“Specie (gold and silver coin) is the most perfect medium because it will preserve its own level, because having intrinsic and universal value, it can never die in our hands, and it is the surest resource of reliance in time of war.” — Thomas Jefferson

Since no current President or Prime Minister nor any Central Bank Chairman understands what money is or the relevance of gold, we turn above back to history and Thomas Jefferson, America’s third president for a proper definition.

Jefferson also understood that “Paper is Poverty, It is only the Ghost of Money, and not Money itself.”

As the world economy goes towards an inflationary depression exacerbated not only by epic debts and deficits but now also by war, the significance of gold takes on a whole different dimension.

So let’s dissect Jefferson’s statement:

“(GOLD) Will preserve its own level”

Gold is Constant Purchasing Power. As such, gold doesn’t go up in real terms. An ounce of gold today buys a good suit for a man just like it did in Roman times.

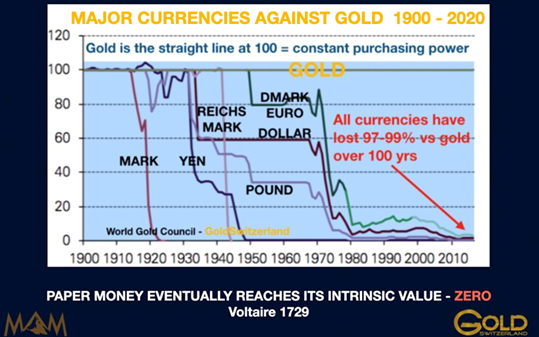

The graph below shows gold as constant purchasing power at the 100 line whilst all the currencies are crashing to the bottom.

All currencies are continuing to lose value against real money although it never takes place in a straight line. With higher interest rates & inflation, higher deficits & debts, poverty, cost of wars and increasing pressures in the financial system, the currency debasement will now accelerate.

Gold is not an investment. Gold is eternal money. As such gold maintains its REAL value whereas paper money loses all its value over time. For 5000 years gold has outlived all other forms of money including paper money.

We must remember that every paper currency in history has gone to ZERO, with no exception. The current monetary system is currently taking its last breaths. With the dollar and most currencies having lost 99% since the Fed was founded in 1913 and 98% since Nixon closed the Gold Window in 1971, it is guaranteed that the remaining 1-2% will be lost in the next few years.

But as I often point out, a loss of the remaining 1-2% means a 100% fall from today.

Anyone who doesn’t understand that is guaranteed to lose all his paper wealth within the next 5-10 years and possibly sooner.

“Intrinsic and universal value, it can never die in our hands”

Throughout history, Gold has never and will never become worthless. Gold is nature’s money and eternal.

Crypto currencies have for many become a religion or cult. For the ones who got in early, there were spectacular gains to be made. I do see that the blockchain could be useful technology but it could never be real money.

So cryptos have nothing to do with real money – gold. Also, they do not serve as a true form of wealth preservation. Bitcoin halving and Luna “dying in investors’ hands” and crashing to zero is certainly not conducive to protecting your wealth.

I am sure that central banks around the world will introduce Central Bank Digital Currencies – CBDCs. But these new currencies are just another form of Fiat money. As such they can and will be created in unlimited amounts and lose most of their value over time just like paper money. The one advantage for governments is of course the ability to track all transactions in their desire to control us all in a dystopian 1984 scenario.

But totalitarian societies do not survive since they are both against the laws of nature and human nature. Nevertheless they can create a very unpleasant period for many people.

The WEF’s (World Economic Forum) objective to create a society in which everybody will be poor and happy is total nonsense which would fail miserably just as a totalitarian society.

Yes, the WEF has a lot of billionaires and political leaders who love mixing with each other under the command of their leader Klaus Schwab, also a billionaire.

But the WEF will collapse as the billionaires lose most of their wealth and the Trudeaus of this world are thrown out in the greatest wealth transfer in history.

“Surest resource of reliance in time of war”

In every crisis in history, gold has always been money, both for nations and individuals. Since gold is universal money, it is the best medium of exchange for people fleeing from a war torn country. Since wars also often produce inflation and debasement of paper money, gold is the “surest resource” and is accepted in all countries.

So why is gold not going up and why don’t more people buy gold if it is so cheap?

I get these questions regularly.

All the ingredients are certainly in place for gold to go up:

INFLATION

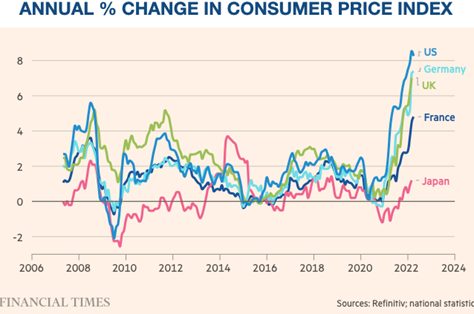

Inflation is increasing rapidly and most certainly soon reaching into the teens in many countries.

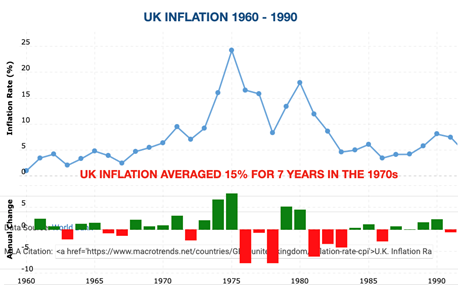

Having experienced inflation in the 1970s in the UK, I know how quickly it can accelerate. Between 1974 and 1981 UK inflation stayed above 10%, peaking at 24%. The average during that period was around 15%.

At an annual inflation rate of 15%, prices double every 5 years.

I would be surprised if inflation in many countries in the West doesn’t reach the 15% level.

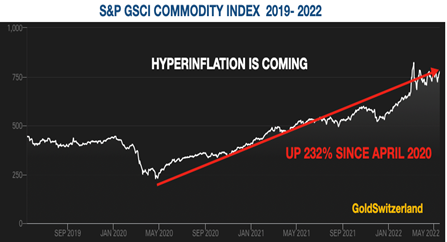

Commodity Shortages

There is a global shortage of commodities. Prices already started to rise in April 2020. The GSCI Commodity Index has gone up 232% since April 2020. Since the Ukrainian crisis started on February 20 this year, commodity prices are up 18%. The UN Food Agency stated already in the autumn of 2021 that the situation of food shortages was catastrophic and that was before the cut off of major supplies from Ukraine and Russia.

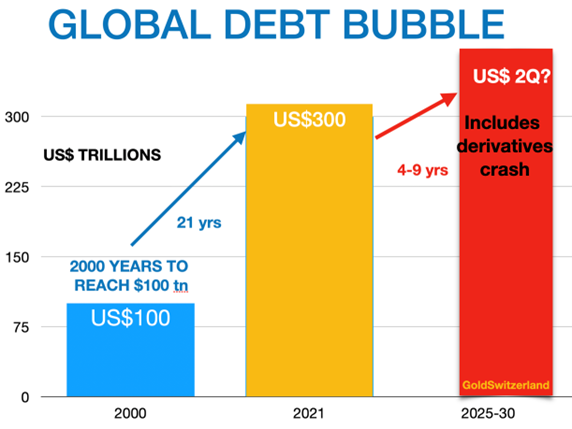

Growth of Global Debt & Money Supply

Global debt is growing exponentially and has trebled in this century. Growth in debt and money supply above GDP growth has over time a direct impact on inflation rates.

Most of the money created since the Great Financial Crisis 2006-9 has not reached consumers but gone into asset markets like stocks, bonds and property. That has kept the velocity of money at very low levels and until recently not affected consumer prices. But that is all about to change with rapid inflation increases to follow.

Nobody Owns Gold!

So if gold is the best performing asset class in this century why are only 0.5% of world financial assets invested in physical gold?

The simple answer is that most investors neither understand nor follow gold, which is why it is so cheap.

Virtually no investor is aware that gold has been the best performing asset class in the last 22 years.

But as inflation continues to rise, institutional investors in particular will be required to buy inflation protection. Stocks, bonds and property have become bubble assets with a massive downside risk and offering ZERO inflation protection.

Many investors will therefore turn to physical gold and precious metals mining stocks.

The total value of the 33 biggest mining stocks is only $210 billion with only 6 worth more than $10 billion.

Global stock market capitalisation is just over $90 trillion so gold mining stocks represent only 0.2% of that.

And if we add the total value of physical gold for private investment, total investable gold assets amount to $2.5 trillion. With global financial investment assets at $220 trillion, the physical gold investment market is only just over 1% of global assets.

What is clear is that the total sums in gold mining stocks or physical gold is minuscule compared to global financial investments.

So when institutional and other investors move into the gold market and increase their holdings from 0.5% to 1% of world financial assets, that would involve a $1.1 trillion investment in gold and gold mining stocks which at today’s prices would represent 50% of that market globally. And if the gold investments went from 0.5% to 1.5% of global assets, that would mean buying all the gold available in the world for investment.

It is self-evident that those quantities would not be available. The only way to satisfy increasing demand in the gold sector would be at a much higher price which could easily be 10x higher than current prices.

Gold on the Cusp of a Major Move

Gold went up 25x in the 1970s and then paused for almost 20 years as stock markets moved up substantially. Gold then bottomed in 1999-2000 at $250. Since then gold has outperformed stocks and most other asset markets.

Measured against paper money, gold went up around 8x since between 1999 and the 2011-12 peak.

It feels like gold has corrected for a very long time since the 2011-2 peak. But if we look at the annual chart of gold in dollars below, we find that the correction only lasted for 3 years in 2013 to 2015.

Studying the chart closely we find that between 2001 and today, there have only been three down years (red bars).

So what we are looking at is a very strong performance already and that is before we will see the effect of all the positive factors for gold mentioned above.

To measure gold in debasing fiat money does not serve much purpose. If I say that gold will go to $25,000, it is meaningless if we don’t relate the price to inflation or purchasing power.

I stated many years ago that gold will go to at least $10,000 in today’s money and that is still a realistic forecast bearing in mind all the positive factors for gold currently.

Or expressed more correctly, the negative factors for fiat money and for the world.

So when will Gold go up then?

Having been properly invested in physical gold for ourselves and our investors since early 2002, we never worry about the shorter term.

Gold is for long term wealth preservation and not for short term gratification.

Still, I know that many gold investors as opposed to wealth preservationists are still impatient.

Short term gold could be finishing a corrective move this week or in the next few weeks. $1,800 is support but as we know, support lines are often tested in order to drive out the longs.

So whatever happens in the short term is of little significance.

Long term I have not changed my mind that gold will reach levels which few can imagine.

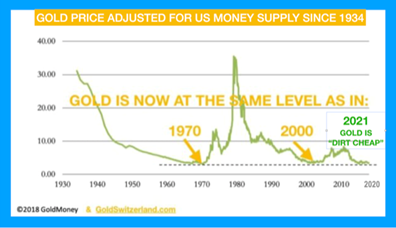

Gold as Cheap as in 1971 and 2000

Finally my favourite chart which shows that gold is a cheap today relative to US money supply as in 1971 when the price was $35 and in 2000 when gold was $290.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.