The bad news is piling up for France, prompting some to take concrete decisions, such as transferring their capital abroad. Éric Dor, Director of Economic Studies at IESEG School of Management, pointed this out on X (Twitter).

The payment system between central banks and commercial banks in the eurozone - TARGET 2 - gives a clear picture of the disequilibrium between countries in the eurozone's internal balances of payments.

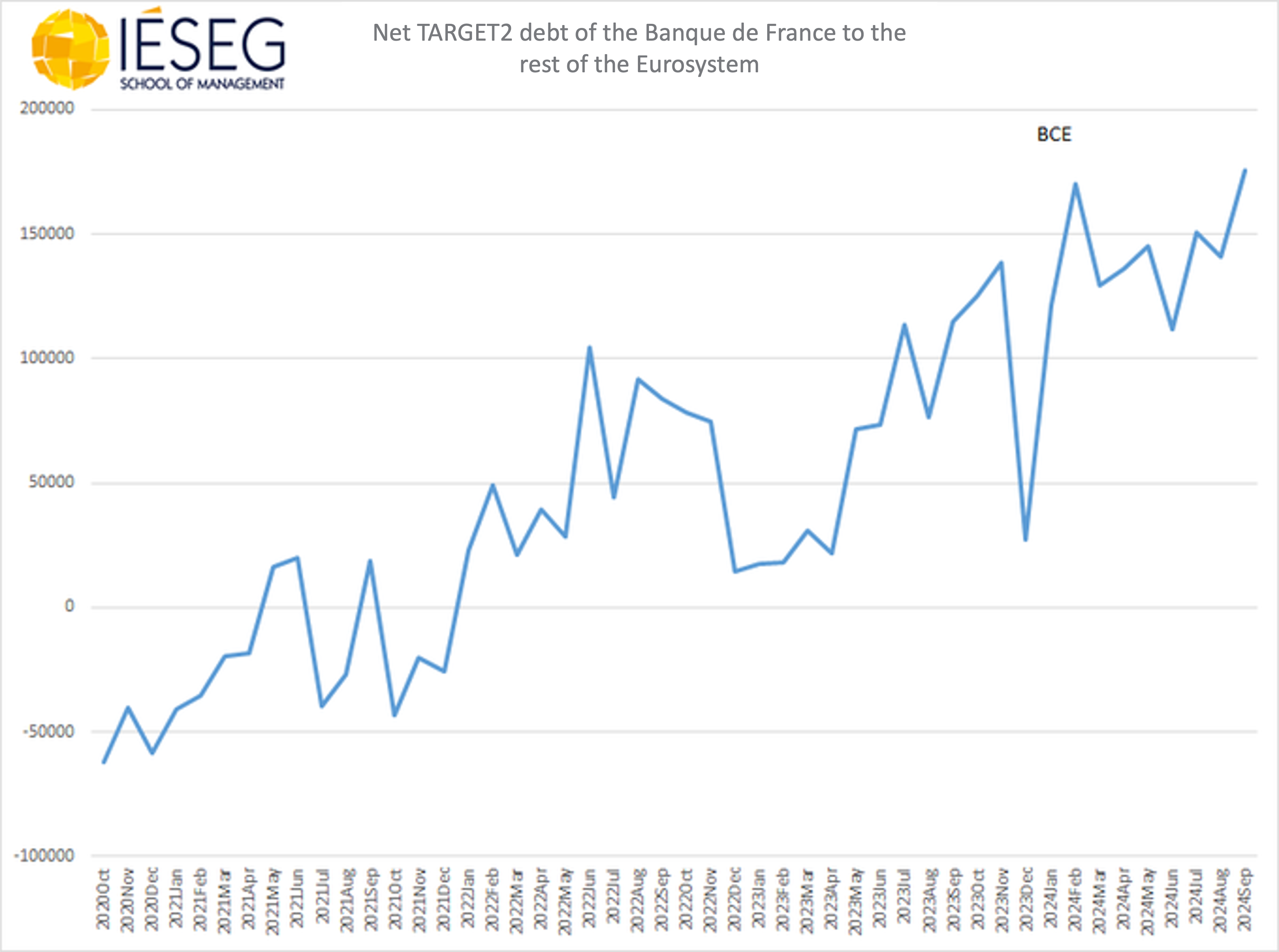

As the economist writes, "the Banque de France's TARGET 2 net debt reached an all-time high of 175 billion euros in September 2024. This must be the result of major capital outflows from France. A deterioration of 237 billion euros since the net claim of 62 billion in October 2020.”

A level of imbalance higher than at the time of the subprime crisis: “The huge TARGET 2 net debt of the Banque de France of 175 billion euros in September 2024 greatly exceeds the exceptional net debt of 117 billion in December 2008 during the great financial crisis with the massive withdrawals of funds from the money market.”

While there is no crisis, France is facing “major capital outflows”, which shows that its credibility as such is at stake. We also note that business bankruptcies are soaring to the record levels seen during the subprime crisis, demonstrating the seriousness of the situation. Without going so far as to close up shop or move their funds abroad, most companies are cutting back (halting investment, cost-cutting, downsizing) in anticipation of the likely tax hikes scheduled in the 2025 budget. It's the big depression!

The concerns are both microeconomic and macroeconomic: Standard & Poor's will publish its rating of French debt on November 29. A downgrade from AA to A would automatically lose buyers, many of whom are obliged to buy at least AA. The pressure on rates would intensify. There's nothing improbable about this scenario: a motion of censure toppling the government, and consequently the budget, would plunge the country into uncertainty.

But why are those who are worried about France's financial situation transferring their capital abroad? The main reason is simple: they fear a possible seizure. The mechanisms exist, and we've talked about them many times here, whether it's the BRRD directive (for bank accounts) or the Sapin 2 law (for life insurance). Such a drain of capital indicates that concerns about of a serious financial crisis are high, with the government unable to finance itself, or at prohibitive interest rates. This would have a direct impact on banks, whose balance sheets, filled with Treasury bonds, would suddenly become very fragile.

An offshore account is not readily available to everyone; however, a simple solution to protect yourself from this grim scenario is to buy physical gold (or bitcoin, provided you know your way around).

This TARGET 2 figure reflects a real concern, and clearly, well-informed people know things that are not yet relayed in the media...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.