The price of gold in South Korea rose sharply, fuelled by a “fear of missing out” (FOMO) rush. This resulted in a record “kimchi premium”, with a spread of almost 20% over the London market. On February 14, gold was trading at 161,990 won per gram in Korea, compared with 135,588 won in London.

The depreciation of the Korean won against the US dollar also contributed to this price surge.

In response to this strong demand, South Korean banks suspended the sale of gold and silver bars, citing a shortage.

Korean investors, no longer able to buy gold, turned to silver, causing a new shortage and also leading to a temporary suspension of silver bars sales.

The Korea Stock Exchange has announced a halt to the supply of silver bars, having already restricted the supply of gold bars due to high demand. Some banks, such as Woori Bank, were informed of this decision on February 13. In addition, 1 kg gold bullion bars are becoming increasingly scarce, with prices exceeding 160 million won, limiting purchases to large investors.

This rush to physical silver is causing the metal to soar, marked by a significant breakout on Friday:

The current silver breakthrough is an exceptional event. Its annual chart shows an explosive dynamic, reminiscent of the historical trends observed in the 1970s:

This breakout comes at a time when short positions in silver are at record levels. Short interest on SLV has reached a new high for the year, with over 62.7 million shares sold short!

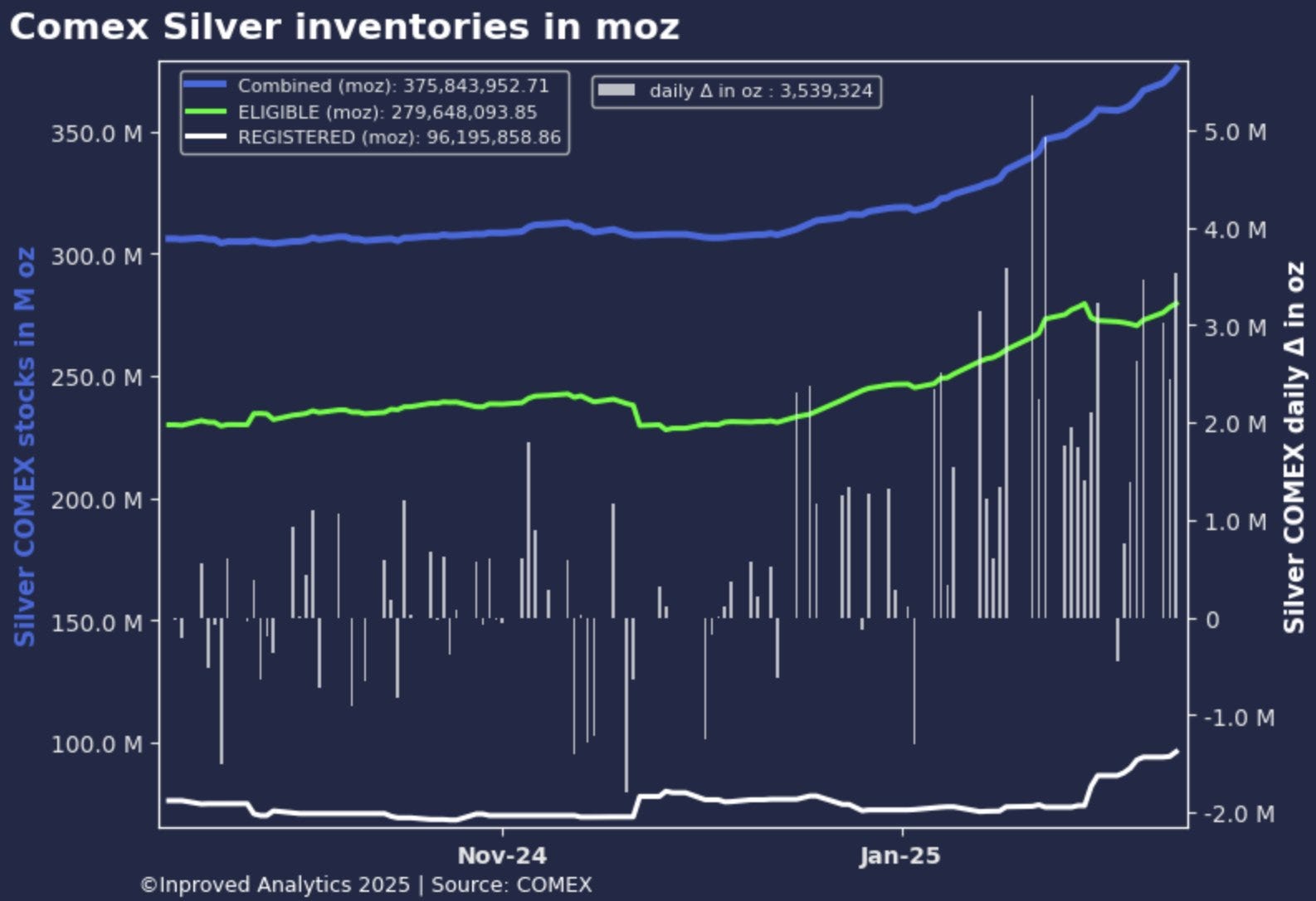

On the COMEX, silver is beginning to experience the same exceptional rush we're seeing on the gold market. Demand for the physical metal is intensifying, putting ever-greater pressure on inventories and pointing to a potential shortage similar to that of gold.

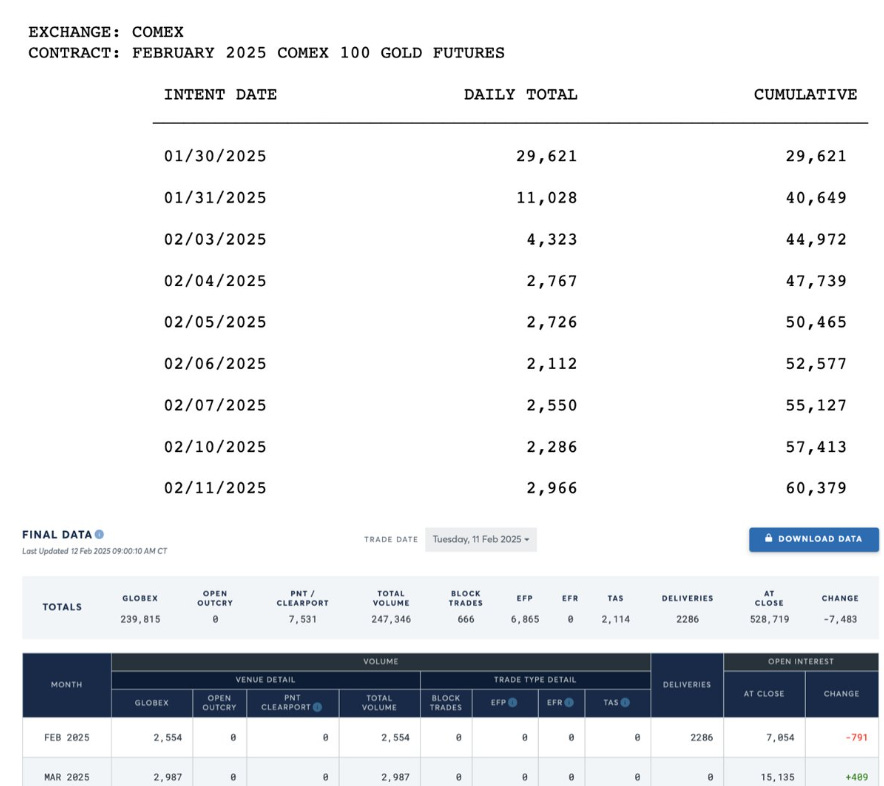

As a reminder, gold deliveries on the COMEX for the February 2025 maturity (EB25) have now exceeded 60,000 contracts and are likely to reach a record of over 70,000 contracts, or more than 200 metric tons of gold:

At the same time, open interest in the March 2025 contract (Mar25), which is supposed to be a contract without physical delivery, continues to grow.

The COMEX has become a veritable vacuum cleaner for physical gold, absorbing massive quantities of the metal. Now it's turning into a physical silver vacuum cleaner, with growing demand putting unprecedented pressure on available stocks.

The COMEX continues to empty LBMA stocks, even in February. Every day, huge quantities of silver flow into the COMEX, and in the first three days of this week, 280 metric tons were added. Since the beginning of the year, 70 million ounces of silver have been accumulated on the COMEX, or almost 2,200 tons!

What's striking is that this accumulation doesn't just involve JPMorgan or one or two other major banks, but seven of the eight main market players.

The question is no longer whether COMEX will continue to drain the LBMA's reserves, but how long it can do so.

Late in Friday's session, sales of COMEX futures succeeded in bringing back the price of silver below $33. For the time being, the derivative paper market is still determining short-term prices. But until when?

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.