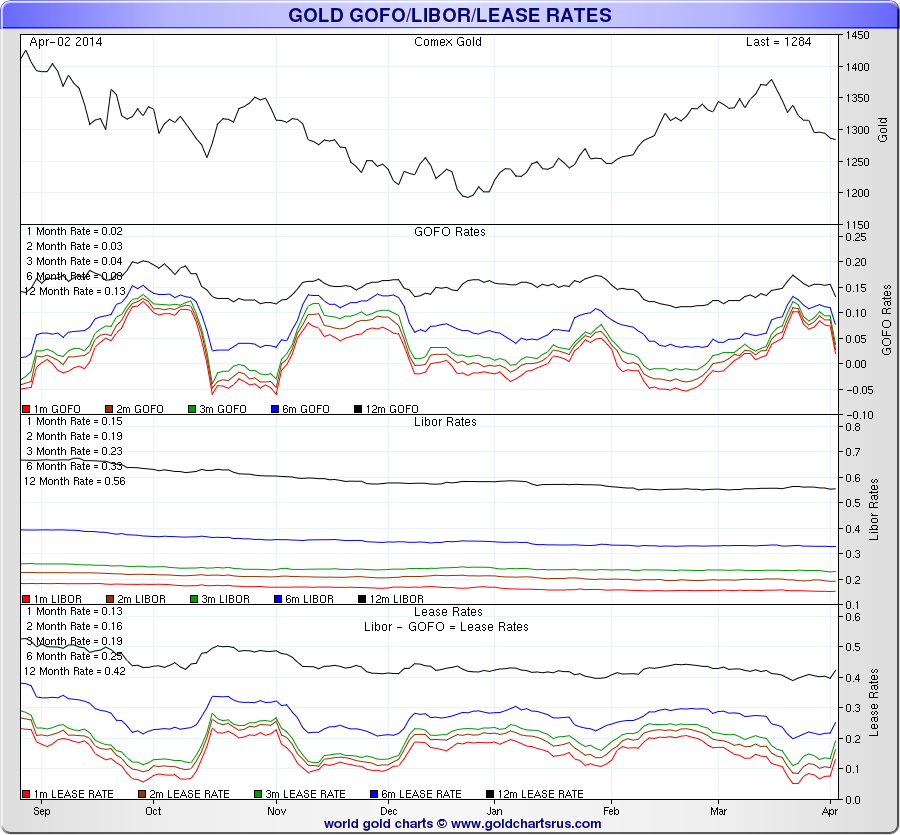

Chart #5: Gold GOFO/LIBOR/Lease Rates

References:

Sandeep Jaitly, Gold Basis Services, Fekete Research (http://www.feketeresearch.com/gold-basis-service.php)

Nick Laird, www.sharelynx.com

Ronald Stoeferle, Incrementum Liechtenstein AG (www.incrementum.li)

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.