I am a collector of the small stones sown on the path to international monetary reform, which is currently underway.

This quest began in November 2008 when, at the G20 meeting in Washington, France, Great Britain, Germany and China, to name but a few of the nations, demanded a Bretton Woods II, i.e. a reform to change the international monetary system put in place in 1944. It is true that in 1971, the United States unilaterally decided to put an end to the Gold Standard Exchange system and that since then, the dollar has been nothing more than a fiduciary currency, printable at will. A quick look back.

As you all know, in 1988, following meetings of the G10 central banks under the aegis of the Bank for International Settlements (BIS), an agreement was signed to ensure the stability of the international banking system. This July 1988 agreement is known as Basel I. It was followed by successive agreements. We are now in Basel III, whose flagship measures must be implemented in all banks by January 1, 2022, in other words, before the end of December 2021. Remember this date.

It was also in 1988 that The Economist magazine published a mythical cover and an article announcing the advent of a new world currency "around 2018". "30 years from now... The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today." The SDR, created in 1969, is a basket of international currencies managed by the IMF. "In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power."

In March 2009, China published a letter of intent on what the new monetary system should aim to achieve, which can be found on the BIS website. The Governor of the Chinese Central Bank emphasizes the currency and its composition:

"Back in the 1940s, Keynes had already proposed to introduce an international currency unit named “Bancor”, based on the value of 30 representative commodities. Unfortunately, the proposal was not accepted."

"The allocation of the SDR can be shifted from a purely calculation-based system to a system backed by real assets, such as a reserve pool, to further boost market confidence in its value."

Since then, China has been working to establish an international monetary system in line with its wishes. The list of actions it has implemented would be too long and tedious, but it has been very active for the past 10 years. Let's get back to the news.

ONE MORE LITTLE STONE ON THE PATH

This is an essential article published on April 5, 2019 on Project-Syndicate, an international showcase linked to 459 media in 155 countries. To advance an idea, you have to go on this network. The author of the article is a member of the Board of Directors of the Central Bank of Colombia and a very active member of the UN. Its publication is therefore not insignificant.

TIME FOR A TRUE GLOBAL CURRENCY

The International Monetary Fund’s global reserve asset, the Special Drawing Right, is one of the most underused instruments of multilateral cooperation. Turning it into a true global currency would yield several benefits for the global economy and the international monetary system.

This year, the world commemorates the anniversaries of two key events in the development of the global monetary system. The first is the creation of the International Monetary Fund at the Bretton Woods conference 75 years ago. The second is the advent, 50 years ago, of the Special Drawing Right (SDR), the IMF’s global reserve asset.

When it introduced the SDR, the Fund hoped to make it “the principal reserve asset in the international monetary system.” This remains an unfulfilled ambition; indeed, the SDR is one of the most underused instruments of international cooperation. Nonetheless, better late than never: turning the SDR into a true global currency would yield several benefits for the world’s economy and monetary system.

The idea of a global currency is not new. Prior to the Bretton Woods negotiations, John Maynard Keynes suggested the “bancor” as the unit of account of his proposed International Clearing Union. In the 1960s, under the leadership of the Belgian-American economist Robert Triffin, other proposals emerged to address the growing problems created by the dual dollar-gold system that had been established at Bretton Woods. The system finally collapsed in 1971. As a result of those discussions, the IMF approved the SDR in 1967, and included it in its Articles of Agreement two years later.

Although the IMF’s issuance of SDRs resembles the creation of national money by central banks, the SDR fulfills only some of the functions of money. True, SDRs are a reserve asset, and thus a store of value. They are also the IMF’s unit of account. But only central banks – mainly in developing countries, though also in developed economies – and a few international institutions use SDRs as a means of exchange to pay each other.

The SDR has a number of basic advantages, not least that the IMF can use it as an instrument of international monetary policy in a global economic crisis. In 2009, for example, the IMF issued $250 billion in SDRs to help combat the downturn, following a proposal by the G20.

Most importantly, SDRs could also become the basic instrument to finance IMF programs. Until now, the Fund has relied mainly on quota (capital) increases and borrowing from member countries. But quotas have tended to lag behind global economic growth; the last increase was approved in 2010, but the US Congress agreed to it only in 2015. And loans from member countries, the IMF’s main source of new funds (particularly during crises), are not true multilateral instruments.

The best alternative would be to turn the IMF into an institution fully financed and managed in its own global currency – a proposal made several decades ago by Jacques Polak, then the Fund’s leading economist. One simple option would be to consider the SDRs that countries hold but have not used as “deposits” at the IMF, which the Fund can use to finance its lending to countries. This would require a change in the Articles of Agreement, because SDRs currently are not held in regular IMF accounts.

The Fund could then issue SDRs regularly or, better still, during crises, as in 2009. In the long term, the amount issued must be related to the demand for foreign-exchange reserves. Various economists and the IMF itself have estimated that the Fund could issue $200-300 billion in SDRs per year. Moreover, this would spread the financial benefits (seigniorage) of issuing the global currency across all countries. At present, these benefits accrue only to issuers of national or regional currencies that are used internationally – particularly the US dollar and the euro.

More active use of SDRs would also make the international monetary system more independent of US monetary policy. One of the major problems of the global monetary system is that the policy objectives of the US, as the issuer of the world’s main reserve currency, are not always consistent with overall stability in the system.

In any case, different national and regional currencies could continue to circulate alongside growing SDR reserves. And a new IMF “substitution account” would allow central banks to exchange their reserves for SDRs, as the US first proposed back in the 1970s.

SDRs could also potentially be used in private transactions and to denominate national bonds. But, as the IMF pointed out in its report to the Board in 2018, these “market SDRs,” which would turn the unit into fully-fledged money, are not essential for the reforms proposed here. Nor would SDRs need to be used as a unit of account outside the Fund.

The anniversaries of the IMF and the SDR in 2019 are causes for celebration. But they also represent an ideal opportunity to transform the SDR into a true global currency that would strengthen the international monetary system. Policymakers should seize it.

JOSÉ ANTONIO OCAMPO

José Antonio Ocampo is a board member of Banco de la República, Colombia's central bank, professor at Columbia University, Chair of the UN Economic and Social Council’s Committee for Development Policy, and Chair of the Independent Commission for the Reform of International Corporate Taxation. He was Minister of Finance of Colombia and United Nations Under-Secretary-General for Economic and Social Affairs. He is the author of Resetting the International Monetary (Non)System, and co-author (with Luis Bértola) of The Economic Development of Latin America since Independence.

This is an article published on April 15 on the Adam Smith Institute website by a former IMF SDR specialist.

Adam Smith (June 5, 1723 - July 17, 1790) is a Scottish philosopher and economist of the Enlightenment. He remains in history as the father of modern economics, whose main work, published in 1776, "The Wealth of Nations", is one of the founding texts of economic liberalism.

The Adam Smith Institute is a very influential think tank in Britain, behind the reforms undertaken by the Conservative Party under Margaret Thatcher and John Major.

The author of the article, Warren Coats, joined the IMF in 1976, where he became head of the SDR division in 1983. He has written two books on the SDR and published three on currency. He retired from the IMF in 2003, while remaining in the high finance circle as a consultant. He is a member of an impressive number of think tanks.

In this article, whose dialectic may seem complex, he advocates ending the Fed's discretionary management, which allows it to create as many dollars as it wants, when it wants, to return to a system close to the previous system, where the Fed could only create dollars according to the gold in its vaults.

"Another weakness of the gold standard was that the price of the anchor, based on one single commodity, varied relative to other goods, services and wages. While the purchasing power of the gold dollar was relatively stable over long periods of time, gold did not prove a stable anchor over shorter periods relevant for investment.

Expanding the anchor from one commodity to a basket of 10 to 30 with greater collective stability relative to the goods and services people actually buy (e.g. the CPI index), would reduce this volatility. The basket would consist of fixed amounts of each of these commodities and their collective market value would define the value of one dollar. There have been similar proposals in the past, but the high transaction and storage costs of dealing with all of the goods in the valuation basket doomed them. However, with indirect redeemability discussed next, the valuation basket would not suffer from this problem."

In its text, Coats refers to an article written in 2011 in the Central banking Journal:

"An enhanced special drawing right (SDR), valued by a basket of goods, would provide the global currency and reserve asset the global economy craves. This paper proposes linking the value of the International Monetary Fund’s SDR and national currencies that fix their exchange rates to the SDR to a representative basket of widely traded goods. The new “real SDR” would be issued and redeemed passively according to “Currency Board” rules in exchange for financial assets with the same market value as the basket. National currencies and/or an international reserve currency with the same value (i.e. fixed to a common unit of account) would lower the cost of trading by reducing transaction and information costs and exchange rate risk and would thus increase world trade and improve the efficiency of international resource allocation. A system anchored to a goods basket would not have the shortcomings that afflict the gold standard-gold's fluctuating relative value. The indirect redeemability rule, issuing and redeeming real SDRs for financial assets of equivalent value would avoid the shortcoming that makes multi-good commodity standards very costly — the need to maintain large reserves of all of the commodities in the basket. The innovative idea of indirect redeemability, discussed by Yeager, Greenfield, and others, keeps the quantity of SDRs equal to the amount demanded when its value is given by the valuation basket, without the need for the monetary authority to warehouse the goods in the basket."

In 2011, Coats took over China's proposal published in March 2009. A kind of SDR secured by a basket of "real assets" in reserve, which is nothing more than BANCOR's proposal from Keynes to Bretton Woods...

This is also what The Economist announced in 1988 in its article.

The IMF Executive Board reviews the SDR assessment basket every five years, or more frequently if circumstances warrant. The last revision was completed on November 30, 2015. The new SDR came into force on September 30, 2016.

The next revision of the SDR evaluation basket will take place in November 2020 for entry into force one year later.

***

The next revision of the SDR valuation method will take place on September 30, 2021, unless circumstances warrant early revision in the meantime. (Source IMF)

It may be that the revision of the valuation method will profoundly change the situation, by including elements in the basket that are not purely monetary.

***

Remember that originally, in 1969, the value of a SDR was defined as the equivalent of 0.888671 grams of pure gold, which was then also equivalent to 1 US dollar (1 ounce of gold = 35 SDR = 35 US dollars).

THE BANCOR PRINCIPLE

In the very principles of BANCOR, the trade balance of nations must be balanced. If a country has a trade surplus, the international trade supervisory body will decide to revalue the country's currency upwards in order to make its exports less competitive and/or devalue the country's currency in trade deficit, in order to make its products more competitive for export, while reducing its purchasing power.

The subject is totally topical with the so-called "Trade War" between the United States and China, which has been on the front page for several months.

China, having itself announced its desire to see Keynes' BANCOR set up, knows that the solution to resolve the huge imbalance in Sino-American trade is to revalue the yuan and devalue the US dollar.

China has prepared for this. While it has been flooding the world with very low-end consumer goods since the 1980s, it has moved up in recent years to offer products that surpass Western products in quality and technology, such as phones and computers. On the other hand, the United States, which has relocated a large majority of its production to third world countries, has a long way to go to recreate the industrial fabric that has disappeared since the 1980s.

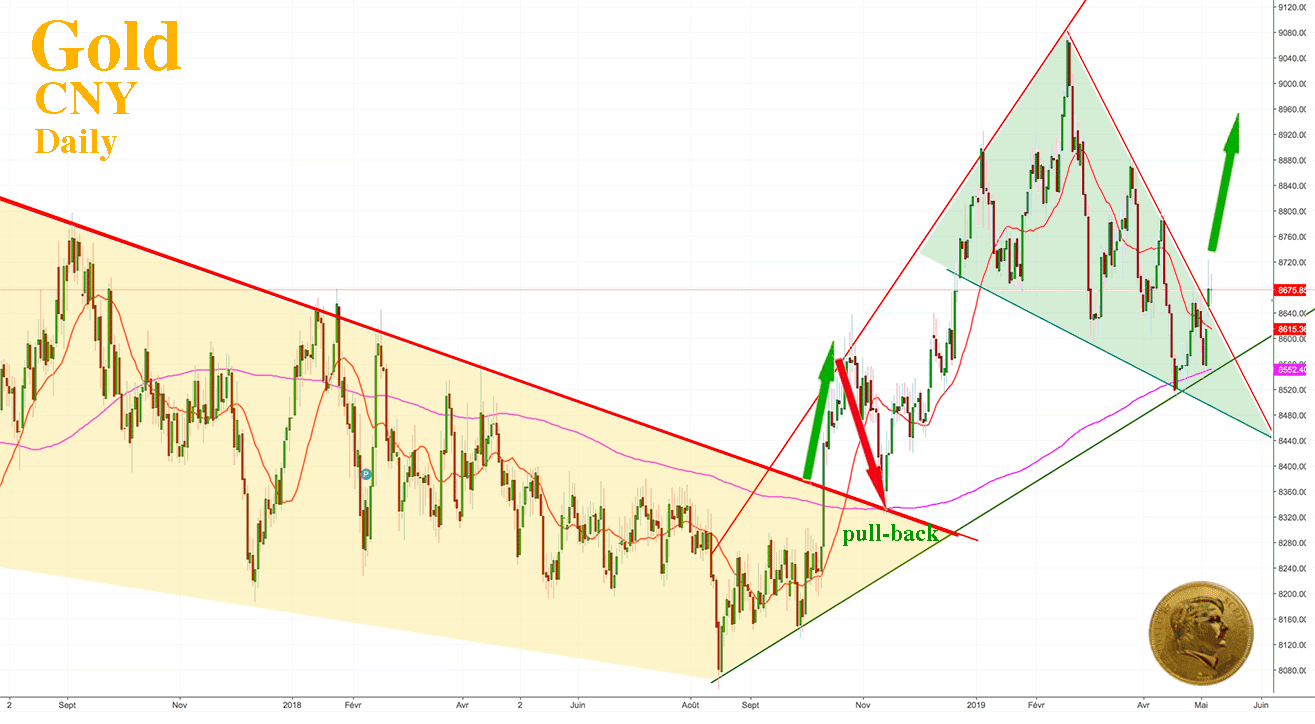

Trump's unbalanced Twitter posture has an immediate impact on the USD/CNY exchange rate and the gold price in yuan. China seems to me today to be the driving force in the gold price.

Over the past two days, gold in yuan has broken the resistance of the falling wedge, which pushed gold down, opening a vast space for it to rise.

Gold in other currencies will follow as China is now the world's largest physical gold market.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.