France, Italy, Japan and the USA all have high budget deficits of comparable magnitude, accompanied by significant public debt in excess of 100% of GDP. However, taking a step back and integrating other macroeconomic financial data, risk levels differ greatly, to France's detriment. This is what a recent article by Patrick Artus, which takes into account all capital movements affecting these nations, indicates.

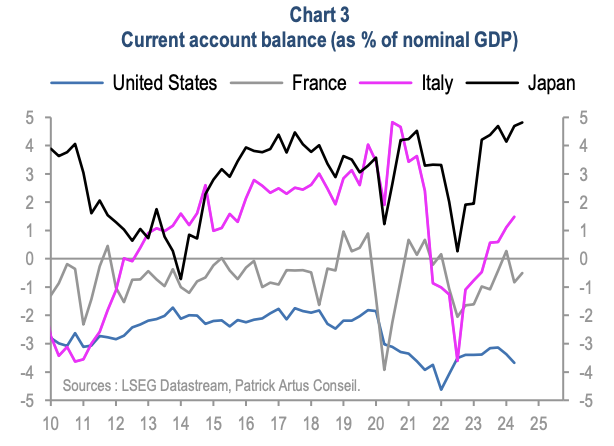

Let's look at the current account balance, which totals the trade balance (exchange of goods and services with foreign countries) and the income balance (from investments abroad or paid to foreigners who have invested in the country, salaries paid or received from abroad). France and the United States are in the red, but Japan and Italy are structurally in surplus, which enables them to finance their deficits relatively easily, and this is reflected in a public debt that is essentially held by national savings (over 90% in Japan, 80% in Italy). As external constraints are low, foreign investor distrust would have no major impact.

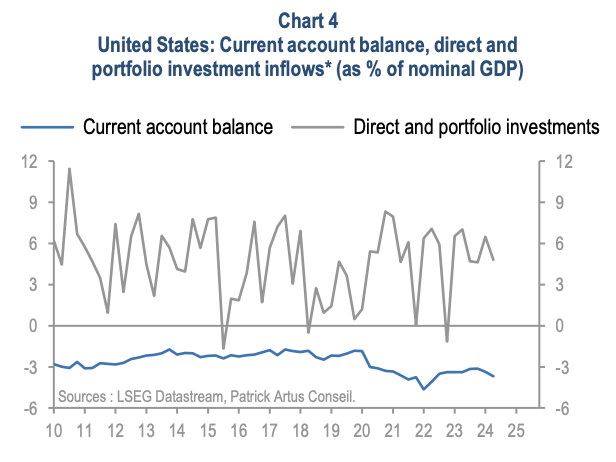

The United States, on the other hand, benefits from substantial inflows of long-term capital. This is the product of their economic attractiveness, whether in technology, capital management (financial markets, hedge funds), industrial renewal (cheap energy, IRA program), or the security provided by the world's leading power. Financing the enormous public debt ($36 trillion) is also relatively easy (23% held by non-residents). Not forgetting, of course, the dollar's inescapable role as a transaction and reserve currency, which obliges the world's countries to inevitably hold it.

France, on the other hand, does not offset its recurrent budget deficit with a positive current account balance, and even suffers - the article doesn't mention it, but we pointed it out in our previous article- a worrying outflow of capital.

France therefore scores all the wrong points, as can be seen from the fact that non-residents, i.e. foreign investors, hold 54% of its public debt, far higher than the other countries mentioned.

As Patrick Artus points out, “The most dangerous case: countries with a budget deficit, a current account deficit and no long-term capital inflows.”

| France | Italy | Japan | United States | |

| Public deficit | - | - | - | - |

| Current account balance | - | + | + | - |

| Long-term capital inflows/outflows | - | 0 | 0 | + |

(-: deficit; +: surplus; 0: balance)

Please note that we are not saying that a high budget deficit is not serious, but that the strain it places on a country depends on its overall capital flows. And for France, the situation is particularly dangerous: a loss of confidence on the part of foreign investors could rapidly lead to an inability to finance, leading to a collapse of the financial system, followed by a freeze on bank accounts and life insurance (BRRD directive and Sapin II Law, see our previous article).

When we see the futility of the 2025 budget, the inconsistency of the debates, the inability to reduce spending, the Lépine competition to create new taxes, we can only conclude that this sword of Damocles is clearly not taken into account by the political staff.

Let's hope savers aren't blind either...

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.