Open Letter to the Glasgow Financial Alliance for Net Zero (GFANZ).

Gentlemen,

First, rest assured that citizens of our planet are grateful to the United Nations and to each one of the members of your assembly for having decided to do everything possible to advance our society towards green energy. As your Financial Alliance for Net Zero brings together the most powerful financial companies in the G7, you can only succeed in this endeavour, as nothing could resist the combination of the will and energy of today’s brightest decision makers, under the leadership of President Mark Carney.

After the creation of the Alliance in April 2021 and the first working meetings late spring and during summer 2021, you must have noticed that there were bottlenecks, which should make it extremely difficult to achieve your objectives and which could only delay their implementation. Despite this, you have set a schedule with very close deadlines. Under the current market conditions, this objectives seems unrealistic. Even by changing some of the factors in the equation, you will remain in an emergency with time constraints that are difficult to compress..

Weeks and months have passed and we have been waiting for you to break these locks, which still limit your actions and your agenda

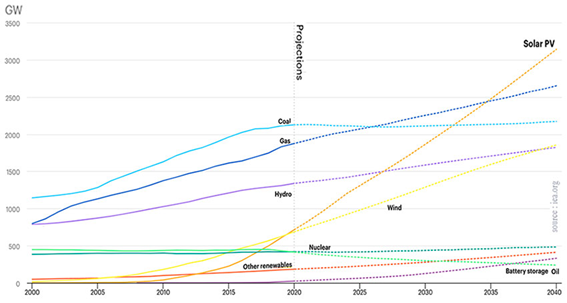

To achieve the Net Zero objectives, solar energy is brought to an increasing development by 2040, as IEA already predicted at the end of 2019.

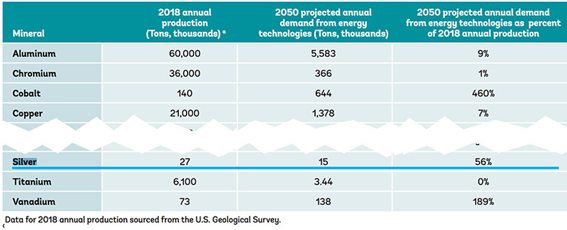

Industrial demand, particularly for photovoltaics, has already increased sharply in 2021, bringing global silver demand to 1 029 Moz for a mining production of only 829 Moz. The World Bank anticipates a doubling of the annual demand for silver for solar PV, which should reach 3 200 tons in 2050, while mining production in 2020 was only 25 000 tons (source: USGS). Depending on the scenarios chosen, the demand for silver for green energies will have to increase by 15 000 tons (Page 96 and chart page 103 of the "Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition" Report).

The mining company South32 estimates that this new demand will require 30 Moz each year for the next 20 years, an increase of 55% but probably even 95% to reach the goal of 1.5 degrees Celsius. (Source: stockhead)

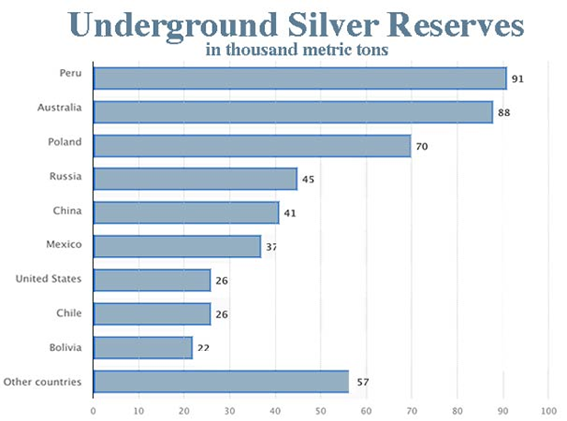

Today, silver reserves in the ground are estimated by the USGS at 500 000 tons, i.e. 20 years of production at the current rate, but less if production is accelerated.

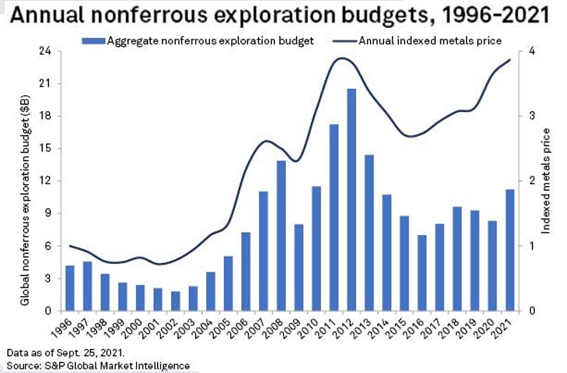

The chart below relates very generally to the geological research budgets for non-ferrous metals, i.e. gold, silver, copper, nickel, platinum, aluminium, tin, lead and zinc. Budgets have barely increased in 2021, despite the very strong increases in some of these metals in the last quarter.

With the continued decline in the silver content of the ores, the former pure silver mines had to diversify, because the silver was no longer profitable enough. As a result, the share of world production of silver from copper, zinc, lead and tin mines is steadily increasing.

The new presidents elected in 2021 in Peru and Chile are making mining companies suffer by questioning previous policies. There will be a sharp increase in royalties paid to the states. The project for a new copper mine is blocked to stop destroying the environment. That seems to be the logic of the times. It simply means that metals will always be more expensive to produce and that their prices must go up.

Whether your name is BlackRock or StateStreet, JPM or Bank of America, to justify to your shareholders an investment in geological research and in Junior Explorers, the game must be worth the candle. However, for the moment, few silver mines are able to make a profit, simply because the price of silver is kept too low. In the Financial Alliance for Net Zero, everyone knows it.

Even if the price of silver were to increase tenfold, it would not be enough to bring it back to a normal price, given the monetary creation of recent years and the loss of purchasing power induced in the main currencies. Even at $200, few investors, who hoard to protect themselves from inflation, would agree to contribute their metal to accelerate the World photovoltaic production.

Between the time when geological research is activated, new veins are identified and the mine goes into production, it takes between 10 and 20 years. If you want to meet your 2030 and 2040 objectives, there is an urgent need to massively revalue the price of silver.

While waiting to see the Financial Alliance at work in this direction, please believe, Gentlemen, in the expression of our respectful consideration.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.