The U.S. economy is showing much deeper signs of fragility than the markets seem to comprehend.

Travelling to New York this week, I'm struck by the contrast with my last visit, shortly after the Covid pandemic. Main Street's decline is evident.

The U.S. tourism sector is feeling the first shocks of the boycott campaign launched in Europe. In the Big Apple, the effect is palpable: Little Italy and Chinatown are virtually deserted, and Broadway is idling despite the mild weather. It's 34°C, but the tourists are conspicuous by their absence. When we landed in Newark, there were only few Europeans on the plane. I've never left an American airport so quickly - the non-American passport queue was completely empty.

U.S. tourism is already seeing a sharp decline in 2025, largely attributed to the trade war and President Trump's rhetoric. The number of Canadian visitors - who traditionally account for a quarter of foreign tourists - is plummeting: air traffic is down 20%, and land crossings fell 35% in April. Europeans, too, are shunning the destination, with a 12% drop in summer bookings from the Old Continent. According to Tourism Economics, the sector could lose up to $8.5 billion, or 5% of annual tourism revenues.

But these figures probably underestimate the reality. On the ground, particularly in New York, the boycott is making itself felt. This disaffection reflects a deeper rift, fuelled by a deterioration in the United States' international image. If the trend continues, the 2025 tourist season could prove disastrous.

Inflation has also left its mark: low-cost stores like Trader Joe's are packed, while organic and “boujee” grocery stores remain desperately empty.

Macroeconomic indicators tell only part of the story. On the ground, however, households are adjusting their consumption choices to the penny.

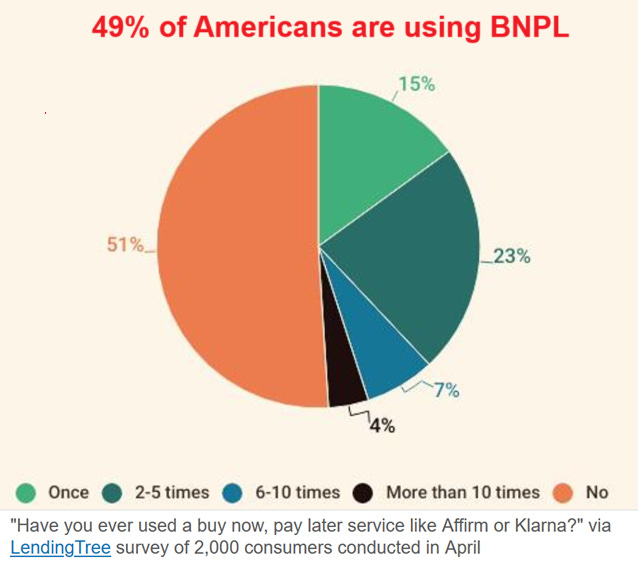

According to a study by LendingTree, 49% of American consumers use “buy now, pay later” (BNPL) services.

Among 18-28 year-olds (Generation Z), this rate climbs to 64%.

Significantly, almost one in two Americans (48%) say they have regretted using these services.

These figures reflect a clear reality: American households are suffering more and more financially.

A growing number of Americans are using “Buy Now, Pay Later” (BNPL) credits to cover essential expenses, particularly food. In 2025, 25% of BNPL users used them to buy food, up from 14% the previous year, according to LendingTree data. Young people from Generation Z are the most concerned. These loans, available without strict solvency checks, are multiplying against a backdrop of persistent inflation and pressure on budgets. Their use today extends far beyond one-off purchases: delivered meals, online orders, supermarket shopping... you name it.

These new forms of credit consumption, even for essential purchases such as food shopping, are now visible on the ground. For young people and the middle classes, the effects of inflation are already very real and perceptible on a daily basis.

Suffocated by soaring prices, American consumers are forced to resort to credit on a massive scale, even to cover their most basic needs. All the levers have been pulled. The next inevitable step will be an economic slowdown.

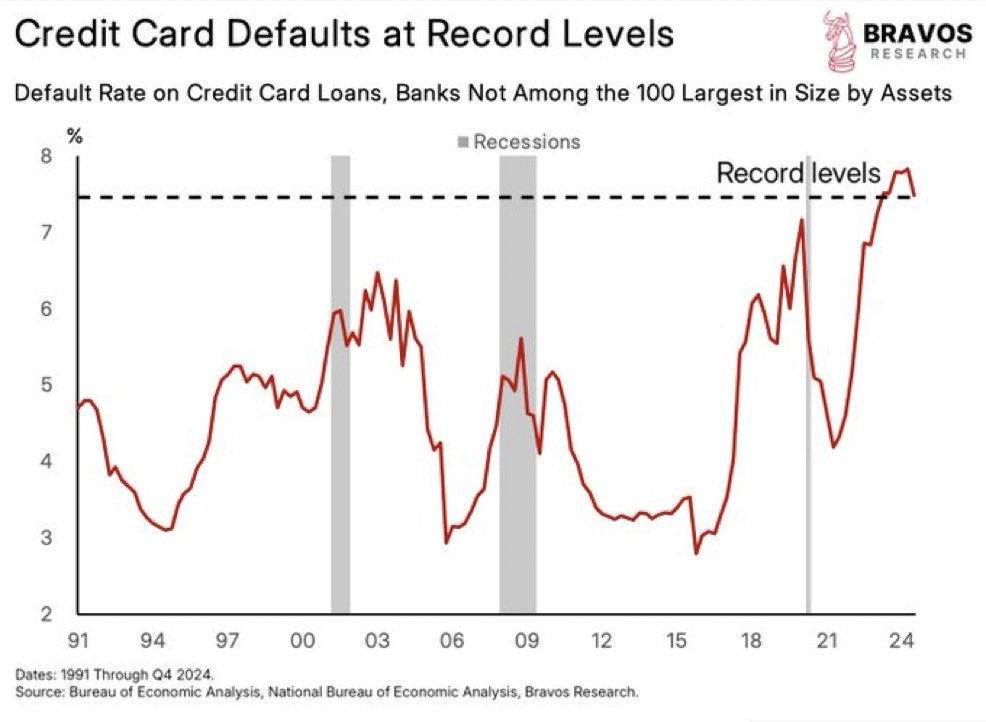

The latest indicators confirm a clear deterioration: national income is declining, consumption is revised down sharply (+1.2% in Q1), and consumer credit defaults are on the rise again - whether for credit cards, car loans or student loans.

Companies, too, are beginning to weaken: profits reported to the tax authorities fell by over $100 billion in the first quarter, or -3.6%, wiping out more than half the gains of Q4 2024. This decline comes against a backdrop of inventory build-up, shrinking investment and a slowdown in hiring. Jobless claims are rising, while job vacancies are falling.

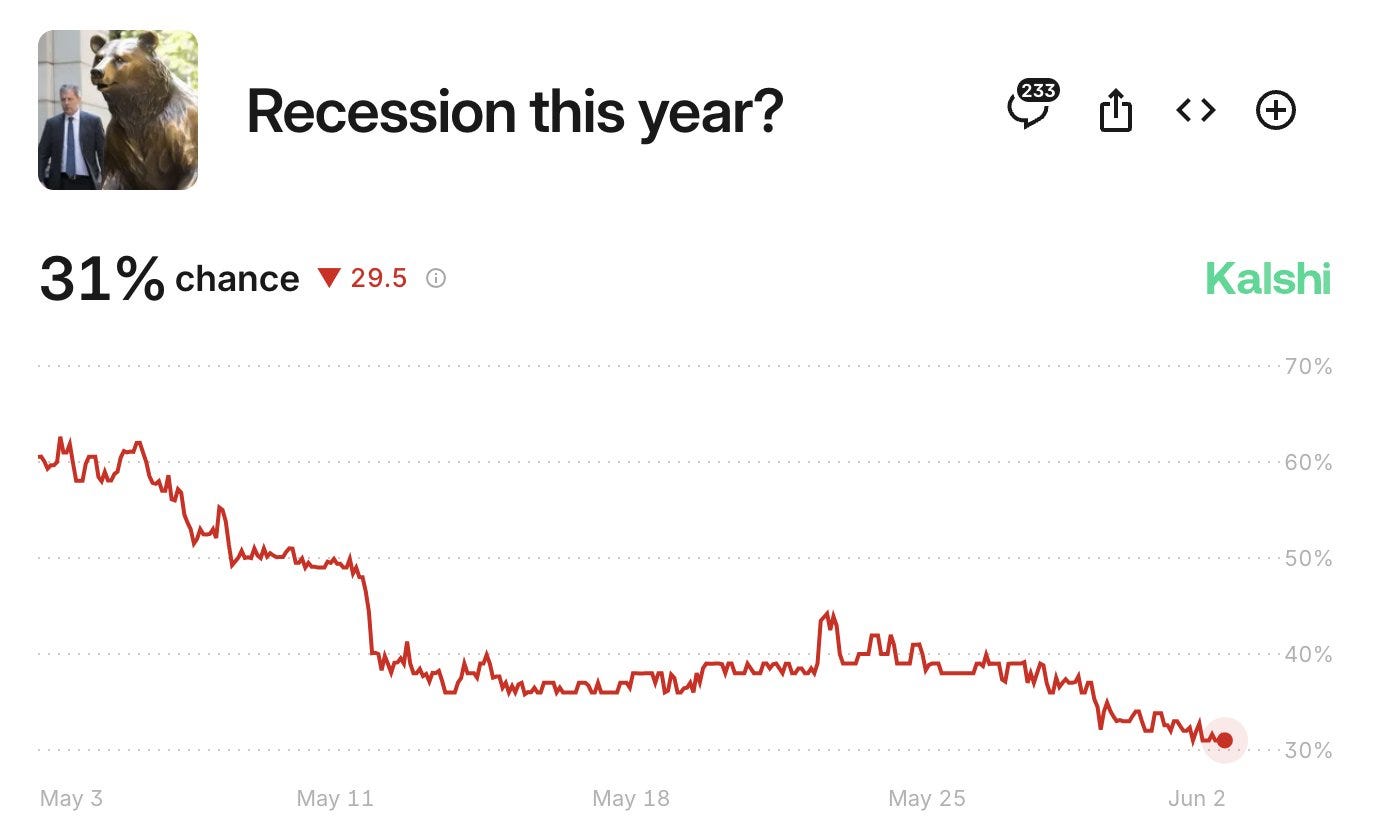

That said, unemployment figures are still apparently solid. Moreover, the probability of recession has recently been revised downwards to around 30%, thanks in part to the easing of tensions linked to tariff threats.

But this is a classic statistical illusion.

Unemployment registration data (claims) are time-delayed indicators: when they deteriorate, the damage is often already done.

What matters today are the signals that are being sent out, and they are worrying:

- The labor market is showing cracks, with JOLTS data down (fewer job offers),

- Business leaders' morale is falling,

- Business surveys show a clear slowdown,

- Budgetary support, once a driving force, is now becoming a brake.

The job market still seems to be holding up... until it suddenly breaks down.

Monetary policy remains resolutely restrictive, with the declared aim of reducing liquidity in the system. In theory, this should translate into a marked contraction in the money supply - particularly aggregates such as M2 - in order to curb inflationary pressures and anchor expectations.

In reality, however, this contraction remains largely theoretical: the fall in M2 that began in 2022-2023 seems to have stabilized, or even reversed, under the effect of compensating mechanisms - notably the expansion of private bank credit and certain technical easings on short-term financing markets. In other words, the desire to reduce the money supply has not yet translated into a lasting and effective contraction.

It is precisely this inertia - the gap between restrictive monetary rhetoric and the reality of liquidity flows - that continues to support financial markets artificially. As long as the monetary contraction has not fully manifested itself in the real economy, risky assets still have sufficient liquidity to maintain or even rebound.

But this situation remains precarious: eventually, if the contraction really materializes, the braking effect could be brutal.

On the fiscal front, the tax bill merely extends existing tax cuts, with no real stimulus effect. Worse still, the ongoing expansion of customs duties could even cancel out the weak impact of the tax plan.

Above all, public debt continues to weigh heavily: its cost is rising, forcing the State to refinance at higher rates. This dynamic, coupled with a general weakening of fundamentals, points to a prolonged period of stagnation. Equity markets, buoyed by hope, risk underestimating future tensions.

The US economy is on a knife-edge. Despite some budget adjustments (Medicaid restrictions, cuts in green subsidies), the deficit remains massive. Its stabilization is based on an assumption of 2% growth. However, a recession would immediately increase the deficit to 7% of GDP. This risk is very real, and current monetary policy is considered too restrictive.

Inflation linked to tariffs is in fact an illusion: only the first waves are inflationary, the following ones provoke a fall in demand, incomes and prices.

A number of interest rate cuts are now expected as early as this year, at a pace well in excess of current market expectations. In addition, a systemic risk is emerging: banks are lending massively to non-depository financial institutions, themselves heavily exposed to risky, over-indebted borrowers.

This systemic risk is one of the main factors supporting gold prices. As I recently mentioned in the monthly bulletin reserved for clients of Goldbroker.com, the yellow metal continues to play a strategic role in an increasingly unstable monetary and geopolitical environment.

China's growing appetite for gold is the most obvious example. In April, Beijing imported 127 tons of gold - a spectacular 73% increase in a single month. This surge is no coincidence: it's the result of a targeted relaxation of import quotas for major commercial banks. In other words, the Chinese authorities are deliberately facilitating the accumulation of precious metals, with the aim of strengthening the defences of their financial system in the face of growing uncertainties surrounding the dollar and the international monetary order.

This strategy is part of a wider dynamic, characterized by sustained physical demand and growing mistrust of derivatives markets.

The silver market is sending out similar signals. In Shanghai, silver stocks are melting week by week, while physical outflows of the metal are accelerating. On the COMEX, physical deliveries are reaching record levels, confirming the return of a cautious attitude: investors are now demanding tangible metal, not just paper contracts.

The price of silver has just broken through major resistance at $35. This is a historic break in the downtrend that began in 2011!

In this context, another metal stands out: platinum. Long neglected, it is making a strong comeback with the decisive crossing of technical thresholds on several time horizons.

This reawakening marks the start of a long-term upward cycle, fuelled by strategic industrial demand - particularly linked to the energy transition - and increasingly constrained supply. Taken together, this is a silent reshaping of the precious metals market, now dominated by the logic of sovereignty and protection in the face of global systemic risk.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.