Inflation is back with a vengeance, at more than 7% in the US and 5% in Europe, "but don't worry" say the Fed and the ECB, "we will raise our key rates and reduce the size of our balance sheet" in order to beat it. This is the narrative that is being used at the moment, causing the markets to tremble as they are divided between the fall in stock prices, following the reduction in liquidity, and relief at the end of the price slippage.

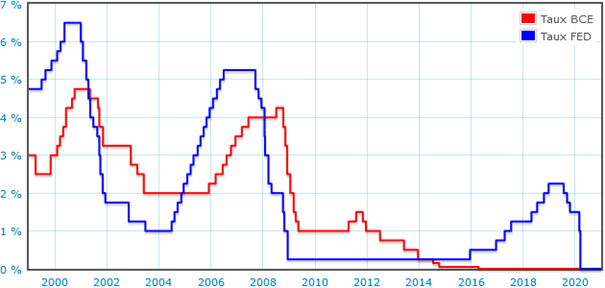

The central banks are in charge, we should not worry. Really? The problem is that these rate hikes have happened before and each time they ended very badly. The first massive drop in our recent history, which was as irrational as it was exaggerated, took place in the early 2000s, after the crash of Internet stocks in early 2000 and the attacks of September 11, 2001. At that time, it was imperative to avoid a recession that would have been interpreted as a victory for terrorism, so the Fed (the American central bank) lowered its key rate to almost zero in order to "support the economy". This liquidity fed the real estate market, notably thanks to a new financial product that allowed these credits to be recycled, the subprimes. We know what happened next. The rise in interest rates that began in mid-2004 was interrupted and the Fed's key rate fell back in 2007-2008 to deal with the recession and banking risk.

The European Central Bank (ECB) is content to follow suit. The aim is to avoid too strong an appreciation of the euro against the dollar. However, it will make its decision in 2011-2012 in order to face the Greek crisis. Its key rate joined that of the Fed, then fell to zero in 2016.

The Fed tried to return to a certain normality by gradually raising its key rate in 2018-2019, but it was a failure: long-term interest rates rose too much, stock prices fell, and economic activity slowed. The Fed halts this rise, then begins a decline in 2019, before dropping its rate to zero in March 2020, the date of the beginning of the health crisis (Covid-19) and the resulting lockdowns.

As we slowly emerge from the Covid parenthesis, is a real rise in policy rates on the horizon? We can doubt it: "Now, in 2022, the US economy is markedly weaker (sharp reduction in the fiscal deficit, falling real wages), and it is therefore unlikely, given the unfortunate experience of the past, that a truly restrictive monetary policy will be implemented in the United States." (Natixis). The ECB will follow and not take the initiative, as usual. The rise in rates will therefore be very limited. Therefore, inflation is here to stay...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.