There is an interesting article from the think tank Fondapol entitled, "Politique monétaire : il faut cesser l'argent facile" (Monetary policy: stop easy money), written by Jean-Baptiste Wautier, which confirms what we say and brings several notable elements. Let's review it.

Inflation comes first and foremost from money printing, from "the catastrophic effect of Quantitative Easing", the author rightly points out. Bravo, this lucidity is not so common, after all. No, it is not Putin's fault, as governments are trying to offload, but it is they and their budget deficits that are at the root of this evil. And unfortunately, inflation is here to stay:

"So we live under the illusion that it will disappear as quickly as it came. Unfortunately, there is little chance of that happening. Once inflation has spread through the system, it takes a long time to subside. [...] The reality on the ground, the economic reality is that no economic actor sees a slowdown in the very short term. Bakers, dry cleaners and other energy-intensive businesses are facing bankruptcy risks, when they haven't already succumbed." (page 17)

Especially since central banks are constantly lagging behind reality, either because they are unable to really understand what is going on, or because they want to falsely reassure economic actors and hope that they will lower their expectations of price increases. To beat inflation, interest rates must still rise, as current levels remain insufficient. We are in negative real interest rates (interest rate - inflation), whereas the inflation of the 1970s was overcome by positive real interest rates (in 1980, the Fed set its key rate at 20% when inflation was at 13%).

"We are only at the beginning of monetary restrictions. The economy has too many levers, so we will have to lower the overall level of debt. This implies some fiscal austerity on the part of the government, but also austerity on the part of households. The companies themselves cannot invest as much as before. The tragedy is that consumers are already suffering, and their purchasing power is deteriorating very quickly, while we are only at the beginning of this great upheaval."(page 21)

The decline in purchasing power is therefore not over. The United Kingdom provides a clear and painful example, because the "automatic stabilizers" and social assistance are weak compared to France:

"There is a study by a large English retailer, Asda, the English counterpart of Auchan in France. The study is quite impressive. It shows that disposable income after unavoidable expenditure (housing, energy, food essentially) has massively decreased, or even completely disappeared for nearly 60% of the population. (page 21)

In addition, the effect of inflation and the resulting loss of purchasing power vary greatly depending on the income scale. This is true in England, as well as in France:

"Of a £100 expenditure, a modest household will allocate about 50% for housing, 20% for energy and food, i.e. 70% for these three items of expenditure; on the other hand, a wealthy household will only allocate 30 or 40% of its income to these three items of expenditure. This is why an inflation of 15% will affect the modest household more than the well-to-do household. For this reason, it is dangerous to look at inflation using overly averaged indexes, as these do not adequately represent the different ways in which it affects different social classes."(page 23)

In the United States, consumption has not yet fallen, but only because "the savings and over-savings made during Covid are melting away like snow in the sun". And when that is no longer enough, households take out consumer credit, which is exploding at the moment (page 24). The situation remains difficult, however: 40% of US small businesses said they could no longer pay their rent (the figure dates from October 2022), an "implausible" proportion (page 24).

As a result of all this, poverty in Europe is increasing rapidly:

"There is also a growing inability of households to pay their energy bills. In the UK, the situation is striking, but it is also starting to be striking in France and the rest of Europe. Moreover, all the food banks claim that they have never experienced this situation, they have never seen so many applicants, and especially applicants from the working population. So we have to agree, all the signs are there. We can't say how long it will last and how much of an economic disaster it will be, but we already know it will be tough and it has already started." (page 24)

And we are just at the beginning:

"With the worst of the inflation not yet absorbed, the worst of the contraction in purchasing power is yet to come." (page 26)

As an inevitable consequence, the real estate sector will enter a period of depression. The situation differs between countries where households are indebted at a fixed rate, such as France, and those where they are indebted at a variable rate (monthly payments increase as rates rise). In the latter case, the reaction is very rapid, as can be seen in Sweden, for example, with a 15% contraction in property prices in 8 months, which represents the worst slump since the early 1990s (page 26).

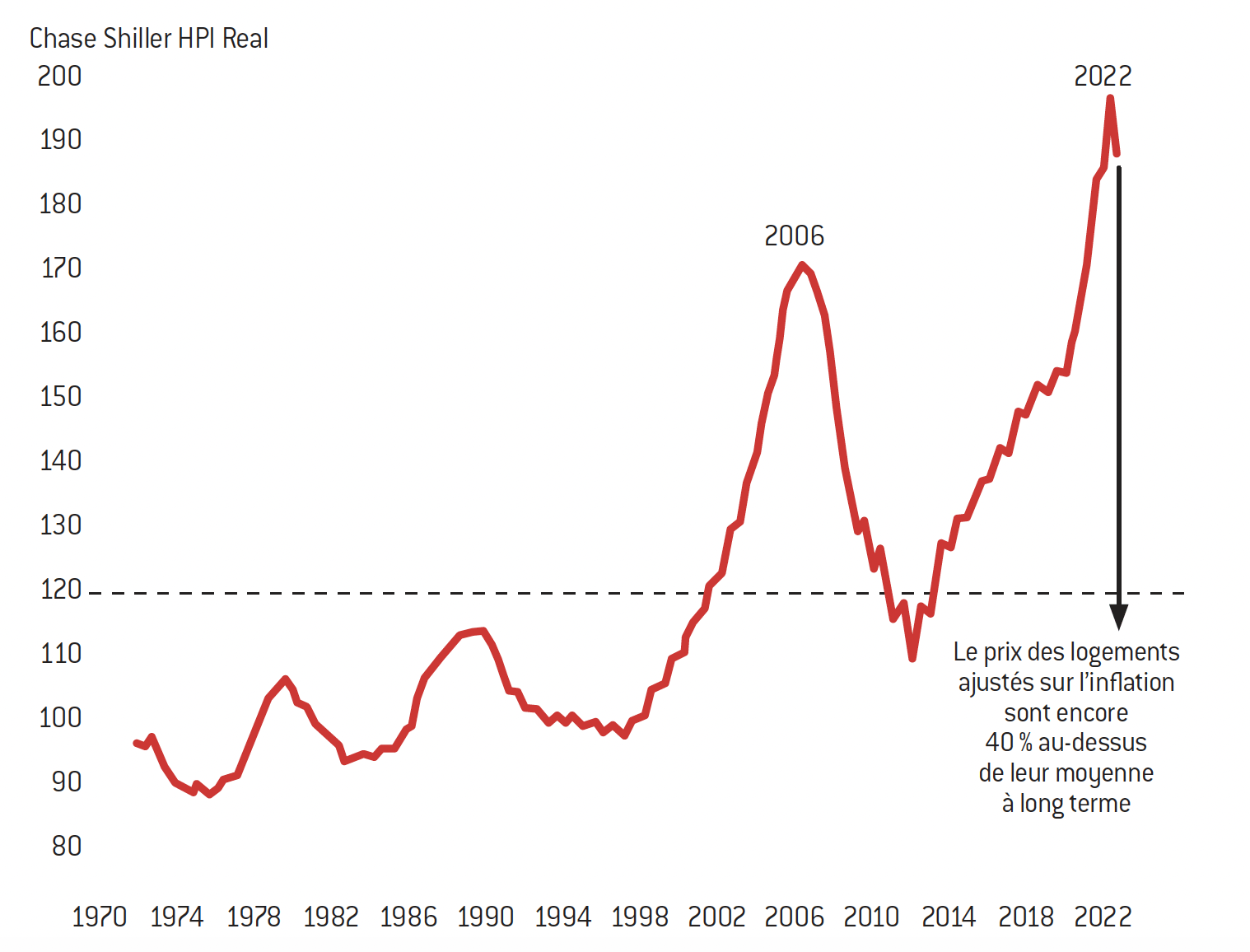

In the United States, the turnaround has been brutal. A bursting of the real estate bubble comparable to that which followed the subprime crisis seems to be looming:

"The average American household that goes from a 3% rate to a 7% rate is still earning about the same, and the amount of real estate hasn't radically changed. So that's going to cause real estate prices to fall (as we're starting to see in Sweden), and/or it's going to cause a dramatic contraction in purchasing power, particularly because in 6 or 9 months, borrowing costs will double. No one can withstand that."(page 28)

As we can see, real estate cycles in the United States are becoming increasingly violent. More globally, rising interest rates are putting at risk all the debt accumulated when rates were low or zero:

"Reading this chart, one can grasp the magnitude of the phenomenon. The crazy surge in U.S. real estate prices took place in a very short period of time. But even before that, the rise in 2006 was also a speculative bubble. We can see the extent of the correction of the cycles here in 2006. It is likely that we will have a similar or even worse slope in 2023. This will have a huge impact on the economy, and not only on borrowers, but also on lenders, financial markets, etc. The recent collapses of banks such as SVB and Credit Suisse are very revealing of the magnitude and speed of a deflating bubble when too much debt has been taken on, and rates rise sharply and continuously. We are not in a simple economic slowdown but in a Minsky moment”.

A "Minsky moment", i.e. a major deflationary crisis (over-indebted investors are forced to sell their assets en masse to meet their need for liquidity, triggering a self-perpetuating downward spiral in the price of these assets and a drying up of liquidity). A crisis that mixes both inflation and disinflation, as Nassim Taleb explained: the prices of what you need (food, energy) rise, and the prices of what you own (real estate, stocks) fall. A catastrophic scissor effect.

In conclusion, the author warns of the risk of a "great depression" which would add to an already deteriorated economic situation:

"We must be aware of the severity of the situation and the risks of a great depression that we are running. A great depression that would be added to all the factors of disintegration of our societies (regression of democratic models, loss of confidence) would be particularly dangerous. We must face the situation, be reactive and not simply observe a collapse of the economy. It is urgent to stop pouring out easy money, multiplying small checks, cobbling together 'shields', etc. On the one hand, all this is inflationary and, on the other hand, we can no longer afford it."(page 30)

A very relevant analysis that we share, but with two caveats:

- Inflation also comes from the energy transition (wind turbines, regulations such as the DPE, the end of the combustion engine in 2035, etc.), which is extremely costly and is causing the cost of energy and many goods to explode.

- Is a rise in interest rates to the point of positive real interest rates (i.e. above 10%) even possible? There is too much public and private debt, much more than in 1980 when Paul Volcker raised the Fed's key rate to 20%. Is there not a risk of a general explosion? We have already had the bankruptcies of SVB and Eurovita.

In any case, we agree that inflation will persist. Central banks are slow to react and the current level of interest rates will not be enough to stop the rise in prices. A "great depression" is looming…

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.