Norway has a dynamic economy and natural resources (oil and gas) that feed the Government Pension Fund-Global, its gigantic sovereign wealth fund, which will continue to generate income once the deposits are exhausted. So everything seems to be going well. So why worry about the country's future? Why are Norwegians worried about their savings and assets? Some "weak signals" are raising questions- even concerns.

The national currency, the Norwegian krone, has weakened against the dollar over the past two years, which can be explained by the rather sharp increase in interest rates initiated by the Fed. However, the decline of the Norwegian currency against the euro remains incomprehensible, as the macroeconomic data of the eurozone is deteriorating compared to that of Norway.

Another warning is that the famous sovereign wealth fund has suffered a loss of 1.637 trillion kroner (151 billion euros) in 2022, to a total value of 12.429 trillion kroner (1.148 trillion euros) at the end of the year. The losses are likely to become more frequent as the fund is mostly invested in Europe, which has suffered a severe competitive hit from rising commodity prices- especially energy-since the war in Ukraine.

Is the "Norwegian model" fracturing? Wealth has an emollient effect, and this will continue with gas prices that remain high in Europe compared to the US and Asia. Since 1990, GDP per capita has been growing much faster than in other Scandinavian countries: money is flowing into the economy and oil is Norway's "money printing machine". The result: property prices are exploding, but salaries are not keeping up with this mad rush. And the krone is plummeting, its fall not being held back by the role of reserve currency played by the dollar and, to a much lesser extent, the euro.

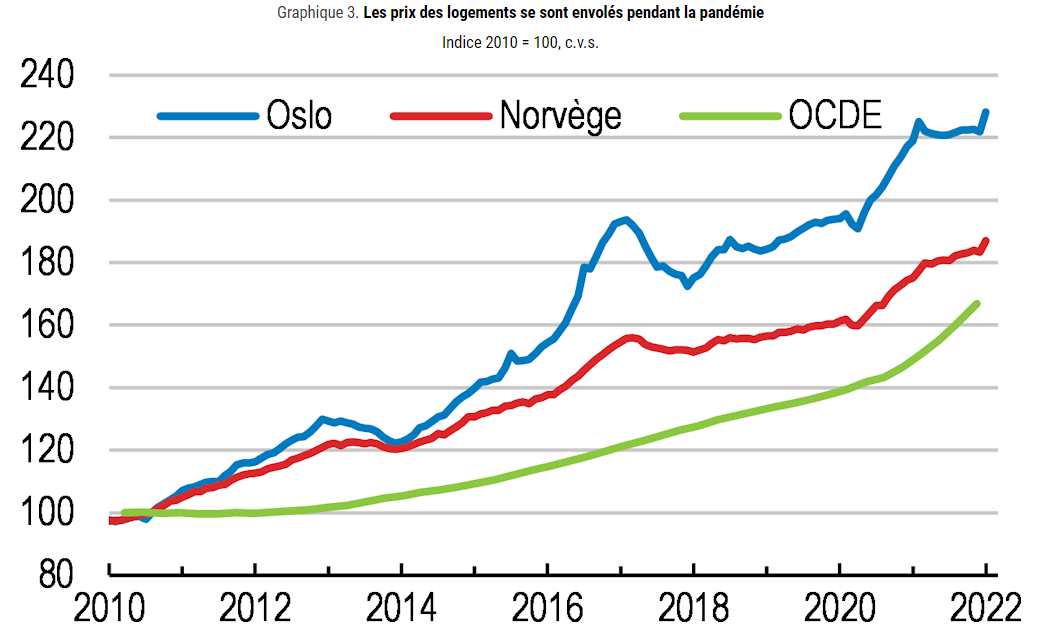

Housing prices soared during the pandemic

Source: Calculations based on data from the Norwegian Association of Real Estate Agents (Eiendom Norge); and OECD (2021), analytical database on house prices.

The Norwegian saver can therefore legitimately worry: between bullish real estate, a currency that is slowly but surely devaluing and a sovereign wealth fund that will not be as promising as expected, the choices become more complex. Perhaps they should think "outside the box" and reconsider assets that have been left aside but are performing well. And there is one asset that is performing very well: gold. For the past ten years, the yellow metal has been steadily rising against the Norwegian krone:

Gold is a good way to protect yourself against currency devaluation, to protect and increase your capital, without fearing a bubble, because it is not the receptacle of excess money (banks are turning away from it, especially on the orders of central banks, and prefer shares and real estate). Physical gold is an age-old investment that persistently continues to prove its worth, even in one of the richest countries on the planet like Norway.

Norwegian savers need to realize this, and the sovereign wealth fund would do well to think about it too, as well as the central bank, which has had no gold in its reserves since 2004, a unique case in Europe.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.