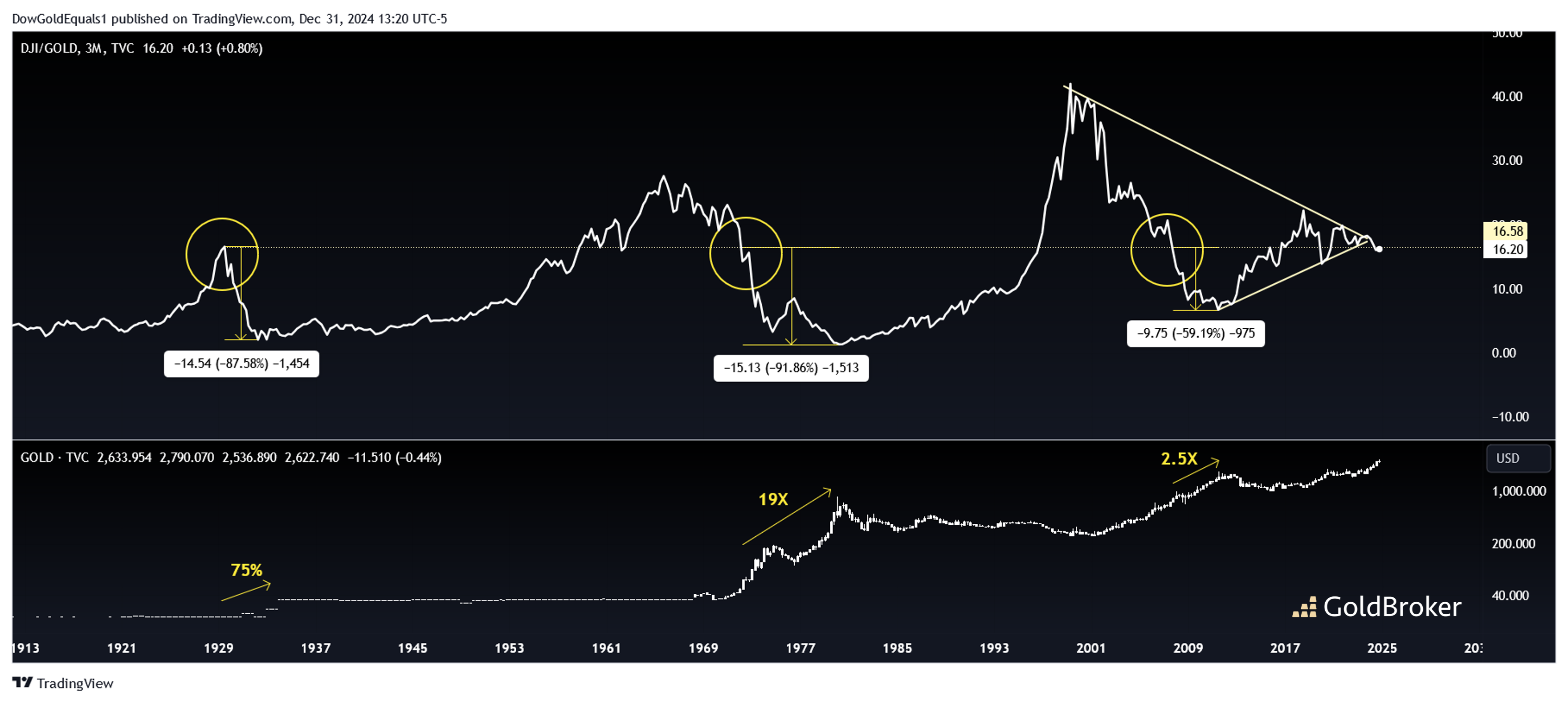

This week, we'll close out our chart analysis for 2024 with a look at a long term combo chart with the Dow/Gold ratio quarterly line above and gold below.

Immediately, we can see that the ratio is currently trading near an historically significant level near the 1929 high. We can see that price has fallen through that level 3 times in history, and when it has, the drop has been dramatic with an 87% decline after 1929, a 92% decline from 1972-1980 and a 59% decline from 2007-2011. This led to exceptional rises in the gold price of 75% (as a result of government revaluation),19X and 2.5X respectively.

Not only is the ratio once again trading below its 1929 level, it is also breaking below the apex of an extremely large wedge that began forming at gold's secular bear bottom in 2001. Falling below such a large technical pattern, combined with losing this historically important level may well mean the ratio is set for its 4th waterfall decline in the last 100 years. If so, precedent says that $4,500 gold is a lock, and a 10X of that level is not out of the question!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.