If you spend much time listening to the political pundits, you'd think that our monetary inflation over the past few years was a "transitory" phenomenon, one caused exclusively by COVID, and a problem no longer worth worrying about as it fades into our rearview mirror. Unfortunately, I'm here to tell you that this assessment is just plain wrong, and I will demonstrate why in a few charts.

First, some context by way of a 100-year inflation chart of the US Dollar, which I have defined as a pretty convincing wedge. Note that the most calamitous times of the United State's monetary history - the Great Depression, 1970's inflation, and more recently COVID inflation - are all captured by the wedge. Now note that time is running out as we quickly approach the apex of this wedge over the coming couple of decades. Can the US thread the needle and keep inflation held within a tighter and tighter range so that the wedge is not violated? Or, will something happen - an accident - to send inflation's rate of change above or below this wedge? A significant breakout, if we are to believe the rules of technical analysis, would lead to an impulsive continuation move. This means, whether deflation or inflation, we would be likely to witness a monetary event far greater in magnitude than any other in the last 100 years of US history!

But are we most likely to see massive inflation or deflation? The next two charts, while not conclusive, suggest the direction we might be heading in over the shorter term. First is a chart of the CRB, which I have shown you in the past. While my readers are familiar with the large bullish falling wedge, I am now able to add an equally compelling Cup & Handle pattern. If the C&H breaks upward, we are likely on the cusp of a huge move higher in inflation over the next few years.

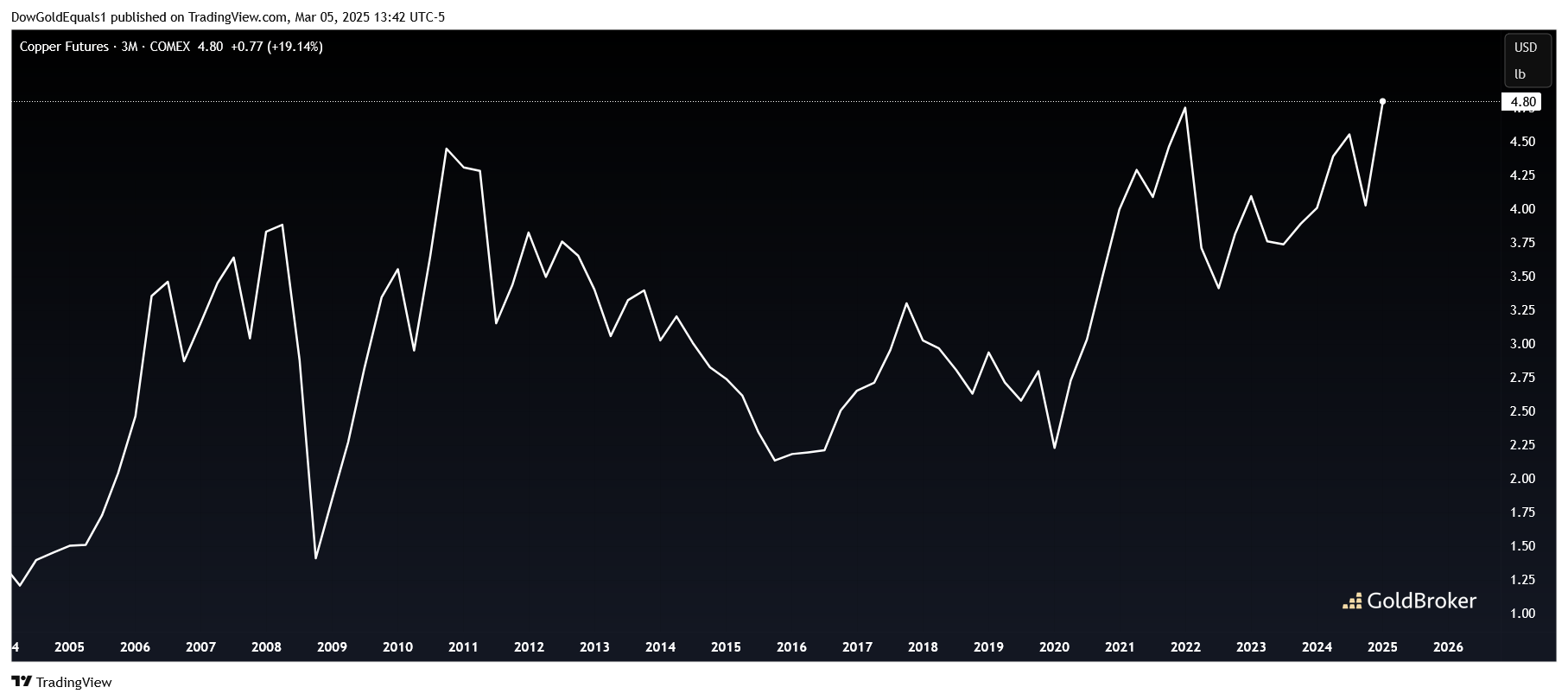

The last chart is of copper, sometimes referred to as "Dr. Copper" for its innate ability to track and telegraph inflationary moves. No TA here, just a simple chart showing you that copper may well be on the verge of setting a quarterly all time high! We will continue to track this and provide a detailed look at copper over the coming weeks. Wherever copper goes, so too does generalized inflation.

Now is not the time to panic about hyperinflation, but you should have a clear-eyed view about all the possibilities. You should also think strongly about how to protect your purchasing power and how gold and silver can play a useful role.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.