The French Revolution has always been seen, and rightly so, as a period of insurrection against the inequalities that remained. But these insurrections and social movements have often been analyzed more than the inequalities themselves. One major phenomenon is often overlooked: the role of debt in the birth of the Revolution of 1789 and the bloody decade that followed. This period marked the end of a long economic cycle.

The Three Estates: Third Estate, Clergy, Nobility @National Library of France

In the 18th century, France was one of the world's leading powers in terms of military, economic, cultural and demographic power. This position led to various conflicts, including the War of the Austrian Succession in 1740, the Seven Years' War in 1756, and the American War of Independence in 1775. Although different, they all led to political and sometimes financial crises, but above all to fiscal reforms (tax hikes, creation of new taxes, etc.) and an increase in public debt. As is the case today, Louis XV (1715-1774) and then Louis XVI (1774-1792) resorted to indebtedness to clear themselves of their actions and avoid suffering the consequences.

These debts, which took the form of metallic money (gold and silver), were contracted with foreign creditors at high rates. It wasn't until 1767, when the Caisse d'escompte (forerunner of the Banque de France) was created, that interest rates were lowered by buying back public loans. But this new institution was not a success, as the State continued to run up debts, and these loans were costly. It was dissolved two years after its creation, then liquidated a few years later.

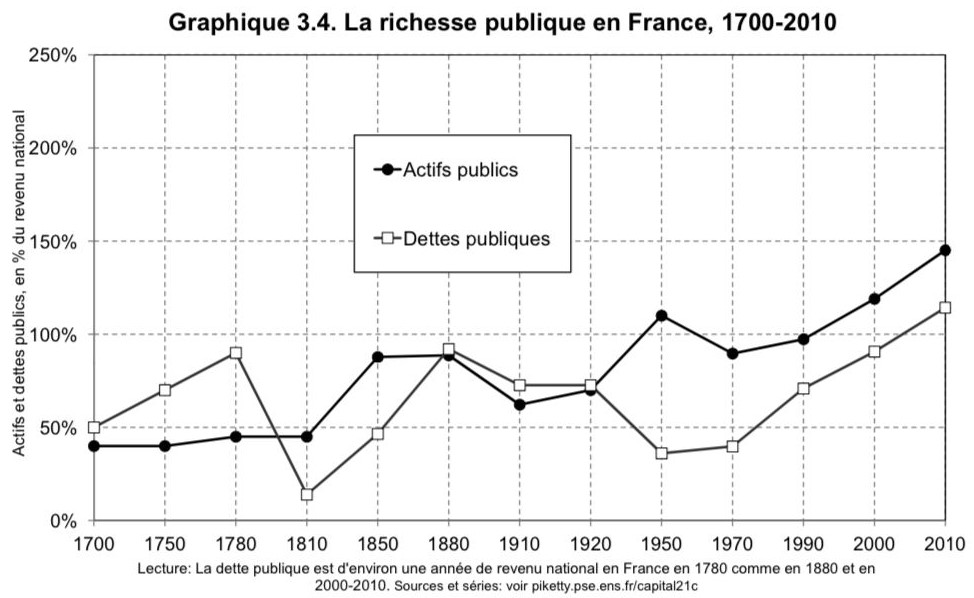

Source : piketty.pse.ens

At the same time, prices continued to rise throughout the second half of the 18th century. As gold and silver coins became scarce, the French, most of whom had no bank accounts, borrowed and saved massively to meet their expenses and ensure their future. As a result, latent inflation progressed over several decades.

Faced with this situation, intellectuals sought to increase the circulation of money and limit inflation, but no solution was found. New schools of economic thought were born, and a division between the liberal and interventionist movements emerged. The former, represented by Turgot, advocated reducing debt and deficits by cutting public spending, while the latter wanted more State support. From 1776 onwards, interventionism dominated under the policies of Necker, a fervent supporter of this model and successively Director of the Treasury and then Minister of Finance.

Over the years, the French economy gradually began to resemble a "war economy", even in times of peace. At the dawn of the French Revolution, almost 30% of the State budget was devoted to the army, 20% to public spending, and the remaining 50% to interest on the debt alone. The deficit was growing, and public debt continued to rise, representing 80% of wealth produced (the equivalent of GDP). National wealth was almost exclusively held by the richest 10%.

Instead of thinking about reforming the monetary system, and while inequalities remained very high, new tax hikes were introduced. The majority of the French population found themselves even more crushed by the tax burden, while the aristocratic minority benefited from exemptions. Inequalities deepened, especially as prices continued to rise, and poor harvests due to drought led to a dramatic increase in the price of bread. With their stomachs empty, the people took to the streets to demand a fair tax system, and in particular that the wealthiest should contribute to the tax effort. In 1788, riots and insurrections broke out. These were the beginnings of the French Revolution.

During this period, a writer named Linguet, aware of the close link between the financial system and the emerging social conflicts, proposed to cancel part of the debt. But his solution was violently contested, and he was guillotined during the Reign of Terror. Without realizing it, he was advocating a solution that was adopted a few years later, after a bloody decade.

The year 1789 began. In January, the enraged French demanded lower taxes as the first measure in the cahiers de doléances (lists of grievances). But the ministers were powerless in the face of events beyond their control. Debt servicing continued to rise, and the State found itself in the throes of bankruptcy. The Estates General were convened to settle the matter. The situation worsened. On July 14, nine hundred people attacked the Bastille prison to seize new weapons.

Against this backdrop, Finance Minister Necker called for the creation of an exceptional tax. Mirabeau, considered to be "close" to the French, supported this proposal, and in September 1789 declared in a now-famous speech: "Two centuries of pillage and theft have deepened the abyss into which the kingdom is about to sink. This terrible abyss must be filled! Here's a list of French property owners. Choose from among the richest, so as to sacrifice fewer citizens. Come on, these two thousand notables have enough to make up the deficit. But now bankruptcy, hideous bankruptcy, is there; it threatens to consume you, your properties, your honour."

Deep in debt, a month later he secretly received 200,000 francs from the king, then several thousand each month to vote in favor of the interests of the nobility...

In the autumn of 1789, a Reign of Terror reigned in France. The financial crisis continued to worsen, and new riots broke out. Necker believed that runaway inflation would solve the public debt and calm the situation. Faced with a shortage of gold and silver, however, he launched a £30 million loan at very high interest rates, which were now set by the market following a reform.

A year later, the Constituent Assembly decided to introduce what had been abandoned since the failure of the Law system in 1720: paper money known as assignat. This currency was created in large quantities from property confiscated from the nobility and the clergy. In 1790, over a billion pounds of interest-bearing assignats were printed. The State then issued more in an attempt to pay off its debt, and to finance the war against Austria in 1792, instigated by the Girondins. But many assignats were counterfeit, some falsified, and many speculated on their value. In the political and social turmoil, confidence was lost and the new currency rapidly depreciated. In the same year, 1793, the country experienced hyperinflation and King Louis XVI was guillotined on the orders of the Montagnards (including Robespierre, Danton and Marat). New insurrections broke out under the Reign of Terror. From then on, they involved all categories of French people, not just the wealthy bourgeoisie.

France is unable to emerge from its financial and monetary crisis. Some people began refusing to accept assignats. Confidence was definitively broken, and the banknote printing press was burned on the famous Place Vendôme in February 1796.

Assignat of ten pounds @istock

When the Directoire (Directory) was established at the end of 1795, the country was still in crisis. But this new regime of five Directors sought to wipe the slate clean. The reforms initiated by the Thermidorians continued.

In 1797, once the insurrections were over and hundreds of thousands of people had died or disappeared, almost 70% of the public debt was cancelled. Finance Minister Dominique Ramel declared, "I am erasing the consequences of past errors to give the State the means for its future."

When Napoleon Bonaparte was elected under the dictatorial power of the Consulate, the French economy was in the doldrums: production was slow and consumption extremely low. Gold and silver coins were reintroduced under a new currency, the franc. Napoleon created the Banque de France in 1800, following a proposal by Swiss financier Perregaux, who had made his fortune by... speculating in assignats. The central bank was privately owned by Napoleon himself. Based on the Swedish and English models, it was designed to distribute liquidity to banks in the event of a crisis. At the beginning of the 19th century, after a decade of revolution, confidence was more or less restored. Trade resumed, the currency stabilized and a new, long cycle began.

This return to history invites us to take a step back. Today's world has many similarities with the French situation at the end of the 18th century:

- France, like other countries around the world, has been racking up debt for decades, particularly since the 2008 financial crisis. As a result, risk is being passed on to future generations.

- Inequalities are reaching historic heights, as they did at the end of the 18th century. In France, the richest 10% now hold a large part of the country's wealth. (The situation is even more worrying in other countries).

- Unconventional tools are used to lower government interest rates. What we now call "quantitative easing" already existed in 1767... from the Caisse d'Escompte.

- Over the last two decades, prices have risen moderately (although housing prices have risen sharply). And since April 2021, inflation has been rising steadily, particularly food prices, as in 1788.

- Today, as in 1789, the three main items in the French government budget include interest on the debt and the army budget. Public spending is also restricted.

- This time, the catastrophe of hyperinflation has been avoided thanks to the action of the central banks. But the ECB is limiting its action in an attempt to reduce indebtedness through inflation (a solution advocated during the bankruptcy of 1789).

- Given the interdependence of the financial system, a new financial crisis could arise. After the collapse of several US regional banks last March, a bigger crisis is likely to emerge between the end of 2023 and 2024.

Despite these similarities, there is a major difference between the monetary system of the 18th century and the current one: since money is no longer bound by a physical limit, the contemporary model allows people to go further into debt, thereby delaying the end of the current cycle. This in turn leads to significant indirect effects (rising wealth inequalities, social and societal tensions, etc.).

While the spectre of a new French Revolution and social unrest (such as the Gilets Jaunes [Yellow Vests]) can never be ruled out, it remains more complicated in the age of hyper-digitization.

In the aftermath of the health crisis, when public indebtedness rose sharply, several think tanks proposed cancelling part of the debt. One idea was to cancel the debt bought up by the central bank between 2020 and 2022, which the State must repay (which ultimately amounts to the State repaying itself, since the central bank is a public institution... In the case of debt cancellation or relief, however, these repayments would be reinvested, not "eliminated"). But this proposal went unheeded after being deemed "unthinkable" by central bankers. Yet it was a solution used on several occasions, both 3000 years ago in Mesopotamia and more recently by various countries (USA, Mexico, Venezuela, etc.). Germany, for example, cancelled two debts in the last century: one in 1918, and the other in 1953, when 60% of its debt was cancelled. Both operations, like the French cancellation in 1797, took place after a terrible war... Perhaps the same will happen this time.

History repeats itself, first as tragedy, second as farce.

At a time when the conflict in Ukraine persists and social tensions are growing in the countries concerned, the solution of cancelling part of the debt remains more topical than ever. It would prevent new social consequences from being added to the current disorders (geopolitical conflicts, inequalities, etc.), and would ease the burden on public finances. However, this solution would only have long-term effects if a new monetary system were to be introduced, one that eliminates cycles.

This paradigm would first require monetary policy to be decided democratically. Money creation would then have to be issued in limited quantities, in line with a growth target adjusted to real needs. New, innovative solutions will have to be used to further reduce government debt without affecting the taxpayer. Debt-free money plays a key role here. Next, we need to ensure the circulation of money to avoid too great a savings surplus (melting money makes this possible). Finally, the long term must always be given priority over the short term, politically speaking. This soft landing would lay the foundations for a new era, in which tomorrow's challenges would be met by today's policies.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.