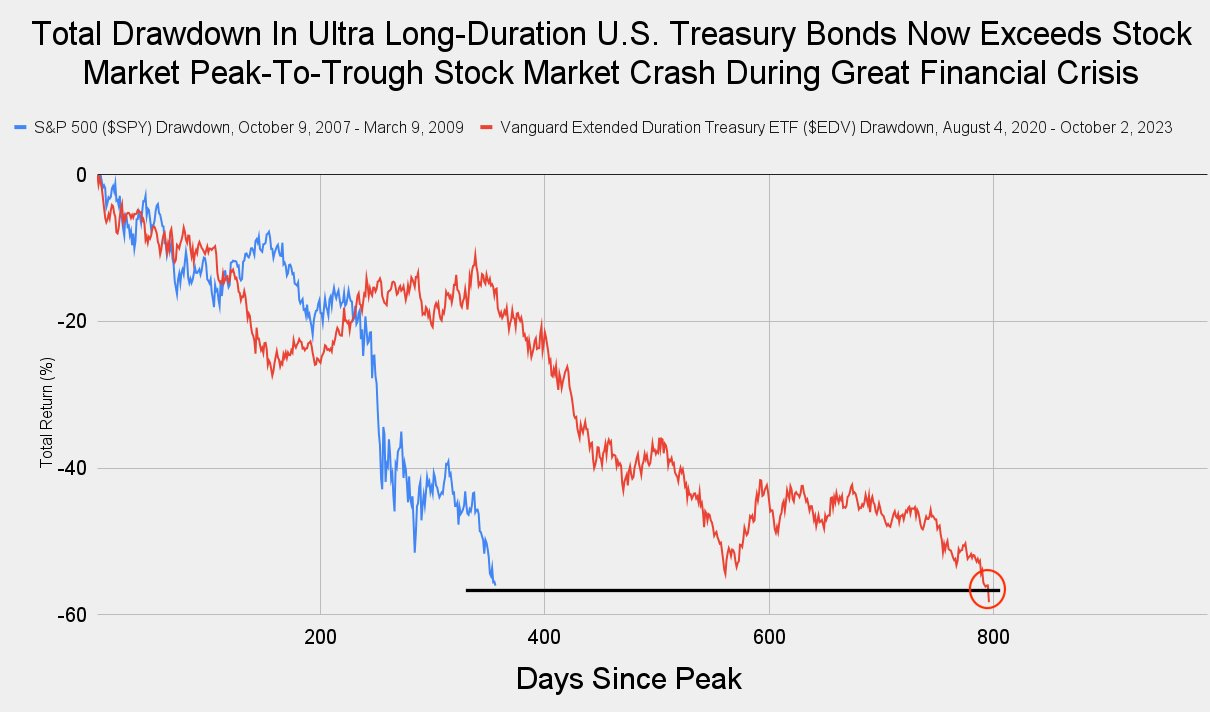

The current bond crash is historic. The EDV ETF, which measures the price of very long-dated US Treasuries, has fallen by 58% in just over a year. The bond market's current fall is now greater than that recorded by the equity market during the last financial crisis in 2008 (-56%). If anything, it is much faster:

This bond crash is taking place in silence: losses remain hidden on the balance sheets of financial institutions, which are now hindered until the bonds mature; they can no longer sell these securities on the market without incurring huge losses that would jeopardize their solvency. Institutions are betting on the fact that they won't face any liquidity problems that might force them to liquidate these bonds, which are veritable time-bombs on their balance sheets.

Institutions are forced to adopt a wait-and-see attitude, hoping that inflation will return to a level deemed acceptable.

They are impatiently awaiting a radical shift in monetary policy, likely to reduce the potential losses associated with the bonds massively acquired during the low-rate era.

These institutions comprise a diverse range of financial players, including banks, insurance companies, pension funds and generalist investment funds.

There is only one scenario in which they can escape the trap into which rising rates have plunged them: one in which the economy slows sufficiently for inflation to subside.

Any other scenario would be unfavorable. If the economy does not slow down sufficiently, central banks will maintain their aggressive rate hike policy. If the sudden rise in rates generates too severe an economic shock, this could trigger a liquidity crisis affecting these institutions, and we might even see a credit event following what would be perceived as a monetary policy error.

Despite the historic bond crash, the prospect of a soft landing for the economy is keeping institutions on their toes. The Fed has the onerous task of steering this landing, and the confidence of economic players has been transformed into hope.

Confidence in the Fed has been a good investment strategy over the last ten years. Today, it's a much riskier bet.

Confidence works when its investments are potential winners.

Hope is a much trickier investment strategy when one's investments are potentially losing.

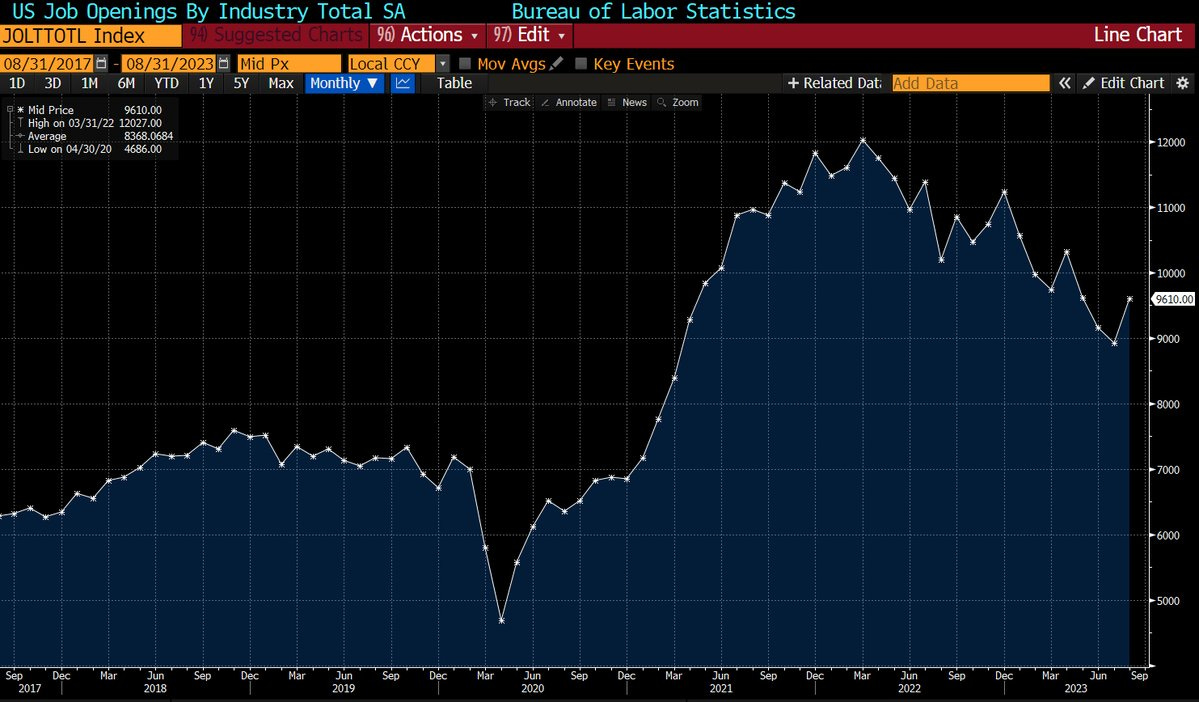

The Fed is still not ready to pivot because the employment situation is better than expected. In fact, job creation figures rose again this week:

In a paper published by the Federal Reserve Bank of Chicago, Austan D. Goolsbee wonders whether the Fed might be using the wrong tools to conduct its monetary policy: according to the economist, "Believing too strongly in the inevitability of a large trade-off between inflation and unemployment comes with the serious risk of a near-term policy error." In other words, by focusing on unemployment as the key factor in its fight against inflation, the Fed is making a major mistake that could jeopardize the necessary soft landing.

The strength of U.S. employment at such a time of monetary tightening comes as a surprise to many economists.

And while the Fed focuses on the employment indicator, rising rates continue to wreak havoc across the economy.

But it is the U.S. federal budget that is bearing the brunt of this sharp rate hike.

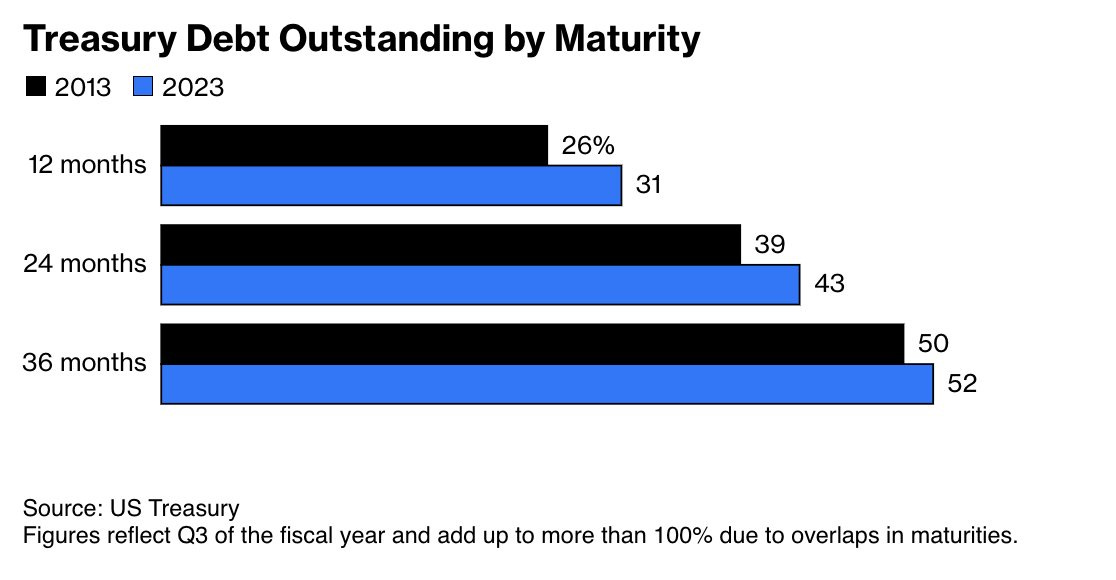

Nearly a third of outstanding US debt will mature in the next twelve months, and 52% is expected to mature in the next thirty-six months, meaning that this debt will have to be refinanced at higher rates.

The period when the Fed kept rates artificially low allowed the government to take on debt at very low cost. Debt service, i.e. the ratio of the annual cost of the sum of borrowings contracted by the Treasury to the total amount of debt, has always been capped at a fairly low level, around 1.5%. Since the Fed abruptly raised rates, we have moved from a period when borrowing cost the government nothing to a new era where the size of the debt is becoming problematic.

The cost of servicing debt has doubled from 1.5% to 3.0%. And as interest rates rise, so do debt servicing costs. It will soon be three times more expensive as rates rise.

Since 2013, the maturity of government bonds has shortened significantly:

In the space of a few months, the annual cost of US debt has risen from $1 trillion to $2 trillion, and maturities have shortened, automatically forcing the Treasury to borrow more and more in order to continue repaying its debts.

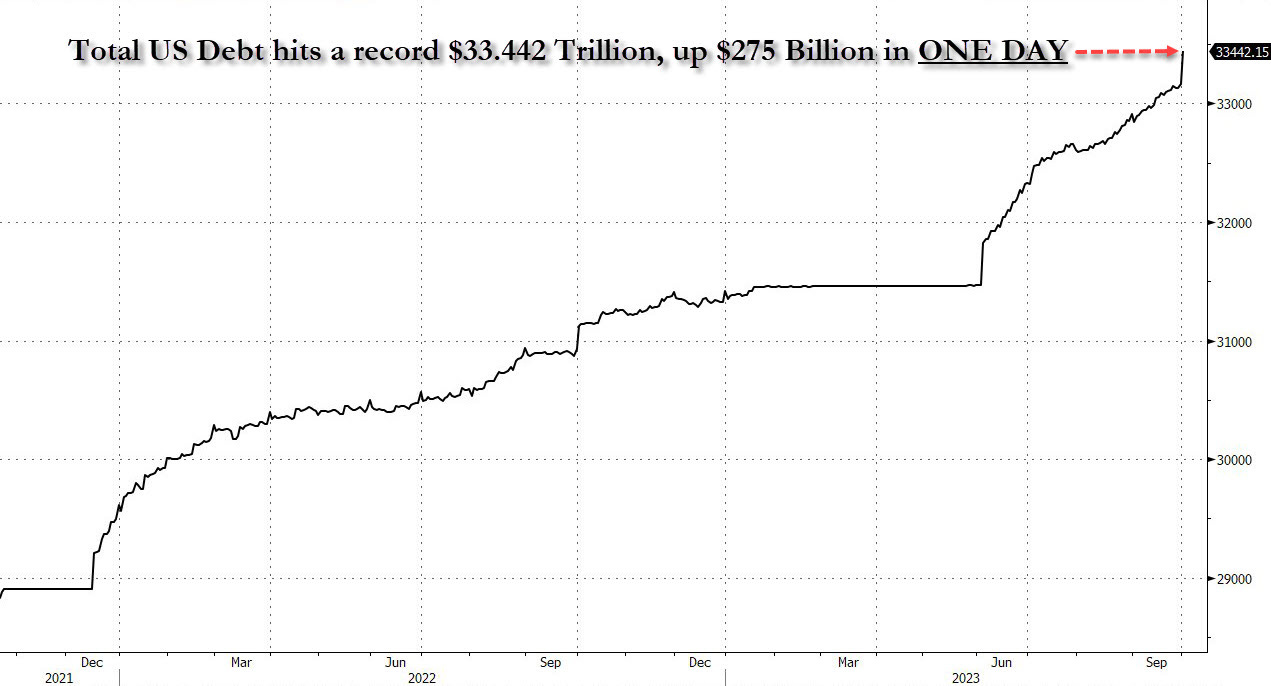

At the same time, public debt has exploded in recent weeks:

In the space of 15 days, US debt has risen by an unprecedented $444 billion.

Until now, the steady rise in US rates was mainly attributed to the prospect of further Fed rate hikes.

However, since the Fed announced a pause in its rate hikes, we have witnessed an unprecedented situation: long rates continue to rise despite this pause. In previous pauses, rates tended to ease, but this time it's the other way around. This is because the US Treasury is going to have to issue even more debt!

Rising rates are now being stimulated by a toxic combination: increasing debt combined with rising borrowing costs.

While the Federal Reserve focuses on unemployment, rate hike momentum regained steam this week.

This situation is creating tension in many market segments. For example, the XLU ETF, which evaluates the performance of utilities (gas, electricity, water), is experiencing a decline comparable to that seen during the Covid-19 crisis:

Gold is also experiencing a correction reminiscent of what happened in 2008, just before the collapse of Lehman Brothers, when the latent credit crisis began to impact all liquid assets. At the time, the price of gold fell sharply by -30% due to margin calls. By the end of the correction, however, the yellow metal had staged a spectacular comeback, doubling in price in the space of a few weeks:

If history repeats itself, it's highly likely that gold's current correction will attract many buyers!

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.