Gold is testing all-time highs in many currencies.

Gold prices in Australian dollars (AUD) are on course to break their weekly closing record:

The same applies to gold in yuan (CNY):

In Malaysian ringgit (MYR), gold is also at its highest:

The price of gold in New Zealand dollars (NZD) is soaring towards new records:

The price of gold in Turkish lira (TRY) has risen 10-fold in just five years:

In Japan, the yellow metal set one record after another. Gold in yen (JPY) has doubled in just three years:

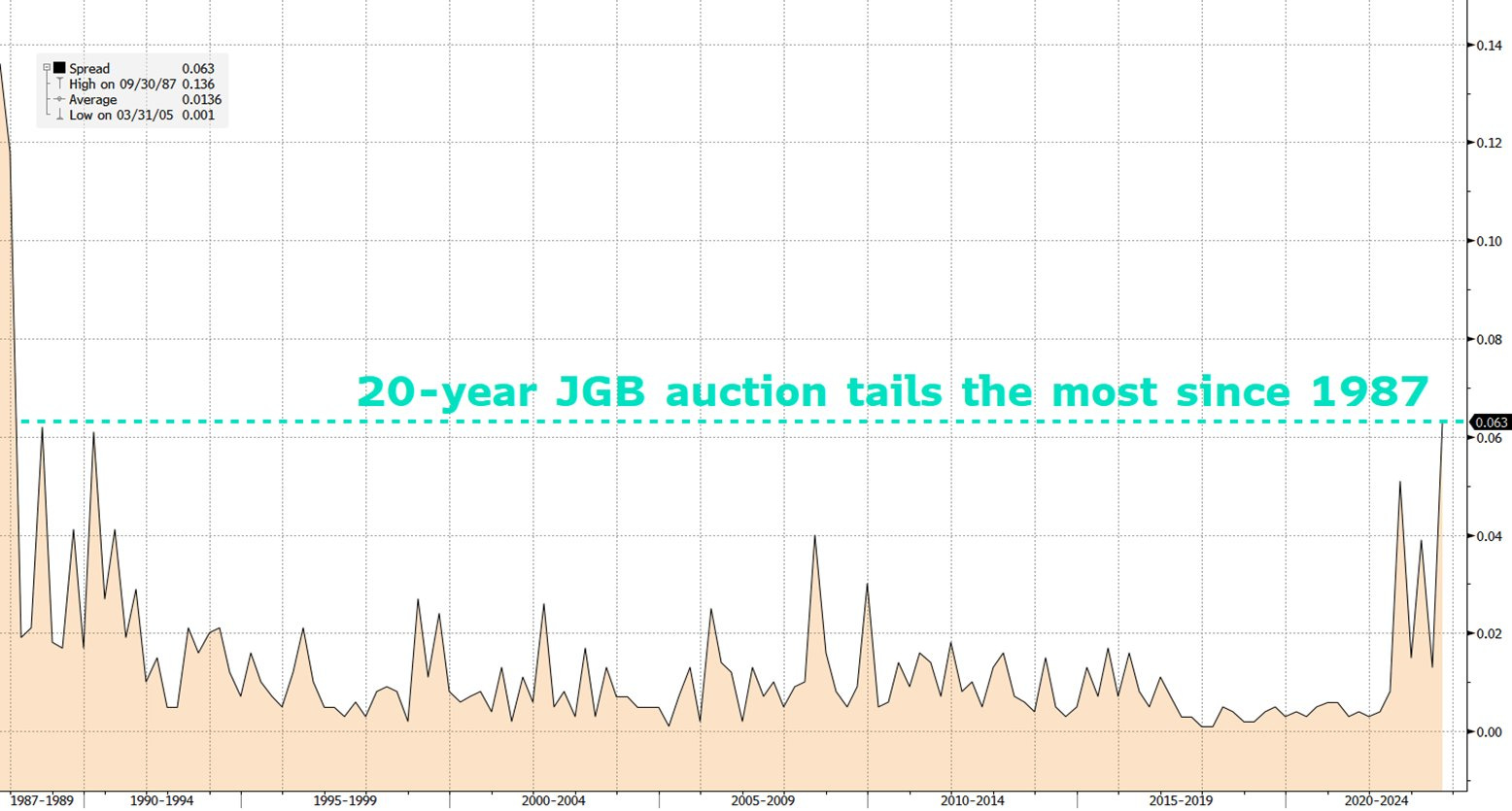

Gold in yen is achieving this performance at a time when the Japanese bond market is going through an unprecedented crisis of confidence.

The latest Japanese 20-year auction was shunned by investors. You have to go back to 1987 to find such defiance:

Although they have started to rise again, Japanese rates are still too low compared with US rates. Apart from Japan's central bank (BoJ), there aren't many buyers for these long-term government bonds. At the moment, it's better to buy US bonds rather than a Japanese product with a similar maturity.

US 10-year yields offer more than 4%. This is the first time the US 10-year has risen above 4% since the regional bank crisis last spring:

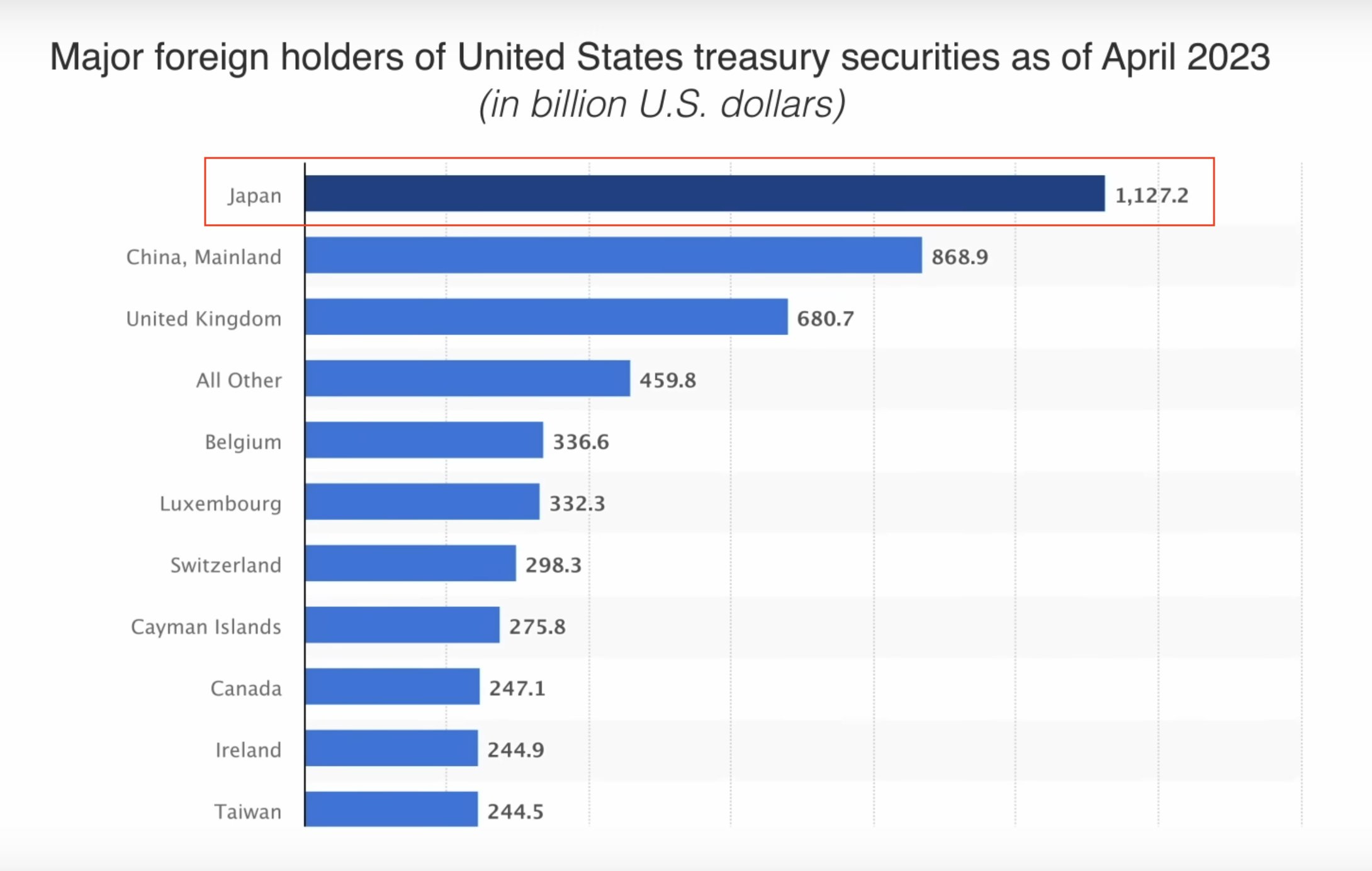

Rising US interest rates are wreaking havoc on the bond market. As rates rise, older US bonds (issued when rates were much lower) are losing their value. Japan has been hard hit by this crash.

For the past two years, the TLT index has been falling steadily:

Problem: Japan is the country most exposed to US bond products, whose prices have collapsed of late.

In fact, Japan is one of the big losers from the sudden rise in US rates, recording a colossal loss on these products.

If Japanese rates were also to rise, it is highly likely that the Japanese would be encouraged to replace their US bond products with domestic ones, which would accentuate selling pressure on US products. Under these conditions, upward pressure on US yields would resume in earnest. And the more US rates rise, the more the BoJ will have to raise its own rates to avoid a too wide rate differential between the US and Japan, and thus avoid another failed bid by the Japanese government.

The BoJ finds itself blocked, obliged to act by means of a tool that sustains the very thing it wants to combat. By defending its domestic bond market, it is pushing the Japanese out of their US bond portfolios, fuelling a rise in US rates and forcing the BoJ to raise rates once again...

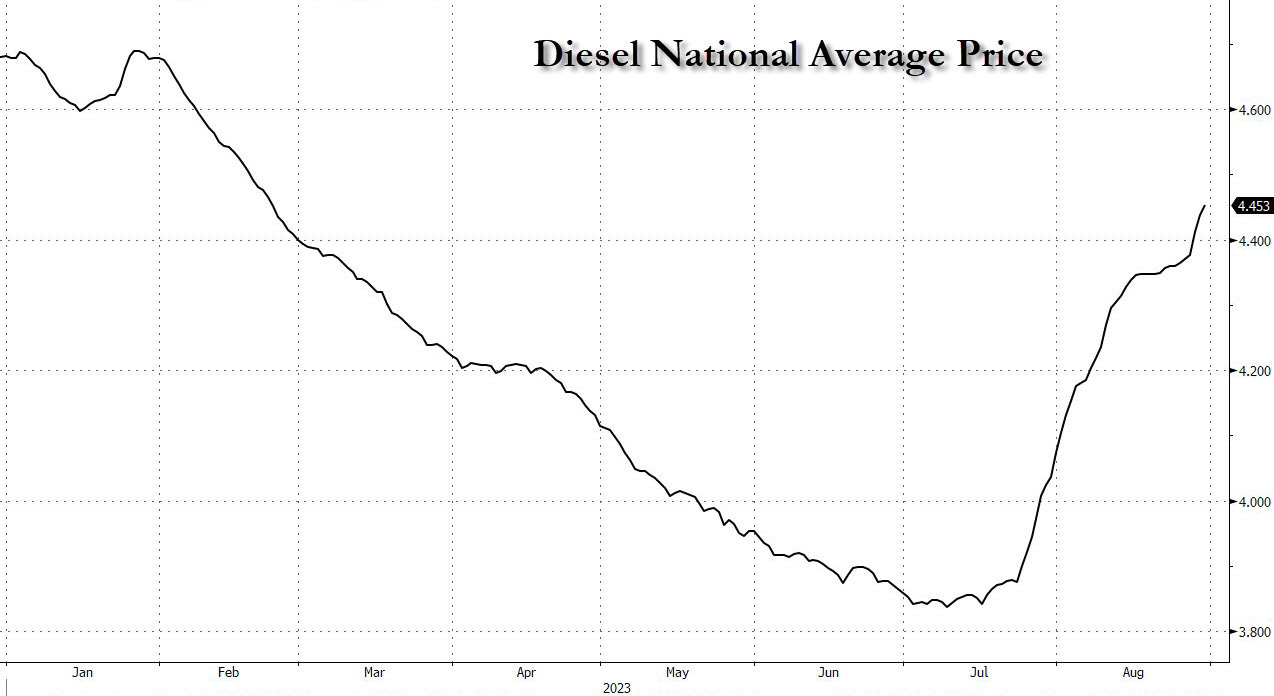

For its part, the Fed is unable to show any sign of inflexion in its restrictive monetary policy, as its battle against inflation is far from over.

The Personal Consumption Expenditures (PCE) price index, the Fed's preferred measure of inflation, rose by 3.3% year-on-year in July. The core PCE price index accelerated to 4.2%. Bad news for US inflation.

The sharp rise in oil prices has raised the threat of a second wave of inflation in the United States:

Japan's central bank is therefore currently stuck on its monetary policy. The BoJ needs a clear signal from the Fed to ease rates, which the new inflationary context does not allow it to do. It would take a very serious credit event to get the Fed to move on rates.

And it is perhaps in Japan that the risk of a credit event is highest.

Since the beginning of the year, we have witnessed a veritable collapse of the Japanese currency, which has lost 10% of its value against the dollar in just nine months:

This decline has even intensified in recent days. The yen's weakness is a sign of the BoJ's stalemate and the heightened risk of a credit crunch in Japan.

The fact that the price of gold in yen is reaching record highs is quite understandable in this context.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.