The final stages of major economic cycles are always accompanied by the maximum amount of bad news as well as heinous events. This time is no different as the West is in the process of committing Harakiri (Seppuku).

As Elon Musk said:

My mentality is that of a Samurai. I would rather commit Seppuku than fail.

Sadly, the problem for the West is that it is both committing Harakiri and failing.

For at least half a century, the world has been in a process of self-destruction.

As the decline accelerates, the next phase of 5-10 years will include major political, social, economic as well as wealth – destruction.

What can be more heinous than a total economic and financial collapse accompanied by a potential World War III that at worst could destroy the world totally.

A recent article of mine discussed global fragility due to War, Debt and Energy Depletion.

In this article I outline the major risks today, financial and geopolitical and also discuss the best way to protect against these risks. Physical gold is of course the ultimate wealth preservation investment. The next major move up in gold is not far away. See further on.

Biden’s recent visit to Ukraine and whistle stop tour of Europe confirmed that there is no desire to make peace but only war. More support of weapons and money from the US is forthcoming. And whatever the US dictates, Europe follows without considering the consequences.

At the end of his Warsaw address Biden stated about Putin: “For God’s sake, this man cannot remain in power”.

Hmmm…. Hardly the talk of a peace maker.

China on the other hand is trying to act as peacemaker but their proposal last Friday was cold shouldered by the West.

More importantly, the Chinese Ministry of Foreign Affairs issued an important policy document this week which is a very strong attack on the US hegemony called “US Hegemony and Its Perils”.

The attack starts in the introduction:

“Since becoming the world's most powerful country after two world wars and the Cold War, the US has acted more boldly to interfere in the internal affairs of other countries, and to pursue, maintain and abuse its hegemony, advance subversion and infiltration, and willfully wage wars, bringing harm to the international community."

It then goes on in detail to attack all the areas of US Hegemony like: Political – Throwing its Weight Around, Military – Wanton Use of Force, Economic – Looting and Exploitation, Technological – Monopoly and Suppression, Cultural – Spreading False Narratives.

The document exemplifies in detail the hegemonic policies and attacks of the US. Although US politicians will totally reject its contents, it is difficult to argue with the facts put forward by China.

As I mention regularly, I very much like America and its people but have difficulties accepting the policies of the Neocons who dominate US politics.

Here is an extract from the conclusion in this Chinese document:

“The United States has been overriding truth with its power and trampling justice to serve self-interest. These unilateral, egoistic and regressive hegemonic practices have drawn growing, intense criticism and opposition from the international community.

Countries need to respect each other and treat each other as equals. Big countries should behave in a manner befitting their status and take the lead in pursuing a new model of state-to-state relations featuring dialogue and partnership, not confrontation or alliance. China opposes all forms of hegemonism and power politics and rejects interference in other countries’ internal affairs.”

It is difficult to argue with this conclusion. But we need to wear the moccasins of the US and rest of the world and look at China from that perspective. This is to follow my adage to walk three moon laps in somebody’s moccasins before you judge him.

China is not attacking various countries in the world by force, but primarily using investments and trade routes to dominate the world like the Modern Silk Road called the Belt and Road Initiative. It sets out to connect 65% of the world’s population to China by creating a network of sea routes and land links. China is estimated to have spent $1 trillion so far but total estimates are as high as $8 trillion. It will most likely take decades to achieve and might become too costly as the world economy declines.

However, what is clear is that China is investing heavily in infrastructure around the world both in Europe, Africa and South America. For example China is buying up ports in a substantial number of countries. They are also investing heavily in the resource sector globally.

Another problem that the West has with China is their human rights record.

Regardless, the trend is clear. The West is in a long term structural decline and the shift to China and the rest of the East and the South is inevitable as I discussed in the article “As West, Debt & Stocks Implode, East, Gold & Oil Will Explode”.

The Structural Decline Of The West

All empires are ephemeral and this is what the US and Europe are currently experiencing.

The final stages of empires, like the Han, Roman, Mongol, Ottoman, Spanish and British always include the same ingredients some of which are:

- Excessive Debts and Deficits

- Currency Collapse

- Collapse of asset prices including property, bonds and stocks

- Hyperinflation in the final stages, especially in food, commodities & services

- Migration

- High Crime Rates & Breakdown of Law & Order

- Moral Decadence

- Social Unrest, Civil War

- Wars

As the West is now falling (& failing), we can tick all the above events also in the current collapse.

Global debt has exploded since 1971 to $2-3 quadrillion as I have explained in many articles like here.

If it wasn’t for the Petrodollar, the US would have collapsed years ago. But as more countries are considering trading oil in other currencies like yuan, the dollar will first Gradually lose its value and then Suddenly to paraphrase Hemingway.

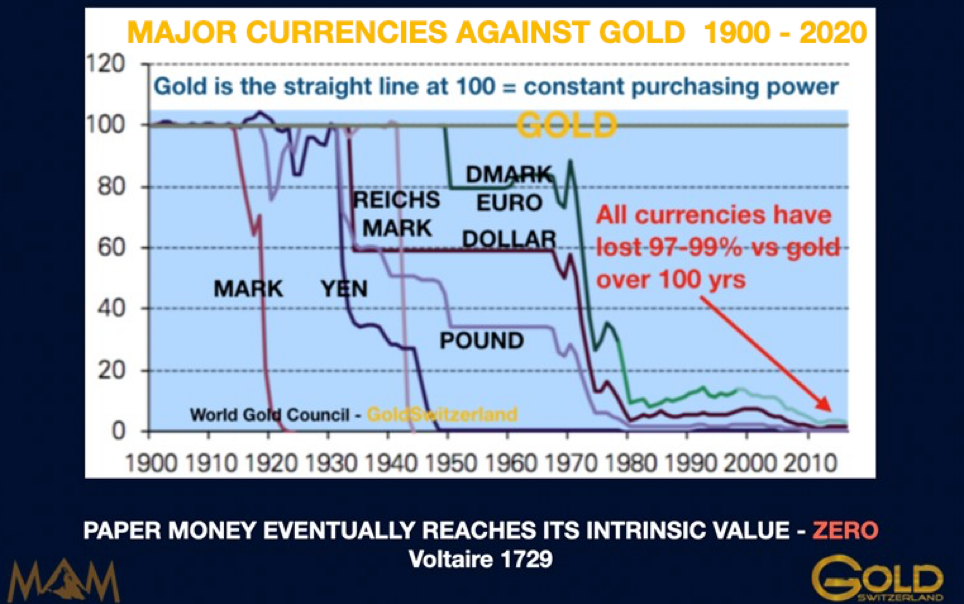

But remember that since Nixon closed the Gold Window in 1971, all currencies have lost at least 97-99% of their value in real terms which is against gold.

Empires seldom die overnight so this process which started in 1971 could take another 5-10 years. But since we are now in the final stages, it could also happen Suddenly.

So let’s paint a potential scenario for the next 5-10 years.

In simple terms it will be more of the same if we look at the 9 points above.

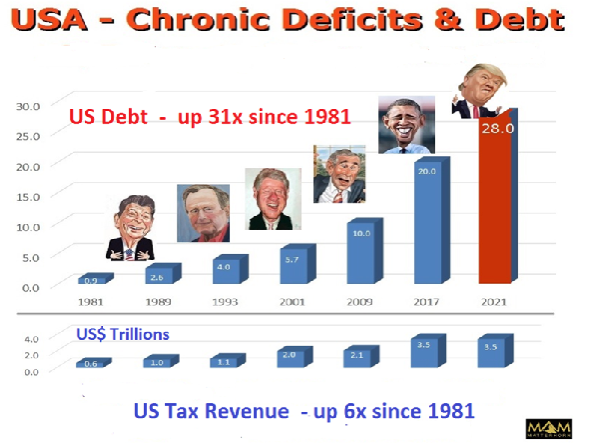

Debts and deficits will increase exponentially. I have for many years shown the growth in US debt which on average has doubled every 8 years since Reagan became president in 1981.

On December 6, 2016, the chart below was included in a Family Office presentation I gave in London:

I projected then in 2016 that when Trump would reach the end of his first term in January 2021, US debt would be $28 trillion on the way to $40 trillion four years later in 2025.

Interestingly, the debt was $28T in Jan. 2021. It doesn’t require a genius to project this figure as it is a straight extrapolation of the trend dating back 40 years. Still, I didn’t see anyone forecasting anywhere near the $28T debt in 2016.

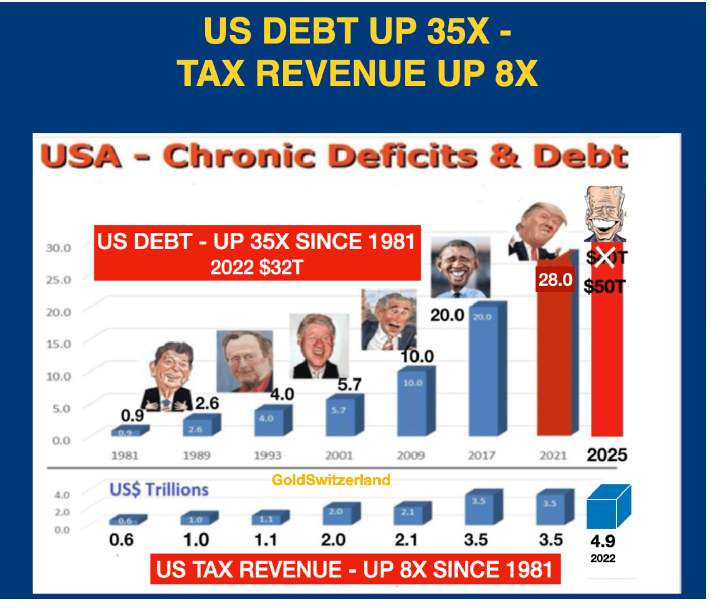

A couple of years ago, I raised my $40T debt in 2025 to $50T as the chart below shows:

So how is the US going to go from $32T to $50T in 3 years. Well, in the same way as bankrupt countries collapse with tax revenue falling precipitously and expenditure exploding.

The Road To Perdition For The US & The West

As the value of the dollar collapses, think:

- Much higher war costs, social security, and pensions. As pension fund assets implode, there probably won’t be any pensions.

- Debt collapse both private and public with $2-3 quadrillion of derivatives turning into debt.

- All bubble assets of stocks, bonds and property, only held up by fake money, collapsing by 75-95% in real terms.

- Banks and financial institutions failing after initially having received $100s of trillions in printed, thus worthless, government support.

- With high inflation or hyperinflation, interest rates going to at least 20% or probably much higher. Financing a debt in the quadrillions at 20%+ will of course lead to even more money printing. The Fed and other central banks will clearly lose control of interest rates which will be determined by a market in panic..

Will There Be A Global Nuclear War?

The US has at this point stressed that there will be no uniformed US military in Ukraine. Both Russia and Ukraine has lost around 150,000 soldiers each. The problem for Ukraine is that this is around 50% of their regular soldiers whilst for Russia it is 13%. Also, a major part of the weapons and ammunition from the West is not forthcoming or substantially delayed. There just isn’t the spare capacity available to fulfil those promises.

At this point, it looks like this war at best will be a very long drawn local conflict although Ukraine will find it difficult to sustain the war. In January 2022 the Ukraine population was 41 million and now 14 million are estimated to have left the country.

In a war of this nature between two super powers, it is impossible to forecast the outcome. An “accident” or false flag can easily trigger the start of a nuclear war.

Remember that this is a war between the US and Russia. So if there was a nuclear war, most missiles would be directed towards those two countries and potentially Ukraine.

But if the world will see a nuclear war, all bets are off since some parts of the world would then be destroyed for decades. Therefore, it is not worth speculation about.

Wealth Preservation & CBDCs

So assuming that this war remains a local conflict in Eastern Europe, how should people outside the war zone prepare financially?

Many countries are planing to introduce Central Bank Digital Money or CBDC.

As the current monetary system in the West collapses, CBDC will only be another form of fiat money. The worst part about it is the ability to spy on and control people that it gives governments. As Western governments’ finances implode, CBDC is the perfect system for the likely socialist or Marxist economies that many Western countries are likely to have.

For individuals who have the freedom to move, it would be preferable to leave the heavily indebted USA and Europe (especially the EU countries).

One country in Europe still stands out as probably the best in the world both politically, economically and socially. This is of course Switzerland.

Yes, I have skin in the game here! I am Swiss from birth and pleased that I am. I was born and educated in Sweden and also like Sweden.

But whilst Switzerland has remained a very sound country, Sweden has deteriorated dramatically. It now has one of the highest crime rates in Europe. As in the last 10-15 years Europe opened its borders for refugees from many poor and war struck countries, this has totally changed Swedish society.

There is nothing wrong with immigration. The world has always had migration. But until recent years, migrants had to look after themselves with no government subsidies. But in many countries in Europe and especially in Sweden, migrants arrive and get free housing and money to live. For many, there is no incentive to work and or to learn Swedish. Sadly an important percentage of men turn to crime and especially drug dealing. Fatal shootings between the immigrants are now happening daily in Sweden whilst 20 years ago, private weapons didn’t exist.

The best proof of a sound country and economy is the currency.

When I, as a younger man, came to Switzerland in the late 1960s, 1 Swiss Franc cost 1.10 Swedish Kroner. Today it costs 11.20 Swedish Kroner to buy one Franc. So the Krona has lost 90% in the last 50+ years.

The Swiss Franc has of course been strong against all currencies. The dollar for example has lost 80% against the Franc over 50 years.

The Superior Swiss Economy And Political System

But Switzerland has so much more than a strong currency and economy like:

- Low debt, normally no deficits

- Lowest crime rate in Europe and in the world (excluding some Middle East countries. It is one of the few countries where you can walk safely in any town at night.

- Rule of Law

- Direct Democracy allowing the population to have a referendum on virtually any topic. If the referendum is approved by a majority, it becomes part of the constitution and cannot be changed by government or parliament but only by another referendum. This is totally unique in the world.

- For example there will be a referendum on stopping Switzerland from becoming cashless

- Whilst all EU countries have decided to confiscate Russian assets, Switzerland has declared: “The expropriation of private assets of lawful origin without compensation is not permissible under Swiss law,” the government said on Thursday. “The confiscation of frozen private assets is inconsistent with the constitution,” it added, and “violates Switzerland’s international commitments”.

- The standard and quality of everything is very high, services, construction, communications etc

- Switzerland also has beautiful nature, and excellent food.

Risk Of War In Europe

Some countries are worrying about a war in Europe. Except for a nuclear war which would be global, the risk of a war on the ground in Europe is in my view minimal.

Russia has been invaded many times with the most famous examples being Karl XII of Sweden in the early 1700s, Napoleon in the early 1800s and Hitler in the 1940s. But Russia has never made any serious invasion into Europe. Their interest lies primarily within their former empire. There was a brief entry into Finland at the beginning of WWII which lasted 3 months. Also at the end of WWII the Russians drove the invading Germans back to Berlin.

So in my view, there is absolutely no reason to fear a Russian invasion of Europe.

Wealth Preservation & Gold

To protect your wealth against all the risks that I have outlined above is absolutely vital. Anyone invested in conventional assets like stocks, bonds and property, which have been artificially inflated by printing fake fiat money will in the coming 5+ years experience a major collapse of their wealth.

As I already said, for anyone who has the ability to move to a country outside the US and the EU, that would be the safest option. It is likely that these areas will have the biggest problems both in the economy and the financial system as well as socially. In that region, Switzerland will be an important exception.

Parts of South America like Uruguay should also avoid many of the problems in the West but sadly crime is high in many of these countries. Many Americans live in Central America but with the coming economic downturn, many countries will become less safe and also poor. In Asia, countries like Singapore and Thailand are very good but if there is a conflict between the US and China after a possible Chinese invasion of Taiwan, these areas could become more precarious.

The problem with Australia and New Zealand is that they are highly indebted with big asset bubbles, especially in property. The socialist policies are not a plus either. But the biggest risk is that a conflict in Taiwan could make these countries very risky with Chinese aspirations.

Many people are moving to Dubai today for tax reasons. Russians are moving there since Dubai doesn’t sanction them. The problem with the UAE is that conflicts in the Middle East occur with regular intervals.

For the ones who can’t move for job or family reasons, a second passport is advisable.

But the most important asset protection is having wealth preservation assets outside your country of residence.

There is no totally safe country today in an unsafe world.

For investors who want to preserve their wealth, the best asset is physical gold followed by the more volatile silver. Gold and silver shares have had a terrible 35 years but the good companies should perform spectacularly. Since most stocks are held by custodians within the financial system, they are not the same degree of wealth preservation as physical metals that you have direct control of.

So my own preference would be to own physical gold and silver that I have direct control of and can withdraw or sell with very short notice.

It is also important to deal with a company that can move your metals at very short notice if the security or geopolitical situation would necessitate it.

Our gold vault in the Swiss Alps is the biggest private gold vault in the world and is also nuclear bomb proof which is totally unique. This is for bigger investors. We also store gold in Zurich. Our second preference is Singapore with the reservations I have mentioned. We also have vaults in many parts of the world and as I have stated, this can be important if the situation in the world changes and the gold/silver needs to be moved.

The world is now moving towards troubled times.

Remember that family and friends are your most important asset and treasure them profoundly.

Also, except for family and friends, many of the best things in life are free like books, nature, music, and sports.

Original source: Matterhorn - GoldSwitzerland

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.