U.S. consumers are back in debt since the end of the Covid crisis.

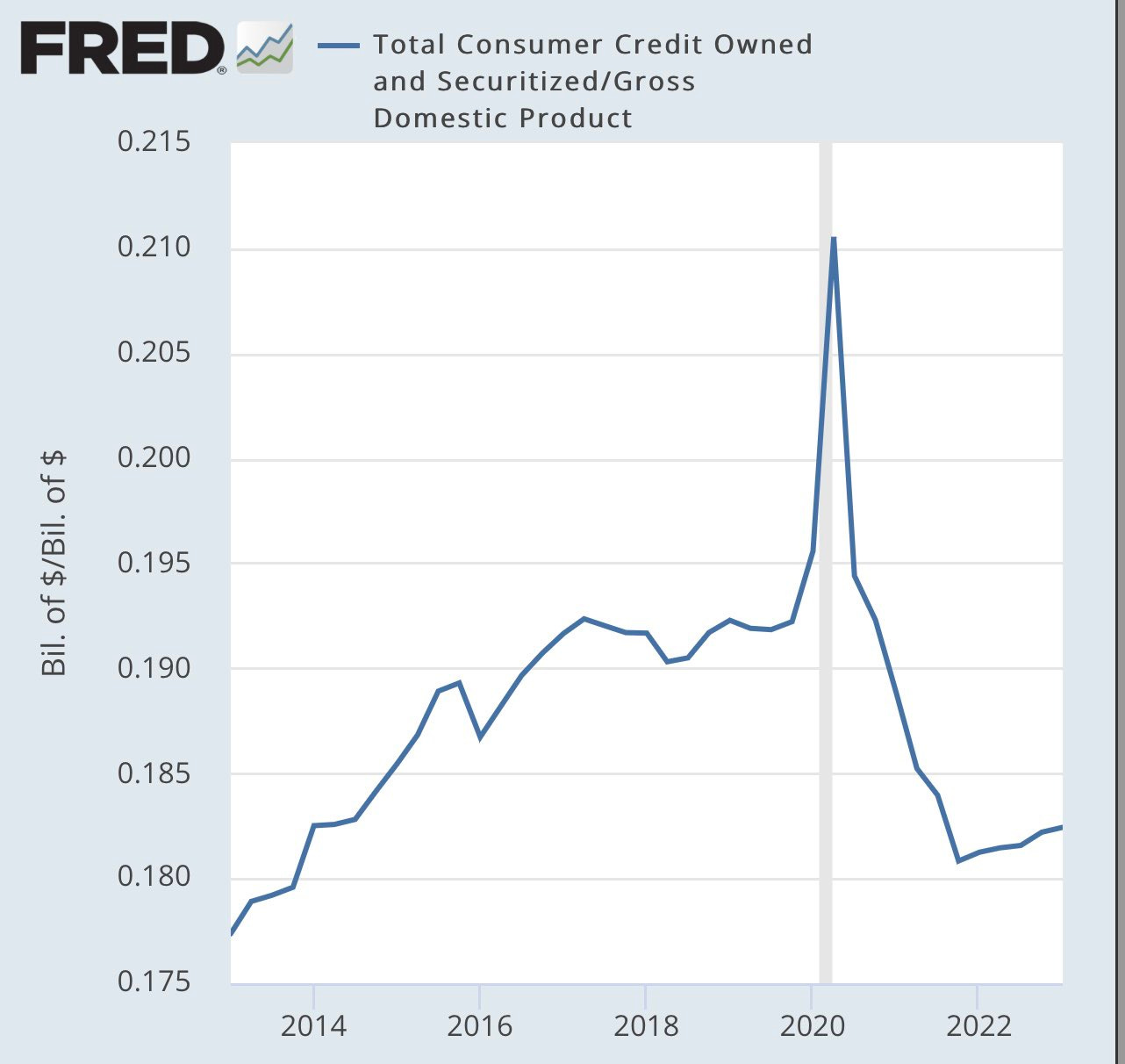

Total consumer debt (auto + credit cards + student loans) has risen to $4.85 billion. Relative to US GDP, this debt remains well below its 2020 peak. The consumer debt/GDP ratio has returned to its 2014 levels:

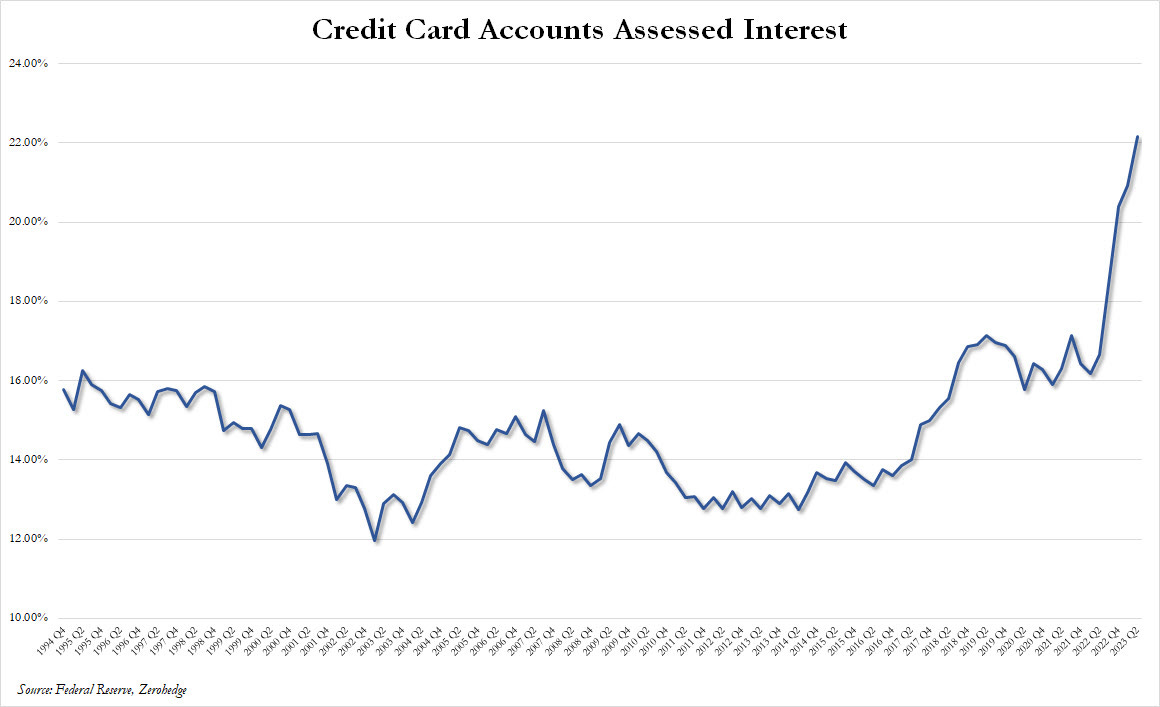

That said, the level of interest rates is not the same as it was in 2014. Every new debt today is contracted under much less favorable conditions for consumers.

The average interest rate on credit cards has reached a new 30-year high of 22.2%:

Even if the volume of consumer debt does not pose a short-term risk, it is the ability to take out new loans that poses a danger. Credit card rates of this magnitude will not be able to sustain American credit consumption for long. Access to credit for consumers is now at risk - the very backbone of the US economy.

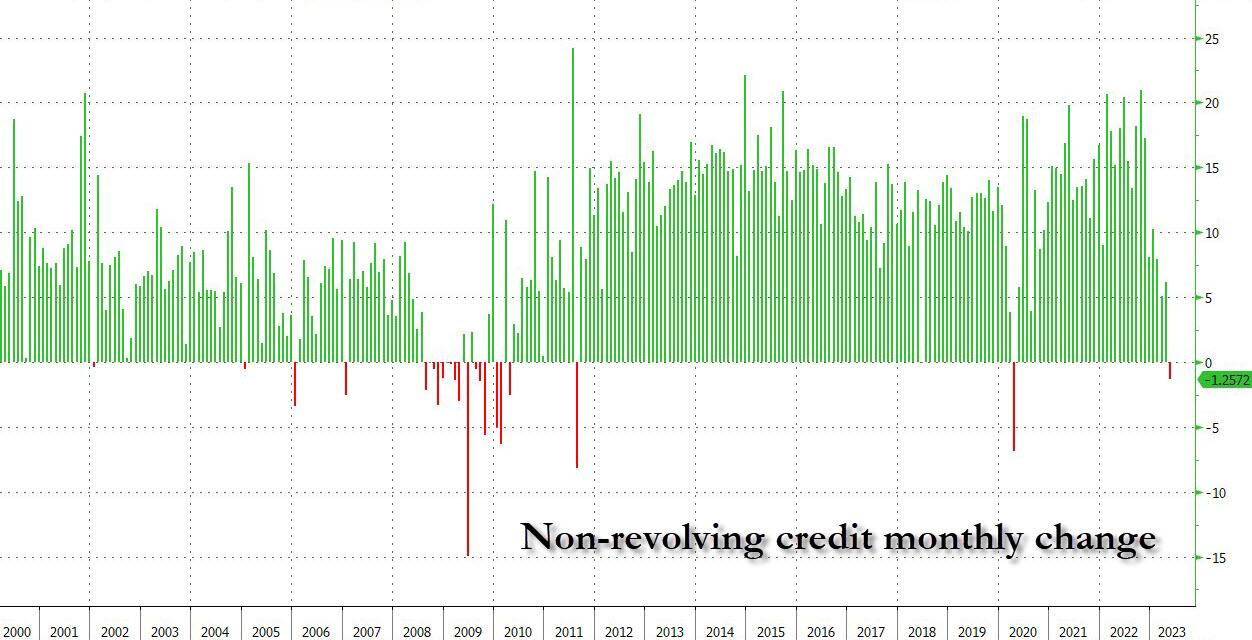

The use of credit is falling sharply. In monthly terms, we are very close to a contraction:

The category of student and car loans (non-revolving credit) recorded an unexpected drop of $1.3 billion. Zerohedge calls it a shock, because while revolving credit growth can fluctuate considerably from month to month, non-revolving credit growth has almost always exceeded $10 billion. This is the first negative print for this indicator since April 2020:

Historically, a negative change in this index has always heralded the start of a recession.

In the United States, recessions are triggered when access to credit is blocked. Growth plummets because consumers can no longer afford to spend by borrowing more, even if they'd like to!

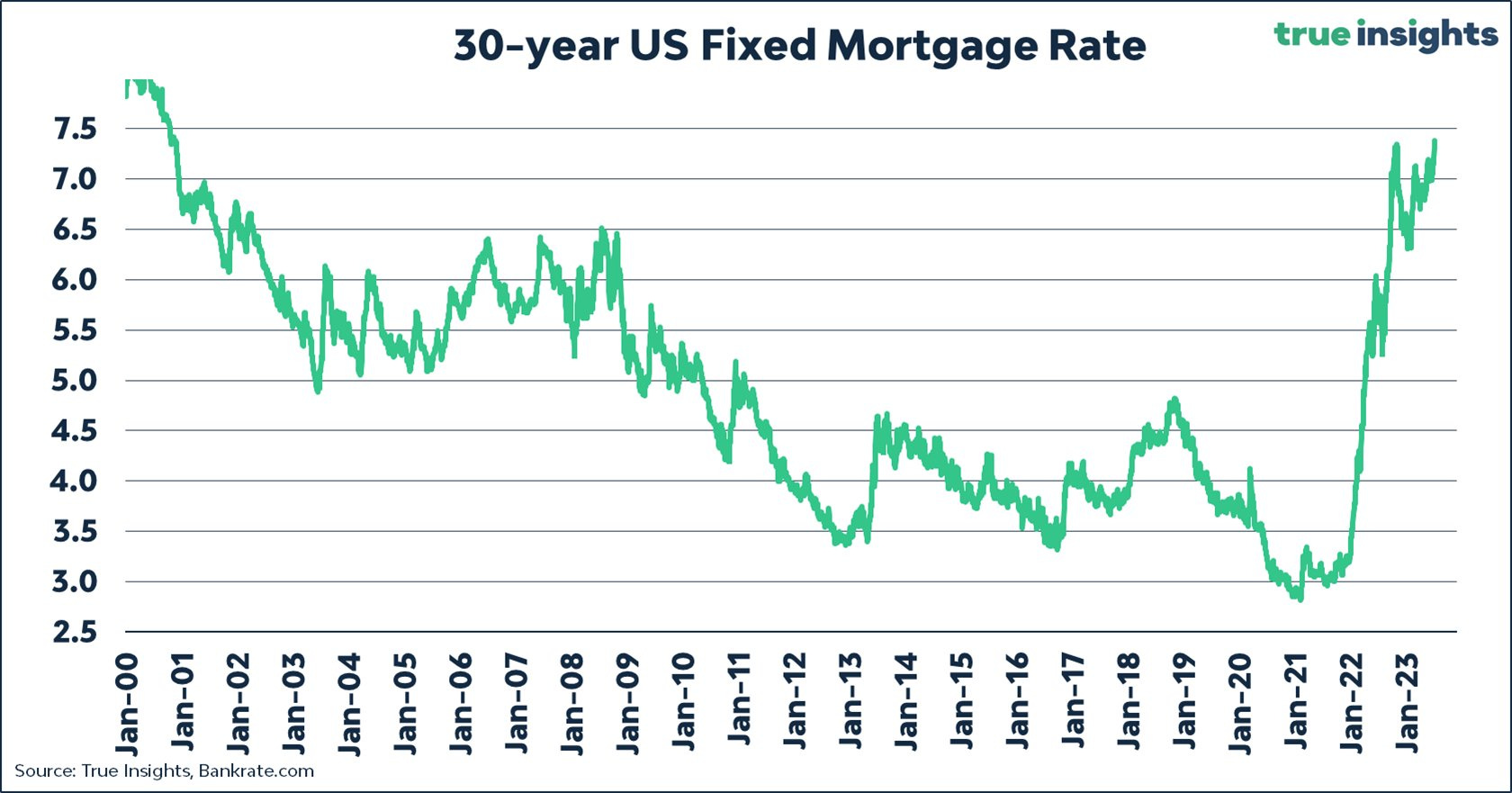

Residential property is the other market that has become inaccessible due to rising rates.

Mortgage rates are also breaking records this week. In just a few months, we're back to the lending conditions that existed in 2000. These rates were 3% eighteen months ago, now they're 7.5%!

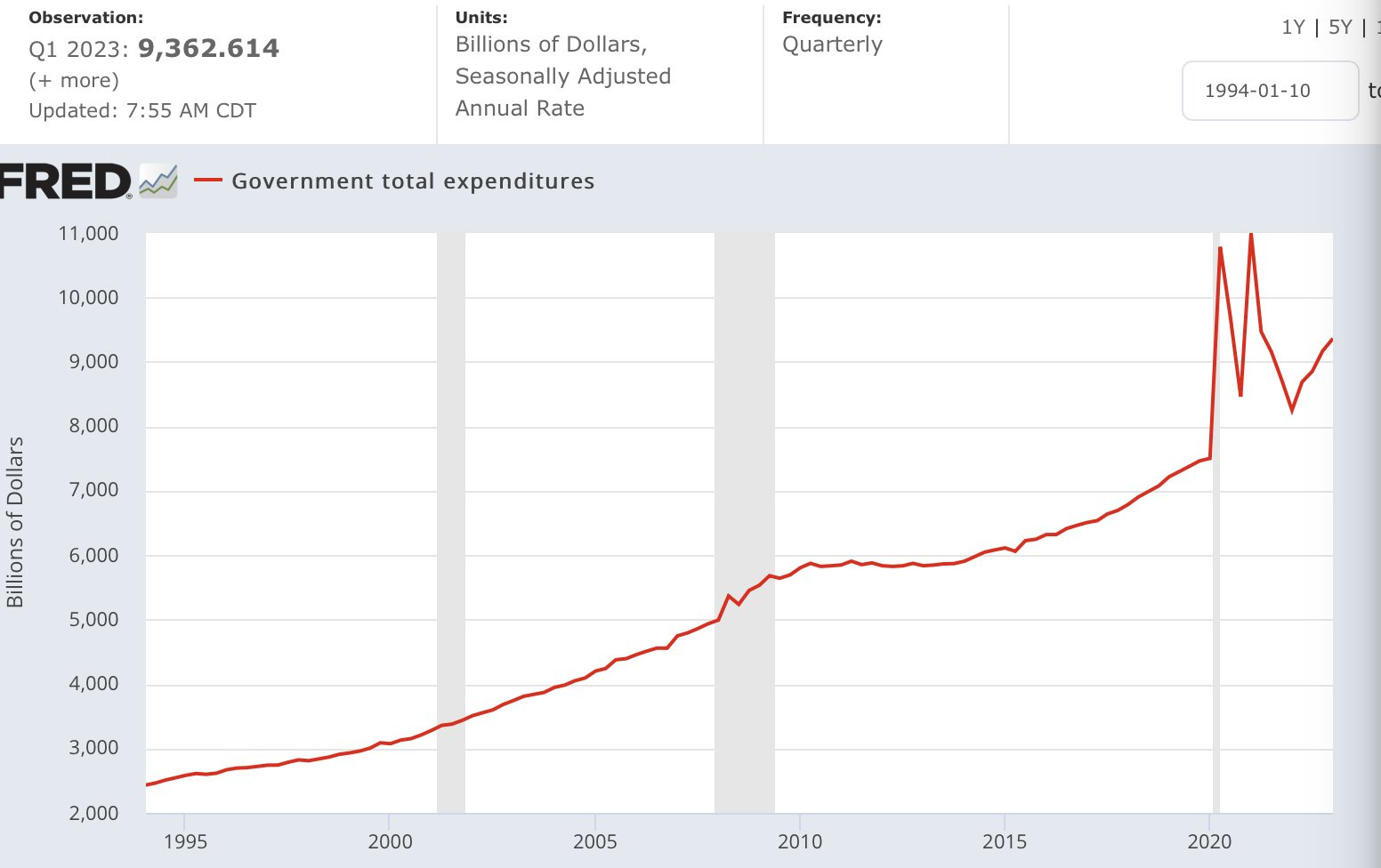

In the absence of a new impetus for consumer credit, the US economy is increasingly dependent on government procurement, which continues to run amok, especially since the resolution of the debt ceiling crisis:

The Treasury has issued a staggering $1 trillion in new debt since the debt ceiling was raised.

Not only does the US government have to cope with higher loan repayments due to rising rates, but it also has to support an economy that has been amputated by a growing number of consumers who no longer have access to credit due to prohibitive rates.

From this point of view, the dollar is logically weakened: the United States' indebtedness no longer has any limit, and we are entering an era of pre-election campaigns where a tightening of the government's fiscal policy is unlikely.

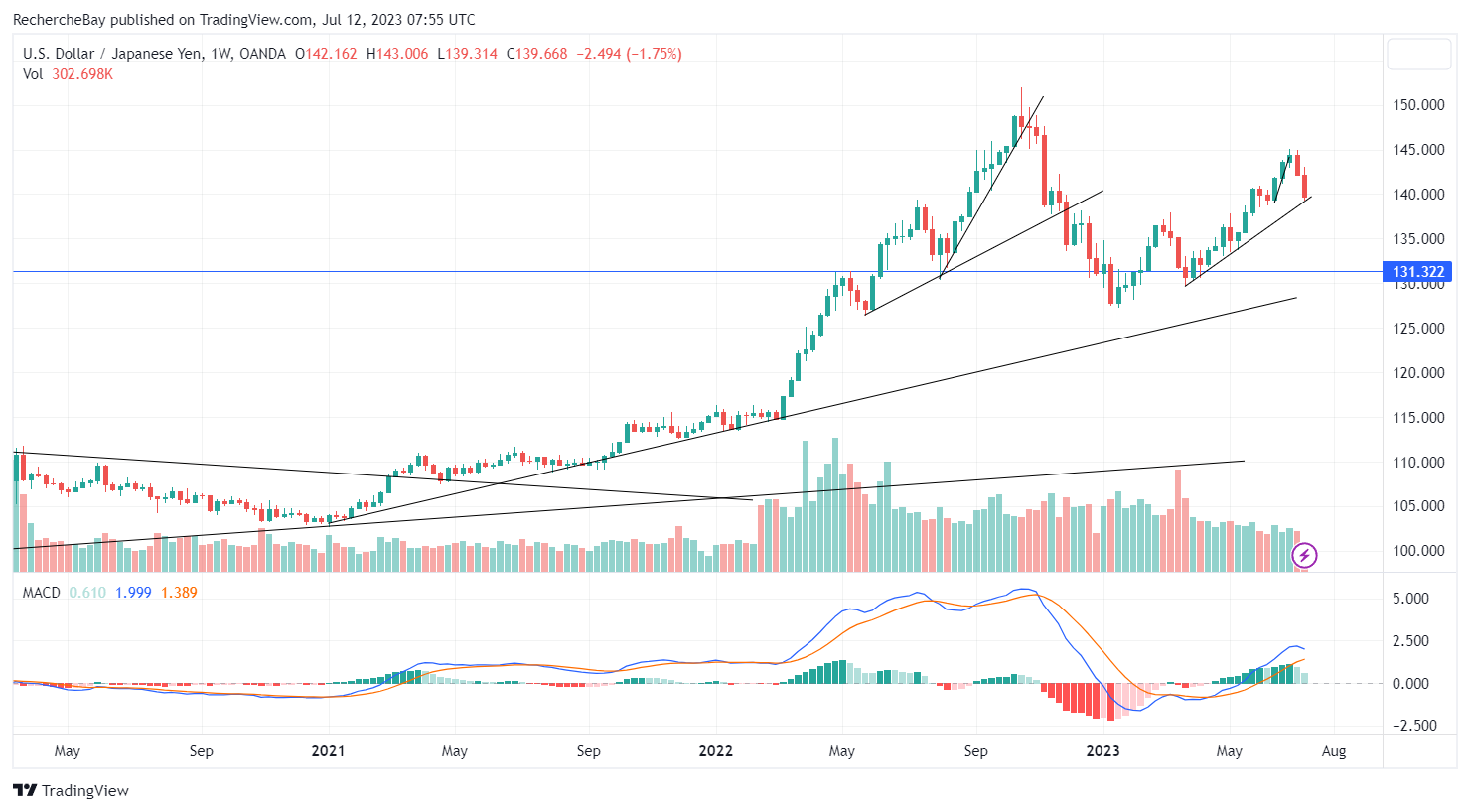

The dollar/yen rate is in a very fragile chart configuration:

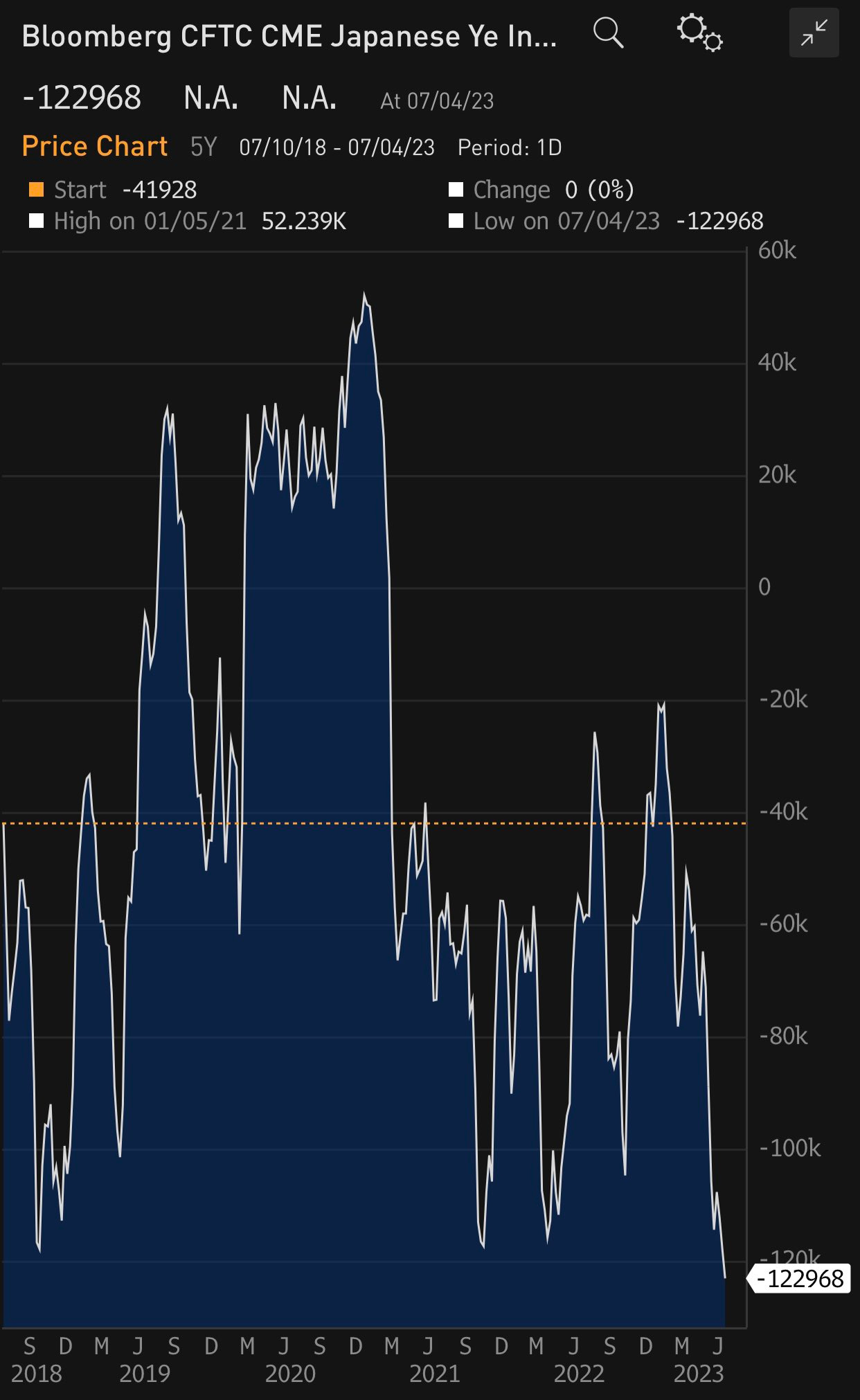

There is a record number of bearish speculators on the yen against the dollar. Here too, the risk of a short squeeze is significant:

A rise in the yen would have significant consequences for the markets.

In any case, the specter of money printing to support the US economy, and the threat it poses to the dollar, has caused many countries to react.

An Invesco survey of 85 sovereign wealth funds and 57 central banks reveals that a growing number of countries are repatriating their gold reserves to protect themselves against possible Western sanctions similar to those imposed on Russia.

Over 85% of respondents believe that inflation will be higher over the next decade than in the past. As a result, physical gold and emerging market bonds are seen as attractive investment options.

The seizure of part of Russia's gold and currency reserves by the West after the invasion of Ukraine is setting a precedent and worrying central banks. Some 60% of respondents find gold more attractive, and 68% want to keep their reserves in their own country.

Geopolitical tensions, as well as opportunities in emerging markets, are encouraging some central banks to diversify their holdings and reduce their exposure to the US dollar. In addition, concerns about rising US debt and inflation are predominant.

According to Invesco, successful SWF managers have recognized the risks associated with overvalued asset prices and are now ready to make major changes to their portfolios.

The study also confirms the accumulation movement in precious metals that we are seeing during this consolidation phase in gold.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.